- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

GSP Crop Science IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

GSP Crop Science IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

GSP Crop Science Limited

GSP Crop Science, a prominent name in India’s agrochemical industry, has over 39 years of expertise in developing and manufacturing insecticides, herbicides, fungicides, and plant growth regulators. With a strong research-driven approach, the company provides crop protection solutions, aiding farmers in boosting productivity through advanced formulations and technicals. These formulations combine active ingredients and additives for optimal performance, while technicals serve as concentrated active ingredient bases for further processing.

As of September 30, 2024, GSP Crop Science holds 507 registrations across formulations and technicals, alongside 89 granted patents, with 98 additional applications under review. Their patented products contributed ₹1,441.11 million, or 20.73% of sales, during the six months ending September 30, 2024. This robust portfolio reflects their unwavering focus on innovation, ensuring comprehensive solutions for modern agriculture and cementing their leadership in the agrochemical sector.

GSP Crop Science Limited IPO Overview

GSP Crop IPO is a bookbuilding issue comprising a fresh issue of ₹280.00 crore and an offer for sale of 0.60 crore shares. The IPO dates are yet to be announced, and the allotment is expected to be finalized soon. The price band details are also awaited. Equirus Capital Private Limited and Motilal Oswal Investment Advisors Limited are the book-running lead managers, while Link Intime India Private Ltd is the registrar for the issue. The IPO will have a face value of ₹10 per share and will be listed on BSE and NSE. The total issue size, lot size, and aggregate value will be updated in due course. The company’s pre-issue shareholding stands at 3,90,18,750 shares, with promoters including Bhavesh Vrajmohan Shah, Tirth Kenal Shah, Vilasben Vrajmohan Shah, Falguni Kenal Shah, Alpha Trust, and Kappa Trust, holding a 98.25% pre-issue stake. Post-issue shareholding will reflect the equity dilution

GSP Crop Science Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹280 crore

Offer for Sale (OFS): 60 lakh equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,90,18,750 shares |

| Shareholding post -issue | TBA |

GSP Crop Science Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

GSP Crop Science Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

GSP Crop Science Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 1.40 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 15.20% |

| Net Asset Value (NAV) | 94.94 |

| Return on Equity | 15.00% |

| Return on Capital Employed (ROCE) | 18.91% |

| EBITDA Margin | 11.32% |

| PAT Margin | 4.80% |

| Debt to Equity Ratio | 0.53 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment or pre-repayment of all or a portion of certain outstanding borrowings | 2,000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

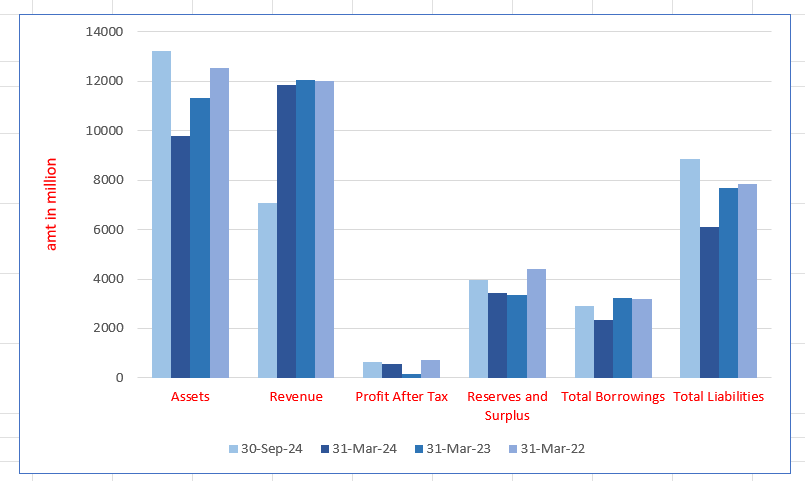

GSP Crop Science Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 13216.70 | 9803.43 | 11321.29 | 12549.90 |

| Revenue | 7089.08 | 11852.28 | 12060.47 | 12025.13 |

| Profit After Tax | 658.69 | 555.40 | 175.73 | 723.08 |

| Reserves and Surplus | 3943.67 | 3444.55 | 3360.02 | 4390.91 |

| Total Borrowings | 2889.63 | 2354.38 | 3242.57 | 3202.34 |

| Total Liabilities | 8851.92 | 6099.17 | 7683.44 | 7862.80 |

Financial Status of GSP Crop Science Limited

SWOT Analysis of GSP Crop Science IPO

Strength and Opportunities

- Over 39 years of experience in the agrochemical industry, enhancing market reputation.

- Extensive product portfolio covering insecticides, herbicides, fungicides, and plant growth regulators.

- Strong research-driven approach ensures continuous innovation and patent growth.

- Presence in multiple markets strengthens global reach and reduces reliance on specific regions.

- Strategic focus on sustainable agriculture aligns with emerging global trends.

- Strong R&D capabilities support the development of unique, high-quality formulations.

- Broad customer base minimises dependence on any single client or region.

- Technological advancements reduce reliance on imports and improve operational efficiency.

- Growing demand for crop protection products provides opportunities for expansion in emerging markets.

- Increasing focus on patented products boosts margins and brand differentiation.

- Strategic investments in expanding manufacturing capacity cater to increasing demand.

Risks and Threats

- High dependence on raw material imports increases vulnerability to currency fluctuations.

- Regulatory compliance challenges in domestic and international markets may hinder operations.

- High working capital requirements due to lengthy receivable periods.

- Exposure to agroclimatic uncertainties impacting demand for products.

- Intense competition from well-established global and domestic agrochemical companies.

- Volatility in raw material prices affects cost structures and profitability.

- Dependence on third-party distributors may affect control over product distribution.

- Rising concerns over environmental impact could lead to stricter regulations.

- Limited direct access to end-users compared to competitors with integrated distribution systems.

- Supply chain disruptions may impact production and delivery schedules.

- Global economic instability could affect export revenues and overall growth.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About GSP Crop Science Limited IPO

More About GSP Crop Science Limited

GSP Crop Science Limited, established in 1985, is a research-driven agrochemical company specialising in developing and manufacturing insecticides, herbicides, fungicides, and plant growth regulators. With over 39 years of industry experience, the company supports farmers by offering advanced crop protection solutions that enhance agricultural productivity.

Product Portfolio

GSP provides two key categories of agrochemical products:

- Formulations: Comprising active ingredients and additives, formulations deliver targeted pest, weed, and disease control while ensuring ease of use. The company holds 387 registrations for various formulations as of September 30, 2024.

- Technicals: Concentrated active ingredients processed into formulations. With 120 registrations, GSP is among the first indigenous manufacturers of numerous technicals.

Research and Development

Innovation underpins GSP’s success. The company has been granted 89 patents and has 98 applications pending. Patented products accounted for ₹1,441.11 million in revenue for the six months ending September 30, 2024, representing 20.73% of its total product sales.

Market Presence

GSP operates in both domestic and international markets:

- Domestic Business: GSP markets its products through B2B and B2C channels under popular brands like Platform, Afford, and Raavan.

- International Business: Operating across 39 countries, GSP focuses on regions such as Latin America and Asia-Pacific. Recent expansions include acquiring GSP Agroquimica Do Brasil LTDA and initiating operations in Uruguay.

Long-standing Client Relationships

GSP serves a diverse clientele, including Bharat Rasayan Limited and Dharmaj Crop Guard Limited, with many partnerships spanning over a decade.

By leveraging innovation and strong customer relationships, GSP continues to lead the agrochemical industry in India and beyond.

Industry Outlook

Global Agriculture Market: An Overview

The global agriculture market plays a pivotal role in ensuring sustainable food systems, eradicating poverty, and supporting economic growth. Key highlights:

- Economic Impact: Agriculture contributes 4% to global GDP, exceeding 25% in some developing countries.

- Market Growth: Reached $3,720 billion in 2023 (CAGR 6.5%, 2019-2023), projected to hit $4,821 billion by 2029 (CAGR 4.1%).

- Volume Trends: Grew 1.2% annually (2019-2023) to 9,863 MMT in 2023; forecasted at 10,559 MMT by 2029.

- Price Drivers: Increased production costs, premium product demand, and supply chain disruptions.

Domestic Agriculture Market Overview

Economic Importance

India’s agricultural sector is vital for food security and economic stability, contributing approximately 17.7% to the nation’s Gross Value Added (GVA) during FY2024.

Key Drivers of Growth

- Modern Practices: High-yield crop varieties and mechanised farming boost productivity.

- Government Policies: Initiatives like Pradhan Mantri Fasal Bima Yojana (crop insurance) and e-NAM (online market platform) support farmers.

- Rising Investments: Improved technology and capital inflows enhance sectoral efficiency.

Market Performance

Production and Value Trends

- Market Value: Reached ₹12,320 billion in FY2024, with a CAGR of 3.3% (FY2019–2024).

- Production Volume: Grew to 892 million tons in FY2024, projected to reach 966 million tons by FY2029.

- Future Projections: Expected market value of ₹14,791 billion by FY2029, at a CAGR of 3.5% (FY2025–2029).

Price Volatility

- Influenced by:

- Extreme weather events.

- Lower reservoir levels.

- Increased production costs impacting supply chains.

Drivers of Agricultural Growth

Key Contributors

- Rising Food Demand: Population growth and urbanisation increase demand for diverse products.

- Employment: Agriculture employs ~46% of India’s workforce (FY2023).

- Rural Development: Enhances infrastructure, healthcare, and education in rural areas.

- Export Market: Significant global exports, with ₹1,119 billion agricultural exports in FY2024.

Emerging Opportunities

- Sustainable Farming: Adoption of digital technologies like precision farming.

- Policy Support: Government initiatives (e.g., PM-KISAN, MSP) ensure stability.

- Diversification: Broader crop range boosts resilience and export potential.

Global Agrochemical Market Overview

- Market Size & Growth: The global agrochemical market reached $71.0 billion in CY2023, with a 4.6% CAGR from CY2019 to CY2023. It is projected to grow to $103.9 billion by CY2029 at a 6.1% CAGR.

- Volume: The market reached 10.03 million tonnes (MMT) in CY2023, growing at 4.0% CAGR. It is expected to hit 13.4 MMT by CY2029, with a 4.5% CAGR.

Key Market Drivers:

- Rising Demand for Agriculture Output: Growing global population increases food production demands, making agrochemicals essential for higher crop yields.

- Modern Agricultural Techniques: Innovations like integrated pest management (IPM) are driving agrochemical usage.

- Government Support: Subsidies and regulations promote agrochemical use, supporting agriculture and food security.

- Technological Advancements: Precision agriculture and biopesticides enhance efficiency and sustainability, catering to eco-conscious consumers.

Indian Agrochemical Market

The Indian agrochemical market reached Rs. 344.2 billion in FY2024, growing at a CAGR of 12.6% from FY2019. The diverse agro-climatic conditions and vast agricultural land make India a key global player in the agrochemical industry, which includes insecticides, herbicides, fungicides, and plant growth regulators.

Key Drivers:

- Population Growth: Rising food demand outpaces production, necessitating agrochemicals to boost crop yields and manage pests.

- Low Manufacturing & Labour Costs: India’s cost-effectiveness supports global competitiveness in agrochemical production.

- Agriculture Sector Growth: A robust agriculture sector, contributing 17.7% to GVA, drives agrochemical demand.

- Regulatory Support: The PMFAI promotes agrochemical exports through conferences and exhibitions.

- Innovations: Direct-to-consumer sales and e-commerce platforms enhance product accessibility and efficiency.

- Land Expansion: Increased cultivation and new crop varieties heighten the need for pest management and agrochemical use.

India’s Rise as a Hub for Agrochemicals

- Cost Advantage: Low labor costs and favorable policies reduce manufacturing expenses.

- Skilled Workforce & Production Capacity: India’s technically trained workforce and untapped production capacity boost agrochemical output.

- Government Support: Programs like Make in India and PLI scheme promote innovation and infrastructure growth.

- Global Shift: Post-COVID, companies diversify suppliers, increasing India’s market share.

- Environmental Regulations: Strict environmental norms ensure sustainable agrochemical manufacturing.

Indian Insecticide Market Growth

- Market Expansion: Driven by the need for increased food production due to population growth.

- Farmer Awareness: Farmers recognise financial benefits from insecticides, including reduced crop losses.

- Technological Advancements: Precision agriculture boosts insecticide application efficiency.

- Government Support: Initiatives like PMFBY and integrated pest management programs foster market growth.

- Environmental Focus: Rising demand for eco-friendly options, such as biopesticides, enhances sustainability in agriculture.

Indian Herbicide Market Growth

- Demand for Effective Weed Control: Weeds reduce crop yields, elevate costs, and degrade product quality, increasing reliance on herbicides.

- Economic Viability: Herbicides offer a cost-effective solution to weed management, enhancing agricultural productivity.

- Increased Crop Losses: Weeds compete for resources, leading to significant crop losses and prompting higher herbicide usage.

- Need for Enhanced Crop Production: India’s growing population and demand for quality agriculture products boost herbicide adoption for optimal crop yields.

Indian Fungicide Market

- Key Role in Agriculture: Fungicides are crucial for protecting crops from fungal diseases, ensuring better yields and quality.

- Market Growth: The market reached Rs 65.5 billion in FY2024, with an expected value of Rs 102.8 billion by FY2029.

- Growth Drivers: Increased crop losses from fungal infections and the rise in crop intensification.

India Plant Growth Regulator (PGR) Market

- Market Growth: The India PGR market reached Rs 4.7 billion in FY2024, with an expected value of Rs 7.9 billion by FY2029.

- Enhanced Productivity: PGRs boost crop yields, optimise plant growth, and improve quality.

- Pest Resistance: As pests develop resistance, PGRs help improve crop defense and reduce reliance on chemical pesticides.

- Government Support: Initiatives like subsidies and research funding are making PGRs more accessible to farmers.

- Sustainable Agriculture: PGRs support integrated practices like Conservation Agriculture for improved soil health and crop yields

How Will GSP Crop Science Limited Benefit?

- Strong Product Portfolio

GSP Crop Science Limited’s diverse agrochemical portfolio of insecticides, herbicides, fungicides, and plant growth regulators meets various crop protection needs, ensuring that farmers benefit from effective solutions. The company’s extensive range, including 387 formulations and 120 technicals, strengthens its position as a leader in crop protection.

- Research and Development Innovation

GSP’s focus on R&D, with 89 patents and ongoing applications, fuels continuous product innovation. The company’s patented products, contributing 20.73% to its revenue, help farmers access cutting-edge solutions that boost crop yields, reduce pest damage, and enhance overall productivity in agriculture.

- Domestic Market Presence

GSP’s strong domestic presence, supported by renowned brands like Platform, Afford, and Raavan, enables it to offer high-quality products directly to Indian farmers. The company’s established market in India ensures access to reliable crop protection solutions for a vast agricultural community.

- International Expansion

With a growing international footprint across 39 countries, including recent expansions in Brazil and Uruguay, GSP is poised to tap into emerging global markets. This international presence enables the company to capitalise on the rising demand for agricultural products and enhances its global competitiveness.

- Long-Term Client Relationships

GSP has cultivated enduring partnerships with major clients like Bharat Rasayan Limited and Dharmaj Crop Guard Limited, establishing trust and mutual growth. These long-term relationships foster stability, ensuring consistent demand for GSP’s products and strengthening its position in both domestic and international markets.

- Strategic Acquisitions

By acquiring companies such as GSP Agroquimica Do Brasil LTDA, GSP strengthens its global footprint and market share in strategic regions like Latin America. Such acquisitions enable the company to expand its product offerings and distribution networks, enhancing overall market penetration and growth opportunities.

- Cost-Effective Manufacturing

GSP’s cost-effective manufacturing capabilities, driven by India’s competitive labour costs, allow the company to produce high-quality agrochemical products at lower prices. This cost advantage positions GSP as an attractive supplier for both domestic and international markets, driving increased demand for its products.

- Government Support and Regulatory Compliance

GSP benefits from supportive government initiatives in India, such as subsidies and export promotion through programs like PMFAI. The company’s adherence to strict environmental regulations ensures its sustainability in agrochemical manufacturing, catering to the growing demand for eco-friendly and compliant products globally.

- Diverse Product Categories

The company’s focus on both formulations and technicals enables GSP to serve a wide range of customer needs. While formulations target ease of use for farmers, technicals offer concentrated, effective solutions for agricultural businesses, strengthening GSP’s position as a versatile agrochemical provider in the industry.

- Sustainable Agriculture Practices

GSP’s commitment to developing eco-friendly products, such as biopesticides and precision farming solutions, aligns with the growing demand for sustainable agriculture. As consumers and governments push for greener farming practices, GSP is well-positioned to meet this demand with its innovative, environmentally conscious product offerings.

Peer Group Comparison

| Name of the Company | Face Value (₹ per share) | Revenue

(₹ in million) |

Basic EPS (₹) | P/E | RONW (%) | NAV

(₹) |

| GSP Crop Science Limited | 10.00 | 11,521.61 | 13.49 | – | 15.00% | 94.94 |

| PI Industries Limited | 1.00 | 76,658.00 | 110.83 | 37.20 | 19.26% | 575.48 |

| Sumitomo Chemical India Limited | 10.00 | 28,439.47 | 7.40 | 73.70 | 15.14% | 48.91 |

| Dhanuka Agritech Limited | 2.00 | 17,585.44 | 52.46 | 30.57 | 19.04% | 275.54 |

| Rallis India Limited | 1.00 | 26,483.80 | 7.61 | 43.20 | 8.08% | 94.08 |

| Bharat Rasayan Limited | 10.00 | 10,446.26 | 229.86 | 48.73 | 9.67% | 2,377.43 |

| India Pesticides Limited | 1.00 | 6,804.10 | 5.24 | 36.24 | 7.29% | 71.63 |

| Excel Industries Limited | 5.00 | 8,261.40 | 13.53 | 104.95 | 1.19% | 1,135.23 |

| Heranba Industries Limited | 10.00 | 12,570.70 | 8.72 | 55.10 | 4.14% | 210.69 |

Key Insights

- Revenue: Revenue highlights the scale of operations. PI Industries Limited leads with ₹76,658 million, indicating a strong market presence. GSP Crop Science Limited has a smaller revenue of ₹11,521.61 million, reflecting its limited scale. India Pesticides Limited shows the lowest at ₹6,804.10 million.

- Basic EPS: Bharat Rasayan Limited leads in Basic EPS with ₹229.86, indicating robust profitability. PI Industries Limited follows at ₹110.83. GSP Crop Science Limited has a more modest EPS of ₹13.49, while India Pesticides Limited lags with ₹5.24, suggesting lower earnings potential.

- P/E Ratio: Excel Industries Limited shows the highest P/E ratio of 104.95, suggesting high investor expectations. PI Industries Limited has a more balanced ratio of 37.20. GSP Crop Science Limited P/E ratio is yet to be declared

- Return on Net Worth (RONW): PI Industries Limited demonstrates the highest RONW at 19.26%, reflecting efficient equity utilisation. Dhanuka Agritech Limited follows closely at 19.04%, while GSP Crop Science Limited reports a negative RONW of -15.00%, signaling potential inefficiencies in generating profits from shareholders’ equity.

- Net Asset Value: Bharat Rasayan Limited has the highest NAV at ₹2,377.43, indicating a strong asset base. Excel Industries Limited also shows a solid NAV of ₹1,135.23. GSP Crop Science Limited has a lower NAV of ₹94.94, suggesting a smaller asset foundation compared to its peers.

GSP Crop Science Limited IPO Strengths

- Well-Diversified Product Portfolio

GSP Crop Science Limited boasts a well-rounded product portfolio, encompassing insecticides, herbicides, fungicides, and plant growth regulators. This broad range of formulations and technicals enables the company to provide comprehensive crop protection solutions tailored to the needs of their customers. By focusing on both product development and manufacturing capabilities, GSP ensures they meet agricultural demands, enhancing productivity and fostering strong relationships with both B-to-B and B-to-C clients. The portfolio supports their strategic aim to maximise agricultural output globally.

- Extensive Customer Relationships and Market Reach

GSP Crop Science Limited has established strong, long-term relationships with B-to-B customers worldwide, including agrochemical companies. These connections, some over a decade old, demonstrate the company’s expertise in producing complex formulations cost-effectively and sustainably. With a presence in 39 countries across regions like Latin America, Asia Pacific, and North America, the company continues expanding its international reach, ensuring resilience and adaptability to meet evolving global agricultural needs.

- Strong In-House R&D Capabilities

With a focus on innovation, GSP Crop Science Limited prioritises in-house research and development (R&D) to drive the creation of high-quality, cost-effective agrochemical products. Their dedicated R&D facility fosters the development and commercialisation of new formulations and technicals. The company invests heavily in improving production processes and the quality of existing products, as well as exploring new off-patent products, ensuring they maintain a competitive edge and continue meeting market demands through continuous innovation.

- Robust Manufacturing Facilities Focused on Sustainability

GSP Crop Science Limited operates four manufacturing facilities in Gujarat and Jammu & Kashmir, with an annual capacity of 15,120 MTPA for Technicals and 43,672 MTPA for Formulations. The facilities are equipped with advanced machinery, enabling efficient production and operational optimisation. Emphasising sustainability, they feature comprehensive effluent treatment plants and solid waste management systems. The company is also focused on cost optimisation and developing alternative production processes for upcoming off-patent products.

- Experienced Leadership and Professional Management Team

GSP Crop Science Limited is led by experienced Promoters with a strong background in the agrochemicals industry. The governance structure includes a diverse Board of Directors, bringing a wealth of expertise from various industries. With a dedicated team of 1,096 employees, the company thrives in addressing market trends, expanding globally, and enhancing manufacturing capabilities. The leadership’s deep understanding of the agrochemicals sector positions the company well for future growth and innovation

Key Insights from Financial Performance

- Assets: GSP Crop Science’s assets have seen fluctuations, with a notable increase from ₹9,803.43 crore (March 2024) to ₹13,216.70 crore (September 2024), indicating asset growth. This increase can signify investment in operations or expansion to support future growth.

- Revenue: Revenue has decreased from ₹12,060.47 crore (March 2023) to ₹7,089.08 crore (September 2024), showing a decline in sales. This decline could be a result of reduced market demand or operational challenges, affecting the overall income generated.

- Profit After Tax (PAT): Profit After Tax has improved from ₹175.73 crore (March 2023) to ₹658.69 crore (September 2024), reflecting growth in profitability. This rise in PAT suggests better cost management or increased efficiency despite the drop in revenue.

- Reserves and Surplus: Reserves and Surplus have increased from ₹3,360.02 crore (March 2023) to ₹3,943.67 crore (September 2024), showcasing the company’s ability to retain earnings. This increment indicates a strengthening of the financial position, helping mitigate potential risks.

- Total Borrowings: Total borrowings have fluctuated, from ₹3,242.57 crore (March 2023) to ₹2,889.63 crore (September 2024), showing a decrease in debt. This reduction in borrowings reflects an effort to reduce leverage and lower interest costs, signaling financial prudence.

- Total Liabilities: Total liabilities have decreased from ₹7,862.80 crore (March 2022) to ₹8,851.92 crore (September 2024). This increase in liabilities, despite lower borrowings, could indicate higher payables, taxes, or other financial obligations impacting overall debt management.

Other Financial Details

- Cost of Materials Consumed: The cost of materials consumed represents the primary expenses incurred in the production process. For the period ending September 30, 2024, it shows a significant value of ₹4,422.31 million, decreasing compared to ₹6,439.18 million for FY 2024. This suggests that GSP Crop Science reduced its raw material costs, potentially due to better procurement or cost optimisation.

- Employee Benefits Expenses: These expenses, including salaries, bonuses, and other benefits, stood at ₹494.80 million for September 2024, significantly lower than ₹804.69 million in FY 2024. This decrease may reflect workforce adjustments or more efficient operations within GSP Crop Science during the six-month period.

- Finance Cost: Finance costs represent the interest and other costs related to borrowings. The cost of ₹147.12 million for September 2024 is considerably lower than ₹339.91 million for FY 2024, suggesting a reduction in borrowings or more favorable loan terms during the recent six months.

- Depreciation & Amortisation Expenses: These expenses account for the allocation of the cost of tangible and intangible assets. For September 2024, this figure is ₹99.07 million, showing a decrease compared to ₹198.58 million for FY 2024. This could indicate reduced capital expenditure or more efficient asset utilisation.

- Other Expenses: These expenses encompass various operational costs such as marketing, administrative, and miscellaneous expenses. The total of ₹1,265.58 million for the six months ended September 30, 2024, is lower than the ₹2,024.60 million for FY 2024, suggesting cost-control measures or lower non-core operational expenses

Key Strategies for GSP Crop Science Limited

- Expanding into International Markets

GSP Crop Science Limited aims to leverage its diverse offerings to expand into international markets, targeting regions such as Latin America, Asia Pacific, and North America. By capitalising on the growing agrochemical market, especially in countries like Brazil and Uruguay, the company plans to increase its global presence, expand customer bases, and tap into high-growth markets, enhancing revenue potential.

- Expanding Product Offerings through R&D

The company plans to diversify its product portfolio by investing in research and development (R&D) to create innovative solutions. With a focus on expanding its range of patented products, including fungicides, insecticides, and herbicides, GSP intends to strengthen its domestic and international manufacturing capabilities, driving consistent revenue growth through the introduction of new, high-demand products.

- Diversifying and Strengthening Customer Base

GSP Crop Science Limited focuses on diversifying its customer base by adding new customers and enhancing relationships with existing clients. By maintaining a strong track record of repeat orders and leveraging its extensive distribution network, the company plans to expand its reach both domestically and internationally, especially in emerging markets across Latin America, Asia Pacific, and North America.

- Optimising Manufacturing through Backward Integration

To optimise manufacturing, GSP plans to enhance its backward integration strategy by producing intermediates used in Technicals. This will allow the company to reduce reliance on external suppliers, control the quality and availability of raw materials, and mitigate supply chain risks. Increased control over production stages will lead to cost savings and improved profitability while strengthening market competitiveness.

- Reducing Borrowings and Improving Financial Leverage

GSP Crop Science Limited aims to reduce its borrowings by utilising proceeds to repay existing loans, thereby improving its financial position. By reducing its debt burden, the company expects to enhance its Net Debt to Equity ratio, allowing for future growth opportunities and investments, and enabling the company to secure funds at competitive rates for expansion projects.

Competitor Analysis of GSP Crop Science Limited

- PI Industries Limited

PI Industries Limited is a leading player in the Indian agrochemical sector, with a focus on crop protection and plant growth. GSP Crop Science competes by focusing on cost-efficient manufacturing, strong customer relationships, and expanding its international presence. While PI Industries holds a robust market position, GSP aims to grow by offering high-quality, affordable alternatives in the industry.

- Sumitomo Chemical India Limited

Sumitomo Chemical India, a subsidiary of the Japanese conglomerate, specialises in crop protection products. GSP Crop Science Limited competes by emphasising its competitive pricing and a wide product portfolio. With Sumitomo’s established global reach, GSP focuses on increasing its domestic and international footprint, aiming to carve out a space in both markets through innovation and product differentiation.

- Dhanuka Agritech Limited

Dhanuka Agritech is a major agrochemical player with a diverse portfolio of crop protection products. GSP Crop Science competes by targeting niche markets with specialised products and an efficient supply chain. Dhanuka’s strength in the domestic market poses competition, but GSP’s focus on cost-effectiveness and expanding product offerings positions it to capture a larger market share in key sectors.

- Rallis India Limited

Rallis India, a subsidiary of Tata Chemicals, is well-known for its broad agrochemical range. GSP Crop Science faces competition from Rallis’ established network and large-scale operations. However, GSP’s strategy to differentiate with value-driven solutions, customer-centric service, and increased focus on international markets allows it to compete effectively, targeting regional and international growth opportunities.

- Bharat Rasayan Limited

Bharat Rasayan Limited specialises in the production of technical grade pesticides, commanding a strong position in India. GSP Crop Science competes by diversifying its product portfolio and leveraging advanced manufacturing processes. While Bharat Rasayan has a solid market presence, GSP focuses on delivering high-quality, cost-effective solutions, aiming to expand its market penetration in both domestic and international markets.

- India Pesticides Limited

India Pesticides Limited is an established name in the pesticide manufacturing space. GSP Crop Science competes with India Pesticides by focusing on sustainability, extensive R&D, and cost-effective manufacturing. India Pesticides has a stronghold in the Indian market, but GSP’s strategy of differentiation through innovation and expanding distribution channels helps it challenge for a larger share in the agrochemical space.

- Excel Industries Limited

Excel Industries specialises in manufacturing crop protection chemicals and is known for its technical expertise. GSP Crop Science competes by expanding its range of products and focusing on high-quality solutions at competitive prices. Excel’s strong market presence in India is challenged by GSP’s agility in responding to market demands and maintaining strong customer relations.

- Heranba Industries Limited

Heranba Industries is a key player in India’s agrochemical industry, focusing on insecticides, herbicides, and fungicides. GSP Crop Science competes by diversifying its product offerings and focusing on operational efficiencies. While Heranba has strong recognition, GSP seeks to build on its competitive advantages such as cost-effective production and specialised products to enhance its market position.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On GSP Crop Science Limited

What is GSP Crop Science Limited's IPO?

GSP Crop Science Limited, an agrochemical company, is planning an initial public offering (IPO) to raise funds for debt repayment and general corporate purposes.

When was the GSP Crop Science IPO Draft Red Herring Prospectus (DRHP) filed?

The company filed its DRHP with the Securities and Exchange Board of India (SEBI) on December 20, 2024.

What is the size of the GSP Crop Science IPO?

The IPO comprises a fresh issue of equity shares worth up to ₹280 crore and an offer for sale of 60 lakh equity shares by promoters.

Who are the merchant bankers for the GSP Crop Science IPO?

Equirus Capital Private Limited and Motilal Oswal Investment Advisors Limited are the appointed merchant bankers for the IPO.

How can investors apply for the GSP Crop Science IPO?

Investors can apply online using UPI or ASBA through their bank accounts.

When is the GSP Crop Science IPO expected to open and close?

The IPO is anticipated to open and close in the last week of March 2025, though exact dates are yet to be confirmed.