- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

ICICI Prudential Asset IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

ICICI Prudential Asset IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

ICICI Prudential Asset Management Company Limited

ICICI Prudential AMC is among India’s largest and oldest asset management companies, with over 30 years of industry experience. As of March 31, 2025, it reported a QAAUM of ₹8,794.1 billion and an advisory asset base of ₹311.3 billion. The company caters to 14.6 million customers through 135 mutual fund schemes across equity, debt, hybrid, FoFs, and other categories. It also provides PMS, AIF, and offshore advisory services, serving both individual and institutional investors, supported by a strong nationwide network of 264 offices.

ICICI Prudential Asset Management Company Limited IPO Overview

ICICI Prudential Asset Management Co. Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 8, 2025, for raising funds through an Initial Public Offer (IPO). The issue is a complete offer for sale of up to 1.77 crore equity shares, with no fresh issue component. The shares will be listed on both NSE and BSE. Citigroup Global Markets India Pvt. Ltd. is the book-running lead manager, while Kfin Technologies Ltd. acts as the registrar. Important details such as IPO dates, price band, and lot size are yet to be disclosed. The company’s promoters are ICICI Bank Limited and Prudential Corporation Holdings Limited.

ICICI Prudential Asset Management Company Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.77 crore shares |

| Fresh Issue | NA |

| Offer for Sale (OFS) | 1.77 crore shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 17,65,20,900 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

ICICI Prudential Asset Management Company Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

ICICI Prudential Asset Management Company Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹150.2 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 82.8% |

| Net Asset Value (NAV) | ₹199.2 |

| Return on Equity (RoE) | 82.8% |

| Return on Capital Employed (RoCE) | 85.50% |

| EBITDA Margin | 0.36% |

| PAT Margin | 53.25% |

| Debt to Equity Ratio | 0.25 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

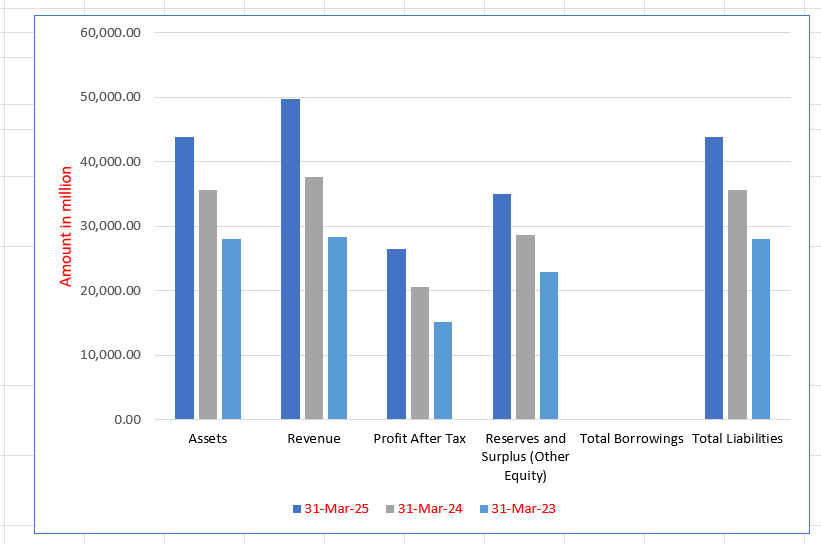

ICICI Prudential Asset Management Company Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 43,836.8 | 35,540.9 | 28,047.6 |

| Revenue | 49,796.7 | 37,612.1 | 28,381.8 |

| Profit After Tax | 26,506.6 | 20,497.3 | 15,157.8 |

| Reserves and Surplus (Other Equity) | 34,992.9 | 28,651.9 | 22,954.1 |

| Total Borrowings | – | – | – |

| Total Liabilities | 43,836.8 | 35,540.9 | 28,047.6 |

Financial Status of ICICI Prudential Asset Management Company Limited

SWOT Analysis of ICICI Prudential Asset IPO

Strength and Opportunities

- Strong joint-venture heritage and brand credibility from ICICI Bank and Prudential Plc.

- One of India's largest and oldest AMCs, founded in 1993

- Diversified offerings including mutual funds, PMS, real estate, and international advisory.

- Broad product suite—equity, debt, hybrid, FoFs, PMS, AIF, and advisory services.

- Pan-India reach with a strong distribution network across states and union territories.

- Opportunity to deepen penetration in semi-urban and rural markets amid rising financial inclusion.

- Growing trend of retail financialization supports mutual fund adoption.

- Scope to scale advisory, PMS, and offshore mandates as wealth management grows.

- Strong digital presence and investor education initiatives to tap first-time investors.

Risks and Threats

- Highly sensitive to market volatility, affecting AUM and revenue.

- Intense competition from SBI, UTI, HDFC, and other AMCs

- Fee compression due to regulatory caps and peer pressure.

- Regulatory risks—policy, tax, and compliance changes could impact margins.

- Reliance on equity markets for flows; downturns reduce investor interest.

- Reputation risk from underperforming schemes or compliance lapses.

- Increasing operational complexity across diverse product lines.

- Macroeconomic shocks or geopolitical tensions may disrupt investment activity.

- Risk of cybersecurity threats and technology disruptions.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About ICICI Prudential Asset Management Company Limited

ICICI Prudential Asset Management Company Limited IPO Strengths

Dominant Market Leadership

ICICI Prudential Asset Management Company Limited is a leader in the Indian asset management industry. It manages the largest assets in active mutual funds and equity schemes, holding a 13.3% and 13.4% market share, respectively. The company also leads in domestic non-corporate discretionary portfolio management services, solidifying its dominant position.

Extensive Investor Base

The company has India’s largest individual investor base in mutual fund assets under management. As of March 31, 2025, individual investors comprised 62.2% of its total mutual fund assets and 86.4% of its equity and equity-oriented schemes, demonstrating a robust and loyal customer base that contributes to stable, long-term assets.

Diversified Product Offerings

The company maintains a well-diversified product suite, managing 135 mutual fund schemes—the largest number in India. This diverse portfolio includes equity, debt, ETFs, and alternate investments like PMS and AIFs, enabling the company to cater to a wide range of customer needs and adapt to various market conditions.

Pan-India Distribution Network

ICICI Prudential has established a broad, multi-channel distribution network across India. Its network includes 264 offices, over 106,000 distributors, 209 national distributors, and 64 banks. The company also leverages digital platforms and the extensive branch network of its parent company, ICICI Bank, to reach a vast customer base.

Profitable Financial Performance

ICICI Prudential is a highly profitable asset management company, leading the industry in operating profit before tax for the Financial Year 2024 with a 21.2% market share. Its capital-efficient business model is reflected in a high return on equity of 82.8% for the financial year 2025, supported by consistent growth in assets and revenue.

Trusted Brand and Strong Culture

The company benefits from a well-established and trusted brand, bolstered by its strong parentage from ICICI Bank and Prudential. This reputation, combined with a culture of customer-centricity, innovation, and strong risk management, has helped it build investor trust and achieve its leading market position.

Experienced Management

ICICI Prudential is managed by a highly experienced and stable leadership and investment team. Senior managers and key personnel have been with the company for an average of 11 years, bringing extensive industry knowledge. The investment and research teams also have significant experience, ensuring a disciplined and professional approach to fund management.

More About ICICI Prudential Asset Management Company Limited

ICICI Prudential Asset Management Company Limited (ICICI Prudential AMC) is among the oldest and most trusted asset management companies in India, with over 30 years of industry presence. As of March 31, 2025, it ranked as the largest AMC in India by active mutual fund QAAUM, holding a 13.3% market share (Source: CRISIL Report). The company’s total mutual fund QAAUM stood at ₹8,794.1 billion, reflecting strong growth momentum.

- Equity & Equity-Oriented Schemes: Market share of 13.4%, the highest among AMCs in India.

- Equity-Oriented Hybrid Schemes: Market share of 25.3%, the largest in the industry.

- Individual Investors: MAAUM of ₹5,658.2 billion, representing the highest retail and HNI share at 13.8%.

Alternate Business

Beyond mutual funds, ICICI Prudential AMC has developed a strong alternates platform, comprising:

- Portfolio Management Services (PMS)

- Alternative Investment Funds (AIFs)

- Advisory Services to offshore clients

As of March 31, 2025, the company managed:

- ₹182.8 billion in discretionary PMS AUM

- ₹638.7 billion in alternates QAAUM

- ₹311.3 billion in advisory assets, including services to Eastspring Investments (Prudential plc’s asset management arm).

Profitability & Scale

ICICI Prudential AMC is also the most profitable AMC in India, with a 21.2% share of operating profit before tax in FY24. Its equity-heavy product mix contributes significantly to margins, with Equity and Equity-Oriented Schemes accounting for 55.5% of total QAAUM.

- Customer Base: 14.6 million investors across India.

- Distribution: 264 offices, 106,475 distributors, 209 national distributors, and 64 banks.

- Technology: Digital-first approach with 2.1 million app downloads, 93.6% digital purchase transactions, and strong social media presence.

Investment Products

The company manages 135 mutual fund schemes, including category leaders such as:

- ICICI Prudential Large Cap Fund

- ICICI Prudential Multi Asset Fund

- ICICI Prudential India Opportunities Fund

- ICICI Prudential Value Fund

- ICICI Prudential Asset Allocator Fund

Promoter Strength

Since 1998, ICICI Prudential AMC has operated as a joint venture between ICICI Bank Limited and Prudential Corporation Holdings Limited, combining strong domestic presence with global expertise

Industry Outlook

Market Scale & Growth Prospects

- The Indian asset management market is projected to expand from about USD 2.20 trillion in 2025 to approximately USD 4.52 trillion by 2030, registering a robust CAGR of 15.47%.

- Within this universe, the mutual funds market—valued at around USD 769.6 billion in 2024—is expected to nearly double to USD 1,585 billion by 2030, reflecting a CAGR of 12.8%.

- As of March 2025, industry AUM stood at approximately ₹65.7 trillion (USD 767.5 billion).

Growth Drivers

- Retail investor surge: Mutual fund folios have crossed 24 crore and AAUM is nearing ₹75 lakh crore (₹75 trillion) as of June 2025. This underscores increasing structured wealth creation via mutual funds.

- SIP momentum and financial inclusion: Monthly SIP inflows have surged, with financial discipline and rupee-cost averaging driving growth. Multi-fold increases in folios reflect deepening penetration.

- Digital transformation: Adoption of e-KYC, digital onboarding, and online platforms is reducing entry barriers, especially across smaller towns.

- Emergence of alternates: Private clients and institutional demand are fuelling PMS and AIF growth, with these segments expected to grow faster (alternatives projected at 16.85% CAGR).

- Policy and regulatory clarity: SEBI and IFSCA frameworks, along with GIFT City initiatives, are bolstering cross-border activity and tokenization pilots.

Product-Level Growth & Trends

Mutual Funds (Equity, Hybrid, ETFs, FoFs)

- Equity and hybrid schemes dominate, comprising 60–60% of total AUM, indicating investor preference for growth-linked and balanced products.

- ETFs and FoFs are the fastest growing segments within mutual funds, gaining traction due to low costs and thematic appeal.

PMS, AIFs & Advisory (Alternates)

- The PMS industry is entering a critical inflection point, propelled by investor sophistication, technological innovation, and stronger regulation.

- APMI targets reaching ₹25 lakh crore (~USD 300 billion) AUM in discretionary PMS within five years—an ambitious but telling growth signal.

- Currently, 70% of PMS capital is managed by non-institutional/alternative managers, highlighting a democratization trend in advisory

How Will ICICI Prudential Asset Management Company Limited Benefit

- A growing retail investor base and surge in SIP inflows will strengthen ICICI AMC’s recurring revenue streams.

- Rising demand for equity, hybrid, ETFs, and FoFs aligns with the firm’s wide product portfolio, ensuring scale and market share gains.

- Expansion in alternates (PMS, AIFs, advisory) offers new fee-generating avenues, supported by investor sophistication and institutional flows.

- Digital onboarding, e-KYC, and FinTech partnerships will lower acquisition costs and deepen penetration into tier-2 and tier-3 cities.

- Supportive SEBI and IFSCA frameworks enhance ICICI AMC’s ability to attract domestic and global investors.

- Strong brand equity and distribution reach position it to outpace industry growth and capture incremental assets.

Peer Group Comparison

| Name of the Company | Revenue

(₹ in million) |

Face value (₹) | EPS (₹) Basic | RoNW | NAV (₹) | P/E |

| ICICI | 49,773.3 | 1.0 | 150.2 | 82.8% | 199.2 | [●] |

| Peer Groups | ||||||

| HDFC Asset Management Company Limited | 34,984.4 | 5.0 | 115.2 | 32.4% | 380.3 | 43.9 |

| Nippon Life India Asset Management Limited | 22,306.9 | 10.0 | 20.3 | 31.4% | 66.4 | 39.4 |

| UTI Asset Management Company Limited | 18,510.9 | 10.0 | 57.4 | 16.3% | 359.4 | 22.6 |

| Aditya Birla Sun Life AMC Limited | 16,847.8 | 5.0 | 32.3 | 27.0% | 129.2 | 25.0 |

Key Strategies for ICICI Prudential Asset Management Company Limited

Focus on Risk-Calibrated Investment Performance

ICICI Prudential Asset Management Company Limited emphasises delivering consistent outperformance over the medium to long term. By leveraging disciplined processes, proprietary research, and robust risk frameworks, it aims to generate superior risk-adjusted returns while safeguarding investor interests, ensuring prudent portfolio management, and maintaining alignment with scheme mandates.

Expand Customer Base and Strengthen Distribution

The company is committed to expanding its customer base through deeper market penetration, stronger distributor relationships, and enhanced direct-to-consumer channels. Leveraging ICICI Bank’s branch network, digital platforms, and international expansions, it seeks to broaden reach, improve investor engagement, and drive sustained growth in both domestic and overseas markets.

Grow the Alternates Business

ICICI Prudential Asset Management Company Limited aims to scale its Alternates business through organic and inorganic opportunities. With leadership in discretionary PMS, it plans to integrate new funds, expand bespoke investment solutions across private credit and real estate, and strengthen high-net-worth client offerings, ensuring long-term leadership.

Diversify Product Portfolio for Customer Needs

The company remains focused on broadening its mutual fund portfolio in line with evolving investor preferences and regulatory changes. By prioritising systematic transactions, launching innovative products like the ICICI Prudential Quality Fund, and enhancing engagement with affluent investors, it ensures adaptability, relevance, and long-term value creation.

Leverage Technology and Digital Capabilities

ICICI Prudential Asset Management Company Limited continues investing in digital platforms, cloud-based systems, and advanced analytics to strengthen customer acquisition and retention. Collaborating with fintechs and digital distributors, it delivers personalised experiences, seamless transactions, and innovative solutions designed to reach younger, tech-savvy investors and enhance engagement.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On ICICI Prudential Asset

How can I apply for ICICI Prudential Asset Management Company Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue type of ICICI Prudential AMC IPO?

It is a book-built issue, consisting entirely of an offer for sale.

Who are the promoters of ICICI Prudential AMC?

The company’s promoters are ICICI Bank Limited and Prudential Corporation Holdings Limited.

Will the company receive proceeds from the IPO?

No, all proceeds will go to the selling shareholders only.

Where will ICICI Prudential AMC IPO shares be listed?

Where will ICICI Prudential AMC IPO shares be listed?

What is the total issue size of ICICI Prudential AMC IPO?

The IPO consists of 1.77 crore equity shares, aggregating up to ₹[.] crore.