- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Hero Motors IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Hero Motors IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Hero Motors Limited

Hero Motors Limited, a leading Indian automotive technology company, specializes in designing, developing, manufacturing, and supplying advanced powertrain solutions for OEMs across the United States, Europe, India, and the ASEAN region. Its diverse portfolio supports two-wheelers, performance vehicles, e-bikes, off-road vehicles, electric and hybrid cars, heavy-duty vehicles, and eVTOL aircraft. Supplying globally recognised brands like BMW, Ducati, and Hummingbird EV, Hero Motors operates through two segments: Powertrain Solutions and Alloys & Metallics. With six strategic manufacturing facilities across India, the UK, and Thailand, alongside two technology centres, the company emphasises innovation, efficiency, and global automotive excellence.

Hero Motors Limited IPO Overview

Hero Motors Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on June 30, 2025, to raise funds through an Initial Public Offer (IPO). The IPO, structured as a book-building issue, aims to raise ₹1,200.00 crores, comprising a fresh issue of ₹800.00 crores and an offer for sale (OFS) of ₹400.00 crores. The company’s equity shares are proposed to be listed on NSE and BSE. ICICI Securities Ltd. will act as the book running lead manager, while Kfin Technologies Ltd. will serve as the registrar. Key details including IPO dates, price band, and lot size are yet to be announced. Promoters Pankaj Munjal, Charu Munjal, Abhishek Munjal, and O P Munjal currently hold 91.41% of shares.

Hero Motors Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1200 crore |

| Fresh Issue | ₹800 crore |

| Offer for Sale (OFS) | ₹400 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 35,83,36,019 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Hero Motors Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Hero Motors Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹0.36 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 4.42% |

| Net Asset Value (NAV) | ₹10.89 |

| Return on Equity (RoE) | 4.54% |

| Return on Capital Employed (RoCE) | 22.59% |

| EBITDA Margin | 7.78% |

| PAT Margin | 1.60% |

| Debt to Equity Ratio | 0.91 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/prepayment/redemption, in full or in part, of certain outstanding borrowings availed by our Company | 2850 |

| Capital expenditure of our Company through purchase of equipment for expansion in capacity of our Gautam Buddha Nagar, Uttar Pradesh facility | 2370 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

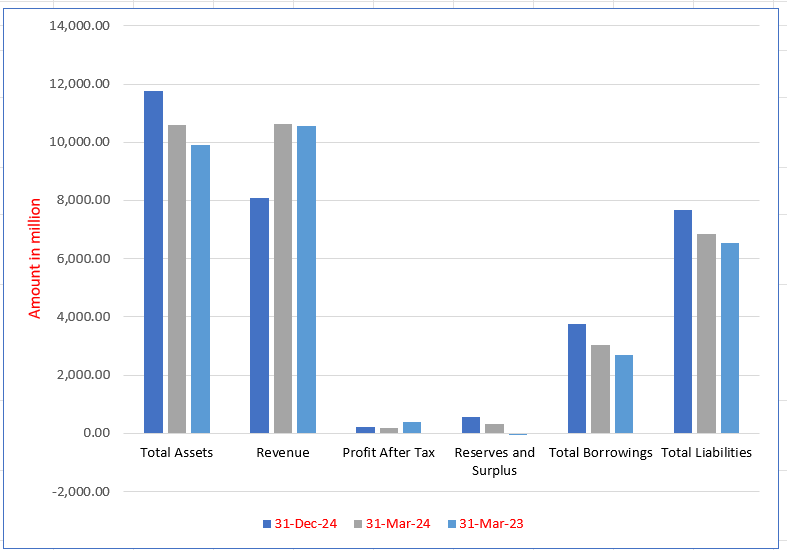

Hero Motors Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Total Assets | 11,777.93 | 10,598.56 | 9,920.18 | 7,031.26 |

| Revenue | 8,072.65 | 10,643.86 | 10,546.24 | 9,141.91 |

| Profit After Tax | 223.93 | 170.35 | 405.06 | 990.22 |

| Reserves and Surplus | 558.81 | 322.61 | (49.41) | 1,261.14 |

| Total Borrowings | 3,739.95 | 3,040.98 | 2,696.11 | 2,653.85 |

| Total Liabilities | 7,659.93 | 6,850.40 | 6,536.81 | 5,424.15 |

Financial Status of Hero Motors Limited

SWOT Analysis of Hero Motors IPO

Strength and Opportunities

- Strong brand equity and recognition in the two-wheeler market.

- Extensive distribution network with over 6,000 dealerships and service centers.

- Robust manufacturing capabilities with six plants in India and facilities in Colombia and Bangladesh.

- Significant focus on research and development, leading to innovative product offerings.

- Strategic partnerships and collaborations enhancing technological advancements.

- Expansion into electric vehicle (EV) segment, aligning with global sustainability trends.

- Investment in advanced powertrain solutions for internal combustion engines (ICE) and EVs.

- Commitment to sustainability and reducing environmental impact through innovative practices.

- Focus on quality and testing to ensure product reliability and customer satisfaction.

Risks and Threats

- Intense competition from both domestic and international motorcycle manufacturers.

- Limited presence in the premium motorcycle segment, affecting market diversification.

- High reliance on domestic sales, with exports forming a small percentage of total sales.

- Vulnerability to fluctuations in raw material costs and supply chain disruptions.

- Regulatory challenges and compliance requirements in international markets.

- Environmental regulations and shifting consumer preferences towards eco-friendly alternatives.

- Economic downturns and reduced consumer spending affecting motorcycle sales.

- Potential impact of rising fuel prices on consumer purchasing decisions.

- Dependence on government policies and subsidies for the EV segment's growth.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Hero Motors Limited

Hero Motors Limited IPO Strengths

Global E-Mobility Industry Solutions Provider

Hero Motors Limited is a leading solutions provider to the global e-mobility industry. The company offers a wide range of products and services, leveraging its two decades of experience in providing high-performance transmission systems and other solutions to the automotive industry. Hero Motors has diversified its offerings to cater to both automotive and non-automotive sectors, including EV transmission components and electrified powertrain solutions for aerospace and marine industries.

Growing Presence in Electric Bikes and Premium Two-Wheelers

Hero Motors Limited has expanded its market presence in the electric bikes and premium two-wheeler segments, securing partnerships with global OEMs like BMW and Ducati. The company provides a complete system of solutions for e-bikes, from design to manufacturing. Its expertise in precision gear components and full transmission systems positions it to capitalize on the accelerating trend of vehicle electrification.

Longstanding Relationships with Global OEMs

Hero Motors Limited maintains a diverse, premium customer base with longstanding relationships with global OEMs. These collaborations span automotive and non-automotive sectors, including partnerships with major companies like BMW and Ducati. The company’s expertise and commitment to quality and timely delivery have earned it exclusive supplier status for several projects, creating significant entry barriers for competitors.

Advanced Infrastructure and Global Operations

Hero Motors Limited has established a robust operational footprint with manufacturing facilities and technology centers across India, the United Kingdom, and Thailand. This strategic geographic diversification allows the company to be close to its customers and offer cost-competitive solutions. Its facilities are equipped with advanced technologies for precision manufacturing and comprehensive testing, enhancing its capabilities in the EV powertrain market.

Strong Research and Development

Hero Motors Limited has significantly increased its R&D investments, establishing technology centers and expanding global facilities to enhance its design and engineering capabilities. The company’s acquisition of Hewland has granted it access to advanced prototyping, transforming it into a comprehensive systems provider. This focus on innovation and value-added engineering services strengthens its customer relationships and market position.

Experienced Management and Strong Governance

Hero Motors Limited is led by a seasoned board of directors and a skilled management team. Their collective experience in the automotive, finance, and engineering sectors, along with a focus on consistent growth and strategic partnerships, provides a significant competitive advantage. This experienced leadership and strong corporate governance are instrumental in the company’s success and strategic direction.

More About Hero Motors Limited

Hero Motors Limited is a leading Indian automotive technology company that specializes in designing, developing, manufacturing, and supplying highly engineered powertrain solutions. According to a CRISIL Report, the company is a fully integrated provider of powertrain systems, offering comprehensive solutions for both electric and non-electric powertrains. These solutions include everything from design and prototyping to validation and delivery.

The company’s offerings are used in a variety of vehicles, including two-wheelers, e-bikes, off-road vehicles, electric and hybrid cars, heavy-duty vehicles, and electric vertical take-off and landing (eVTOL) categories. Hero Motors Limited caters to a global customer base that includes major OEMs like BMW AG and Ducati Motor Holding S.P.A., as well as leading manufacturers of electric bicycles.

Key Business Segments and Product Expertise

Hero Motors Limited’s operations are divided into two main segments: Powertrain Solutions and Alloys and Metallics (A&M).

- Powertrain Solutions: This segment is further split into two sub-units:

- Gears and Transmissions (G&T): Serves a wide range of automotive and other mobility applications, including those for premium and performance internal combustion engine (ICE) vehicles that require high-performance transmission systems.

- Bike Powertrain (BPT): Focuses on the micro-mobility sector, such as e-scooters and e-bikes. Hero Motors Limited was among the first in India to capitalize on the global e-bike powertrain opportunity and is the only company in the country to manufacture and export continuously variable transmission (CVT) hubs to global OEMs.

- Alloys and Metallics (A&M): This segment provides sheet metal and tubular assemblies, as well as component solutions, primarily to automotive OEMs.

Global Reach and Innovation

Hero Motors Limited is a technology and innovation-driven company that has made significant investments in its in-house design and engineering capabilities. The company has also formed technology partnerships with global players to enhance its product and service offerings. This has allowed the company to expand its global footprint, with manufacturing and technology centers in India, the United Kingdom, and Thailand.

The company’s commitment to innovation and global expansion is highlighted by its acquisition of a majority stake in Hewland, a British company specializing in motorsport and high-performance vehicle gearboxes. This acquisition has provided Hero Motors Limited with a manufacturing base in the UK, strengthened its customer network, and expanded its design and validation capabilities. The company also entered a joint venture with Yamaha Motors Japan in 2021 to manufacture electric motors, further diversifying its portfolio.

Industry Outlook

India’s two-wheeler industry is poised for significant growth, driven by urbanization, rising disposable incomes, and evolving consumer preferences.

Market Growth and Projections

- Market Size: The Indian two-wheeler market was valued at 24.9 million units in 2024 and is projected to reach 92 million units by 2033, growing at a CAGR of 15.64%.

- Revenue Outlook: The market is expected to surpass USD 33 billion by 2030, indicating robust financial growth.

Growth Drivers

- Economic Factors: Interest rate cuts by the Reserve Bank of India have reduced borrowing costs, enhancing consumer affordability.

- Urbanization: Rapid urban development has increased the demand for efficient and affordable commuting options.

- Government Initiatives: Policies promoting electric vehicles (EVs) and stricter emission norms are steering the market towards sustainable mobility solutions.

Hero Motors Ltd. Product Segments

Hero Motors Ltd. operates in both traditional and electric vehicle segments:

- Electric Vehicle Components: Through its Bike Powertrain Division, Hero Motors manufactures advanced components such as hub motors, batteries, controllers, chargers, and sensors, catering to the growing EV market.

- Collaborations: The company has partnered with Yamaha Motors Japan (HYM) to design and produce motors for the global market, expanding its footprint in the international EV sector

With a strategic focus on innovation and sustainability, Hero Motors Ltd. is well-positioned to capitalize on the evolving dynamics of India’s two-wheeler industry

How Will Hero Motors Limited Benefit

- Hero Motors Limited is well-positioned to benefit from the rapid growth of India’s two-wheeler and electric vehicle market, with rising demand for efficient and sustainable mobility solutions.

- Its Powertrain Solutions segment, particularly Bike Powertrain (BPT), allows the company to capitalise on the expanding e-scooter and e-bike market domestically and globally.

- Advanced capabilities in CVT hubs, hub motors, batteries, and controllers enable Hero Motors to supply premium technology solutions to major OEMs like BMW and Ducati.

- Partnerships and joint ventures, including with Yamaha Motors Japan, strengthen Hero Motors’ access to global markets and advanced electric vehicle technologies.

- The Alloys and Metallics (A&M) segment provides additional revenue streams through sheet metal and tubular assemblies for automotive OEMs.

- Strategic acquisitions, such as Hewland in the UK, expand manufacturing, design, and validation capabilities, enhancing global competitiveness.

- Innovation-focused R&D and in-house engineering capabilities position Hero Motors to adapt rapidly to evolving market trends and regulatory requirements.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue

(₹ million) |

EPS (₹) | PE Ratio | NAV | RONW (%) |

| Hero Motors Limited | 10 | 10,643.86 | 0.36 | TBD | 10.29 | 4.42 |

| Peer Groups | ||||||

| CIE Automotive India Limited | 6 | 92,803.49 | 21.03 | 21.14 | 157.84 | 15.82 |

| Endurance Technologies Limited | 10 | 1,02,408.71 | 48.38 | 54.37 | 335.73 | 14.41 |

| Sona BLW Precision Forgings Limited | 10 | 31,847.70 | 8.83 | 54.44 | 47.75 | 20.24 |

| UNO Minda Limited | 21 | 1,40,308.90 | 15.36 | 70.44 | 91.71 | 19.58 |

| Varroc Engineering Limited | 15 | 75,519.37 | 34.43 | 16.20 | 62.60 | 57.82 |

Key Strategies for Hero Motors Limited

Expanding E-Mobility Powertrain Solutions

Hero Motors Limited is expanding its e-mobility offerings by focusing on providing comprehensive powertrain systems and components for electric vehicles. This strategy includes investing in technology centers to develop full EV powertrain solutions and leveraging its acquisition of Hewland’s expertise in EV gearboxes and drive units.

Diversifying into New Segments and Geographies

Hero Motors Limited is broadening its market reach beyond motorcycles into new segments and geographies. The company is securing orders for components in electric hybrid passenger cars, lawnmowers, and marine applications. Additionally, it is expanding its manufacturing footprint into the ASEAN region to be closer to key customers and opportunities.

Leveraging Hewland’s Expertise for Cost-Effective Solutions

Hero Motors Limited is leveraging its acquisition of Hewland to provide innovative, design-to-cost solutions. By integrating Hewland’s consultancy and manufacturing expertise, the company is developing end-to-end powertrain solutions, from concept to high-volume production. It is also establishing a UK Technology Centre to test and validate e-drive units.

Strengthening Technology Partnerships

Hero Motors Limited is pursuing strategic partnerships to enhance its technological capabilities. Collaborations include a joint venture with Yamaha Motors for hub motors and a partnership with a German company for DCT transmissions. These alliances enable the company to access advanced designs, broaden its product portfolio, and cater to global markets.

Pursuing Inorganic Growth Opportunities

Hero Motors Limited is actively seeking inorganic growth opportunities to expand its market presence. The company evaluates potential acquisitions, investments, and joint ventures that align with its business goals, such as strengthening product segments, improving efficiency, and adding new technologies. This strategy aims to drive future expansion and growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Hero Motors Limited IPO

How can I apply for Hero Motors Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of Hero Motors Limited IPO?

The IPO size is ₹1,200.00 crores, comprising ₹800.00 crores fresh issue and ₹400.00 crores OFS.

Where will Hero Motors IPO be listed?

The IPO is proposed to be listed on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

What is the purpose of Hero Motors IPO proceeds?

Proceeds will be used for repayment of borrowings, capital expenditure, acquisitions, and general corporate purposes.

Who are the promoters of Hero Motors Limited?

The promoters include Pankaj Munjal, Charu Munjal, Abhishek Munjal, and O P Munjal Holdings.