| Category | Shares Offered | Shares Bid For | Subscription (x) |

|---|---|---|---|

| Qualified Institutional Buyers (QIBs) | 3,20,85,713 | 1,77,96,82,480 | 55.47 |

| Non-Institutional Investors (NIIs) | 2,40,64,286 | 24,02,60,540 | 9.98 |

| Retail Individual Investors (RIIs) | 5,61,50,000 | 7,89,86,860 | 1.41 |

| Employees | 2,85,714 | 16,31,020 | 5.71 |

| Shareholders (HDFC Bank) | 1,78,57,142 | 7,59,51,840 | 4.25 |

| Total | 13,04,42,855 | 2,17,65,12,740 | 16.69 |

- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

HDB Financial Services IPO Live

₹14,800/20 shares

Minimum Investment

IPO Details

Open Date

25 Jun 25

Close Date

27 Jun 25

Minimum Investment

₹14,800

Lot Size

20

Price Range

₹700 to ₹740

Listing Exchange

NSE, BSE

Issue Size

₹12 Cr

Listing Date

02 Jul 25

Open Free Demat Account

HDB Financial Services IPO Live Timeline

Bidding Start

25 Jun 25

Bidding Ends

27 Jun 25

Allotment Finalisation

30 Jun 25

Refund Initiation

01 Jul 25

Demat Transfer

01 Jul 25

Listing

02 Jul 25

HDB Financial Services IPO Live Updates

HDB IPO Day 3 Subscription Status (Final Day)

HDB IPO Day 2 Subscription Update

- Overall subscription stands at 1.16× on Day 2.

- NII portion sees strong traction at 2.29×, led by HNIs and individuals.

- QIB bids pick up pace, now at 0.90×.

- Retail segment still muted at 0.64×, expected to rise on Day 3.

- Employee and shareholder categories show healthy interest at 2.97× and 1.68× respectively.

HDB IPO Day 1 Subscription Update

- QIBs subscribed 0.01x

- NIIs subscribed 0.72x

- bNII (> ₹10 lakh) subscribed 0.75x

- sNII (₹2L–₹10L) subscribed 0.68x

- RIIs subscribed 0.29x

- Employees subscribed 1.75x

- Shareholders (HDFC Bank) subscribed 0.68x

- Total bids received: 4.68 crore shares out of 13.04 crore offered

Employee quota was the only segment to see oversubscription on Day 1, at 1.75 times. The shareholder category, reserved for eligible HDFC Bank investors, reached 0.68 times, while retail investor response stood at 0.29 times.

About HDB Financial Services Limited

Incorporated in 2007, HDB Financial Services Limited is a retail-focused non-banking financial company offering lending products through Enterprise Lending, Asset Finance, and Consumer Finance. It also provides BPO services such as back-office, collections, and sales support to its Promoter, along with fee-based offerings like insurance distribution to lending customers. With a “phygital” model combining branches, tele-calling teams, and partners, the company had 1,772 branches in 1,162 towns across 31 States and UTs, supported by 80+ brand partnerships and 140,000+ dealer touchpoints as of September 30, 2024.

HDB Financial Services IPO Overview

HDB Financial Services Limited plans to raise ₹12,500.00 crore through its IPO, structured as a book building issue. This includes a fresh issue of ₹2,500.00 crore and an offer for sale amounting to ₹10,000.00 crore. The IPO dates and price band have not yet been announced. The allotment date is also awaited. The IPO will be listed on both BSE and NSE, with a face value of ₹10 per share.

The book running lead managers include JM Financial, BNP Paribas, BofA Securities India, Goldman Sachs (India) Securities, HSBC Securities, IIFL Capital Services, Jefferies India, Morgan Stanley India, Motilal Oswal, Nomura, Nuvama Wealth, and UBS Securities. MUFG Intime India Private Limited (Link Intime) will serve as the registrar for the issue.

As per the Draft Red Herring Prospectus (DRHP), the IPO was filed with SEBI on October 30, 2024, and received approval on May 28, 2025. HDFC Bank Limited is the promoter, holding a pre-issue shareholding of 94.36%, with total pre-issue shares standing at 79,39,63,540. The post-issue shareholding will reflect the equity dilution resulting from the fresh issue component.

Check HDB Financial IPO RHP for detailed information

HDB IPO Dates: Key Dates

IPO Open Date: June 25, 2025 (Wednesday)

IPO Close Date: June 27, 2025 (Friday)

Allotment Finalisation: June 30, 2025 (Monday)

Listing Date: July 2, 2025 (Wednesday)

Refunds Initiation (if any): July 1, 2025

Shares Credited to Demat Accounts: July 1, 2025

HDB IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 3,37,83,784 shares (aggregating up to ₹2,500.00 Cr) Offer for Sale (OFS): 13,51,35,135 shares of ₹10 (aggregating up to ₹10,000.00 Cr) |

| IPO Dates | 25 June 2025 to 27 June 2025 |

| Listing Date | 2 July 2025 |

| Price Bands | ₹700 to ₹740 per share |

| Lot Size | 20 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 79,39,63,540 shares |

| Shareholding post -issue | 82,77,47,324 shares |

HDB IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 20 | ₹14,800 |

| Retail (Max) | 13 | 260 | ₹1,92,400 |

| S-HNI (Min) | 14 | 280 | ₹2,07,200 |

| S-HNI (Max) | 67 | 1340 | ₹9,91,600 |

| B-HNI (Min) | 68 | 1360 | ₹10,06,400 |

HDB Financial IPO Reservation

| Investor Type | How Many Shares? | % of Total IPO |

|---|---|---|

| Big Institutions (QIB) | 7.58 crore | 44.92% |

| High-Net-Worth Individuals (NII) | 2.27 crore | 13.48% |

| Big Investors (Above ₹10L) (bNII) | 1.51 crore | 8.98% |

| Small Investors (Below ₹10L) (sNII) | 75.87 lakh | 4.49% |

| Retail Investors (RII) | 5.31 crore | 31.44% |

| Employees of HDB | 2.70 lakh | 0.16% |

| Shareholders Shares Offered | 1.68 crore | 10.00% |

| Total Shares in IPO | 16.89 crore | 100% |

HDB IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 27.4 (Basic) |

| Price/Earnings (P/E) Ratio | Pre IPO 27 |

| Return on Net Worth (RoNW) | 14.7% |

| Net Asset Value (NAV) | ₹ 198.8 |

| Return on Equity | 19.55% |

| EBITDA | ₹9,512.37 crore |

| PAT | ₹2,175.92 crore |

| Debt to Equity Ratio | 5.85 |

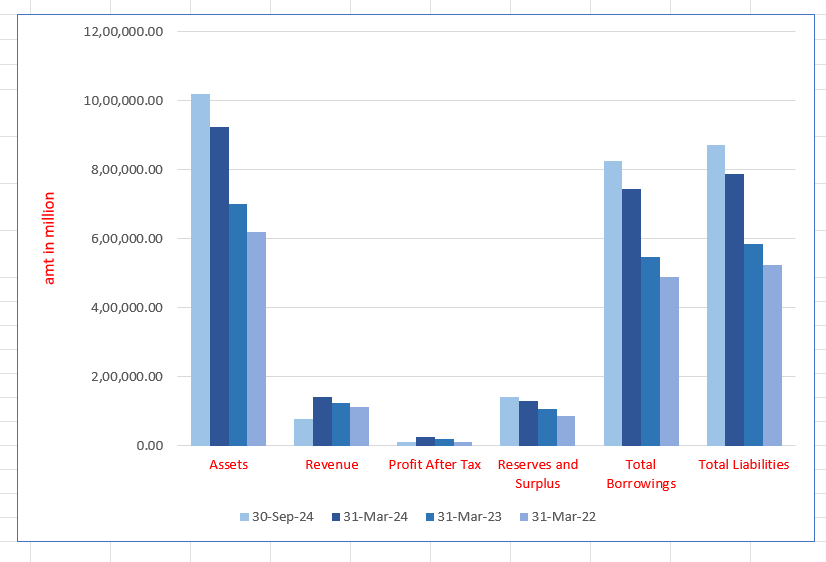

HDB Financial Services Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 1,019,603.5 | 925,565.1 | 700,503.9 | 620,259.4 |

| Revenue | 78,906.3 | 141,711.2 | 124,028.8 | 113,062.9 |

| Profit After Tax | 11,727 | 24,608.4 | 19,593.5 | 10,114.0 |

| Reserves and Surplus | 140,853.7 | 129,496.3 | 106,455.7 | 87,492.9 |

| Total Borrowings | 826,811 | 743,306.7 | 548,653.1 | 489,730.8 |

| Total Liabilities | 870,810.2 | 787,090.3 | 585,134.2 | 524,862.1 |

Financial Status of HDB Financial Services Limited

How to Apply for HDB Financial IPO

The HDB Financial Services IPO is one of the biggest public offers in recent times, opening a ₹12,500 crore opportunity for investors. Backed by HDFC Bank, HDB Financial is a leading non-banking financial company (NBFC) with a wide presence across India. The IPO includes a fresh issue of ₹2,500 crore and an offer for sale worth ₹10,000 crore.

The IPO opens on 25 June 2025 and will close on 27 June 2025. The price band is set between ₹700 to ₹740 per share, and the minimum lot size is 20 shares. For retail investors, the minimum investment is ₹14,800.

If you’re planning to invest in HDB and want a hassle-free experience, you can apply directly using the HDFC SKY app. Here’s how:

Step 1: Open the HDFC SKY App

Start by launching the HDFC SKY App on your smartphone. On the home screen, you’ll see an IPO section, tap on it to view the available IPOs.

Step 2: Find and Select the HDB IPO

You’ll see a list of ongoing IPOs. Locate the HDB Financial Services IPO and tap on it to explore the details.

Step 3: Review the IPO Information

You’ll be able to see:

– Lot size (20 shares)

– Price band (₹700 to ₹740)

– Issue dates (25 to 27 June 2025)

– Company details and background

– After reviewing, click ‘Apply Now’.

Step 4: Choose Investor Type

Next, select your category. Then, enter how many lots you want to apply for. For better allotment chances, select the cut-off price option.

Step 5: Confirm Payment via UPI

You’ll receive a payment request in your UPI app (like Google Pay or PhonePe). Approve the request to complete your application.

You’re Done!

Once your payment is approved, your IPO application is complete. Now, just wait for the allotment date on 30 June 2025. If allotted, shares will be credited to your demat account by 1 July, and listing is scheduled for 2 July 2025 on both NSE and BSE.

Live HDB IPO News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Swot Analysis of HDB IPO

Strengths

- Large and fast-growing customer base (18 million) with a CAGR of 28.22%.

- Highly granular and diversified retail loan book with low product concentration.

- Strong asset quality: GNPA at 2.10%, NNPA at 0.83%, and provisioning cover of 66.82%.

- Competitive AAA credit rating, ensuring access to low-cost funding.

- Robust “phygital” presence: 1,772 branches + 140K dealer touchpoints + 95% digital onboarding.

- Advanced use of technology, AI, and data analytics for underwriting and collections.

Weaknesses

- High debt-to-equity ratio of 5.81x indicating significant leverage.

- Lack of full profitability data like EBITDA or PAT margin at IPO stage.

- Diluted P/E ratio yet to be determined challenging for valuation benchmarking.

- Sensitivity to rate cycles and funding cost pressures.

How Will HDB Financial Services IPO Benefit

- Rising retail credit demand supports HDB’s diversified portfolio across enterprise, asset, and consumer finance.

- Projected 15–17% NBFC sector growth aligns with HDB’s consistent 20%+ loan CAGR, positioning it for market share gains.

- Housing finance sector expansion creates opportunities in affordable housing-linked consumer lending.

- Increased financial inclusion and rural credit demand strengthen HDB’s edge with 80% branches in non-metro areas.

- RBI’s rate cuts and lagged repricing favour HDB’s margins, enhancing profitability.

- Digital adoption surge complements HDB’s tech-driven onboarding and collections processes.

- Asset quality concerns are mitigated by HDB’s strong GNPA/NNPA ratios and high provisioning cover.

- Government initiatives like PMAY indirectly boost demand for vehicle and consumer loans in emerging areas.

- AAA-rated funding access keeps borrowing costs competitive amid rising capital pressures.

- Industry shift toward granular lending suits HDB’s first-time borrower focus and secured loan strategy.

Strong Financial Growth and Profitability

- Total Gross Loans reached ₹986.2 billion as of September 30, 2024, with a CAGR of 20.93% since March 2022.

- Assets Under Management stood at ₹902.3 billion as of March 31, 2024, growing at a CAGR of 21.18% over two years.

- Profit After Tax was ₹24.6 billion in FY24, with a CAGR of 55.98% since FY22.

- Delivered ROA of 3.03% and ROE of 19.55%, among the highest in its peer group.

Customer-Centric Approach

With origins in 2007 as a subsidiary of HDFC Bank, the company serves 17.5 million customers, primarily from low to middle-income households, including first-time borrowers. It focuses on underserved markets with granular loan distribution—its top 20 customers account for less than 0.36% of the loan book.

HDB Financial Services Branch Network and Technology Integration

HDB Financial Services operates 1,772 branches across 31 states/UTs, with over 80% located outside major cities. Its hybrid “phygital” model includes:

- 140,000+ dealer touchpoints

- Partnerships with 80+ brands/OEMs

- Digitally-assisted sales and collections

- 95%+ digital customer sourcing and onboarding

Peer Group Comparison

| Name of the Company | Total Revenue

(₹ million) |

Face Value (₹) | P/E Ratio (Diluted) | P/B Ratio | Restated EPS (₹) | NAV (₹) |

| HDB Financial Services Limited | 1,41,711.2 | 10 | NA | 3.1 | 31.08 (Basic) 31.04 (Diluted) |

173.3 |

| Peer Groups | – | – | – | – | – | – |

| Bajaj Finance Limited | 5,49,694.9 | 2 | 5.72 | 6.89 | 235.98 | 1239.0 |

| Sundaram Finance Limited | 72,671.2 | 10 | 4.71 | 30.31 | 130.31 | 997.1 |

| L&T Finance Limited | 1,35,805.8 | 10 | 1.5 | 9.34 | 9.30 | 94.2 |

| Mahindra & Mahindra Financial Services Limited | 1,57,968.5 | 2 | 1.7 | 15.66 | 15.65 | 161.3 |

| Cholamandalam Investment and Finance Company Limited | 1,91,396.2 | 2 | 5.54 | 41.17 | 41.06 | 233.1 |

| Shriram Finance Limited | 3,63,795.2 | 10 | 2.5 | 196.32 | 195.69 | 1302.5 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On HDB IPO

What is the company’s relationship with HDFC Bank?

HDB Financial is a subsidiary of HDFC Bank, which holds a 94.36% pre-issue stake. Post-IPO, it will remain a subsidiary, retaining 75% ownership.

What is the HDB IPO price band and lot size?

The price band is set at ₹700 to ₹740 per share, with a lot size of 20 shares. Retail investors can apply for up to 13 lots (260 shares).

How can I apply for HDB Financial Services IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total issue size of the HDB Financial Services IPO?

The HDB IPO size is ₹12,500 crore, including ₹2,500 crore fresh issue and ₹10,000 crore offer for sale.

When will the HDB Financial Services IPO open for subscription?

The HDB IPO opening date is 25 June 2025 and closing date is 27 June 2025 and the listing date is 2 July 2025.

On which stock exchanges will HDB Financial Services be listed?

The shares will be listed on both the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Who is the promoter of HDB Financial Services Limited?

HDFC Bank Limited is the promoter and holds a 94.36% stake pre-IPO.

What is the face value of shares in HDB IPO?

Each share of HDB IPO carries a face value of ₹10.