- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

How to Save Tax in India? What Are The Tax Saving Alternatives Except Section 80C?

By HDFC SKY | Published at: May 28, 2025 04:52 PM IST

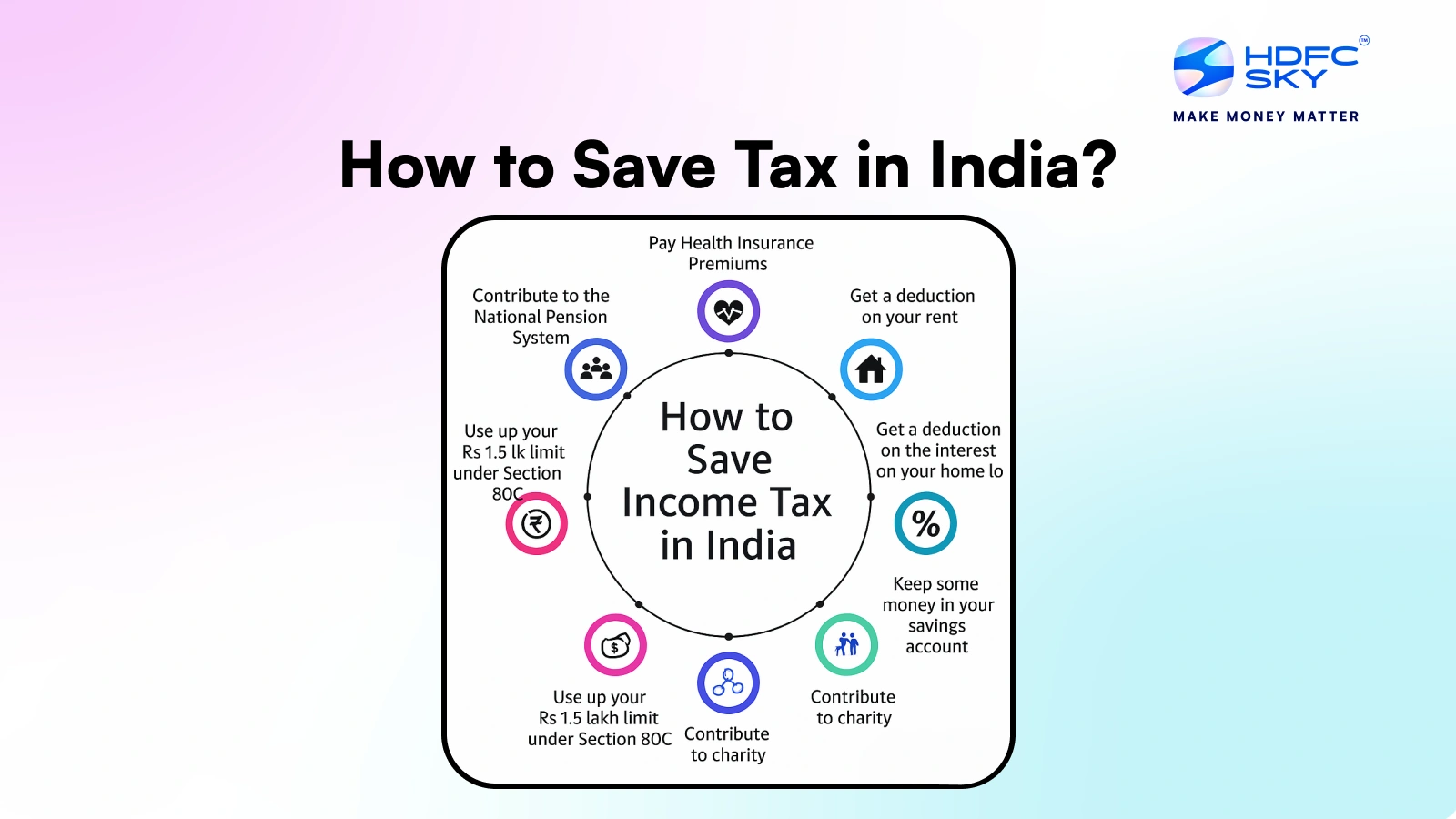

Many individuals want to know how to save tax in India. It is not difficult if you prepare early. The key is to utilise the right tax-saving options for you. These enable you to pay less tax and save more money for yourself. You can utilise old and new tax regimes, but the options differ.

In the old regime, you received higher deductions. The new regime offers lower tax rates but fewer deductions. However, there are a few ways to save tax even in the new regime. You need to know about tax saving investment options and tax saving schemes in India.

Some are extremely popular, such as ELSS, PPF, and NSC. Others are less popular but also helpful. You will also want to seek tax saving investment opportunities beyond 80C if you have already exhausted your 80C quota. Getting the right combination is crucial. This manual will lay out all the key choices and guide you on what is best for you.

Tax Saving Instruments and Sections Therein

Saving tax is a large issue for everyone. The government provides several means to do so. Section 80C is the most widely utilised section, allowing individuals and Hindu Undivided Families (HUFs) to claim deductions on specified investments and expenditures up to a maximum limit of ₹1.5 lakh per financial year.

Section 80C

Section 80C is the most popular section for tax saving. You can invest up to ₹1.5 lakh in a year. The top choices are PPF, ELSS, NSC, Tax Saver FDs, ULIPs, EPF, and others. These are safe and convenient to use. Each one of them has its own guidelines.

Equity Linked Savings Scheme

Equity-Linked Savings Scheme (ELSS) is a type of mutual fund that primarily invests in equities. Compared to other tax-saving options, its lock-in period is relatively short, at three years.

Investments can be made via a Systematic Investment Plan (SIP) or a lump sum. While ELSS can offer higher returns, it also carries market risk.

Public Provident Fund

Public Provident Fund (PPF) is a government-backed scheme that is extremely safe. It has a long lock-in period of 15 years and offers tax-free interest and maturity amounts.

The maximum annual investment limit is ₹1.5 lakh. It is suitable for long-term financial goals and risk-averse investors.

National Savings Certificate

NSC is another secure, government-backed instrument with a five-year lock-in period. You can invest a minimum of ₹1,000, and the interest is guaranteed. The invested amount, up to ₹1.5 lakh, qualifies for deduction under Section 80C.

Interest earned is taxable but is often reinvested, which can also qualify for deduction under Section 80C in the subsequent year (except for the interest in the final year). It is ideal for those seeking stable and secure growth.

Tax-Saver FDs

Tax-saver Fixed Deposits are similar to regular FDs but come with a mandatory lock-in period of five years. Investments up to ₹1.5 lakh are eligible for deduction under Section 80C. The interest earned on tax-saver FDs is taxable as per your income tax slab. These are simple and safe investment options offered by many banks.

Senior Citizens Savings Scheme

The Senior Citizens Savings Scheme (SCSS) is for seniors over 60. It is a lock-in of five years, which can be extended by three more.

You are given a nice interest rate. You can deduct up to ₹1.5 lakh under Section 80C. The interest will be taxable but has special TDS rules. It is a secure option for retirees.

Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana (SSY) is a government scheme to secure the financial future of a girl child below the age of 10. Contributions to SSY are eligible for deduction under Section 80C up to ₹1.5 lakh annually. The interest earned and the maturity amount are tax-free. It’s an excellent tool for saving for a girl’s education and future.

Employee Provident Fund

EPF is a mandatory retirement savings scheme for salaried individuals. Both the employee and the employer contribute to the fund. The employee’s contribution is eligible for deduction under Section 80C. The interest accrued and the withdrawal amount after a specified period are tax-free. It is a key component of retirement planning for salaried individuals.

Home Loan Repayment

If you repay a home loan, you can take the principal as a deduction under Section 80C. The interest component is under Section 24(b) to ₹2 lakh. This saves you plenty of tax if you have a house.

Tuition Fees

The tuition fees you pay towards your children’s education can be deducted under Section 80C. Only two children are considered, which benefits parents who pay school fees.

Tax Saving Alternatives Except Section 80C

After exhausting your 80C quota, you may still save tax. There are numerous tax-saving investment options other than 80C.

- Section 80D: Medical Insurance Premium

Premiums paid for health insurance for yourself, your spouse, and dependent children are eligible for deduction under Section 80D up to ₹25,000. An additional deduction of up to ₹25,000 (or ₹50,000 for senior citizens) is available for premiums paid for parents. - Section 80CCD(1B): National Pension System (NPS)

Under Section 80CCD (1 B), an additional deduction of up to ₹50,000 for contributions to the National Pension System (NPS) is available. This is over and above the ₹1.5 lakh limit under Section 80C. NPS is a retirement savings scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). - Section 24(b): Interest on Home Loan

As mentioned earlier, the interest paid on a home loan for a self-occupied property is deductible up to ₹2 lakh under Section 24(b). The entire interest paid for rented properties can be claimed as a deduction. - Section 80DD: Medical Treatment for Dependents with Disability

Expenses incurred on the medical treatment (including nursing), training, and rehabilitation of a dependent with a disability are eligible for a deduction under Section 80DD. The deduction amount is ₹75,000 for a dependent with a disability and ₹1.25 lakh for a dependent with a severe disability (80% or more). - Section 80G: Donations to Charitable Institutions

Donations made to certain approved charitable institutions and funds are eligible for deduction under Section 80G. Depending on the institution, the deduction amount can be 50% or 100% of the donated amount. Donations in cash exceeding ₹2,000 are not eligible for deduction. - Section 80E: Interest on Education Loan

Interest paid on a loan taken for higher education for yourself, your spouse, or your children is eligible for deduction under Section 80E. There is no upper limit on the amount of interest that can be claimed, and the deduction is available for a maximum of eight years or until the interest is fully repaid, whichever is earlier. - Savings account interest income is tax-free up to ₹10,000

Another option is choosing the new tax regime. The new tax regime offers lower tax rates compared to the old regime. Moreover, taxable income up to ₹12 lakhs (for non-salaried) and ₹12.75 lakhs (for salaried) does not attract any tax.

However, the new regime does not allow the deductions and exemptions available under the old regime. So, you can calculate your tax liability under both schemes and choose one that offers the lowest outgo.

Conclusion

There are numerous solutions to save taxes in India. You will have to take a combination of tax-saving options to get the maximum outcome. Begin at the beginning of the year. Exhaust Section 80C, but don’t neglect other sections.

Choose tax-saving investment options based on your requirements. If you fall under the new tax regime, there are fewer options, but you can save through NPS and health insurance. Always cross-check the rules before investing. Smart planning will help you save more tax and grow your money for the future.

Related Articles

FAQs on Saving Tax in India

What is the maximum investment limit under Section 80C?

The maximum investment limit under Section 80C is ₹1.5 lakh for each financial year. This is for eligible investments such as PPF, ELSS, NSC, life insurance premiums, etc. Individuals and Hindu Undivided Families can claim the deduction from their taxable income.

What tax exemptions can I avail myself of in India?

You can claim tax exemptions on several incomes, such as income from agriculture, house rent allowance, leave travel allowance, gratuity, pension, receipts from life insurance, and interest from specific bonds. The basic exemption limit is ₹2.5 lakh for regular citizens, ₹3 lakh for all senior citizens, and an amount of ₹5 lakh for extremely senior citizens.

Do I have the right to deduct medical expenses on my income tax return?

Yes, you can claim medical expenses as deductions. Section 80D permits health insurance premiums up to ₹25,000 (₹50,000 for senior citizens) and Section 80DDB permits deductions for certain diseases up to ₹40,000 (₹1 lakh for senior citizens). Preventive health check-ups are included.

Can I get a refund in case I have paid more income tax?

If you have overpaid income tax, you may get a refund by filing your income tax return. The refund is sent after the Income Tax Department verifies and credits it to your bank account. Your bank account should be pre-validated for easy processing.