- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

How to Invеst in Sharе Markеt?

By Shishta Dutta | Updated at: Sep 26, 2025 05:13 PM IST

Investing in the share market is a powerful way to grow your wealth over time. It involves buying shares of companies to earn returns through price appreciation or dividends. For beginners, understanding how to invest in the share market includes learning the basics, opening a trading and demat account and choosing the right stocks based on research and goals.

What is the Share Market?

The share market is a platform where buyers and sellers trade shares of publicly listed companies. It enables investors to buy ownership in businesses and earn returns through price gains and dividends. It includes two segments: the primary market (where new shares are issued) and the secondary market (where existing shares are traded).

Types of Share Markets

The share market is broadly divided into two main types based on the stage of trading:

- Primary Market

- Companies issue new shares to the public via IPOs.

- Investors buy directly from the company.

- Secondary Market

- Existing shares are traded among investors.

- Includes stock exchanges like NSE and BSE.

These markets work together to support capital raising and liquidity in the financial system.

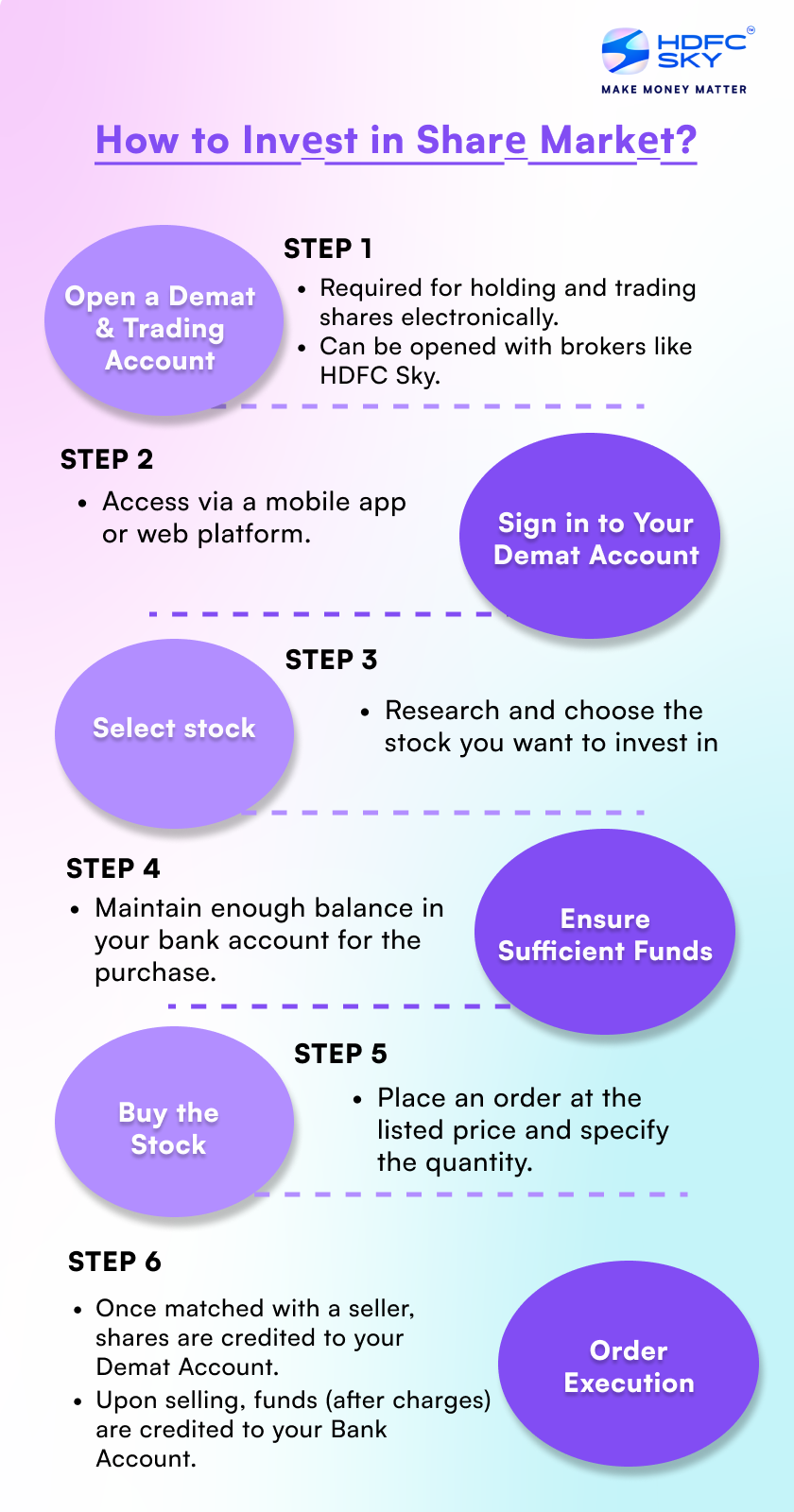

How to Invest in Share Market

To invest in the share market in India necessitates a systematic approach. Here are the steps to get started:

- Open a Demat & trading Account: To start share market trading a demat & trading account is necessary. Demat account holds shares electronically. Through the trading account, you buy and sell shares held in dematerialised form. All trading and investments in stocks are now done electronically or in dematerialised form. You can open your demat & trading account with a broker such as HDFC Sky.

- Sign in to Your Demat Account: Access your demat account via a mobile app or web platform provided by your broker.

- Select a Stock: Research and pick a stock you wish to invest in.

- Ensure Sufficient Funds: Make sure you have enough funds in your bank account to purchase the desired shares.

- Buy the Stock: Purchase the stock at its listed price and specify the number of units.

- Order Execution: Once a seller matches your request, the transaction is completed. Your bank account is debited, and the shares are credited to your demat account. Similarly when you sell shares, money equal to the selling price, less any charges, is credited to your bank account. Your bank account gets credited.

Things You Need Before You Invest in the Stock Market

Before investing in the stock market, ensure you have the following:

- PAN Card: Mandatory for opening investment accounts.

- Bank Account: Linked to your trading and demat accounts for fund transfers.

- Demat Account: Holds your shares in electronic form.

- Trading Account: Used to buy and sell stocks on stock exchanges.

- Mobile Number & Email ID: For account verification and transaction alerts.

- KYC Compliance: Complete your Know Your Customer process with valid ID and address proof.

- Basic Market Knowledge: Understand risks, returns, and how the market functions.

Investment Process

The investment process involves several key steps:

1. How to Open a Demat & Trading Account

You can open a demat & trading account online in just a few minutes, with HDFC Sky. The copies of the following documents need to be submitted:

- Proof of address (e.g., utility bill, rental agreement)

- Proof of identity (e.g., Aadhar Card, passport, voter ID)

- PAN card (Permanent Account Number issued by the Income Tax Department)

- A cancelled cheque from your bank account

Once you have opened a demat & trading account with a broker like HDFC Sky you are ready to invest and trade in stocks.

2. Login to Your Demat & trading Account

To start trading log in to your Demat & Trading account using the official app or website of your stock broker.

- Identify the Stock you want to Buy or Sell

- Enter the quantity you want to buy or sell

- Select the type of order – Limit order or Market order

- Click on Confirm

- In a few minutes you will get a message on your phone or email regarding the execution of your order.

That’s how easy it is to invest and trade in stock markets.

Factors to Consider Before Making Share Market Investment

Before investing in the share market, it’s important to evaluate key factors to reduce risk and make informed decisions:

- Investment Goals: Define whether you’re investing for short-term gains or long-term wealth creation.

- Risk Appetite: Assess how much risk you can handle based on your financial situation.

- Market Research: Study the company’s fundamentals, industry outlook and stock performance.

- Diversification: Avoid investing all funds in a single stock or sector.

- Financial Stability: Ensure you have an emergency fund and no high-interest debt.

- Timing & Market Trends: Keep an eye on market conditions and economic indicators.

- Investment Horizon: Know how long you plan to stay invested to pick suitable stocks.

Conclusion

Now that you understand how to invеst in sharе markеt, you can opеn a dеmat & trading account with a brokеr and start trading. Rеmеmbеr to considеr your financial goals and risk tolеrancе and divеrsify your portfolio for bеttеr outcomеs.

Related Articles

FAQs on Share Market Investment

How Can a Beginner Invest in Shares?

A beginner can invest in shares by opening a demat and trading account, completing KYC, and starting with well-researched or blue-chip stocks. It’s wise to begin with small amounts, use a trusted broker, and learn basic market concepts before diving in.

How do I buy stock for thе first timе?

To buy stock in India for thе first time, opеn a DEMAT and trading account with a brokеr, rеsеarch and sеlеct thе stocks, еnsurе you havе sufficiеnt funds in the bank account linked to your trading account, and placе a buy ordеr through thе brokеr’s platform.

How to invеst in thе Sharе markеt with lеss monеy?

Stock markets give you the convenience to buy even a unit quantity of a stock. So you can start with very little money.