- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What is SIP in ETFs & Why Invest in ETFs Through SIPs?

By HDFC SKY | Updated at: May 26, 2025 02:22 AM IST

Exchange-traded funds or ETFs can be seen as a basket of assets. It may include shares, bonds, etc. ETFs are traded on the stock market, and the fund aims to track one specific index, say Nifty 50 or Sensex, etc.

Similar to mutual funds, you can do SIPs in ETF funds as well. SIP or systematic Investment Planning helps you invest a fixed amount on a regular basis. ETFs are becoming quite popular among investors, and the introduction of SIP in ETFs can be a good feature for several investors. Explore in this guide how to start ETF SIPs.

What is an ETF (Exchange-Traded Fund)?

Exchange-traded funds work somewhat similarly to an individual stock. ETFs are simply a collection of multiple assets, and you may purchase or sell them on the stock market like an individual stock. Exchange-traded funds target a specific index and specific features in the index, like the price of shares.

Unlike mutual funds, the price range of ETFs may vary throughout the day. SIP in ETFs has become a part of several investors’ portfolios. So, let’s explore why ETFs are such a buzz in the stock market.

What is SIP in ETFs?

SIP stands for Systematic Investment Planning. It is a feature offered by brokerages where you can invest a fixed amount at regular intervals (generally done on a monthly basis). As the service is automated, the hassle of keeping up with the instalments or the worry of missing out on an instalment no longer exists.

SIP in ETFs is simply a way of regularly investing in ETFs. If you want to invest a fixed amount regularly in ETFs, you may sign up for a SIP. It offers you several benefits, like the flexibility to invest or exit at your will, low-cost investment, etc. Read on to learn how to start ETF SIPs in India.

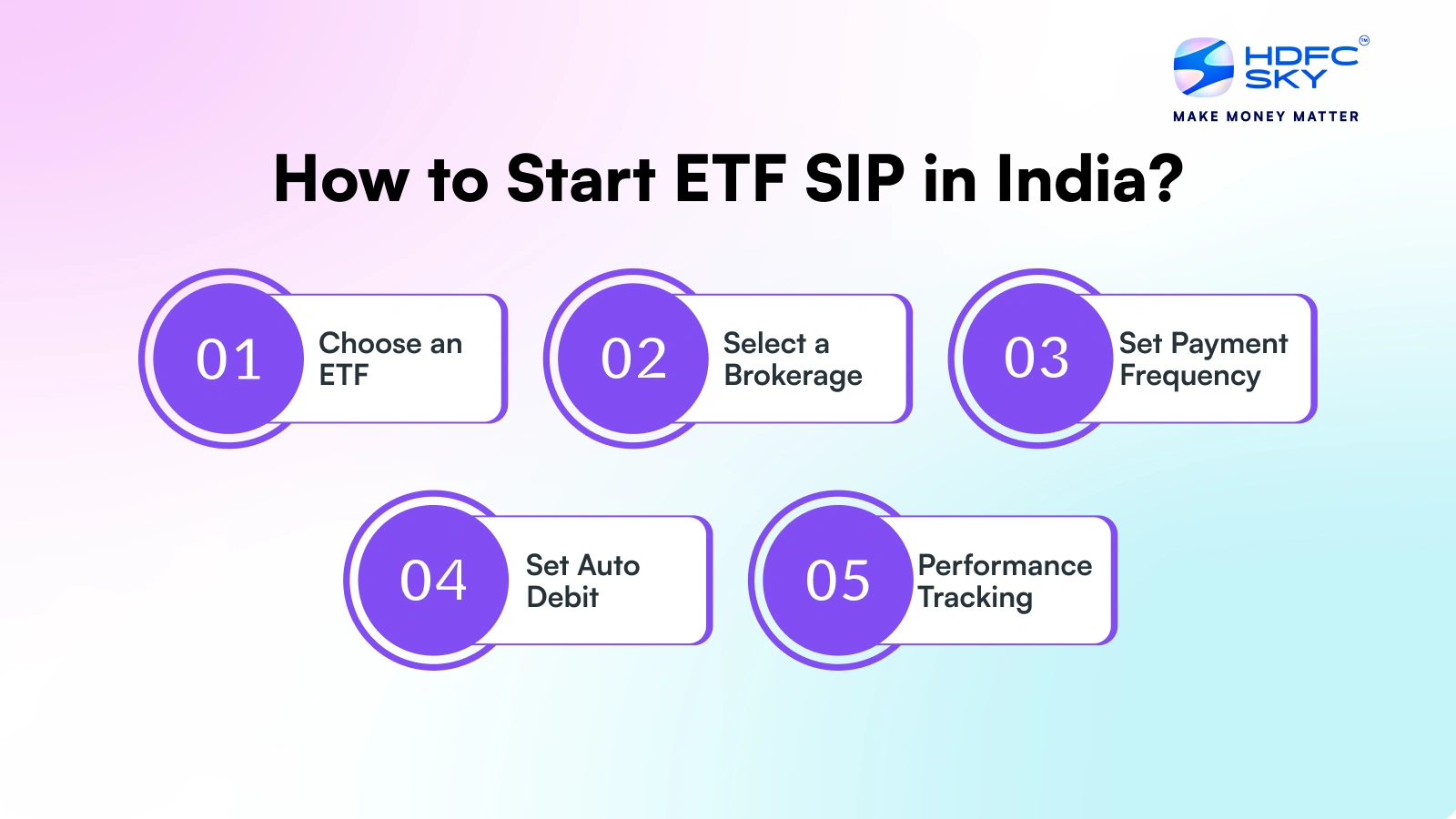

How to Start SIP in an ETF?

An ETF SIP is a smart move for long-term, disciplined investing. To know how to start SIP in ETFs, follow this simple step-by-step guide:

- Step 1: Choose an ETF

The first step is to choose the type of exchange-traded funds you want to invest in. There are several ETFs to choose from. Make sure to assess market conditions, risk appetite, global news, etc., to make the right choice.

- Step 2: Select a Brokerage

Once you have chosen the ETF for which you want to start an SIP, now is the time to select a brokerage. Make sure to confirm whether the brokerage offers SIP in ETFs. You may have a range of options to choose from.

- Step 3: Set Payment Frequency

Now that your ETF and brokerage are all set, you need to decide the payment frequency. The frequency of SIP and the installation amount must be decided carefully. Since it is a regular commitment, make sure to factor in your ongoing expenses, so that paying the SIP doesn’t burden your budget.

- Step 4: Set Auto Debit

Almost all brokerages offer an auto-debit feature; you may set it up. If you wish otherwise, you may also choose a manual method for regular transactions. Once the auto-debit is set, your ETF SIP is good to go.

- Step 5: Performance Tracking

ETFs are considered a passive investment. However, make sure to track the performance of your ETF closely. This will help you balance the risks and rewards so you can achieve your financial goals!

Why Invest in ETFs Through SIPs?

Investing in ETFs using SIPs is a smart strategy. ETFs offer easy diversification by holding many investments, like stocks or bonds, in one place. SIPs add discipline by letting you invest a fixed amount regularly, maybe every month.

This combination helps you avoid trying to guess market highs and lows. With SIPs, you automatically buy more ETF units when prices are cheaper and fewer units when prices rise. This averages out your purchase cost over time (rupee cost averaging). It’s a simple, disciplined way to build wealth steadily using a variety of ETFs.

Let’s discuss some of the striking reasons why SIP in ETFs could be a game-changer.

Common Query: Is It Good to Do SIP in ETFs?

SIP in ETFs can have multiple benefits. First and foremost, you need not lock in large amounts at once. Instead, you may invest in installments over time. You also get a chance to do rupee-cost averaging through SIP. This means you may buy more shares when prices are favourable and vice versa.

ETFs are passively managed, so the expense ratio is low compared to other funds, like mutual funds. Also, there are very low to no additional costs. Just like any other stock, you may buy or sell ETFs anytime during the market day. These are some of the major benefits of investing in ETFs through SIPs.

SIP in ETFs vs Index Fund

ETFs and index funds may sound somewhat similar. At a glance, you, too, may think so. However, these two are different funds. To completely understand what SIP is in ETFs, you also need to know the differences between ETFs and index funds.

| Feature | SIP in ETFs | Index Funds (via SIP) |

| What You Invest In | You buy units of an Exchange Traded Fund (ETF), which is a fund that holds a basket of securities (like stocks or bonds) designed to track a specific market index. | You invest in units of a Mutual Fund scheme specifically designed to mirror a market index (like Nifty 50 or Sensex). It also holds the same securities as the index it tracks. |

| How You Buy/Sell | You trade ETF units on a stock exchange (like NSE or BSE) through a stockbroker, which is exactly like buying or selling shares of a company. | You transact directly with the Asset Management Company (AMC) or through a distributor/platform. Buying and selling happen directly with the fund house. |

| How Your SIP Works | Your broker attempts to buy the ETF units on the stock exchange around your chosen SIP date, based on the available market price at that time. | The fund house automatically deducts the SIP amount from your bank account on the set date and allocates you fund units based on that day’s closing NAV. |

| Price You Get | The price changes throughout the trading day based on market demand and supply. You buy or sell at the current market price available when your order executes. | You get the Net Asset Value (NAV) declared at the end of the trading day. All transactions during the day (buys or sells) happen at this single closing NAV price. |

| Account Needed | Requires a demat account (to hold the ETF units electronically) and a Trading account (to buy/sell orders on the exchange). | Primarily requires a bank account linked for SIP deductions and completion of Mutual Fund KYC (Know Your Customer) formalities. No demat account is mandatory. |

| Main Costs Involved | Includes the ETF’s low expense ratio, your stockbroker’s brokerage fees for each transaction, and potentially demat account annual maintenance charges (DP charges). | Primarily involves the fund’s expense ratio (often slightly higher than a comparable ETF’s). No brokerage fees apply for direct transactions with the AMC. |

| Ease of Selling | You can sell your ETF units anytime the stock market is open, getting the real-time market price. | You place a redemption request with the fund house. The proceeds, based on the closing NAV of the day the request is processed, are credited to your bank account, usually in a few days. |

| Minimum SIP Amount | The starting amount varies significantly depending on the broker and the specific ETF’s unit price. Some brokers facilitate very low starting amounts. | Typically starts at standard amounts like ₹100, ₹500, or ₹1000 per instalment, making it very accessible for small regular investments. |

| Fractional Units | On Indian stock exchanges, buying parts of a single ETF unit is generally not possible. You usually have to buy whole units. | You can usually invest a fixed amount (e.g., ₹1000), and the fund house will allot you fractional units based on the NAV (e.g., 10.53 units). |

Conclusion

Here’s hoping this guide could give you a clear understanding of how to start a SIP in ETFs. Before you begin your investment journey, go through various ETFs to choose the right one that aligns with your financial goals.

Also, choose a reliable brokerage platform that supports ETF SIPs, offers user-friendly features, and has low transaction costs. With the right planning and discipline, an ETF SIP can be a powerful tool to build wealth over time.

Related Articles

FAQs on SIP in ETFs

Is investing in ETFs through SIPs safe?

Yes. ETF SIPs are gaining traction in the Indian market, and more investors are leaning towards them. You need to take time to research and compare different ETFs to find one that suits your risk profile and long-term financial goals. Then, you need to choose the right brokerage, and you’re good to go.

How much should I invest in an ETF SIP?

The amount that you decide to invest in ETF SIP may depend on your future financial goals, risk appetite, and ongoing financial commitments. So, there is no one-size-fits-all concept in this.

Is SIP possible in ETFs in India?

Yes. Several brokerages are offering ETF SIPs in India. Make sure to confirm with your chosen broker before planning a tour of SIP in ETFs.

Is SIP in an ETF better than SIP in mutual funds?

ETFs and mutual funds are different funds in terms of their security composition, nature, and risk level. So, based on your personal financial goals and risk appetite, you may choose to invest in either or both of these funds.