- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Hotel Polo Towers IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Hotel Polo Towers IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Hotel Polo Towers Limited

Incorporated in 1986, Hotel Polo Towers Limited develops, owns, and operates a chain of upscale and midscale hotels and resorts primarily in Northeast, East, and North India under its flagship ‘Polo’ brand and the new boutique ‘Chapter Hotels by Polo’ brand. As of August 31, 2025, its portfolio includes nine operational properties with 425 keys, 17 on-premise cafés and restaurants, and two standalone cafés. The company has a significant focus on Food and Beverage (F&B) services, which contributes substantially to its stable revenues. With a robust pipeline of upcoming properties in key locations like Nagaland and Meghalaya, the company is strategically positioned to capitalize on the growing tourism demand in the region.

Hotel Polo Towers Limited IPO Overview

Hotel Polo Towers Ltd. filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on September 27, 2025, seeking approval to raise funds through an Initial Public Offer (IPO). The IPO is proposed as a Book Built Issue, comprising a fresh issue of ₹300.00 crores and an offer for sale (OFS) of up to 0.71 crore equity shares.

The equity shares of Hotel Polo Towers Ltd. are proposed to be listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). The book running lead manager for the issue has not yet been announced, while MUFG Intime India Pvt. Ltd. has been appointed as the registrar to the issue. Key details such as the IPO opening and closing dates, price band, and lot size are yet to be disclosed. Interested investors can refer to the Hotel Polo Towers Ltd. DRHP for detailed information.

As per the preliminary details, the IPO will have a face value of ₹2 per share and will follow the Bookbuilding process. The issue structure includes a fresh capital-cum-offer for sale, with the fresh issue aggregating up to ₹300.00 crore and the OFS comprising 71,20,030 equity shares of ₹2 each. The company’s pre-issue shareholding stands at 5,78,73,000 shares, and the shares will be listed on both BSE and NSE upon completion of the IPO process.

Hotel Polo Towers Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue of ₹300.00 Cr + OFS of up to 0.71 Cr shares |

| Fresh Issue | [.] shares (aggregating up to ₹300.00 Cr) |

| Offer for Sale (OFS) | 71,20,030 shares of ₹2 (aggregating up to ₹[.] Cr) |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 5,78,73,000 shares |

| Shareholding post-issue | TBA |

Hotel Polo Towers IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Hotel Polo Towers Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

Hotel Polo Towers Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.47 (Basic & Diluted) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 19.70% |

| Net Asset Value (NAV) | ₹19.38 |

| Return on Equity (RoE) | 19.70% |

| Return on Capital Employed (RoCE) | 15.90% |

| EBITDA Margin | 44.60% |

| PAT Margin | 17.87% |

| Debt to Equity Ratio | 0.40 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are proposed to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Part-financing for the cost of establishment, expansion and upgradation of our existing properties | 755.17 |

| Financing the capital expenditure requirements of the Company | 350.59 |

| Investment in the Subsidiaries for capital expenditure requirements | 270.44 |

| Pre-payment/ re-payment, in part or full, of certain outstanding borrowings availed by our Company | 362.96 |

| Investment in our Subsidiary, HPT Orchid Resort for repayment/prepayment, in part or full, of certain outstanding borrowings availed by it | 149.94 |

| Funding inorganic growth through unidentified acquisitions and general corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

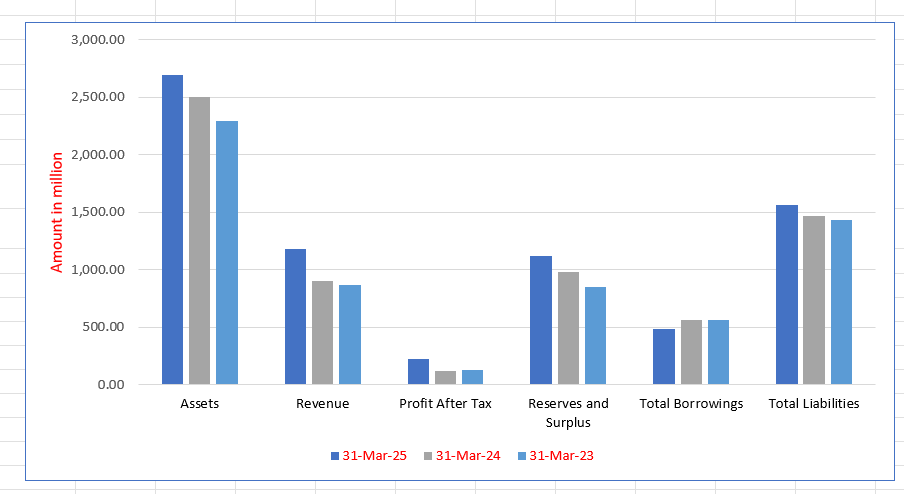

Hotel Polo Towers Limited Financials (in ₹ million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,693.84 | 2,504.71 | 2,295.82 |

| Revenue | 1,179.73 | 899.33 | 871.15 |

| Profit After Tax | 220.88 | 120.04 | 131.34 |

| Reserves and Surplus | 1,117.20 | 978.59 | 851.36 |

| Total Borrowings | 486.25 | 567.71 | 563.13 |

| Total Liabilities | 1,563.83 | 1,472.37 | 1,429.75 |

Financial Status of Hotel Polo Towers

SWOT Analysis of Hotel Polo Towers IPO

Strength and Opportunities

- Strategically located hospitality assets in high-growth regions of Northeast India.

- Robust pipeline of strategic hospitality projects enhancing future capacity and market share.

- Established and emerging brand architecture with 'Polo' and 'Chapter Hotels by Polo'.

- Focused operational management approach resulting in industry-leading EBITDA margins.

- Track record of strong operational and financial performance with high revenue and profit CAGR.

- Experienced promoters supported by a qualified and skilled management team.

- Dominant market position in key locations like Cherrapunjee and Agartala.

- Significant contribution from high-margin Food and Beverage (F&B) operations.

- Capital-efficient development model involving lease arrangements for land and buildings.

- First-mover advantage in several emerging tourist destinations with limited organized supply.

Risks and Threats

- High dependence on the Northeastern market, which may be susceptible to regional disruptions.

- Significant portion of assets held under lease arrangements, leading to substantial lease liabilities.

- Execution risks associated with the large pipeline of under-development projects.

- Intense competition from both established national chains and unorganized local players.

- Susceptibility to economic cycles impacting discretionary spending on travel and hospitality.

- Dependence on key managerial personnel for strategic direction and operations.

- Seasonality of the hospitality business, leading to fluctuations in occupancy and revenue.

- Regulatory risks, including changes in tourism, environmental, and land lease policies.

- Exposure to inflationary pressures increasing costs of supplies, utilities, and employee benefits.

- Potential delays in receiving regulatory approvals for new projects and expansions.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Hotel Polo Towers Limited

Hotel Polo Towers Limited IPO Strengths

Strategically Located Hospitality Assets

Hotel Polo Towers Limited has developed a portfolio of strategically located hotels and resorts in the high-growth regions of Northeast, East, and North India. Its properties are situated in prime locations, often in proximity to key attractions, transportation hubs, and commercial centers. This strategic positioning allows the company to effectively cater to diverse demand segments, including business travelers, leisure tourists, and MICE (Meetings, Incentives, Conferences, and Exhibitions) events, capitalizing on the unique tourism and economic potential of each location.

Robust Pipeline of Strategic Hospitality Projects

The company maintains a robust and diversified pipeline of under-development hospitality projects, primarily in Northeast India. This pipeline includes a mix of new-build properties and the expansion or upgradation of existing operational hotels under its established “Polo” brand and the new boutique “Chapter Hotels by Polo” brand. This strategic expansion is expected to significantly increase its room inventory and market share, positioning it to capture the growing demand for organized hospitality in the region.

Focused Operational Management Approach

Hotel Polo Towers Limited follows a focused operational management approach that drives significant operating efficiencies. This includes optimal space utilization, energy efficiency initiatives, shared services models for central functions, and staffing optimization measures. The implementation of these strategies has resulted in the company achieving a superior EBITDA Margin of 44.60% for Fiscal 2025, which is higher than the average of its listed peers, demonstrating effective cost control and resource allocation.

Track Record of Strong Operational and Financial Performance

The company has demonstrated a strong track record of operational and financial growth. Its revenue from operations increased from ₹871.15 million in Fiscal 2023 to ₹1,179.73 million in Fiscal 2025, representing a CAGR of 16.37%. More notably, its Profit After Tax grew at a CAGR of 29.68% over the same period. This consistent performance underscores the company’s effective business model and its ability to scale operations profitably in its target markets.

Experienced Promoters and Management Team

Hotel Polo Towers Limited is supported by experienced promoters, Kishan Tibrewalla and Deval Tibrewalla, who have been instrumental in the company’s growth over decades. Their expertise is complemented by a qualified management team with considerable experience in the hospitality industry. This leadership combination provides strategic direction, deep operational knowledge, and strong execution capabilities, which are critical for navigating the competitive landscape and achieving long-term growth objectives.

More About Hotel Polo Towers Limited

Company Overview and Portfolio

Hotel Polo Towers Limited is a prominent hospitality group with a rich legacy dating back to 1986. The company develops, owns, and operates a chain of upscale and midscale hotels and resorts. As of August 31, 2025, its operational portfolio encompasses nine hotels and resorts with a total of 425 keys, supported by 17 on-premise cafés and restaurants and two standalone cafés. A core part of its business is its extensive F&B operations, which contribute significantly to stable revenues by serving both in-house guests and the local community’s demand for organized dining experiences.

Brand Architecture and Expansion

The company is strategically expanding its portfolio under two distinct brand identities:

- The Polo Brand: This is the company’s established flagship brand, representing upscale hotels and resorts known for their quality service and prime locations.

- Chapter Hotels by Polo: This is an emerging boutique brand, designed to provide more intimate, curated, and experiential stays, catering to travelers seeking unique and personalized hospitality experiences.

Operational Footprint and Key Assets

Hotel Polo Towers Limited has a significant presence in Northeast India, with properties in states like Meghalaya, Tripura, and Nagaland, along with a unique floating hotel, Polo Floatel, in Kolkata. Some of its notable assets include:

- Polo Orchid Resort, Cherrapunjee (Sohra): The largest resort in Cherrapunjee in terms of rooms.

- Hotel Polo Towers, Agartala: Noted as the first and only five-star hotel in Tripura.

The company also operates 34 event and banquet spaces, catering extensively to the MICE segment, which includes weddings, corporate events, and social functions.

Growth Strategy and Future Outlook

The company’s growth is fueled by a robust pipeline of upcoming projects in strategic locations such as Kohima, Dimapur, and Shillong. These projects are a combination of greenfield developments and upgrades to existing properties. This expansion strategy is aimed at broadening its geographic footprint, enhancing its service offerings, and solidifying its leadership position in the organized hospitality sector of Northeast India. The company employed 630 permanent employees as of August 31, 2025, underscoring its scale and commitment to the region.

Industry Outlook

Indian Hospitality Industry: A Promising Trajectory

The Indian hospitality industry is on a strong growth path, driven by rising disposable incomes, increased domestic travel, and government initiatives to boost tourism. The sector has witnessed a robust recovery post-pandemic and is expected to continue its expansion. Key growth drivers include the rising middle class, better air and road connectivity, and the growing prominence of destinations beyond traditional metros.

Northeast India: An Emerging Hospitality Hotspot

The hotel industry in Northeast India, in particular, has witnessed remarkable growth. According to industry reports, chain-affiliated inventory expanded by 1,475 new rooms between Fiscal 2021 and Fiscal 2025, with 77% of this addition occurring in Fiscal 2023 and Fiscal 2024. This growth is underpinned by:

- Improved Connectivity: Enhanced air and road links making the region more accessible.

- Infrastructure Development: Government and private investments in supporting infrastructure.

- Rising Travel Demand: Growing interest in the region’s unique natural beauty and cultural experiences from both domestic and international tourists.

The upscale and midscale hotel segments are poised to benefit significantly from this trend, as demand for quality, organized accommodation outstrips supply in many emerging cities and tourism hubs within the region.

Future Projections and Market Share

The pipeline for new hotel rooms in Northeast India remains strong. Hotel Polo Towers Limited is a key player in this expansion. If the company’s inventory were included in the chain-affiliated supply, it would account for a 35% share of the existing upscale hotel supply in the region. Notably, the company is expected to contribute 20% of the total hotel pipeline (in terms of keys) in Northeast India between Fiscal 2026 and Fiscal 2030, with its share of the cumulative chain-affiliated inventory projected to reach 13% by Fiscal 2030. This highlights the company’s pivotal role in the region’s hospitality development.

How Will Hotel Polo Towers Limited Benefit

- Benefit from the overall growth in domestic tourism and the specific boom in travel to Northeast India, leading to higher occupancy rates and room tariffs.

- Capitalize on the limited supply of organized hospitality in the region, allowing it to command premium pricing and strengthen its market position.

- Leverage its extensive pipeline to capture a significant share (20%) of the new room supply in Northeast India, driving future revenue growth.

- Utilize its established “Polo” brand and new “Chapter” brand to cater to multiple customer segments, from upscale business travelers to experiential leisure seekers.

- Enhance revenue per available room through its strong F&B operations and MICE facilities, which are key demand drivers in the region.

- Benefit from improved connectivity and infrastructure in Northeast India, which will make its properties more accessible to a larger tourist base.

- The industry’s positive outlook supports its expansion and investment plans, improving investor confidence and potential valuation.

Peer Group Comparison

| Name of the Company | Face value (₹) | P/E | EPS (Basic) (₹) | RoNW (%) | NAV (₹ per share) |

| Hotel Polo Towers Limited | 2 | NA | 3.47 | 19.70 | 19.38 |

| Peer Group | |||||

| The Indian Hotels Company Limited | 1 | 58.36 | 13.40 | 16.42 | 87.22 |

| ITC Hotels Limited | 1 | 79.16 | 3.05 | 5.94 | 51.55 |

| EIH Limited | 2 | 34.00 | 11.82 | 16.23 | 75.86 |

| Lemon Tree Hotels Limited | 1 | 69.41 | 2.48 | 13.59 | 22.60 |

| Schloss Bangalore Limited | 10 | 214.85 | 1.97 | 1.32 | 148.88 |

| Apeejay Surrendra Park Hotels Limited | 1 | 40.70 | 3.92 | 6.51 | 60.17 |

Key Strategies for Hotel Polo Towers Limited

Driving Organic Expansion

Hotel Polo Towers Limited will focus on driving organic growth by successfully completing its robust pipeline of under-development hotels and resorts. The strategy involves broadening its geographic presence in high-growth regions lacking organized hospitality and intensifying efforts to expand F&B operations. This includes enhancing dining offerings, expanding outdoor catering, and creating differentiated guest experiences through curated menus and events. The company also aims to replicate integrated hospitality-retail formats, like the Polo Central Mall in Agartala, to diversify revenue streams and enhance asset value.

Accelerating Growth through Rebranding and Premiumization

The company plans to accelerate growth by repositioning its current assets through strategic rebranding, premiumization, and operational uplift. This involves upgrading properties to higher quality standards, enhancing guest experiences, and repositioning them in more premium market tiers. Initiatives include comprehensive renovation and refurbishment, enhancing service standards, developing new F&B concepts, and strengthening marketing. The goal is to improve average daily rates, attract more guests, and generate sustained growth in EBITDA while building long-term brand equity.

Improving Operational Efficiencies

A key strategy is the continuous enhancement of operational efficiencies across the portfolio. Hotel Polo Towers Limited will focus on optimizing space utilization by repurposing underutilized areas into revenue-generating spaces like additional rooms, F&B outlets, or event venues. It will also implement a cluster-based, centralized negotiation approach for procurement to achieve economies of scale. Additionally, the company is committed to sustainability initiatives and establishing training cells to develop a skilled workforce, ensuring consistency and efficiency in day-to-day operations.

Pursuing Inorganic Growth

Hotel Polo Towers Limited intends to pursue inorganic growth through strategic acquisitions of hotel assets, particularly in Northeastern and Eastern India. The company has prior experience in successfully turning around an underperforming asset (Polo Floatel, Kolkata). This strategy will allow it to accelerate expansion, strengthen its geographic footprint, and capture early-mover advantages in high-opportunity markets without the longer gestation periods associated with greenfield developments, thereby complementing its organic growth.

Entering into Asset-Light Models

To drive scalable and capital-efficient growth, the company plans to expand its portfolio through asset-light models, specifically management contracts and operating leases. Under these arrangements, it would leverage its operational expertise and brand strength to manage properties owned by third parties. This approach provides flexibility to enter new markets with limited capital deployment and diversifies revenue streams through management fees, supporting a more efficient capital structure alongside its owned assets.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Hotel Polo Towers Limited IPO

How can I apply for Hotel Polo Towers Limited IPO?

You can apply via ASBA through your bank account or through the online trading platform of your broker using UPI.

What is the lot size for the Hotel Polo Towers IPO?

The lot size and the minimum investment required will be announced along with the price band before the IPO opens.

What is the face value of Hotel Polo Towers Limited's shares?

The face value of Hotel Polo Towers Limited’s equity shares is ₹2 per share.

Where will the Hotel Polo Towers IPO be listed?

The equity shares will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

Is the Hotel Polo Towers IPO a fresh issue?

The IPO comprises both a fresh issue of ₹300 crores and an Offer for Sale (OFS) of up to 0.71 crore shares by promoters.