- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What is Greenshoe Option in IPO?

- How Does a Greenshoe Option Work?

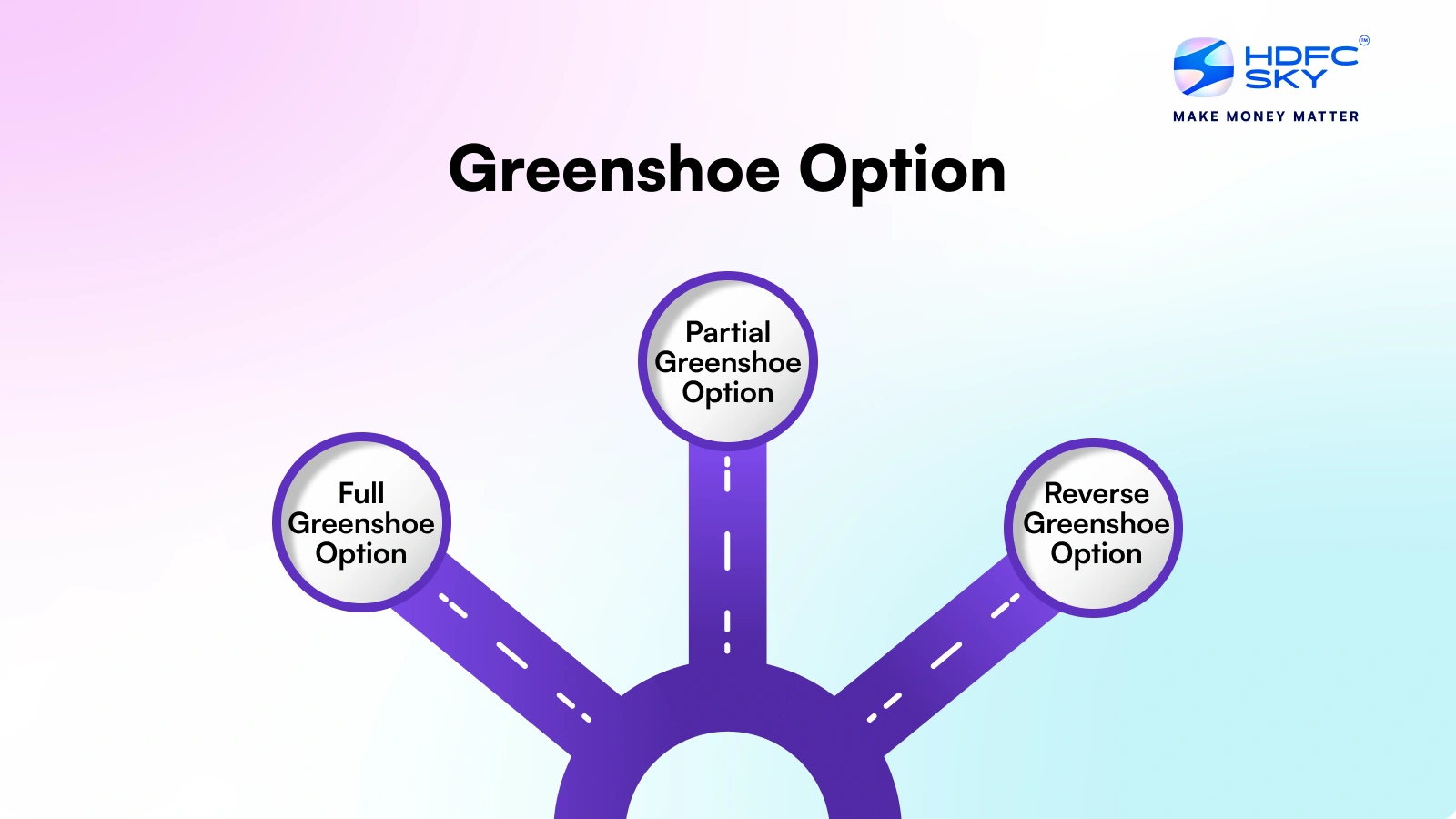

- Types of Greenshoe Options

- Guidelines for Implementing Greenshoe Options

- Greenshoe Option Example

- Importance of Greenshoe Share Options

- Advantages of the Greenshoe Option

- Limitations of Greenshoe Option

- How Investors Benefit from Greenshoe Option

- Conclusion

- FAQs on Greenshoe Option

- What is Greenshoe Option in IPO?

- How Does a Greenshoe Option Work?

- Types of Greenshoe Options

- Guidelines for Implementing Greenshoe Options

- Greenshoe Option Example

- Importance of Greenshoe Share Options

- Advantages of the Greenshoe Option

- Limitations of Greenshoe Option

- How Investors Benefit from Greenshoe Option

- Conclusion

- FAQs on Greenshoe Option

What is Greenshoe Option in IPO? Know Importance of Greenshoe Options

By HDFC SKY | Updated at: Aug 25, 2025 03:00 PM IST

The greenshoe option is a provision used during an IPO to stabilise stock prices. It allows underwriters to sell more shares than initially planned typically up to 15% extra. If demand is high they keep the extra shares. If prices drop they buy back shares to support the price. The greenshoe option in an IPO is considered a smart mechanism and as a buyer or investor interested in IPOs you must understand the greenshoe option’s meaning.

What is Greenshoe Option in IPO?

A Greenshoe Option is an over-allotment option used during an IPO that allows underwriters to sell up to 15% more shares than originally offered. It helps stabilise the stock price after listing by allowing the underwriter to buy back shares if the price falls below the offer price or release additional shares if demand is high. This reduces post-IPO volatility and ensures smoother price determination.

How Does a Greenshoe Option Work?

A Greenshoe Option works as a price stabilisation tool during an IPO.

- Extra Allotment: Underwriters are allowed to sell up to 15% more shares than initially offered.

- High Demand Scenario: If the stock price rises post-IPO due to strong demand underwriters exercise the option to buy additional shares from the company at the issue price and then deliver them to investors. This helps control excessive price spikes.

- Low Demand Scenario: If share price falls below the issue price underwriters buy back shares from the open market at lower prices to cover their short position this helps stabilise the price.

Overall the Greenshoe Option ensures smoother price movements and builds investor confidence in the early days of listing.

Types of Greenshoe Options

Underwriters can choose from three types of IPO greenshoe options depending on the situation.

- Full Greenshoe Option: This option is typically used when there is a high demand for shares in the market and the underwriters decide to sell all 15% extra shares to meet the excess demand.

- Partial Greenshoe Option: This option is usually used when stock share prices are slightly above or around the initial price. Underwriters sell only a portion of the allowed extra shares.

- Reverse Greenshoe Option: This is less common and distinct from the standard Greenshoe. In a reverse Greenshoe the underwriter sells shares back to the issuing company if the price falls significantly below the IPO price. This mechanism reduces the number of shares in the market and supports the price.

Guidelines for Implementing Greenshoe Options

Guidelines for implementing greenshoe options ensure fair practice and price stability after an IPO. These rules are set by SEBI and include strict disclosure and time-bound usage.

- SEBI Approval: In India the use of the greenshoe option in IPOs must comply with SEBI (Securities and Exchange Board of India) regulations.

- Maximum Limit: Underwriters are allowed to issue up to 15% additional shares over the original issue size to stabilise the stock price.

- Stabilising Agent: A merchant banker is appointed as the stabilising agent to manage and execute the greenshoe option.

- Time Frame: The option can typically be exercised within 30 days from the date of listing of the securities.

- Disclosure Requirements: Companies must disclose the existence and terms of the greenshoe option in the IPO prospectus.

- Funds Management: The proceeds from the oversubscribed shares are held in a separate escrow account and used only for price stabilisation.

These guidelines ensure transparency and investor protection while providing flexibility to manage post-listing volatility.

Greenshoe Option Example

Let’s break down what a greenshoe option is with an example in the actual market.

Suppose a tech company decides to launch 1 crore shares at an IPO price of ₹10 per share. If the underwriter has the greenshoe option they can sell an extra 15 lakh shares (15% extra shares). This way the underwriter can use these extra shares in case there is an excess demand.

In this example two scenarios are possible:

Scenario 1:

The share price goes up to ₹12 per share. Here underwriters are not able to buy back the extra shares at ₹10 anymore. They turn to the company and buy those extra shares at ₹10 to give to the investors.

This way the underwriter has made a profit of ₹2 while also ensuring that these share prices are stabilised in the market.

Scenario 2:

Imagine that the share price goes down to ₹8. Now the underwriters buy back the extra shares at ₹8 to cover the short position. This buying activity supports the share price and prevents a further decline. In this scenario the underwriters also make a profit buying at ₹8 and covering a short sold at ₹10.

Importance of Greenshoe Share Options

Let’s take a quick look at the benefits of the greenshoe option.

- Price Stabilisation: Once an IPO is launched, the company and investors fear uncertainty in stock prices. The greenshoe option allows underwriters to take steps to stabilise the share price in the market and keep it as close as possible to the initial IPO price.

- Investor’s Confidence: An IPO with the greenshoe option builds confidence in investors that there won’t be extreme fluctuations in the share prices since underwriters have the power to intervene. Greenshoe options benefit investors by providing security, safety and profitability.

- Fulfil the Market Demand: If the IPO is performing well in the market there are high chances for excessive demand in the market. The greenshoe option allows the underwriter to sell an additional 15% of shares to meet the market demand.

- Flexibility for Underwriters: The greenshoe option allows underwriters to make appropriate decisions and intervene in the IPO process easily to adjust the demand and supply. They can employ built-in tools and strategies to ensure a real-time response.

Advantages of the Greenshoe Option

The greenshoe option provides key benefits in IPOs by ensuring price stability and supporting investor confidence during the initial days of listing.

- Price Stabilisation: Helps prevent excessive volatility in a newly listed stock.

- Increased Investor Trust: Builds confidence among investors by showing that the company and underwriters are prepared for demand fluctuations.

- Flexibility for Underwriters: Allows underwriters to sell additional shares and manage oversubscription efficiently.

- Improved Liquidity: Adds more shares to the market if needed, boosting trading volumes.

- Better IPO Performance: Encourages positive sentiment around the IPO, leading to healthier long-term performance.

Limitations of Greenshoe Option

While the Greenshoe option helps stabilise prices post-IPO. It also has certain drawbacks

- Limited Timeframe: The option can only be exercised for a short period post-listing (usually 30 days).

- May Delay Price determination: It can artificially maintain the IPO price, delaying natural market correction.

- Not a Guarantee Against Volatility: It reduces volatility but doesn’t eliminate it, especially in weak market conditions.

- Regulatory Compliance: Implementing it requires strict adherence to regulatory guidelines which can be complex.

How Investors Benefit from Greenshoe Option

The greenshoe option offers investors greater price stability and reduces volatility after an IPO. This helps build confidence and ensures smoother trading in the initial days.

- Provides price stability by reducing volatility after the IPO.

- Helps prevent sharp price drops due to excess demand or supply.

- Increases investor confidence through better market regulation.

- Offers potential for improved liquidity in the stock post-listing.

- Ensures a smoother trading experience during the initial phase.

Conclusion

In conclusion the Greenshoe Option serves as a vital stabilisation mechanism in the IPO process. Allowing underwriters to manage share supply in response to market demand contributes to price stability, enhances investor confidence and provides flexibility to the underwriting syndicate. With established guidelines and reporting requirements, the Greenshoe Option is a regulated tool that supports the orderly functioning of the market during the critical period following an initial public offering.

Related Articles

FAQs on Greenshoe Option

How does a company benefit from the greenshoe Option?

The company benefits from the greenshoe option by making a smoother market debut, expanding the potential for generating more capital by selling an additional 15% of shares if the IPO is oversubscribed.

Is the greenshoe Option mandatory in an IPO?

No, the greenshoe option is not mandatory in an IPO. However, if the company plans to use a greenshoe option, it has to be mentioned in the IPO prospectus or the offer document.

Can a retail investor benefit from a Greenshoe Option?

While retail investors do not directly exercise the Greenshoe Option, they can benefit indirectly from the price stabilisation it provides.