- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Hexagon Nutrition IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Hexagon Nutrition IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Hexagon Nutrition Limited

Hexagon Nutrition Ltd. is a research-driven nutrition company specialising in the development and manufacturing of micronutrient premixes, branded wellness and clinical nutrition products, therapeutic formulations, and ready-to-use foods. The company operates three manufacturing units in India—at Nasik, Chennai, and Thoothukudi—and one international facility in Tashkent, Uzbekistan. Its product portfolio includes branded wellness and clinical nutrition (B2C), premix formulations (B2B2C), and ready-to-use foods under ESG initiatives. With a PAN-India omnichannel network and exports to over 75 countries, Hexagon Nutrition maintains a strong global presence.

Hexagon Nutrition Limited IPO Overview

Hexagon Nutrition Ltd. submitted its Draft Red Herring Prospectus (DRHP) to the Securities and Exchange Board of India (SEBI) on September 23, 2025, as part of its plan to raise capital through an Initial Public Offer (IPO). The proposed Hexagon Nutrition IPO will be a Book-Built Issue, comprising solely an Offer for Sale (OFS) of up to 3.09 crore equity shares. The company’s shares are proposed to be listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

While Kfin Technologies Ltd. has been appointed as the registrar for the issue, the book-running lead manager has not yet been announced. Essential details such as the IPO opening and closing dates, price band, and lot size are still awaited. As per the DRHP, the face value of each share is ₹1, and the total issue size stands at 3,08,59,704 shares, aggregating up to ₹[.] crore. Since this issue is an Offer for Sale, the company’s pre-issue and post-issue shareholding will remain unchanged at 11,06,27,404 shares. Investors can refer to the Hexagon Nutrition IPO DRHP for further information.

Hexagon Nutrition Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 3.09 crore equity shares |

| Fresh Issue | NA |

| Offer for Sale (OFS) | 3.09 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 11,06,27,404 shares |

| Shareholding post-issue | 11,06,27,404 shares |

Hexagon Nutrition IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Hexagon Nutrition Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Hexagon Nutrition Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹0.51 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 12.46% |

| Net Asset Value (NAV) | ₹15.91 |

| Return on Equity (RoE) | 10.47% |

| Return on Capital Employed (RoCE) | 17.06% |

| EBITDA Margin | 12.33% |

| PAT Margin | 7.36% |

| Debt to Equity Ratio | 0.14 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

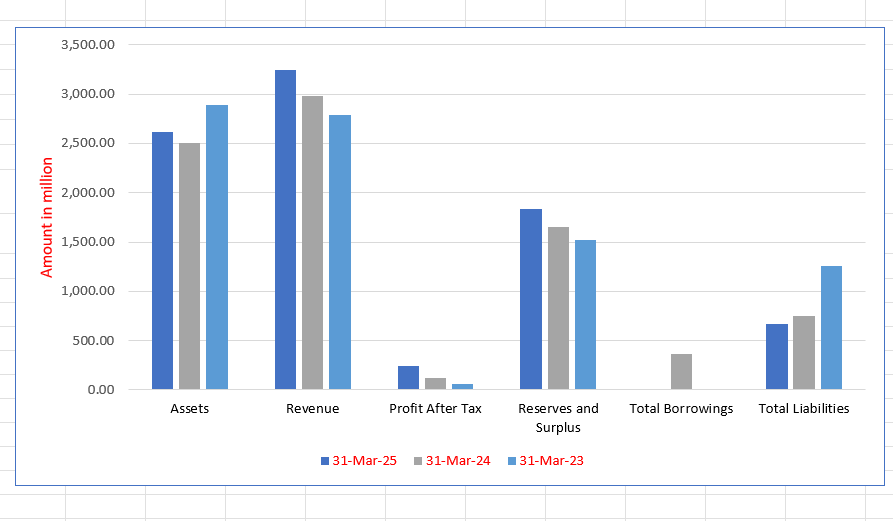

Hexagon Nutrition Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,613.59 | 2,505.44 | 2,889.00 |

| Revenue | 3,249.29 | 2,977.31 | 2,785.01 |

| Profit After Tax | 243.77 | 122.14 | 58.24 |

| Reserves and Surplus | 1,831.18 | 1,648.10 | 1,520.21 |

| Total Borrowings | 266.00 | 368.93 | 518.73 |

| Total Liabilities | 671.78 | 746.71 | 1,258.16 |

Financial Status of Hexagon Nutrition Limited

SWOT Analysis of Hexagon Nutrition IPO

Strength and Opportunities

- Strong R&D base and in-house expertise in nutrition science.

- Established pan-India omnichannel distribution network and export presence in 70+ countries.

- Manufacturing facilities in strategic SEZ locations offering duty-free benefits and port access.

- Opportunity to expand growth via the branded wellness and clinical nutrition segment nationally.

- Strong linkages with international organisations enabling global contracts and collaborations.

- Growing global interest in nutritional and therapeutic products presents new market potential.

- Strong quality certifications and credibility in micronutrient premixes and fortified foods.

- Ability to innovate in therapeutic nutrition and ready-to-use foods for ESG and malnutrition initiatives.

- Opportunity to leverage branded product growth alongside B2B premix operations for higher margins.

Risks and Threats

- Heavy reliance on the premix formulation business and a few large customers.

- Moderate scale of operations compared to large global nutraceutical players.

- Vulnerability to raw material price fluctuations and foreign exchange risks.

- Intense competition in the nutrition and wellness sector can pressurise margins.

- Dependence on external distribution partners and logistics providers with limited direct control.

- Regulatory risks from changing government policies on food fortification and supplements.

- Working-capital intensity due to high inventory and receivables can strain liquidity.

- External funding or project delays in ESG initiatives may reduce production volumes.

- Currency and export market volatility could impact profitability for global operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Hexagon Nutrition Limited

Hexagon Nutrition Limited IPO Strengths

End-to-End Integrated Nutrition Player

Hexagon Nutrition is a fully integrated, holistic nutrition company, providing end-to-end solutions across the entire value chain. It is a market leader in customized micronutrient formulations and the only such holistic player in India offering products from premixes up to clinical and therapeutic nutrition, a capability that significantly distinguishes it within the industry.

Market Leadership in Premixes and MNPs

The company is recognized as one of India’s largest premix players, supplying customized vitamin and mineral premixes to leading domestic and multinational FMCG firms. Furthermore, it is one of the largest licensed suppliers of Micronutrient Powders (MNPs) under various UN programs, supporting global food fortification and critical public health initiatives.

Recognized Clinical and Wellness Brands

Hexagon has strategically moved up the value chain by developing successful in-house brands such as PENTASURE and OBESIGO. These brands cater to diverse and complex therapy areas, including renal, diabetes, and other specialized conditions. The company’s global footprint across over 70 countries reinforces its integrated and innovation-led position.

Strong Customer Relationships and Repeat Business

Hexagon boasts a track record of nurturing long-standing relationships across its B2C, B2B2C, and ESG segments, which drives high levels of repeat business. This continuity is a key indicator of customer satisfaction and product efficacy, providing the company with revenue predictability and a stable foundation for scalable growth.

Established In-House R&D Capabilities

The company maintains a competitive edge through its two dedicated in-house R&D facilities in Nasik and Chennai. This focus has yielded deep expertise in ingredient interaction and formulation science, ensuring premixes do not compromise the end product’s taste or quality, and maintaining an active new product innovation pipeline.

Scalable Manufacturing and Quality Assurance

Hexagon operates three manufacturing facilities in India and one in Uzbekistan, with the Indian sites strategically located in SEZ zones. Its infrastructure is designed for scale and efficiency, complemented by stringent quality and food safety standards evidenced by certifications like FSSC 22000 and GMP, reinforcing global product credibility.

Robust Omnichannel Distribution Network

The company ensures widespread accessibility through its pan-India omnichannel distribution. This includes retail pharmacies, hospital networks, leading e-commerce platforms, and its own brand websites. This, combined with a presence in over 20 countries for branded products, mitigates regional risk and leverages brand value.

Consistent Track Record of Financial Growth

Hexagon has demonstrated a consistent track record of growth in both revenues and profitability over the last three fiscals. This sustained financial performance, with an increase in Profit After Tax (PAT), reflects the scalability of its business model and its strong ability to generate long-term, sustained profitability.

More About Hexagon Nutrition Limited

Hexagon Nutrition Limited is a differentiated, research-oriented nutrition company offering a holistic range of products — from micronutrient premixes to therapeutic and clinical nutrition formulations. Recognised as one of India’s largest premix manufacturers, the company provides customised vitamin and mineral blends to leading Indian and multinational FMCG players. It is also among the top licensed suppliers of Micronutrient Powders (MNPs) under UN programmes, contributing significantly to food fortification and global health initiatives.

Journey and Growth

Founded in 1993 as a micronutrient formulation player, Hexagon Nutrition has steadily moved up the value chain. Over the years, it has developed successful brands such as Pentasure, Obesigo, and Pediagold, catering to adult, weight management, and paediatric nutrition respectively. In FY 2024, the company expanded its branded portfolio with Nutrone, strengthening its presence in the wellness and clinical nutrition market.

Integrated Operations and Global Presence

Hexagon Nutrition operates three manufacturing facilities in India—Nasik, Chennai, and Thoothukudi—and one in Tashkent, Uzbekistan. The SEZ-based plants in Chennai and Thoothukudi offer strategic advantages like duty-free imports and proximity to ports. Its products are exported to over 75 countries, supported by overseas offices in South Africa, Hong Kong, and Uzbekistan.

Product Segments

- Branded Wellness & Clinical Nutrition (B2C): Products meet diverse nutritional needs, addressing deficiencies and providing specialised support for hospitalised patients.

- Premix Formulations (B2B2C): Supplies customised micronutrient blends to FMCG and nutrition brands for fortified products such as dairy items, beverages, and snacks.

- RUFs & MNPs (ESG Segment): Offers ready-to-use therapeutic foods and micronutrient powders to combat malnutrition and support global ESG initiatives.

Commitment to Quality and Innovation

The company’s facilities are certified by FSSC 22000, GMP, and ISO 9001:2015, ensuring adherence to international standards. With a strong R&D team and a PAN-India omnichannel network, Hexagon Nutrition continues to drive innovation in nutrition science, enabling healthier lives worldwide.

Industry Outlook

The Indian nutrition industry — spanning dietary supplements, food fortification premixes, clinical nutrition, and therapeutic foods — is witnessing strong growth driven by rising health awareness, lifestyle shifts, and government-led nutrition initiatives.

Overall Nutrition & Supplement Market

- The Indian nutritional supplements market was valued at approximately US$ 42.97 billion in 2024 and is projected to grow at a CAGR of around 8.1% from 2025 to 2030.

- Other estimates suggest it will expand from US$ 46.5 billion in 2025 to US$ 94.52 billion by 2034, reflecting a CAGR of about 8.2%.

- Key growth drivers include increasing disposable incomes, a growing preventive-healthcare mindset, urbanisation, and the rise of digital and omnichannel access to nutrition products.

Clinical & Therapeutic Nutrition Segment

- The Indian clinical nutrition sector was valued at around US$ 2.1 billion in 2024 and is forecast to reach US$ 4.3 billion by 2033, implying a CAGR of 7.8% during 2025-33.

- Growth is being driven by the rise in chronic diseases, malnutrition concerns, hospitalisation rates, and the demand for specialised nutritional interventions.

Food Fortification & Micronutrient Premixes

- The Indian food fortification premix market stood at about US$ 108.8 million in 2024 and is expected to grow to US$ 193 million by 2034, at a CAGR of nearly 5.9%.

- Growth is supported by government programmes to combat micronutrient deficiencies, mandates for fortified staple foods like rice and wheat, and collaborations between government and private players in public health initiatives.

Key Growth Drivers & Trends

- Preventive healthcare and wellness focus: Consumers are prioritising nutrition for long-term wellness.

- Government nutrition programmes: Initiatives addressing anaemia and malnutrition are increasing demand for fortified foods and premixes.

- Urbanisation and e-commerce: Wider access to nutrition products in urban and semi-urban areas is fuelling sales.

- Clinical nutrition adoption: Hospitals and healthcare providers are increasingly recommending medical nutrition therapy.

- Food processing expansion: Growth in packaged foods supports greater fortification opportunities.

How Will Hexagon Nutrition Limited Benefit

- Hexagon Nutrition Limited is strategically positioned to capitalise on India’s expanding nutrition and wellness market, supported by its diversified product portfolio across premixes, clinical, and therapeutic nutrition.

- With the premix market’s steady CAGR of 5.9%, the company’s established expertise in micronutrient formulations aligns perfectly with the growing demand for fortified foods.

- The rising clinical nutrition segment offers growth opportunities for Hexagon’s brands such as Pentasure and Obesigo, catering to hospital and home-based nutrition needs.

- Increasing government-led food fortification initiatives directly boost demand for Hexagon’s B2B2C solutions.

- The growing preventive healthcare trend and awareness about balanced nutrition support its branded wellness products.

- Expanding urbanisation and digital health platforms enhance visibility for its e-commerce and retail distribution network.

- Global expansion and exports to over 75 countries position the company to benefit from rising international demand for fortified and functional foods.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ in Million) | Basic EPS (₹) | Diluted EPS (₹) | P/E | Return on Net Worth (%) | NAV (₹) |

| Hexagon Nutrition Limited | 1 | 13,249.29 | 1.75 | 1.75 | [●] | 12.46 | 15.91 |

| Peer Group | |||||||

| Zydus Wellness Limited | 2 | 27,089.00 | 10.90 | 10.90 | 45.64 | 6.12 | 178.26 |

| Nestlé India Limited | 10 | 202,015.60 | 16.63 | 16.63 | 71.44 | 77.91 | 121.35 |

Key Strategies for Hexagon Nutrition Limited

Expand Product Portfolio into New Categories

Hexagon intends to achieve growth by expanding its product portfolio into new categories like functional foods, plant-based nutrition, and specialized maternal/geriatric products. This leverages its R&D and regulatory expertise to address evolving consumer health trends, diversify revenue streams, and strengthen its overall presence across both B2C and B2B2C segments.

Deepen Domestic Market Penetration

The company plans to significantly strengthen its footprint across India, where exports currently dominate revenue. It aims to leverage its international technical know-how to increase brand visibility and consumer awareness domestically. The strategy focuses on introducing new offerings in functional and therapeutic nutrition to broaden its Indian customer base.

Enhance Focus on Branded B2C Segment

Hexagon is committed to further emphasizing its branded nutrition segment (PENTASURE, OBESIGO, etc.) by augmenting online sales and expanding into Tier 2 and Tier 3 cities. It plans to double its sales field force within five years to increase reach and visibility, thereby strengthening market share in both existing and new geographies.

Capitalize on Post-COVID Nutritional Demand

The company is strategically responding to the increased global demand for immunity-building and fortified foods post-COVID-19. It aims to launch new products, such as fortified rice kernels (FRK), and expand its portfolio of clinically backed, fortified offerings to effectively participate in both public and private sector nutritional programs.

International Geographical Expansion

Hexagon continues to strengthen its global presence by strategically expanding its geographical footprint beyond existing markets. Utilizing regional hubs and a manufacturing facility in Uzbekistan, the company seeks to improve logistical efficiency and access to markets like CIS, Africa, and new high-growth regions such as Latin America and Eastern Europe.

Launch Products in New Therapy Areas and Formats

The company intends to broaden its offerings in clinical and wellness segments by entering new therapy areas (e.g., gynaecology, fertility, healthy ageing). It is also investing in innovative delivery formats like gummies, chewable tablets, and nutrition bars, which enhance consumer appeal and compliance, strengthening its competitive positioning.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Hexagon Nutrition Limited IPO

How can I apply for Hexagon Nutrition Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Hexagon Nutrition Limited IPO about?

Hexagon Nutrition Limited’s IPO is a Book Build Issue consisting entirely of an Offer for Sale of up to 3.09 crore shares.

When was the IPO filed with SEBI?

The company filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 23, 2025.

What type of company is Hexagon Nutrition Limited?

It is a research-driven nutrition company manufacturing micronutrient premixes, clinical nutrition, therapeutic foods, and wellness products.

Where will the Hexagon Nutrition shares be listed?

The equity shares are proposed to be listed on both the NSE and BSE.

What are the IPO price band and issue dates?

The price band, IPO opening and closing dates, and lot size are yet to be announced.