- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Greaves Electric Mobility IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Greaves Electric Mobility IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Greaves Electric Mobility Limited

Greaves Electric Mobility Private Limited (GEMPL) is an Indian company that specializes in designing and manufacturing electric vehicles (EVs). They offer a wide range of vehicles, including electric two-wheelers and three-wheelers, catering to both personal and commercial needs. The company’s portfolio includes high-speed, city-speed, and low-speed scooters, showcasing the engineering expertise of the Greaves group.

In addition to two-wheelers, GEMPL provides an extensive range of three-wheelers, including electric and internal combustion engine models, as well as e-rickshaws for cargo and passenger transport. These vehicles are designed to meet the diverse needs of last-mile mobility, ensuring cleaner, smarter, and cost-effective solutions for individuals and businesses alike.

Greaves Electric Mobility Limited IPO Overview

Greaves Electric IPO is a bookbuilding issue comprising a fresh issue of Rs 10.00 crore and an offer for sale of 18.94 crore shares. The IPO dates and price bands are yet to be announced, with the allotment expected to be finalized on [.]. Motilal Oswal Investment Advisors Limited, Iifl Securities Ltd, and Jm Financial Limited are the book-running lead managers, while Link Intime India Private Ltd is the registrar for the issue. The IPO will be listed on BSE and NSE, with a face value of ₹1 per share. The total issue size, price band, and other details are still pending. The pre-issue shareholding of the company stands at 96,18,43,550 shares, with Greaves Cotton Limited being the promoter holding a 62.26% stake.

Greaves Electric Mobility Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹1000 crore

Offer for Sale (OFS): 18.94 crore shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 96,18,43,550 shares |

| Shareholding post -issue | TBA |

Greaves Electric Mobility IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Greaves Electric Mobility Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Greaves Electric Mobility Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (7.11) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (165.16%) |

| Net Asset Value (NAV) | 4.31 |

| Return on Equity | – |

| Return on Capital Employed (ROCE) | – |

| EBITDA Margin | (30.26%) |

| PAT Margin | (33.94%) |

| Debt to Equity Ratio | 0.12 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment for (a) product and technology development; and (b) enhancing capabilities at the Company’s Technology Centre in Bengaluru, Karnataka | 3,752.72 |

| Development of the Company’s in-house battery assembly capabilities | 829.00 |

| Funding expansion of the manufacturing capacity of BAPL | 198.94 |

| Funding expansion of the manufacturing capacity of MLR | 382.56 |

| Increasing our Company’s stake in our Material Subsidiary, MLR, through acquisitions | 736.67 |

| Increase digitisation and deployment of information technology infrastructure | 278.02 |

| Funding inorganic growth through unidentified acquisitions and general corporate purposes | [●] |

| Net Proceeds | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

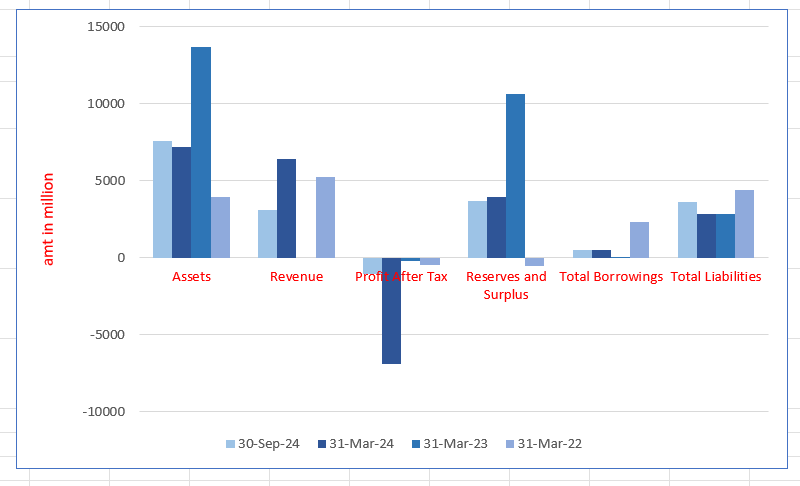

Greaves Electric Mobility Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 7588.60 | 7182.70 | 13,702.44 | 3963.87 |

| Revenue | 3127.47 | 6413.12 | 11.564.47 | 5213.67 |

| Profit After Tax | (1061.54) | (6915.70) | (199.14) | (453.79) |

| Reserves and Surplus | 3675.85 | 3933.11 | 10,661.68 | (547.28) |

| Total Borrowings | 476.02 | 467.56 | 33.85 | 2325.55 |

| Total Liabilities | 3591.02 | 2846.96 | 2854.30 | 4393.96 |

Financial Status of Greaves Electric Mobility Limited

SWOT Analysis of Greaves Electric Mobility IPO

Strength and Opportunities

- Strong presence in the electric vehicle market with an expanding portfolio of two-wheelers and three-wheelers.

- Growing demand for clean, sustainable, and affordable last-mile mobility solutions in urban areas.

- Wide range of electric vehicles, including scooters, three-wheelers, and e-rickshaws, catering to diverse transportation needs.

- Strategic partnerships with various stakeholders to drive growth and improve product offerings.

- Expansion of manufacturing facilities to meet the increasing demand for electric vehicles.

- Focus on innovation and R&D to develop new, efficient, and affordable electric vehicle models.

- Plans for IPO to raise capital for further expansion and growth in the electric vehicle market.

- Strategic entry into new markets, enhancing its customer base and geographical reach.

- Strong after-sales service network to ensure customer satisfaction and product reliability.

- Emphasis on sustainability, reducing CO2 emissions, and contributing to a cleaner environment.

- Rising consumer awareness of the environmental impact of fossil fuel-powered vehicles, creating demand for electric vehicles.

Risks and Threats

- High competition in the electric vehicle market with many new entrants and established companies.

- Limited consumer awareness and adoption of electric vehicles in rural regions.

- High initial cost of electric vehicles may deter some customers from making the switch.

- Dependence on government subsidies and incentives for the growth of the electric vehicle market.

- Challenges in scaling up production capacity to match demand and meet deadlines.

- Potential challenges related to the availability and cost of key raw materials for battery production.

- Possible delays in IPO due to market conditions and regulatory approvals.

- Regulatory changes in different regions can impact business operations and market entry strategies.

- Limited availability of charging infrastructure in some areas, which may affect the growth of electric vehicle adoption.

- Risk of technological obsolescence as new competitors develop advanced electric vehicle technologies.

- Economic downturns and fluctuations in consumer spending could slow the adoption of electric vehicles.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Greaves Electric Mobility Limited

Greaves Electric Mobility Limited is one of India’s pioneering companies in the electric vehicle (EV) sector. With a strong legacy, it has played a crucial role in driving EV adoption, offering a diverse range of electric vehicles across the two-wheeler (E-2W) and three-wheeler (3W) segments. Catering to both B2C and B2B customers, their product portfolio includes high-speed, city-speed, and low-speed electric scooters, along with electric three-wheelers, internal combustion engine three-wheelers, and e-rickshaws.

Over 16 years of expertise in EV design and manufacturing has solidified their position in the market. Greaves Electric leverages the engineering capabilities of the Greaves group, which boasts over 165 years of experience, and focuses on the “made in India” ethos.

Corporate Structure

Greaves Electric is part of Greaves Cotton Limited, an Indian conglomerate with a long legacy in powertrain manufacturing across fuel types like diesel, CNG, and electric. The group’s extensive network in last-mile mobility, manufacturing, and service systems provides Greaves Electric with significant scale and resources. In addition to being supported by marquee investor Abdul Latif Jameel Green Mobility Solutions DMCC, the company benefits from Greaves Cotton’s strong supply chain and pan-India sales service network.

Research & Development Capabilities

R&D plays a critical role in Greaves Electric’s ongoing innovation. In 2024, they launched a state-of-the-art technology center in Bengaluru, enhancing their testing and design capabilities.

Product Portfolio and Manufacturing Capabilities

Greaves Electric continually evolves its EV portfolio, with a focus on offering products for a wide range of customer segments. Their EVs cater to different needs, from B2C to B2B applications. The company has established a solid manufacturing base in Tamil Nadu, Uttar Pradesh, and Telangana, enabling scalability. With a strong distribution network across 27 states and union territories, they have sold over 270,000 E-2Ws and 40,000 3Ws, reinforcing their market presence.

Sustainability and Workforce Diversity

Greaves Electric is committed to sustainability through energy-efficient processes and innovative practices. The company also promotes workforce diversity, with a significant portion of its manufacturing workforce being women, particularly in the Ranipet Factory.

Industry Outlook

PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme

- The PM E-DRIVE scheme, with a ₹109 billion outlay, will run from October 1, 2024, to March 31, 2026.

- The scheme aims to accelerate EV adoption, set up charging infrastructure, and develop the EV manufacturing ecosystem in India.

- Incentives for E-2W and E-3W vehicles include ₹5,000 per kWh for FY25 and ₹2,500 per kWh for FY26, with vehicle-specific caps.

- The charging infrastructure plan includes 22,100 fast chargers for E-4Ws, 1,800 for e-buses, and 48,400 for E-2Ws and E-3Ws.

- The total outlay for charging infrastructure is ₹20 billion.

- By FY2029, public charging stations are expected to reach 120,000 to 140,000 units, significantly boosting the EV ecosystem.

- The subsidy for L5 E-3W will be reduced starting November 2024 as sales reach the upper limit for FY25.

- Financing support for EVs is expanding, with traditional banks, NBFCs, and fintech companies offering competitive terms.

- Digital financing platforms provide customized options, transparency, and flexibility, including instant approvals and flexible EMIs.

- Leasing and subscription models are being introduced for businesses using E-2Ws for logistics, further driving adoption.

- The expanding financing scope and competition will support the growth of electrification in India’s two-wheeler industry.

Review of the E-2W Industry in India

- Government Support & Environmental Awareness: India’s commitment to the Paris Agreement and the EV30@30 campaign, with support from government schemes (FAME II, PM E-DRIVE), is driving the growth of the E-2W sector.

- Expansion of E-2W Offerings: Technologically advanced, competitive-priced vehicles are attracting consumers, with notable growth in high-speed electric two-wheelers (E-2Ws).

- Advancements in Battery Technology: The evolution of LFP and NMC lithium-ion batteries enhances vehicle range, life, and safety, addressing range anxiety.

- Market Growth: E-2W sales have surged at a 73% CAGR from 2019-2024, driven by expanding offerings, rising EV awareness, and incentives.

- Government Incentives: The new PM E-DRIVE scheme, effective from October 2024, offers substantial incentives to boost E-2W adoption.

Domestic High-Speed Two-Wheeler Industry Outlook

- Growth Momentum: Long-term growth expected, driven by macroeconomic factors, rural demand, and premiumization.

- Key Drivers: Favourable financing, shrinking replacement cycles, and continued R&D investments by OEMs.

- E2W and ICE Segments: E2Ws are projected to grow at 40-45% CAGR, while ICE two-wheelers will grow at 1-3% CAGR.

- EV Penetration: By FY2030, EVs are expected to make up 28-32% of total two-wheeler sales.

Electrification Outlook

- E-2W Growth: High-speed electric two-wheelers saw 101% CAGR in the last six years and are expected to grow at 40-45% CAGR, reaching 7.5-8.5 million units by FY2030.

- Segment Leaders: Scooters are anticipated to lead electrification efforts.

Low-Speed E-2W Outlook

- Modest Growth: Expected to grow at 0-2% CAGR due to rising urbanization and traffic congestion.

- Regulation Impact: Tighter regulations will promote safety and greener transport solutions.

Export Outlook

- Export Growth: Projected to grow at 3-5% CAGR, reaching 4-4.5 million units by FY2030.

- EV Contribution: Exports of electric vehicles are expected to rise with OEMs expanding their portfolios and export markets.

E-Autos Overview

- Growth: E-Auto sales grew rapidly, exceeding 100,000 units in FY24.

- Drivers: OEM offerings, better EV awareness, expanding charging infrastructure, and lower operating costs.

Retail Sales Trend

- E-Auto sales show strong growth, based on VAHAN data.

Passenger Segment

- Market Leaders: Mahindra & Atul Auto dominate the passenger segment.

Competitive Landscape

- M&M’s Growth: Mahindra’s share grew from 4% in FY19 to ~39% in FY24.

- Other Players: Bajaj, Piaggio, and GEM are expanding.

Cargo Segment

- Growth: Bajaj and Greaves Electric Mobility are growing in this segment.

E-Rickshaw (L3) Segment

- Growth: E-Rickshaws grew 36% CAGR from FY19-24, with a strong rebound post-pandemic.

Competitive Landscape

- Fragmented Market: YC Electric, Saera Electric, and others lead in passenger E-Rickshaw, with YC Electric as a top player

How Will Greaves Electric Mobility Limited Benefit?

- Government Schemes Support

The PM E-DRIVE scheme’s incentives for electric vehicles (EVs) will aid Greaves Electric by enhancing affordability and encouraging further adoption, helping the company expand its E-2W and E-3W offerings in both B2C and B2B segments.

- R&D Advancements

Greaves Electric’s state-of-the-art R&D center in Bengaluru will support continuous innovation, improving the performance, safety, and efficiency of its electric vehicles, ensuring they remain competitive in the rapidly evolving EV market.

- Expanding Market Reach

With a robust distribution network spanning 27 states and union territories, Greaves Electric can leverage the growth in EV demand, particularly in the rural and premium segments, facilitating wider market penetration and increased sales.

- Sustainability Commitment

The company’s focus on sustainability, through energy-efficient processes and environmentally friendly practices, aligns with the growing demand for green mobility solutions, strengthening Greaves Electric’s position as an eco-conscious leader in the EV sector.

- Diverse Product Portfolio

Offering a wide range of electric two-wheelers, three-wheelers, and e-rickshaws, Greaves Electric can cater to various customer needs, including urban, rural, and commercial applications, further solidifying its market dominance and future growth potential.

- Financing and Leasing Options

As financing and leasing models grow in India’s EV sector, Greaves Electric can benefit from easier access to capital for customers, driving higher adoption rates for their products across both individual and business customers.

- Strategic Partnerships

Greaves Electric’s alliance with investors like Abdul Latif Jameel Green Mobility Solutions DMCC and its backing by Greaves Cotton’s extensive supply chain and service network provide a solid foundation for scaling operations, increasing production capacity, and ensuring effective customer support.

- Legacy and Brand Trust

With over 16 years of experience in EV manufacturing and the support of a 165-year-old group, Greaves Electric enjoys a reputation for quality, fostering consumer trust and further accelerating growth as the EV market continues to expand.

Peer Group Comparison

| Name of Company | Revenue

(₹ million) |

Face Value (₹ per share) | EPS (₹) Basic | NAV per Share (₹) | P/E | RoNW (%) |

| Greaves Electric Mobility Limited | 6,118.17 | 1 | (7.11) | 4.31 | NA | (165.16%) |

| Peers | ||||||

| Ola Electric Mobility Limited | 50,098.31 | 10 | (4.35) | 5.54 | NA | (78.46%) |

| Ather Energy Limited | 17,538.00 | 1 | (47.32) | 24.38 | NA | (194.12%) |

| TVS Motor Company Limited | 3,91,447.40 | 1 | 35.50 | 142.78 | 71.21 | 24.86% |

| Hero Motorcorp Limited | 3,77,886.20 | 2 | 187.36 | 885.51 | 24.27 | 21.16% |

| Bajaj Auto Limited | 4,48,704.30 | 10 | 272.70 | 1,024.51 | 33.00 | 26.61% |

| Mahindra & Mahindra Limited | 13,82,793.00 | 5 | 101.14 | 594.08 | 30.63 | 17.02% |

| Atul Auto Limited | 5,272.90 | 5 | 3.39 | 158.66 | 182.08 | 2.14% |

Key Insights

- Revenue: Greaves Electric Mobility’s revenue of ₹6,118.17 million significantly trails its peers. Industry leaders like Mahindra & Mahindra (₹13,82,793.00 million) and Bajaj Auto (₹4,48,704.30 million) highlight its smaller scale. Ola Electric (₹50,098.31 million) and Ather Energy (₹17,538.00 million) surpass it among EV-focused peers.

- Face Value: The face value ranges from ₹1 (Greaves Electric Mobility, TVS Motor, Ather) to ₹10 (Bajaj Auto, Ola). Greaves aligns with industry norms but lags in operational performance compared to peers with higher face values like Hero Motorcorp (₹2) and Atul Auto (₹5).

- EPS: Greaves Electric Mobility reports negative EPS (-₹7.11), reflecting financial losses. While TVS Motor (₹35.50) and Bajaj Auto (₹272.70) perform strongly, Ola (-₹4.35) and Ather (-₹47.32) also show losses, underscoring challenges within the electric vehicle segment.

- NAV per Share: Greaves Electric Mobility’s NAV is low at ₹4.31 compared to peers like Bajaj Auto (₹1,024.51) and Mahindra & Mahindra (₹594.08). The NAV reflects lower equity strength, especially when benchmarked against Ather’s ₹24.38 and Ola’s ₹5.54.

- P/E Ratio: Greaves Electric Mobility’s negative EPS results in an undefined P/E ratio. Among profitable peers, TVS Motor (71.21) and Bajaj Auto (33.00) show favourable valuations. Atul Auto’s 182.08 ratio signals market optimism despite its lower earnings.

- RoNW: Greaves Electric Mobility’s return on net worth is highly negative (-165.16%), reflecting operational inefficiency. Bajaj Auto (26.61%) and TVS Motor (24.86%) lead with strong returns. Negative RoNW for Ola (-78.46%) and Ather (-194.12%) highlights challenges within the EV industry.

Greaves Electric Mobility Limited IPO Strengths

- Diverse Product Portfolio

Greaves Electric Mobility Limited offers a wide-ranging product portfolio in the E-2W and 3W segments, meeting diverse customer needs. Their offerings span high-speed, city-speed, and low-speed e-scooters under the Ampere brand, and include passenger and cargo 3Ws. This extensive range ensures affordability and optimised value, enabling them to cater to B2C and B2B segments effectively while mitigating risks from single-segment dependency.

- Comprehensive Market Coverage

Greaves Electric Mobility Limited demonstrates strong market positioning, catering to personal and commercial mobility needs. Their product offerings address value-conscious, aspirational, and commercial segments. By including fixed and portable battery options, they serve diverse preferences. With increasing sales across E-2Ws and E-3Ws, the company supports India’s evolving mobility landscape while working toward sustainable transportation solutions.

- Innovative Product Development

Greaves Electric Mobility Limited consistently identifies and fills market gaps with innovative product launches. Their portfolio includes advanced e-scooters, rugged 3Ws, and versatile battery options, serving passenger and cargo requirements. By launching cutting-edge models like the Nexus ST and enhanced 3Ws, they demonstrate a commitment to sustainable mobility, advanced features, and customer-centric solutions across diverse use cases.

- Extensive Distribution Network

Greaves Electric Mobility Limited’s robust omnichannel distribution network spans pan-India, with 3S dealerships and Greaves Care outlets enhancing their reach. They maintain a balanced geographic distribution of E-2W and 3W dealers, prioritising non-metro markets. Strategic collaborations with e-commerce platforms ensure accessibility and convenience, streamlining the purchase experience for customers nationwide. Their decentralised network reduces reliance on top dealers, fostering resilience.

- Customer Care Excellence

Greaves Electric Mobility Limited focuses on customer satisfaction through a robust service network. Their expertise in EVs enables tailored servicing across vehicle life stages. They centralise complaint resolution and operate Ampere Care centres for maintenance and roadside assistance. By transitioning to component repairs over replacements, they minimise costs and downtime, ensuring superior vehicle performance and customer trust.

- Sustainability and Value Creation

Greaves Electric Mobility Limited prioritises sustainability by offering cost-effective solutions and minimising service costs. Their commitment to advanced EV technology, battery options, and eco-friendly mobility aligns with India’s transition to greener transportation. Through innovative product launches and a broad product mix, they empower customers while contributing to the sustainable transformation of the mobility sector.

Key Insights from Financial Performance

- Assets: The assets have shown a consistent increase from ₹3,963.87 million in March 2022 to ₹7,588.60 million as of September 2024. This reflects growth in the company’s resources and indicates effective asset management and expansion. However, the value experienced a sharp drop in March 2023, which needs attention.

- Revenue: Revenue witnessed a significant fluctuation, peaking at ₹11,564.47 million in March 2023. However, it dropped to ₹3,127.47 million by September 2024, reflecting a decline in performance. This highlights challenges in maintaining steady revenue growth despite earlier peaks, and attention is needed to identify and address revenue decline.

- Profit After Tax (PAT): The company has experienced consistent losses across the periods. In September 2024, the loss stood at ₹1,061.54 million, which is an improvement from ₹6,915.70 million in March 2024. While a reduction in losses is noted, the company is still operating at a loss, and strategies for profitability need focus.

- Reserves and Surplus: Reserves and surplus have fluctuated significantly. Starting from a negative ₹547.28 million in March 2022, reserves have improved to ₹3,675.85 million by September 2024, showing a positive turnaround. However, this improvement has not been smooth and requires continued positive financial management.

- Total Borrowings: The company’s total borrowings remained relatively stable at ₹476.02 million as of September 2024, a slight increase from ₹467.56 million in March 2024. Borrowings were significantly higher in March 2022, indicating a shift towards lower debt levels, suggesting better control over liabilities.

- Total Liabilities: Total liabilities increased from ₹2,846.96 million in March 2024 to ₹3,591.02 million by September 2024. However, it remains lower than the ₹4,393.96 million recorded in March 2022. Despite a recent increase, the company has reduced its liabilities compared to previous years, indicating improved financial leverage.

Other Financial Details

- Cost of Materials Consumed: The cost of materials consumed saw a significant decrease in the six-month period ending 30 September 2024, amounting to 2,767.38. This represents a reduction from 5,191.68 in the year ended 31 March 2024, reflecting cost control or changes in production efficiency.

- Employee Benefits Expense: Employee benefits expense decreased to 358.34 in the six months ended 30 September 2024, compared to 1,013.60 for the year ended 31 March 2024. This could reflect restructuring, lower headcount, or optimization of compensation-related costs.

- Finance Costs: Finance costs were recorded at 56.50 in the six-month period ended 30 September 2024, a decrease from 82.13 in the year ending 31 March 2024. This reduction may indicate lower borrowings or improved management of debt-related expenses.

- Depreciation and Amortisation Expense: Depreciation and amortisation expense stood at 208.25 for the six months ending 30 September 2024, reflecting a decrease from 316.11 in the previous year. The decrease could result from lower asset additions or better asset utilization.

- Other Expenses: Other expenses were recorded at 869.67 in the six months ending 30 September 2024, showing a decline from 1,894.59 in the year ended 31 March 2024. This decline may point to reduced operational or non-recurring expenditures.

Key Strategies for Greaves Electric Mobility Limited

- Maintain Leadership in E-2W and E-3W Segments

Greaves Electric Mobility Limited aims to sustain its leadership in the E-2W and E-3W markets, expanding its product portfolio strategically. By launching products across varying price points, the company intends to capture a broader customer base and provide accessible mobility solutions in India. Furthermore, it plans to address regional preferences and expand manufacturing capacity for E-3Ws.

- Leverage economies of scale via Multi-Product Platforms

The company focuses on utilizing economies of scale by deploying the Nexus platform across various E-2W models. This platform integrates core components like batteries and powertrains, catering to different customer needs. Additionally, Greaves plans to establish common platforms for 3Ws, enhancing their offerings by incorporating fast-charging and battery-swapping features.

- Focus on In-House R&D and Technology Development

Greaves Electric Mobility aims to strengthen its in-house R&D, focusing on technology development and manufacturing. With plans to assemble battery packs internally by 2027, the company strives for cost optimization, enhanced quality control, and supply chain resilience. They are investing in advanced battery technologies and software capabilities to improve performance and efficiency.

- Expand Market Penetration in India and Internationally

The company is working on increasing its market penetration in India, especially in Tier 1 and 2 cities, with the Nexus model, and targeting Tier 2, 3, and 4 cities with Magnus and Reo models. Greaves is also expanding internationally, having started exporting to Nepal and the Philippines, and is considering additional markets in Sri Lanka and Africa.

- Increase B2B Sales through Partnerships

Greaves Electric Mobility plans to grow its B2B sales by forming strategic partnerships with corporate and institutional entities. They are already supplying multi-city delivery fleets to a food chain and E-2Ws for healthcare workers. The company aims to develop customized product variants and solutions to cater to diverse B2B customer needs.

- Explore synergies within the Greaves Group

Leveraging synergies within the Greaves Group, the company aims to enhance its market reach and penetration. By utilizing Greaves Retail outlets and Greaves Care outlets, Greaves plans to expand its product visibility and sales. The company also intends to collaborate with Greaves’ financing and engineering arms to optimize supply chains and improve customer access to its products.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Greaves Electric Mobility IPO

What is the Greaves Electric Mobility Limited IPO?

Greaves Electric Mobility Limited plans to raise ₹1,000 crore through an initial public offering (IPO) to fund product development, battery assembly, and expansion.

When is the Greaves Electric Mobility IPO expected to open?

The IPO is anticipated to open in the second week of March 2025, with the listing date projected for the third week of March 2025.

What is the expected price band for the IPO?

The expected price band for the IPO is around ₹662 per share, though this is subject to change.

How can investors apply for the IPO?

Investors can apply online using UPI or ASBA through their bank accounts or via brokers offering UPI services.

Who are the lead managers for the IPO?

The lead managers for the IPO are IIFL Securities Limited, JM Financial Limited, and Motilal Oswal Investment Advisors Limited.

What is the minimum investment amount for retail investors?

The minimum investment for retail investors is expected to be around ₹14,760, based on a price of ₹662 per share.

How can investors check their IPO allotment status?

Investors can check their allotment status on the registrar’s website, Link Intime India Private Limited, by entering their application number or PAN.