- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What is a Demat Account, and How Does It Work?

- Why do you Need to Open a Demat Account?

- Facilities Offered by a Demat Account

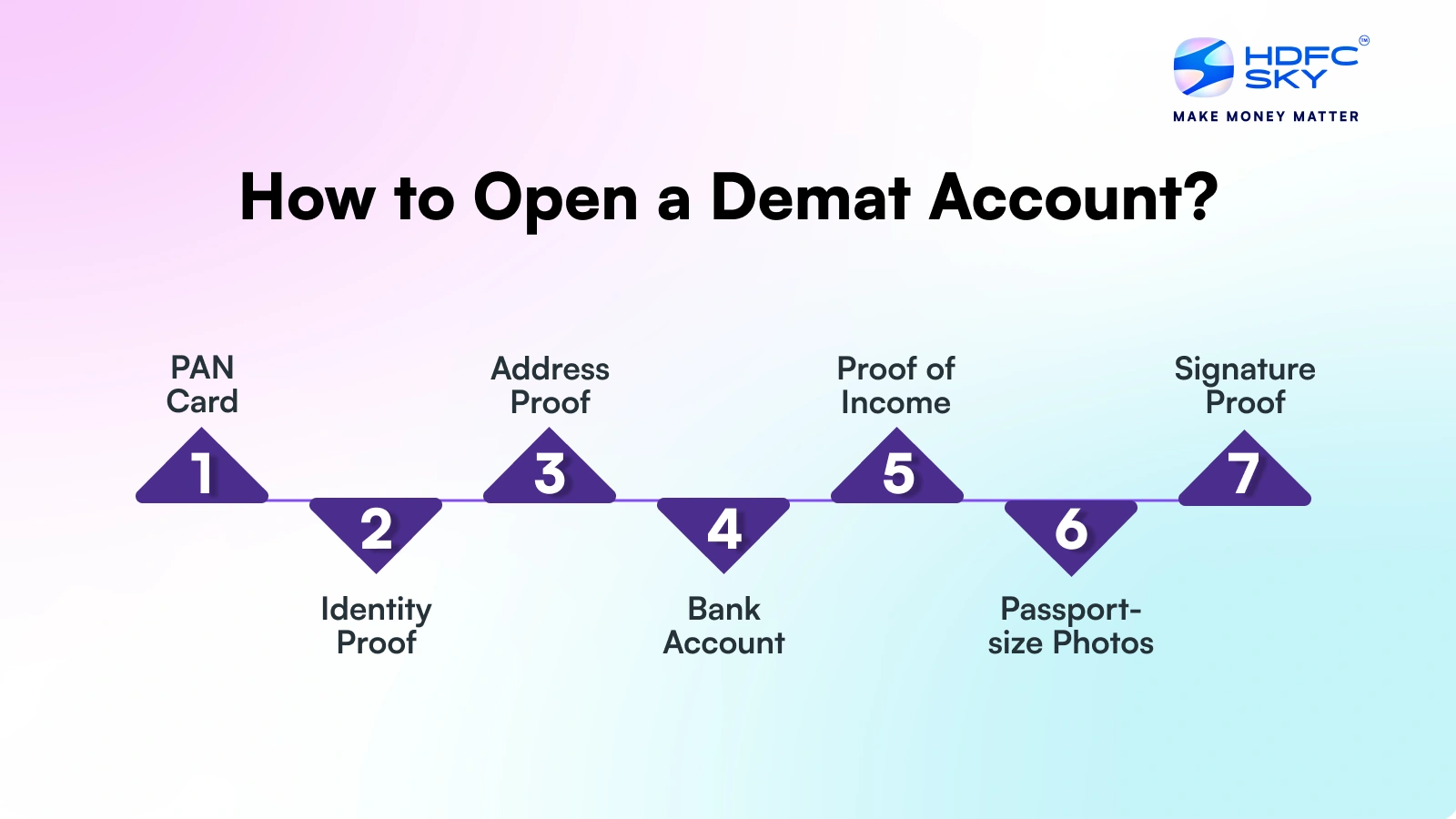

- What are the Documents Required to Open a Demat Account?

- Charges for Opening a Demat Account

- Demat Account Opening Process:

- Steps for Opening A Demat Account Offline

- Things to Remember While Opening a Demat Account

- Conclusion

- FAQs on How to Open Demat Account

- What is a Demat Account, and How Does It Work?

- Why do you Need to Open a Demat Account?

- Facilities Offered by a Demat Account

- What are the Documents Required to Open a Demat Account?

- Charges for Opening a Demat Account

- Demat Account Opening Process:

- Steps for Opening A Demat Account Offline

- Things to Remember While Opening a Demat Account

- Conclusion

- FAQs on How to Open Demat Account

How to Open a Demat Account in India: Steps for Opening a Demat Account Online and Offline

By HDFC SKY | Updated at: Jul 25, 2025 11:12 AM IST

Summary

- What is a Demat Account?

A Demat account holds shares and securities in electronic format, essential for stock trading and investing in India. - Types of Demat Account

- Regular Demat Account

- Repatriable Demat Account (for NRIs)

- Non-Repatriable Demat Account (for NRIs)

- Online Account Opening Process (Paperless & Instant)

- Visit the HDFC SKY website.

- Enter mobile number & email; verify with OTP.

- Submit PAN, Aadhaar, bank details, and income proof.

- Complete in-app selfie and e-sign via Aadhaar.

- Account activated within 15 minutes post-verification.

- Offline Account Opening Process

- Visit the nearest HDFC Bank or authorized branch.

- Fill out the physical Demat account form.

- Submit KYC documents and passport-size photos.

- Verification and account opening take 1–2 days.

- Key Documents Required

PAN card, Aadhaar, cancelled cheque, income proof, and passport-size photo. - Market Implication

Streamlined onboarding supports increased retail investor participation in capital markets via HDFC SKY.

Remember the days when your parents kept share certificates in bank lockers? That’s changed now. With Demat accounts, you can buy and sell shares from your phone. As of September 2024 over 17 crore people in India now use Demat accounts to invest in the stock market. So if you’re considering investing, here’s everything you need to know about opening a Demat account.

What is a Demat Account, and How Does It Work?

Think of a Demat account as a bank account for your shares. Just like your bank account shows how much money you have, your Demat account shows all the shares you own. When you buy shares, they get added to your account. When you sell them, they get removed.

Banks and brokers (called Depository Participants or DPs) help manage these accounts. They work with two main organisations – NSDL and CDSL – that keep track of everyone’s shares.

It’s like how banks keep track of everyone’s money but for investments instead.

Why do you Need to Open a Demat Account?

Just like you need a bank account to keep your money safe, you need a Demat account to keep your shares safe. Here’s why it makes sense:

- Everything is paperless, so there is no fear of losing or damaging paper certificates

- Your dividends (money companies share with investors) come straight to your account

- You can check your investments anytime, anywhere, on your phone using a secure demat app.

- Buying and selling shares takes minutes instead of days

- All your investment details are in one place – shares, bonds, mutual funds

Facilities Offered by a Demat Account

When you open a Demat account, you get more than just a place to store shares. Here’s all you can do with your account:

- Trading Made Easy: Buy or sell shares whenever you want. Whether it’s company shares, government bonds, or mutual funds – you can trade them all from one account.

- Quick Money Transfers: When companies give dividends or return your investment money, it goes straight to your linked bank account. You do not need to wait for checks in the mail.

- Loan Options: Banks often give loans against the shares in your Demat account. This allows you to use your shares as a guarantee, just like people use gold for gold loans.

- Portfolio Tracking: You can see the value of your investments at any time. Your account gives you a complete overview, from what you bought to when you bought it and how much it’s worth now.

What are the Documents Required to Open a Demat Account?

Opening a Demat account is a fairly easy process. Here are all the documents that you need:

- PAN Card: Your PAN card is a mandatory document

- Identity Proof: This includes documents like an Aadhaar card, passport, voter ID or other government issues IDs

- Address Proof: Recent electricity bill, phone bill, or rental agreement

- Bank Account: You need to link your bank account to your demat account for easy money transfers

- Proof of Income: To provide income proof, provide your income tax returns, bank statements, salary proofs, net worth statements

- Passport-size Photos: Most online applications need your recent photo for verification

- Signature Proof: Ensure you add have a blank white paper with your signature

Charges for Opening a Demat Account

Before you open your account, it’s good to know the charges that can be levied on you:

- Account Opening Fee: Many brokers now offer free account opening

- Custodian Charges: Custodian charges are levied to safeguard the Demat account. This amount depends on the number of securities in your account

- Yearly Charges: Just like bank accounts have maintenance charges, demat accounts have annual charges:

- Account Maintenance: ₹300-500 per year

- Transaction Fees: Small charges when you buy or sell (usually ₹20-30 per trade)

- Demat Charges: Around ₹10-15 per company’s shares you hold

All these charges may vary from broker to broker.

Demat Account Opening Process:

Steps for Opening a Demat Account Online

Opening a Demat account online is like creating a social media account but with a few extra security steps. Here’s how to open a Demat account online:

Step 1: Choose a DP Website

Look for a trusted broker or bank website. A quick search will help you find the most popular ones. For your safety, ensure that the broker or bank is registered with SEBI.

Step 2: Click ‘Open Demat Account’

Once you’re on the website, you’ll find a big button saying ‘Open Demat Account‘ or ‘Start Investing’. Click that button to begin.

Step 3: Fill Out Your Details

This step is where you add your details, such as:

- Your name (exactly as it appears on your PAN card)

- Phone number

- Email address

- Address

- Professional information

Step 4: Verify with OTP

Once you have added your basic information, it is time to verify your information. In this step, you will generate a one-time password on your registered mobile number. This one-time password will verify the validity of your account.

Step 5: Share Your Documents

Now comes the important part – uploading your documents. All the documents uploaded need to be scanned properly. Remember to share scanned copies of the necessary documents, such as:

- Your PAN card

- Address proof

- Banking details

- Passport photo

Step 6: Complete e-KYC

This is the final step while opening a Demat account. Here’s all that you need to do to complete the e-KYC process:

- Take a quick video of yourself

- Show your PAN card in the video

- Repeat the words given during this verification process

- Sign digitally using your Aadhaar

Steps for Opening A Demat Account Offline

Here’s the procedure on how to open a Demat account offline by visiting a branch:

Step 1: Pick Your DP

Choose a bank or broker near you. Walk into their branch during working hours.

Step 2: Get Your Papers Ready

Carry original copies of:

- PAN card

- Address proof

- Identity proof

- Income proof

- Recent passport photos

- Bank statement

Step 3: Sign the Agreement

You will be provided with an agreement that outlines the regulations, rules and limitations of a Demat account. Read it carefully before you sign the document.

Step 4: Get Your Client ID

Once everything’s approved, the DP will provide you with a unique client ID. This and other important information provided will help you access your Demat account.

Step 5: Learn the Basics

The DP will provide you with an instruction sheet that will explain the basic functionality of the Demat account, such as:

- Transfer shares

- Check your balance

- Buy and sell

- How to get help when needed

Things to Remember While Opening a Demat Account

Before you jump in, there are some important things you should know. These tips can save you money and trouble later:

Check the Charges Carefully

Different brokers charge different fees. Some might call it a “free account opening”, but have high yearly charges. Others might charge upfront but offer better rates for trading. Look at all the costs before deciding.

Link Your Bank Account Right

The bank account you link to should be one you use regularly. This will be the account you will cash in your investment and make your payments. This is why ensuring the account is active and the details mentioned are correct is important.

Choose Between NSDL and CDSL

These are the two main depositories in India. Both are equally good and secure. Your broker might work with one or both. Ensure you have ample information about the two before you make a decision.

Add a Nominee

Many people overlook this important step. Adding a nominee to your account is like adding a nominee to your bank account. It ensures that your investments go to the right person if you pass away.

Watch Out for Hidden Fees

No one likes any hidden fees. Ensure you ask about all possible charges, such as:

- Demat account maintenance fees

- Trading account charges

- SMS alert charges

- Account closure charges

Conclusion

Opening a Demat account isn’t as complicated as it might seem. Whether you choose to do it online from the comfort of your home or offline at a branch, the process is quite straightforward.

Just ensure you have your documents ready, compare different brokers to find the best fit, and carefully read the fine print regarding charges. Adding a nominee is a smart step for future security, and keeping your account details safe is essential.

Once your Demat account is set up, you’re all set to begin your investment journey. Start small, learn along the way, and always invest wisely.

Related Articles

FAQs on How to Open Demat Account

How much does it cost to open a Demat Account?

Many brokers now offer free Demat account opening. However, you’ll need to pay annual maintenance charges ranging from ₹300 to ₹1000, depending on your broker. Some brokers also charge small fees for each trade, usually between ₹15-30. Watch out for additional charges like SMS alerts or account statement fees.

How many days will it take to open a Demat account online?

With digital KYC, you can open your Demat account in just 24-48 hours. If all your documents are correct and you complete the video KYC properly, some brokers even activate accounts on the same day. However, if there are any document issues, it might take 3-4 working days.

What is the difference between online and offline Demat accounts?

There’s no difference in the account itself – only in how you open it. An online opening is faster and can be done from home, while offline requires visiting a branch. Both types give you the same trading abilities and security. The main difference is in the opening process and paperwork handling.

How to open a Demat Account as an NRI?

NRIs can open Demat accounts by:

- Repatriable accounts (money can be sent abroad) linked to NRE bank accounts

- Non-repatriable accounts (money stays in India) linked to NRO accounts. NRIs must follow FEMA rules and can own up to 5% of a company’s paid-up capital.

Do I require a Demat account for SIP?

No, you don’t need a Demat account for SIP (Systematic Investment Plan) in mutual funds. You can start a SIP directly through mutual fund companies or apps. However, you’ll need a Demat account if you want to trade in ETFs (Exchange Traded Funds).

What are the disadvantages of offline trading?

Offline trading means dealing with physical share certificates, which has several problems:

- Risk of loss or damage to certificates

- Long settlement times (sometimes weeks)

- Higher chances of fraud

- Difficult to track investments

- Time-consuming paperwork for each trade

What are the two types of Demat accounts?

The main types are:

- Regular Demat Account – For residents trading in Indian markets

- NRI Demat Account – Further divided into:

- Repatriable (allows sending money abroad)

- Non-repatriable (money stays in India)

Are there any disadvantages to opening a Demat account?

While Demat accounts are essential for trading, be aware of:

- Annual maintenance charges

- Transaction fees for each trade

- Need to maintain accurate records for tax purposes

- Account might become dormant if not used regularly

However, these minor drawbacks are far outweighed by the benefits.

How to open a Demat account in India?

Opening a Demat account is straightforward:

- Choose a broker or bank

- Keep PAN card, income proof, address proof, and ID proof ready

- Fill out the account opening form

- Complete KYC verification

- Link your bank account

- Start trading once your account is activated