- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

HD Fire Protect IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

HD Fire Protect IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

HD Fire Protect Limited

HD Fire Protect Ltd. designs, manufactures, and supplies advanced fire protection equipment and systems for industrial, commercial, and institutional sectors. Focused on reliability, innovation, and global certification, the company combines strong research, continuous improvement, and compliance with international standards. Operating two manufacturing facilities in Maharashtra’s Jalgaon MIDC and Thane MIDC over 8.50 acres, it offers a wide range of products, including fire sprinklers, valves, foam equipment, and detection systems. As of March 31, 2025, HD Fire Protect Ltd. employed 261 permanent and 185 contractual staff.

HD Fire Protect Limited IPO Overview

HD Fire Protect Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 24, 2025, to raise funds through an Initial Public Offer (IPO). The HD Fire Protect IPO is a Book-Build Issue consisting entirely of an Offer for Sale of up to 2.63 crore equity shares. The company’s shares are proposed to be listed on both NSE and BSE. Ambit Pvt. Ltd. is acting as the book-running lead manager, while MUFG Intime India Pvt. Ltd. is serving as the registrar of the issue. Details such as IPO opening and closing dates, price band, and lot size are yet to be announced. Investors can refer to the HD Fire Protect IPO DRHP for complete information.

As per the draft prospectus, the face value of each share is ₹5, and the total issue size comprises 2,62,84,500 shares, aggregating up to ₹[.] crore. The issue is a pure offer for sale, meaning there will be no fresh issue of shares. Post-issue, the company’s total shareholding will remain unchanged at 17,52,30,000 shares. The DRHP was officially filed with SEBI on September 24, 2025.

The promoters of HD Fire Protect Ltd. include Harish Narshi Dharamshi, Kusum Harish Dharamshi, Miheer Sadanand Ghotikar, Parika Miheer Ghotikar, and Anik Narendra Dharamshi. Their collective promoter holding before the issue stands at 100%, and it will remain the same after the issue since it is an offer for sale.

HD Fire Protect Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | NA |

| Offer for Sale (OFS) | 2.63 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 17,52,30,000 shares |

| Shareholding post-issue | 17,52,30,000 shares |

HD Fire Protect IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

HD Fire Protect Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

HD Fire Protect Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹6.25 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 27.67% |

| Net Asset Value (NAV) | ₹22.59 |

| Return on Equity (RoE) | 29.59% |

| Return on Capital Employed (RoCE) | 39.64% |

| EBITDA Margin | 31.89% |

| PAT Margin | 24.31% |

| Debt to Equity Ratio |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

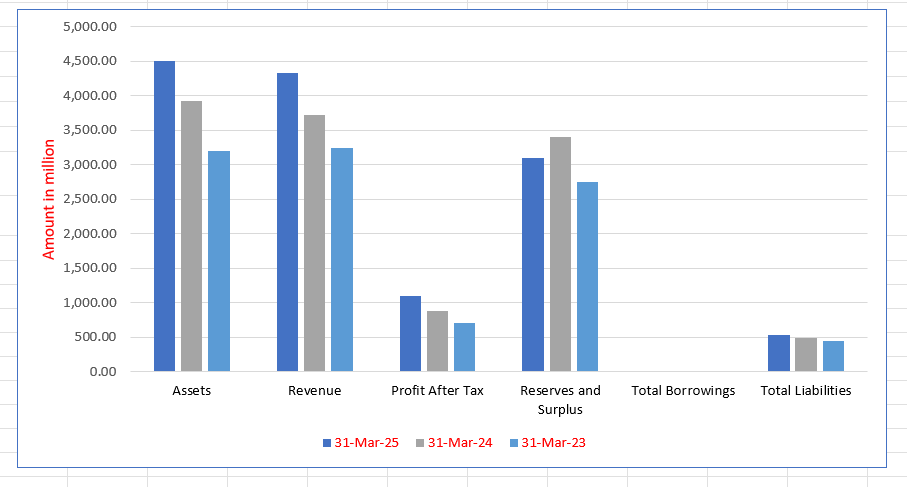

HD Fire Protect Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 4,499.10 | 3,926.32 | 3,198.81 |

| Revenue | 4,327.99 | 3,729.53 | 3,240.78 |

| Profit After Tax | 1,095.46 | 879.20 | 702.25 |

| Reserves and Surplus | 3,094.45 | 3,407.58 | 2,746.62 |

| Total Borrowings | – | – | – |

| Total Liabilities | 528.50 | 492.19 | 442.69 |

Financial Status of HD Fire Protect Limited

SWOT Analysis of HD Fire Protect IPO

Strength and Opportunities

- Strong global presence with products distributed across more than 90 countries.

- Diverse product portfolio including water, foam, and gas-based fire-fighting systems.

- Compliance with top international certifications such as UL, FM, and CE.

- Established brand reputation with over 35 years of industry experience.

- Growing demand for advanced fire safety systems in India and global markets.

- Opportunity to introduce smart and IoT-enabled fire protection solutions.

- Strong presence in high-value industries like oil, gas, and infrastructure.

- Potential for expansion into maintenance and after-sales services.

- Development of eco-friendly, fluorine-free foam systems enhances sustainability.

Risks and Threats

- Heavy dependence on export markets makes the business vulnerable to currency fluctuations.

- Intense competition in the fire-protection sector pressures pricing and innovation.

- Limited manufacturing base with only two plants may restrict large-scale expansion.

- Rising raw material costs, especially metals and foam chemicals, can impact margins.

- Frequent regulatory changes increase compliance and certification costs.

- Rapid technological advancements may render existing systems outdated.

- Dependence on large projects may lead to uneven revenue flow.

- Global supply chain challenges may disrupt timely deliveries.

- Emerging low-cost competitors could erode international market share.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About HD Fire Protect Limited

HD Fire Protect Limited IPO Strengths

Established Global Presence in a High-Barrier Industry

HD Fire Protect Limited possesses a well-established global presence with a business legacy exceeding 35 years, exporting fire protection systems to over 90 countries. The company operates in a highly regulated industry characterized by substantial entry barriers due to the necessity for extensive, internationally recognized product certifications (like UL Listed, FM Approved) and stringent, time-consuming vendor empanelment processes. This positioning reinforces their competitive advantage in this high-barrier sector.

Comprehensive Portfolio for Diverse End-Use Sectors

The company offers an extensive and comprehensive portfolio of fire protection equipment and systems, covering water, foam, and gas-based suppression technologies across eight product categories. This diversified offering is supplied to over 90 countries across a wide array of end-use sectors including oil & gas, heavy engineering, and aerospace, mitigating dependence on any single industry. Their ability to deliver high-performance, customized solutions is demonstrated by installations at key global sites.

Strong, Diversified Global Customer Base

HD Fire Protect Limited maintains a robust and diversified customer base of over 2,179 clients across domestic and international markets. The company’s resilience is enhanced by its broad sectoral and geographical distribution, which protects against regional downturns. Their revenue is consistently supported by a high percentage of repeat customers (over 86%) and is bolstered by long-standing relationships, with more than 54% of Fiscal 2025 revenue from clients associated for over five years.

Advanced Vertical Integration and Innovation Capabilities

The firm boasts advanced, vertically integrated design and manufacturing capabilities at its Jalgaon facility, controlling the entire value chain from casting and machining to final quality control. This integration ensures high quality, reduced lead times, and strict compliance with global standards. With patents filed and granted and a continuous focus on R&D for advanced, sustainable fire protection technologies, the company is well-equipped to deliver high-performance, certified solutions.

Track Record of Strong Profitability and Financial Performance

HD Fire Protect Limited has demonstrated a consistent and resilient financial performance, achieving a revenue CAGR of 15.56% between Fiscal 2023 and 2025. It reported the highest operating and net profit margins among its focused peers in Fiscal 2024. The company has a debt-free balance sheet and strong cash flows, with robust return ratios (ROE and ROCE) that highlight effective capital deployment and operational efficiency.

More About HD Fire Protect Limited

HD Fire Protect Limited, an Indian manufacturer and supplier of fire protection equipment, offers a comprehensive range of water, foam, and gas-based fire suppression systems. The company develops most of its products in-house, utilizing proprietary designs to meet national and international standards. Catering to both industrial and commercial sectors, it serves high-hazard industrial applications such as oil & gas, power & energy, and aerospace, as well as residential and commercial sectors like hospitality and healthcare.

Leadership in the Industry

With over three decades of experience, HD Fire Protect has become a globally recognized brand. According to a CRISIL report, the company was the second-largest manufacturer of fire protection equipment in India in terms of operating income for fiscal 2024. Additionally, it emerged as the largest exporter of fire protection equipment from India in the same fiscal year. The company boasts UL Listing and FM Approval for a variety of products, making it a pioneer in the Indian market.

Product Portfolio and Manufacturing

The company’s product portfolio spans eight key categories, including sprinklers, deluge valves, foam equipment, water spray nozzles, and gas suppression systems. As of March 31, 2025, HD Fire Protect operates two manufacturing facilities in Maharashtra, covering 8.5 acres, with plans for further expansion. The company also engages in contract manufacturing and white-labelling to meet diverse customer requirements.

Global Presence and R&D Focus

HD Fire Protect exports to over 90 countries, including key markets like UAE, Saudi Arabia, and Brazil. The company maintains a strong focus on quality, with a product recall rate of just 0.01%. Its R&D efforts are directed towards next-generation fire protection technologies, with innovations such as the next-gen pre-action system and a new deluge valve design currently under patent.

Financial Performance

The company has demonstrated consistent financial growth, with revenue from operations growing at a CAGR of 15.56% from fiscal 2023 to 2025. It reported operating EBITDA margins of 31.89% and PAT margins of 24.31% for fiscal 2025, underlining its robust financial health and operational efficiency.

Industry Outlook

The Indian Fire Protection Equipment Industry is experiencing robust growth, driven by both domestic and international demand for advanced fire safety systems. This industry is forecast to grow at a CAGR of around 7-8% over the next five years, driven by the increasing awareness of safety standards and regulations across industrial, residential, and commercial sectors.

Growth Drivers:

- Regulatory Compliance: The Indian government and international bodies have stringent fire safety regulations, which mandate the use of certified fire protection systems in industries like oil and gas, manufacturing, and infrastructure.

- Urbanization and Infrastructure Development: As urban areas expand and new infrastructure projects emerge, the demand for fire protection systems in commercial buildings, hospitals, schools, and high-rise buildings continues to increase.

- Rising Industrialization: With industries such as power, energy, pharmaceuticals, and oil & gas expanding, the need for fire suppression systems, including foam and gas-based systems, grows significantly.

- Environmental and Safety Awareness: Growing focus on environmental impact and safety standards further boosts demand for advanced fire protection technologies.

Key Industry Products:

- Water-based systems: Including sprinklers and water spray nozzles, essential for residential, commercial, and industrial sectors.

- Foam suppression systems: Widely used in high-risk industries like petrochemicals and oil & gas.

- Gas-based systems: Particularly for areas with sensitive equipment like data centers or telecom facilities.

Market Outlook:

With the continued focus on safety, quality certifications like UL and FM approval are becoming critical differentiators. The industry is expected to see increasing investments in R&D for next-gen fire protection technologies, positioning it for long-term growth.

How Will HD Fire Protect Limited Benefit

- HD Fire Protect Limited’s broad product range, including water-based, foam, and gas suppression systems, positions it to meet the growing demand across industrial and commercial sectors.

- The company’s UL and FM certifications ensure compliance with stringent fire safety regulations, making it a trusted player in a market focused on quality standards.

- As industries such as oil, gas, and power expand, HD Fire Protect’sexpertise in high-risk sectors will drive increased demand for its fire protection solutions.

- The ongoing urbanization and infrastructure growth in India will lead to higher demand for fire protection systems in commercial and residential buildings, benefitting the company.

- With a strong emphasis on R&D and innovation, HD Fire Protect is set to stay ahead in providing advanced, next-generation fire safety technologies, capitalizing on future market opportunities.

Peer Group Comparison

| Name of the Company | Face Value (₹ per share) | EPS – Basic (₹ per share) | EPS – Diluted (₹ per share) | P/E | RoNW (%) | NAV (₹ per share) | Total Income (₹ in million) |

| HD Fire Protect Limited | 5 | 6.25 | 6.25 | NA | 27.67% | 22.59 | 4,506.75 |

| Peer Group | |||||||

| Azad Engineering Limited | 2 | 14.66 | 14.66 | 104.37 | 6.21% | 233.94 | 4,679.45 |

| KSB Limited | 2 | 14.22 | 14.22 | 58.08 | 16.66% | 85.34 | 25,698.37 |

| Kirloskar Pneumatic Company Limited | 2 | 32.56 | 32.48 | 37.52 | 19.27% | 169.09 | 16,624.16 |

| Elgi Equipment Limited | 1 | 11.09 | 11.08 | 42.59 | 18.96% | 58.43 | 35,681.00 |

| Ingersoll-Rand (India) Limited | 10 | 84.74 | 84.74 | 44.93 | 43.90% | 193.02 | 13,745.81 |

Key Strategies for HD Fire Protect Limited

Innovation and Portfolio Expansion

HD Fire Protect Limited strategically focuses on R&D to expand its portfolio with next-generation, sustainable fire protection technologies. They are developing advanced deluge valves and fluorine-free foam systems to meet rising global compliance standards and environmental demands, leveraging patented technology and integrated capabilities to reinforce market leadership in high-performance fire safety solutions.

Strategic Capacity and Infrastructure Enhancement

The company is strategically expanding its manufacturing footprint at both the Jalgaon and Thane facilities to boost operational efficiency, shorten lead times, and meet growing global demand. This includes creating a dedicated fire test laboratory and a new production unit. These investments, funded by internal accruals, will enhance throughput, control over critical processes, and support the scaling of custom-engineered products.

Enhancing Credibility with Global Certifications

HD Fire Protect Limited aims to further enhance product credibility by aggressively pursuing international approvals, particularly FM Approvals. This strategy, building on their existing highest number of UL Listed and FM Approved certifications among Indian peers, is key to scaling their presence in highly regulated global markets. Certified products unlock opportunities in mission-critical sectors like oil & gas and aviation.

International Geographic Expansion and Partnerships

The firm is executing a multifaceted international growth strategy, with a focus on Saudi Arabia, Southeast Asia, and other high-potential regions. This includes plans for local manufacturing and trading presence in Saudi Arabia to serve large government projects and deepen engagement in regional infrastructure development. The strategy emphasizes strategic partnerships and tailored solutions to expand global wallet share.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs HD Fire Protect Limited IPO

How can I apply for HD Fire Protect Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the HD Fire Protect Ltd. IPO offering?

The HD Fire Protect IPO is a Book Build Issue consisting entirely of an offer for sale of up to 2.63 crore shares.

When will HD Fire Protect Ltd. IPO be listed?

The listing date and IPO dates are yet to be announced, as per the Draft Red Herring Prospectus.

What is the face value of HD Fire Protect Ltd. shares?

The face value of each share in the IPO is ₹5 per share.

What is the reservation policy for HD Fire Protect IPO?

50% is reserved for Qualified Institutional Buyers (QIBs), 35% for Retail Investors, and 15% for Non-Institutional Investors (NIIs).

Who are the promoters of HD Fire Protect Ltd.?

The promoters are Harish Narshi Dharamshi, Kusum Harish Dharamshi, Miheer Sadanand Ghotikar, Parika Miheer Ghotikar, and Anik Narendra Dharamshi.