- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Hy-Tech Engineers IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Hy-Tech Engineers IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Hy-Tech Engineers Limited

Hy-Tech Engineers Ltd., incorporated in 1978, is a leading manufacturer of hydraulic fittings such as DIN-Metric fittings, conversion adaptors, JIC fittings, O-ring face-seal fittings, mesh fittings, and soft-seal fittings. Operating from four advanced manufacturing facilities in Thane, Pune (Shirwal), Nashik, and Pithampur, the company offers a vast catalog of over 3,500 products with more than 10,000 fitting varieties. Following a B2B model, it caters to domestic and international markets through direct engagement with OEMs, industrial customers, and a strong distributor network.

Hy-Tech Engineers Limited IPO Overview

Hy-Tech Engineers Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 4, 2025, to raise funds through an Initial Public Offering (IPO). The IPO will be a Book Build Issue, comprising a fresh issue of ₹70 crore along with an offer for sale of up to 1.19 crore equity shares. The equity shares are proposed to be listed on both NSE and BSE. New Berry Capitals Pvt. Ltd. is acting as the book-running lead manager, while Bigshare Services Pvt. Ltd. has been appointed as the registrar.

Details such as IPO dates, price band, and lot size are yet to be disclosed, and investors can refer to the DRHP for more information. The issue consists of fresh capital and an offer for sale, with a face value of ₹5 per share. Post listing, the shares will trade on NSE and BSE under a bookbuilding mechanism. Before the issue, Hy-Tech Engineers has a shareholding of 8,35,31,840 equity shares. The company’s promoters are Hemant Tukaram Mondkar, Surekha Hemant Mondkar, and Ashwin Hemant Mondkar, holding 97.99% stake pre-issue, which will reduce following the IPO.

Hy-Tech Engineers Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹70 crore |

| Offer for Sale (OFS) | ₹1.19 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

Hy-Tech Engineers IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Hy-Tech Engineers Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Hy-Tech Engineers Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹2.35 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 19.38% |

| Net Asset Value (NAV) | ₹12.12 |

| Return on Equity (RoE) | 21.39% |

| Return on Capital Employed (RoCE) | 20.46% |

| EBITDA Margin | 22.18% |

| PAT Margin | 11.77% |

| Debt to Equity Ratio | 0.69 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirement of the Company towards procurement of machinery and equipment for expansion at Kavathe Unit, Shirwal Unit and procurement Pithampur Unit-I | 319.86 |

| Prepayment or repayment, in full or in part, of certain outstanding borrowings availed by the Company | 180.00 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

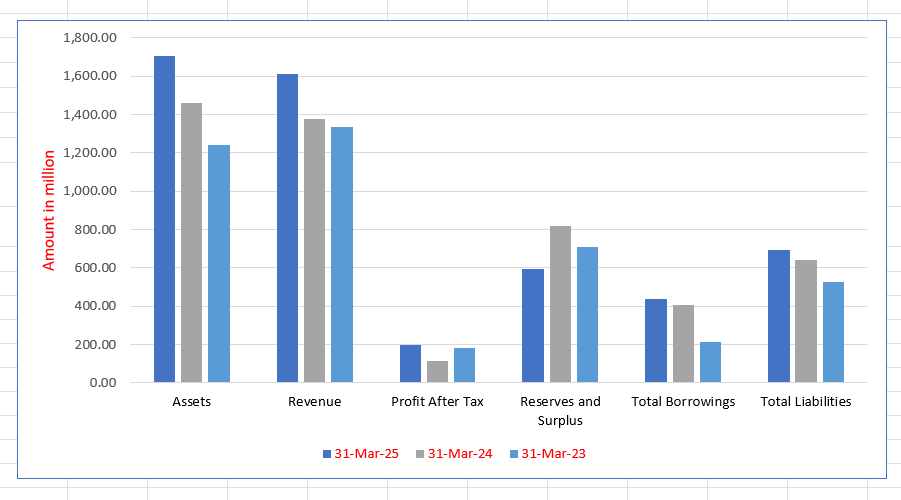

Hy-Tech Engineers Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,706.47 | 1,462.38 | 1,239.38 |

| Revenue | 1,613.82 | 1,377.08 | 1,333.36 |

| Profit After Tax | 196.19 | 115.96 | 180.02 |

| Reserves and Surplus | 594.85 | 818.43 | 709.30 |

| Total Borrowings | 435.25 | 408.38 | 212.06 |

| Total Liabilities | 693.96 | 640.22 | 526.88 |

Financial Status of Hy-Tech Engineers Limited

SWOT Analysis of Hy-Tech Engineers IPO

Strength and Opportunities

- Broad product portfolio across DIN, JIC, O-ring, conversion and custom fittings

- Multiple modern manufacturing facilities (Thane, Pune, Nashik, Pithampur) enable scale and redundancy

- Certifications such as IATF 16949 & ISO 14001 bolster credibility in quality & sustainability

- Export and global market reach offer growth and diversification

- Rising demand in sectors like construction, agriculture, automation offer market tailwinds

- Opportunity to expand into adjacent hydraulic components or systems

- Use of IPO proceeds can fund R&D, capacity expansion, modernization

- Strategic partnerships, alliances or acquisitions can accelerate growth

- Growing focus on “Make in India” and import substitution supports domestic demand

Risks and Threats

- High promoter shareholding pre-IPO constrains public float and liquidity

- Revenue dependence on OEM/B2B clients leads to demand vulnerability

- Moderate size vs global peers limits ability to compete at scale

- Margins susceptible to commodity and input cost volatility

- Currency fluctuations and regulatory exposure in foreign markets

- Working capital pressure from inventory and receivables in B2B operations

- Intense competition in hydraulic fittings sector could erode pricing power

- Threat of substitute materials or emerging manufacturing methods

- Macro-economic downturns or slowdown in industrial capex may hurt orders

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Hy-Tech Engineers Limited

Hy-Tech Engineers Limited IPO Strengths

Integrated Product Development and Operations

Hy-Tech Engineers Limited possesses robust, integrated capabilities, encompassing in-house die-designing, forging, heat treatment, machining, plating, and testing. Backward integration with captive forging at its Nashik Unit ensures quality control, cost efficiency, and reduced reliance on external suppliers. This streamlined process supports a broad, adaptive product portfolio of over 10,000 SKUs, including 5,420 new SKUs developed over the last three fiscal years, catering to both standard and application-specific needs.

Diversified Customer Base and Market Reach

Hy-Tech Engineers Limited leverages a dual-channel approach—direct sales to large OEMs and a distributor network—to serve a wide spectrum of domestic and overseas customers across ten countries. This model grants access to various market segments, mitigates risk by reducing dependence on any single channel or industry vertical (e.g., construction, agriculture, automotive), and is reflected in the growing number of direct customers and the substantial export contribution to total revenue.

Experienced Leadership and Deep Market Credibility

The company benefits from over four decades of industry experience and experienced leadership, including its IIT-educated Promoter, providing strategic vision and technical expertise. This long-standing presence and proven track record of consistently satisfying OEM qualification standards have fostered enduring customer relationships and high customer retention (e.g., 95.20% revenue from repeat customers in Fiscal 2025). This market credibility provides revenue visibility and a platform for expansion.

Established Global Presence and Market Access

Hy-Tech Engineers Limited has successfully established an export footprint across ten countries, including the USA and Europe, with sales supported by a broad product portfolio. Its distribution agreement with Hy-Tech USA Inc. strengthens its foothold in North America, Canada, and Brazil. This diverse export experience positions the company to capitalize on the dynamic growth of the global hydraulic fittings market and maintain revenue stability.

Decentralized Cell-Based Manufacturing Model

The company employs a decentralized cell-based manufacturing model where operations are organized into self-contained cells, often aligned with specific customer or product requirements. This structure fosters dedicated oversight, accountability, and ownership of outcomes, enhancing operational agility and cost discipline. This allows Hy-Tech Engineers Limited to flexibly respond to diverse demand scenarios while ensuring consistent standards of quality and reliability in production.

More About Hy-Tech Engineers Limited

Hy-Tech Engineers Limited is an established engineering company with more than four decades of expertise in the design, manufacture, and supply of hydraulic fittings. The company caters to a wide spectrum of industrial applications through a comprehensive portfolio that includes DIN-metric fittings, JIC flared and flareless fittings, O-Ring Face Seal (ORFS) fittings, conversion fittings, and customised solutions.

As of March 31, 2025, Hy-Tech Engineers Limited offers over 10,000 stock keeping units (SKUs), serving industries such as construction machinery, automotive, agriculture, injection moulding, and hydraulic systems. Certifications also enable the company to expand into specialised sectors like railways and defence.

Business Model and Market Reach

Operating under a B2B framework, the company serves both domestic and international markets. Its sales model is dual-channel:

- Direct Engagement: Collaboration with original equipment manufacturers (OEMs) and industrial customers, building long-term relationships through tailored solutions. In Fiscal 2025, the company supplied to 152 direct customers.

- Distribution Network: Authorized distributors in India and overseas maintain inventories, promote products, provide after-sales support, and act as local interfaces. A non-exclusive partner in Europe supports post-sale services and logistics.

International presence extends to markets including the USA, Belgium, Russia, Brazil, Italy, and Saudi Arabia.

Manufacturing Strength

Hy-Tech Engineers Limited operates six strategically located manufacturing facilities:

- Maharashtra: Thane, Shirwal, Kavathe, and Nashik

- Madhya Pradesh: Two units in Pithampur

These facilities collectively provide a large installed capacity and advanced infrastructure. The Nashik unit offers backward integration by forging metal parts for captive use, creating a competitive advantage. Each unit functions independently, ensuring operational flexibility and efficient inventory management.

Leadership

The company is led by Promoter and Managing Director Hemant Tukaram Mondkar, an IIT Bombay alumnus with over forty years of experience in the hydraulic fittings industry. Ashwin Hemant Mondkar, Promoter and Non-Executive Director, contributes significantly to international expansion efforts. Backed by a strong Board of Directors and management team, Hy-Tech Engineers Limited is well-positioned to identify opportunities, execute growth strategies, and meet customer needs.

Global & Indian Growth Snapshot

- The global hydraulic fittings market was valued at around USD 10.23 billion in 2024 and is projected to reach USD 15.87 billion by 2032, implying a CAGR of about 5.5% over 2026–2032.

- Another forecast for hydraulic hose + fittings puts the CAGR around 4.5% (2024–2031).

- The hydraulic fittings & adapters segment (a subset directly relevant to Hy-Tech’s products) is expected to grow at ~4.5% CAGR from 2025 to 2033, and reach ~USD 5.8 billion by 2033.

- In India specifically, the hydraulic fitting market was estimated at ~USD 97.32 million in 2024 and is forecast to grow at a rather aggressive ~13.5% CAGR over the coming years (Asia-Pacific region estimate).

Key Growth Drivers

- Industrial & infrastructure expansion: Urbanization, growing construction & mining, and heavy machinery deployment drive demand for hydraulic systems and components.

- Mechanization & automation: Sectors like agriculture, material handling, and factory automation increasingly rely on hydraulics, spurring higher usage of fittings.

- Demand for customized, high-performance components: OEMs seek precision, durability, leak-free performance, which benefits suppliers who can deliver advanced sealing designs (e.g. O-Ring face seal) and conversion solutions.

- Policy and “Make in India” push: Government impetus on localization, import substitution, and infrastructure development in India can favor domestic engineering suppliers.

- Export opportunity growth: As global OEMs look for alternate sourcing beyond China, Indian players with quality credentials can gain market entry abroad.

Challenges & Risks

- Raw material volatility: Price fluctuations in steel, brass, alloy materials can compress margins.

- Competitive pressure: Global and local players with scale and cost advantages may intensify competition, especially on standard fittings.

- Technological disruption: New sealing technologies, additive manufacturing, or alternative actuation systems (electric/hybrid) may reduce reliance on traditional hydraulic fittings.

- Regulatory, quality, and certification barriers: For sectors like defense or railways, stringent regulatory/quality standards must be met, which raises entry cost.

How Will Hy-Tech Engineers Limited Benefit

- The strong global CAGR of 5% and India’s 13.5% growth rate create a favourable demand environment for Hy-Tech’s DIN, JIC, ORFS, and conversion fittings.

- Infrastructure, construction, and mining expansion in India directly boost requirements for hydraulic components, aligning with the company’s diverse product portfolio.

- Mechanisation in agriculture, factory automation, and material handling generates steady demand for precision, leak-free fittings, strengthening Hy-Tech’s relationships with OEMs.

- Government “Make in India” push and global OEMs seeking alternatives beyond China provide Hy-Tech with opportunities to grow exports and secure localisation-led contracts.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Hy-Tech Engineers Limited

Augmenting Production Capabilities

Hy-Tech Engineers Limited is enhancing its manufacturing capabilities by expanding production at its Shirwal, Kavathe, and Pithampur Unit-I facilities. This will be achieved through installing new, high-precision machinery like CNC equipment and introducing automation. This expansion aims to boost throughput, shorten production cycles, and support long-term growth by significantly increasing hydraulic fittings capacity.

Strategic Sector Diversification

The Company is strategically deepening its penetration into high-growth sectors by entering the defence and railways markets. Hy-Tech Engineers Limited has secured IRIS certification for railway fittings and DRDO approval for defence supplies. This move aims to leverage its quality fittings expertise in specialized, high-reliability applications driven by national modernization and indigenization initiatives.

Product Portfolio Expansion into Valves

Hy-Tech Engineers Limited is evaluating opportunities for diversification into the hydraulic valve segment. This is a logical extension of its current product line, targeting similar end-use industries. Expanding into valves would broaden the product range, strengthen the customer base, and create cross-selling opportunities by leveraging the Company’s existing distribution channels and operational expertise.

Expanding Global and Domestic Distribution

The Company intends to significantly expand its distribution network by increasing the number of domestic and international distributors. This strategy, supported by planned capacity expansion, aims to ensure broader market coverage and improved product accessibility. Hy-Tech Engineers Limited will also implement incentive programs and feedback mechanisms to strengthen relationships and increase market share.

Increasing International Market Presence

Hy-Tech Engineers Limited is focused on increasing international sales, which consistently account for over 25% of revenue. The strategy involves maintaining existing relationships while establishing new ones with direct customers and distributors across new geographies. The Company will invest in localized logistics, support, and targeted marketing to drive growth and capitalize on higher-value export markets.

Operational Efficiency and Cost Optimization

The Company is committed to cost optimization and enhancing operational efficiency through leveraging economies of scale, backward integration, and strategic supplier relationships. Initiatives include installing solar panels and effluent treatment plants to reduce costs and improve sustainability. Hy-Tech Engineers Limited consistently implements process improvements to minimize wastage and strengthen its competitive position.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Hy-Tech Engineers Limited IPO

How can I apply for Hy-Tech Engineers Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of Hy-Tech Engineers IPO?

The IPO comprises a fresh issue of ₹70.00 crore and an Offer for Sale of up to 1.19 crore shares.

On which stock exchanges will Hy-Tech Engineers IPO be listed?

The equity shares are proposed to be listed on the NSE and BSE mainboards.

What is the purpose of the IPO proceeds?

Proceeds will fund capital expenditure, repay certain borrowings, and support general corporate purposes.

What is the face value of Hy-Tech Engineers’ shares?

Each equity share has a face value of ₹5, with the issue price band yet to be announced.

Who are the lead manager and registrar for the IPO?

New Berry Capitals Pvt. Ltd. is the book running lead manager, and Bigshare Services Pvt. Ltd. is the registrar.