- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Highway Infrastructure IPO

₹13,715/211 shares

Minimum Investment

IPO Details

05 Aug 25

07 Aug 25

₹13,715

211

₹65 to ₹70

NSE, BSE

₹130 Cr

12 Aug 25

Highway Infrastructure IPO Timeline

Bidding Start

05 Aug 25

Bidding Ends

07 Aug 25

Allotment Finalisation

08 Aug 25

Refund Initiation

11 Aug 25

Demat Transfer

11 Aug 25

Listing

12 Aug 25

Highway Infrastructure Limited

Highway Infrastructure Limited (HIL), founded in 1995, is an Indian infrastructure company involved in tollway operations, EPC projects, and real estate development. It manages tollway systems across 11 states and a Union Territory, using technologies like ANPR and RFID. As of August 2024, HIL has completed 24 toll projects and operates seven. In EPC, it has executed 63 projects and is working on 20 more, primarily in Madhya Pradesh. Its smallest segment, real estate, focuses on residential and commercial properties. The company employs 398 people across all its business operations.

Highway Infrastructure Limited IPO Overview

Highway Infrastructure IPO is a book-built issue amounting to ₹130.00 crore. The offer comprises a fresh issue of 1.39 crore equity shares aggregating to ₹97.52 crore and an offer for sale of 0.46 crore shares aggregating to ₹32.48 crore. The IPO opens for subscription on August 5, 2025, and closes on August 7, 2025. The allotment is expected to be finalised on Friday, August 8, 2025, and the shares are proposed to be listed on both BSE and NSE, with a tentative listing date of Tuesday, August 12, 2025.

The price band for the IPO is fixed at ₹65 to ₹70 per share. The application lot size is 211 shares. For retail investors, the minimum investment amount is ₹13,715. For small non-institutional investors (sNII), the investment size is 14 lots, amounting to 2,954 shares or ₹2,06,780, and for big non-institutional investors (bNII), it is 68 lots, translating to 14,348 shares or ₹10,04,360. Pantomath Capital Advisors Pvt Ltd is acting as the book-running lead manager for the issue, while Bigshare Services Pvt Ltd is the registrar.

Highway Infrastructure Limited IPO Details

| Particulars | Details |

| IPO Date | 5 August 2025 to 7 August 2025 |

| Listing Date | 12 August 2025 |

| Face Value | ₹5 per share |

| Issue Price Band | ₹65 to ₹70 per share |

| Lot Size | 211 Shares |

| Total Issue Size | 1,85,71,428 shares (aggregating up to ₹130.00 Cr) |

| Fresh Issue | 1,39,31,428 shares (aggregating up to ₹97.52 Cr) |

| Offer for Sale | 46,40,000 shares (aggregating up to ₹32.48 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 5,77,89,204 shares |

| Share Holding Post Issue | 7,17,20,632 shares |

| Market Maker Portion | NA |

Highway Infrastructure Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 30% of the Net Issue |

| Retail | Not less than 40% of the Net Issue |

| NII (HNI) | Not less than 30% of the Net Issue |

Highway Infrastructure Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 211 | ₹14,770 |

| Retail (Max) | 13 | 2,743 | ₹1,92,010 |

| HNI (Min) | 14 | 2,954 | ₹2,06,780 |

| HNI (Max) | 67 | 14,137 | ₹9,89,590 |

| B-HNI (Min) | 68 | 14,348 | ₹10,04,360 |

Highway Infrastructure Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 94.95% |

| Post-Issue | [To be updated] |

Highway Infrastructure Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.88 (Pre IPO), ₹3.12 (Post IPO) |

| Price/Earnings (P/E) Ratio | 18.06 (Pre IPO), 22.41 (Post IPO) |

| Return on Net Worth (RoNW) | 19.03% |

| Net Asset Value (NAV) | ₹20.37 per share |

| Return on Equity | 19.03% |

| Return on Capital Employed (ROCE) | 16.56% |

| EBITDA Margin | 6.32% |

| PAT Margin | 4.44% |

| Debt to Equity Ratio | 0.61 |

Objectives of the Proceeds

- Funding working capital requirements of the company – ₹65.00 crore

- General corporate purposes

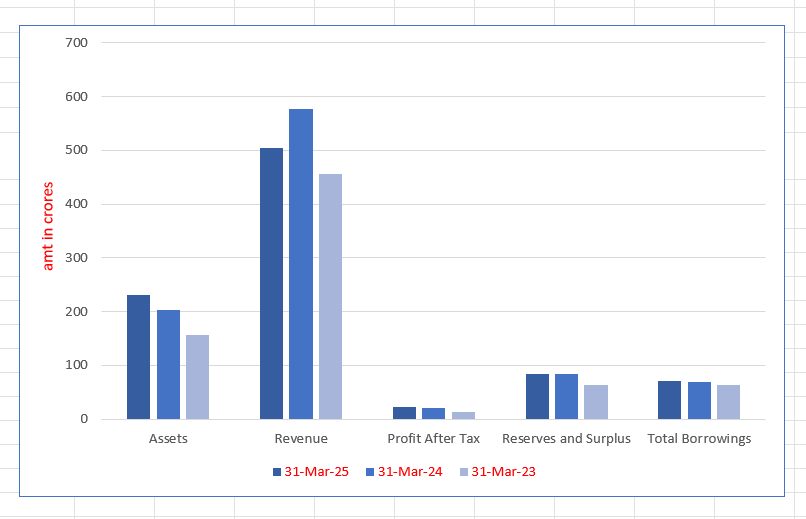

Key Financials (in ₹ Crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 231.56 | 202.63 | 156.59 |

| Revenue | 504.48 | 576.58 | 456.83 |

| Profit After Tax | 22.40 | 21.41 | 13.80 |

| Reserves and Surplus | 83.90 | 83.49 | 64.44 |

| Total Borrowings | 71.82 | 69.62 | 63.36 |

SWOT Analysis of Highway Infrastructure IPO

Strength and Opportunities

- Extensive experience in tollway and EPC projects across India.

- Advanced tech like ANPR and RFID for toll collection.

- Strong order book and execution across 11 states.

- Established footprint in infrastructure with 87 completed projects.

Risks and Threats

- Heavily dependent on government contracts and clearances.

- Revenue decline noted in FY 2025 vs FY 2024.

- Real estate segment contributes minimally to revenues.

- High dependence on a few key projects and regions.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Highway Infrastructure Limited

Highway Infrastructure IPO Strengths

- With nearly 30 years of experience, the company has established strong expertise in toll operations and EPC projects.

- It was among the first to implement ANPR technology for efficient toll collection on major expressways.

- The company has a well-diversified project portfolio spanning several Indian states, which broadens its market presence.

- It has shown consistent financial performance, marked by healthy revenue generation and profitability.

- The promoters bring deep industry knowledge and benefit from long-standing relationships within the infrastructure sector.

Peer Group Comparison

| Company Name | EPS (Basic) | NAV (per share) | P/E (x) | RoNW (%) |

| Highway Infrastructure | 3.40 | 20.37 | 22.41 | 19.03% |

| Peer Groups | ||||

| Udayshivakumar Infra | -1.18 | 30.43 | NA | -4.28% |

| IRB Infrastructure Developers | 1.12 | 32.83 | 44.38 | 32.69% |

| H.G. Infra Engineering | 75.04 | 452.62 | 14.00 | 17.13% |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Highway Infrastructure Limited IPO

How can I apply for Highway Infrastructure Limited IPO?

You can apply via HDFC Sky using UPI-based ASBA process during the IPO window.

What is the minimum lot size and investment for retail investors?

The minimum lot size is 211 shares, requiring an investment of ₹13,715.

When will Highway Infrastructure IPO be listed?

The IPO is tentatively scheduled to be listed on BSE and NSE on 12 August 2025.

Who are the promoters of Highway Infrastructure Limited?

The promoters of the company are Arun Kumar Jain, Anoop Agrawal, and Riddharth Jain.