- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

History of Indian Stock Market

By HDFC SKY | Updated at: Jul 23, 2025 05:21 PM IST

The history of Indian stock market shows how far we’ve come from the days of informal trading. What seems like a simple online process today began in the 18th century when the East India Company started trading in loan securities. Let’s explore the share market history and key turning points that shaped the market into what it is today.

What is Share Market?

The share market is where people buy and sell shares of companies. When you buy a share, you own a small part of that company. If the company performs well, the share price may rise, giving you profit. In India, shares are traded on stock exchanges like BSE and NSE using trading and Demat accounts. Prices go up or down based on demand, company news, and market trends

History of Stock Exchange

The history of share market in India began in the 1830s when company shares started getting traded in Mumbai. Here are major milestones in the stock market history that show its evolution:

- 1830s: During this decade, corporate shares started being traded in Mumbai. Most notably, stocks of banks and cotton presses were traded during this time.

- 1850s: The first version of a stock exchange came into existence during this decade. It started with a group of brokers finding a location in Mumbai’s Horniman Circle.

- 1874: As more brokers jumped onto the bandwagon in downtown Mumbai, Dalal Street was born. Today, Dalal Street has become a metonym for the entire Indian financial sector, much like Wall Street is in the US.

- 1875: The small group of brokers formed ‘The Native Share & Stockbrokers Association’ that is today known as the BSE (formerly Bombay Stock Exchange).

- Over the late 19th and early 20th century, exchanges cropped up at Ahmedabad, Calcutta (now Kolkata) and Madras. But BSE remained the dominant exchanged, as it was located in Mumbai, which had emerged as the country’s leading commerce hub. And yet, trading in stocks remained restricted to a limited group of people.

- 1956: India passed the Securities Contracts Regulation Act, which formalised stock trading.

- 1964: The newly-created UTI launched India’s first mutual fund scheme, the US 64. The scheme raised Rs 6,400 crore by 1988, making UTI the big player in the Indian market.

- 1977: Dhirubhai Ambani’s Reliance Industries, with interests in textiles and petrochemicals, listed. The IPO garnered huge interest from retail investors kickstarting the ‘cult of equity’.

- 1986: On 1st January this year, BSE SENSEX, a 30-share index was established. This was the country’s first equity index with base year as 1978-79 and base value of 100.

- 1988: This period was marked by a lack of transparency and undependable clearing and settlement systems; making it imperative to set up a financial market regulator. Hence, the Securities and Exchange Board of India (SEBI) was established. However, it was not until 1992 that it was granted statutory power.

- 1992: The National Stock Exchange of India Limited (NSE) was established. It was around the same time that interest in stock market spiked sharply, thanks to the bull market led by Harshad Mehta.

- 1994:NSE became the first Indian exchange to provide a modern, fully automated screen-based electronic trading system.

- 1996: The NSE launched Nifty 50 index on April 22 this year. The Nifty 50 is a benchmark Indian stock market index that represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange.

Earlier, the Nifty 50 index was calculated based on full market capitalisation methodology. However, after June 26, 2009, the computation was changed to a free-float methodology. The base period for the Nifty 50 index is November 3, 1995, and the base value of the index has been set at 1,000.

It’s been a long journey but today India is among the top five stock markets in the world by market capitalisation. It has been among the most well-performing markets of the world. For instance, the Sensex has grown at a CAGR of 15% over the past 20 years and 16% since inception.

How Many Stock Exchanges are There Currently?

After independence, 23 stock exchanges were added to compete with BSE. However, in 2012 SEBI said that stock exchanges whose net worth was less than Rs 100 crore and turnover less than Rs 1,000 crore will be closed by 2015.

At present, there are only seven recognised stock exchanges in India.

- BSE

- NSE

- Calcutta Stock Exchange

- Magadh Stock Exchange

- Metropolitan Stock Exchange of India

- India International Exchange (India INX)

- NSE IFSC

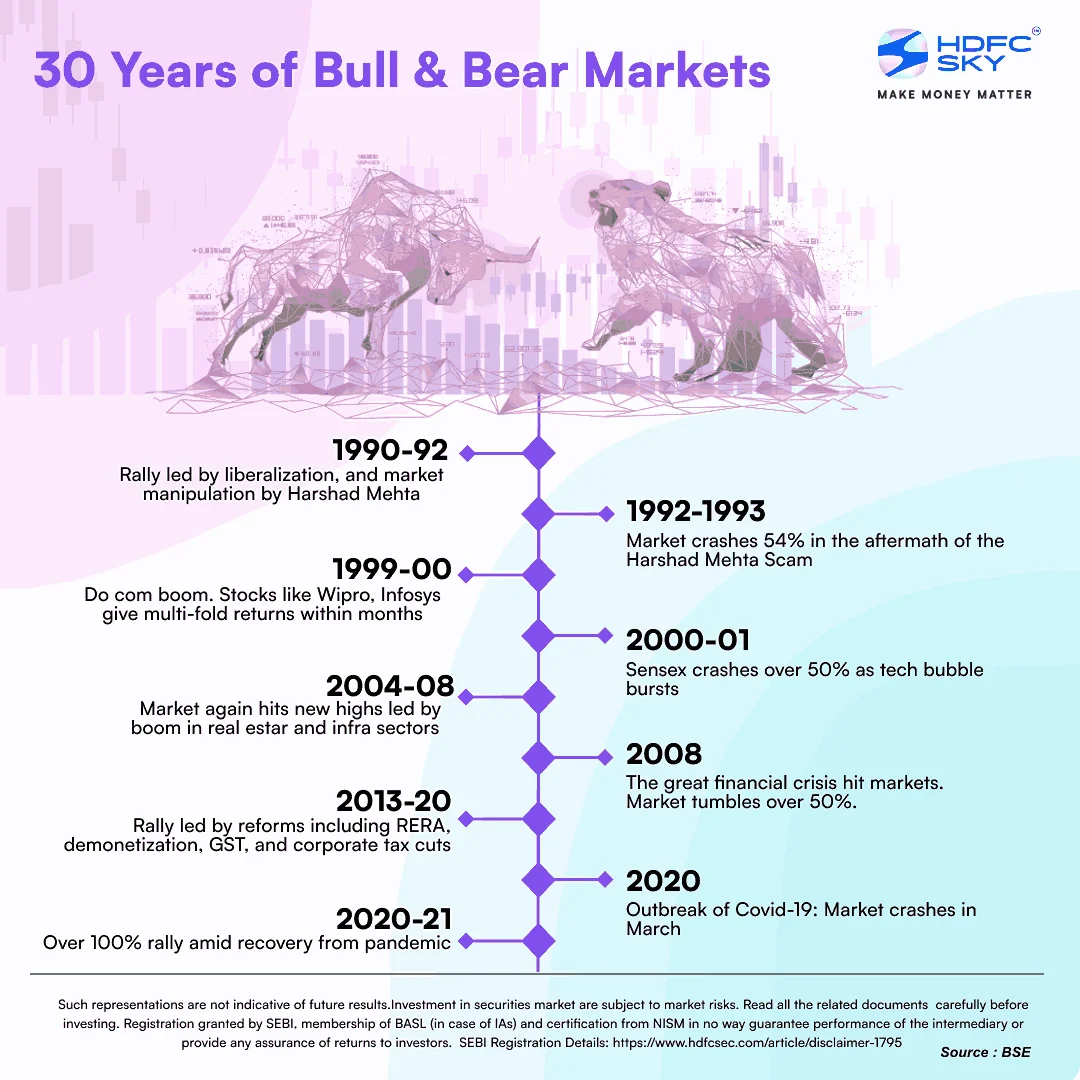

Indian Stock Market Crashes

No story about the stock market history is complete without mentioning major corrections. Here are some of the most notable stock market crashes in history:

|

Some Prominent Crashes in Indian Stock Markets in Recent History |

||

|

Year |

Event |

Crash in market from the most recent peak |

|

1992 |

Market manipulation scam of Harshad Mehta |

13% |

|

2004 |

Shock defeat of NDA in general elections |

15.52% |

|

2006 |

Rise in US interest rate and fall in commodity prices |

9% |

|

2007-08 |

US subprime crisis & global financial crisis |

17% |

|

2020 |

Covid lockdown |

22.50% |

|

2024 |

2024 General Election results |

6% |

|

Data Source: BSE, NSE |

||

Conclusion

The evolution of the Indian stock market reflects a fascinating journey from the 18th century to the present day. From the humble beginnings of trading loan securities by the East India Company to the establishment of the BSE, NSE, and other major exchanges, the market has grown to become one of the world’s top five by market capitalization. Key milestones such as the launch of mutual fund schemes, the establishment of regulatory bodies like SEBI, and advancements in trading technology have shaped the market’s landscape.

Related Articles

FAQs

What is the origin of stock trading in India?

Stock trading in India dates back to the 18th century when the East India Company began trading in loan securities.

When did corporate shares start being traded in Mumbai?

Corporate shares started being traded in Mumbai during the 1830s, notably stocks of banks and cotton presses.

What was the role of the Securities Contracts Regulation Act of 1956?

The Securities Contracts Regulation Act of 1956 formalized stock trading in India.

When was the BSE SENSEX established?

The BSE SENSEX, a 30-share index, was established on January 1, 1986.