- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

How To Improve Your Chances of IPO Allotment?

By Shishta Dutta | Updated at: May 23, 2025 04:09 PM IST

Before we go into the discussion of how to improve your chances of allotment in an IPO, it is important to quickly understand how the basis of allotment for an IPO is done for retail investors.

- In the case of HNI/NII, the allotment is on a proportionate basis

- For QIBs also the allotment is done on a proportionate basis.

- In the case of retail, the first priority for the SEBI allotment process is that as many unique investors as possible get at least one lot of the IPO and then the others are allotted on a proportionate basis.

- It is only in case the oversubscription is substantial that the lottery method is used.

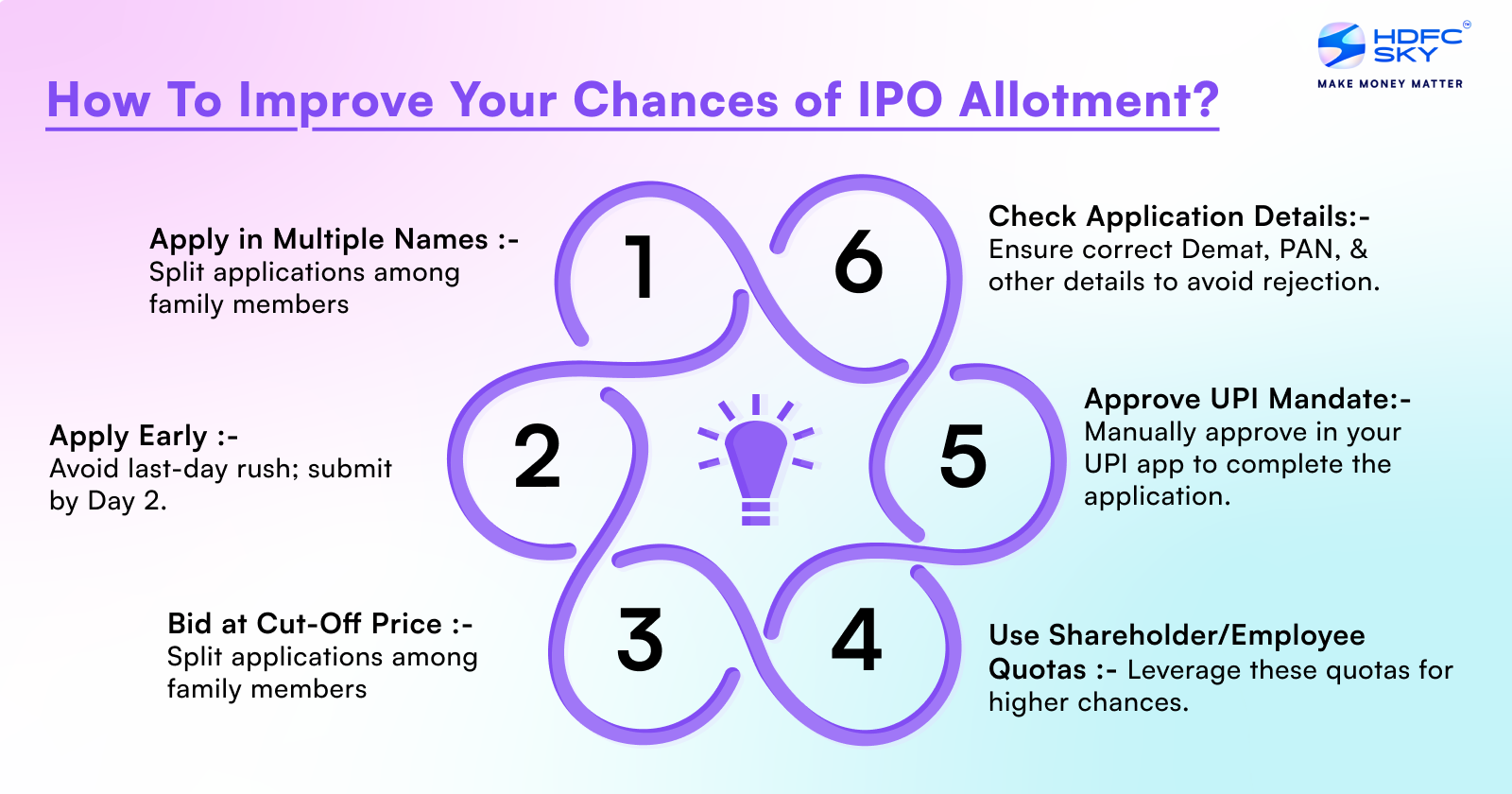

How To Improve Your Chances of IPO Allotment?

Here are some suggestions to improve your chances of allotment in an IPO in the retail quota.

- Instead of putting one large application in the retail quota, try to split the application among your family members. If the issue is oversubscribed, and the basis of allotment gives minimum 1 lot to each applicant, you stand a much higher chance of getting an IPO allotment into your family.

- The last thing you want is for your IPO application to not go through because you submitted the application too late to the broker. In a 3-day IPO, try to finish your IPO application by the second day. On the last day, there is a lot of pressure from QIBs and HNI / NII funding portion. It is best to avoid rush hour as brokers may not input forms after a certain cut-off time on the closing day.

- Applying in retail quota at cut-off price can substantially improve your chances of getting IPO allotment. In a cut-off application, you just accept the final discovered price. On the contrary, if you bid at a price and if the discovered price is higher, then your application is automatically rejected. Bidding at cut-off can save you the blushes in an IPO.

- You must review your IPO carefully before submitting the application. Ensure that your demat account and other details are entered property. Your PAN number must be used only in one application, otherwise it is grounds for rejection. By reviewing your application thoroughly, you substantially raise your chances of allotment in the IPO.

- Quite often you may be eligible to apply for the IPO either as part of employee quota or parent shareholder quota. It may also make sense to buy the parent company shares before the cut-off date to be eligible for shareholder quota. Normally, this is a closed user group and so your chances of allotment are much higher.

- Finally, the efficiency lies in the detail, so don’t miss out on the finer points of the IPO. A simple thing people tend to forget in IPO applications is that if the IPO mandate is an ASBA mandate and a UPI debit mandate, there is one step in the process you must not forget. You need to go into your UPI application and manually approve the UPI mandate request. If you apply for the IPO, but forget to approve the UPI mandate request; your IPO application will be rejected for no fault of yours.

There is no rocket science, but some basic ground rules can go a long way.

Allocation that Retail Investors Get

The normal retail allocation in the overall quota is 35%. However, there are specific cases, where under SEBI regulations, the QIB portion has to be allocated 75% of the IPO quota. In such cases, the retail portion is limited to 10%.

Bidding at the Lower or Upper End of the Price Range

Applying at the lower end is not a good idea since if the discovered price is higher then your application gets rejected. Instead, just bid at the cut-off price.

For example, if the IPO is priced in the band of Rs240 to Rs252 and you bid at Rs249, your bid would automatically get rejected if the cut-off price determined is higher. Instead, if you just mention “cut-off” as the price choice, it is presumed that whatever price is discovered is acceptable to you and your application will be treated accordingly.

Hence, for retail investors, there is a much better chance of getting an allotment by simply applying at cut-off.

Conclusion

If you want to improve your chances of getting an IPO allotment, apply early, bid at the cut-off price, and keep your application small, as retail investors often have better luck with smaller lots. You can also ask family members to apply through their accounts to increase your overall chances. By staying informed and planning your strategy wisely, you will stand a better chance of securing those sought-after shares.

Related Articles

FAQs on How to Increase the Chances of IPO Allotment

How do I get a successful IPO allotment?

The first step is to do your due diligence and ensure that finer details like particulars in the form are correct and you approve the UPI mandate. These can reduce your chance of rejection. Also, applying the names of your family members can enhance your allotment chances.

What is the best time to apply for an IPO?

That does not make much of a difference. However, it is best to avoid the last-day rush for IPOs.

How do I guarantee an IPO allotment?

While you cannot guarantee allotment of IPO shares, you can take certain measures like applying in smaller lots, splitting application between family members, applying early to improve your chances of IPO allotment.