- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Indo-MIM IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Indo-MIM IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Indo-MIM Limited

Founded in 1996, Indo-MIM is a global leader in precision engineering components using metal injection molding (MIM) technology. It offers complete solutions from mold design to assembly, along with advanced methods like investment casting, precision machining, ceramic injection molding, and 3D metal printing. Serving industries such as automotive, defence, medical, consumer, and aerospace, Indo-MIM produced over 6,400 products in FY 2025. With 15 facilities across India, the US, the UK, and Mexico, it holds the world’s largest installed MIM capacity.

Indo-MIM Limited IPO Overview

Indo-MIM Ltd. has submitted its Draft Red Herring Prospectus (DRHP) to SEBI on September 26, 2025, to raise funds through an Initial Public Offering (IPO). The proposed Indo-MIM IPO will follow the book-building route and comprises a fresh issue worth ₹100.00 crore along with an offer for sale (OFS) of up to 12.97 crore equity shares. The company’s equity shares are planned to be listed on both the NSE and BSE. HDFC Bank Ltd. will serve as the book-running lead manager, while MUFG Intime India Pvt. Ltd. will act as the registrar for the issue. Key information such as the IPO opening and closing dates, price band, and lot size are yet to be announced. Investors are advised to refer to the Indo-MIM IPO DRHP for comprehensive details.

As per the DRHP, the IPO will have a face value of ₹1 per share, and the issue type will be a Book Building IPO. It will include a fresh issue aggregating up to ₹100.00 crore and an offer for sale of 12,96,74,393 equity shares of ₹1 each. The equity shares will be listed on both BSE and NSE, with a pre-issue shareholding of 48,20,30,772 shares.

Indo-MIM Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹100 crore |

| Offer for Sale (OFS) | 12.97 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 48,20,30,772 shares |

| Shareholding post-issue | TBA |

Indo-MIM IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Indo-MIM Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Indo-MIM Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹8.79 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 19.94% |

| Net Asset Value (NAV) | ₹45.63 |

| Return on Equity (RoE) | 19.94% |

| Return on Capital Employed (RoCE) | 23.51% |

| EBITDA Margin | 28.01% |

| PAT Margin | 12.73% |

| Debt to Equity Ratio | 0.57 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in full or part, of all or certain outstanding borrowings availed by our Company | 7200 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Indo-MIM Limited Financials (in million)

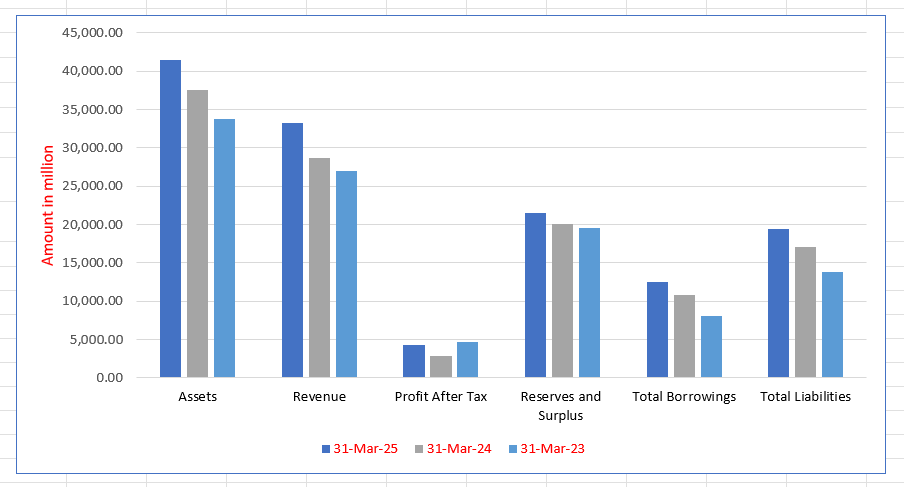

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 41,408.41 | 37,575.13 | 33,804.46 |

| Revenue | 33,295.77 | 28,703.95 | 26,927.61 |

| Profit After Tax | 4,237.34 | 2,837.34 | 4,626.93 |

| Reserves and Surplus | 21,512.31 | 20,023.08 | 19,515.74 |

| Total Borrowings | 12,471.95 | 10,850.12 | 8,079.08 |

| Total Liabilities | 19,414.07 | 17,070.02 | 13,808.83 |

Financial Status of Indo-MIM Limited

SWOT Analysis of Indo-MIM IPO

Strength and Opportunities

- Strong global manufacturing footprint with facilities in India, the US, the UK, and Mexico.

- Leadership in metal injection moulding (MIM) with the world’s largest installed capacity.

- Diverse customer base across automotive, defence, medical, consumer, and aerospace sectors.

- Fully integrated production process from design and tooling to finishing and assembly.

- Growing global demand for MIM components presents significant expansion opportunities.

- Continuous innovation through advanced manufacturing technologies such as 3D metal printing.

- Strong R&D capabilities enabling customisation and precision engineering.

- Established global customer relationships in over 45 countries.

- Robust financial performance providing investment flexibility for future growth.

Risks and Threats

- Heavy dependency on export markets and exposure to currency fluctuations.

- High capital costs and complexity associated with MIM tooling and operations.

- Intense competition from alternative technologies like additive manufacturing and precision machining.

- Limited geographic and product diversification compared to global peers.

- Fluctuating raw material prices and supply chain disruptions may affect profitability.

- Compliance with environmental and defence regulations adds operational burden.

- Rising labour costs and workforce management challenges in multiple geographies.

- Technological disruption risk from next-generation materials and manufacturing methods.

- Dependence on key clients or industries may create concentration risks.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Indo-MIM Limited

Indo-MIM Limited IPO Strengths

Global Market Leadership in MIM Components

Indo-MIM Limited holds the global lead in manufacturing precision engineering components using Metal Injection Molding (MIM) technology, commanding a 7% market share by revenue in Fiscal 2025. The company has maintained this position for five years, offering comprehensive, end-to-end solutions to customers, supported by expertise in mold design, tooling, material selection, and rapid new product introductions.

Strategic Customer Relationships with Global OEMs

The company maintains long-standing relationships with a diverse base of Indian and global OEMs, fostering partnerships through collaborative problem-solving. This approach ensures Indo-MIM is a preferred value chain partner, demonstrated by customer loyalty: repeat customers contributed over 90% of revenue in the last three fiscals, reinforcing high quality and reliability.

Diversified Product Portfolio Across Key Industries

Indo-MIM serves a wide range of end-use industries, including automotive, defense, medical devices, consumer goods, and aerospace, by offering a diverse product portfolio. In Fiscal 2025, the company supplied over 1,950 types of products to the defense industry alone. This strategic diversification mitigates industry-specific risk and provides stable revenue streams.

Backward Integrated, Dual-Shore Manufacturing Model

Operating 15 manufacturing facilities across India, the US, the UK, and Mexico allows Indo-MIM to offer cost and logistical advantages while serving global and domestic OEMs. The company has a vertically integrated set-up, including in-house secondary and finishing processes, and is pursuing further backward integration, such as iron powder production, for enhanced efficiency and control.

Export-Driven Revenue and Extensive Global Reach

Indo-MIM is a highly export-focused player, generating nearly 90% of its revenue from outside India. The company supplied components to customers in over 50 countries globally in the last three fiscals. Its extensive reach is supported by a dedicated global sales team and offices across North America, Europe, and Asia.

Experienced Leadership and Robust Financial Performance

The company is led by Promoters with over two decades of MIM industry experience, supported by a large employee base that includes 817 engineers and technicians. This leadership has driven a track record of robust financial growth, with revenues increasing to $33,295.77$ million in Fiscal 2025, while maintaining strong profitability and an efficient debt-to-equity ratio.

More About Indo-MIM Limited

Indo-MIM Limited is a world leader in manufacturing precision engineering components using advanced Metal Injection Molding (MIM) technology. With over 25 years of expertise, the company provides end-to-end solutions, including mold design, tooling, finishing, and assembly. Holding a global market share of 7% in MIM revenue (F&S Report, FY 2025), Indo-MIM has maintained this leadership position for five consecutive years.

Technological Excellence

Beyond MIM, Indo-MIM integrates multiple advanced manufacturing technologies such as:

- Investment Casting

- Precision Machining

- Ceramic Injection Molding

- 3D Metal Printing

These technologies enhance production flexibility and enable the company to cater to diverse industry requirements with superior precision and quality.

Diverse Product Portfolio

Indo-MIM serves multiple industries through its five specialised product groups:

- Automotive: Components for vehicle safety, fuel systems, interiors, and powertrains.

- Defence: Firearm parts like triggers, hammers, and sights.

- Medical: Surgical device components for endoscopy, laparoscopy, and orthopaedics.

- Consumer: Fashion accessories, tools, and mobile components.

- Aerospace: Manifolds, housings, nozzles, and brackets for OEMs.

Global Manufacturing and Reach

As of March 2025, Indo-MIM operates 15 manufacturing facilities — six in India, six in the United States, two in the UK, and one in Mexico. This dual-shore manufacturing model allows efficient service to both Indian and international clients, offering supply chain reliability and scalability.

Global Sales Network

The company has sales offices in China, Germany, and the US, supported by representatives in ten other countries, serving over 1,000 customers across 45 nations. Nearly 90% of its revenue in recent fiscals came from exports.

Sustained Relationships and Recognition

Indo-MIM’s long-term relationships with global OEMs have resulted in a high repeat order rate, reflecting customer trust and consistent performance. The company has also earned industry accolades, including the ‘Award of Distinction’ by the Metal Powder Industries Federation and the ‘Raksha Niryat Ratna’ by the Government of India.

Industry Outlook

The Indian precision engineering market, which includes high-precision components across automotive, aerospace, medical, and consumer sectors, was valued at approximately USD 500 million in 2024. It is projected to grow at a CAGR of around 7.2% between 2025 and 2033, reaching about USD 930 million by 2033.

Meanwhile, the Indian manufacturing sector overall is expected to expand from about USD 0.90 trillion in 2024 to approximately USD 2.24 trillion by 2035, reflecting a strong CAGR of 8.6%.

Market for Metal Injection Moulding (MIM) & Related Technologies

The Indian Metal Injection Moulding (MIM) market presents strong growth potential.

- Valued at USD 210 million in 2025, it is expected to reach USD 319 million by 2031, registering a CAGR of nearly 7.1%.

- Globally, the MIM market was estimated at about USD 4.86 billion in 2024, projected to reach USD 11.08 billion by 2034 (CAGR around 8.6%).

- Major growth drivers include rising demand for complex, high-precision components in automotive, medical, electronics, and defence sectors, along with material efficiency and automation advantages.

Growth Drivers & Key Product Segments

- Automotive: Demand driven by electric vehicle growth, safety systems, fuel-efficient powertrains, and lightweight metal components.

- Medical & Defence: Increased need for miniaturised surgical tools and firearm components due to MIM’s precision and cost efficiency.

- Aerospace & Consumer: High-complexity parts like manifolds, nozzles, and accessories support the aerospace and premium consumer segments.

- Government initiatives such as Make in India, defence indigenisation, and export-led policies enhance manufacturing competitiveness.

Outlook Summary

Overall, the Indian precision engineering and MIM sectors are poised for steady growth. Favourable government policies, rising end-use demand, and the push for high-precision, lightweight components are creating a strong foundation for companies in this space. Firms offering end-to-end advanced manufacturing solutions across automotive, medical, defence, and aerospace industries are expected to lead this expansion both domestically and globally.

How Will Indo-MIM Limited Benefit

- Indo-MIM Limited will benefit directly from the expanding Indian MIM market, which is projected to grow at a CAGR of 7.1% through 2031, driven by precision manufacturing demand.

- The company’s strong presence in automotive, medical, aerospace, and defence aligns perfectly with the fastest-growing end-use sectors.

- Its expertise in Metal Injection Moulding, Investment Casting, and 3D Metal Printing positions it to meet the rising demand for lightweight, high-performance components.

- The global MIM market expansion will enhance Indo-MIM’s export opportunities, strengthening its global footprint and revenue diversification.

- Indo-MIM’s dual-shore manufacturing and global sales network ensure scalability and supply reliability amid growing international demand.

- Government initiatives such as Make in India and defence localisation will further boost domestic orders.

- Its innovation-driven approach and long-term OEM relationships will allow Indo-MIM to capture a larger share of high-value, precision-engineered component contracts worldwide.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Indo-MIM Limited

Expand Customer Base and Increase Wallet Share

Indo-MIM plans to expand its customer base and deepen existing relationships, leveraging its track record of repeat orders for organic growth. The company will actively manage key accounts and collaborate with OEMs early in development to increase its business share and capitalize on the industry trend of supplier consolidation.

Leverage Diversified Technologies for Portfolio Growth

The company will utilize its technological expertise in MIM, ceramic injection molding, investment casting, and 3D printing to expand its product portfolio. This diversification is focused on seizing opportunities in high-growth sectors like defense and medical, with an early adoption strategy for advanced technologies like the Desktop Metal Production System.

Strengthen Technological and Engineering Leadership

Indo-MIM is committed to strengthening its competitive position through innovation and R&D. Future plans include developing new MIM materials, exploring 2K MIM technology for multi-material components, and utilizing sacrificial plastic in molds. This focus aims to expand material options and enhance manufacturing flexibility for customers.

Continuous Improvement in Operational Efficiencies

The strategy involves reducing operating costs and achieving economies of scale by increasing capacity utilization and efficiency. Indo-MIM is actively implementing Industry 4.0 technologies, including 476 IoT-enabled machines and 431 robots, to optimize production, improve manpower productivity, and ensure consistent quality components.

Augment Growth via Global and M&A Expansion

Indo-MIM plans to grow its global footprint, capitalizing on exports which comprise nearly 90% of revenue. The company will pursue selective, disciplined acquisitions—potentially a European MIM manufacturer—to gain access to better infrastructure, new technologies, and a broader geographical reach, thereby strengthening its competitive market position.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Indo-MIM Limited IPO

How can I apply for Indo-MIM Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Indo-MIM Limited’s IPO about?

Indo-MIM Limited plans to raise ₹100 crore through a fresh issue and an offer for sale of 12.97 crore shares.

On which stock exchanges will Indo-MIM shares be listed?On which stock exchanges will Indo-MIM shares be listed?

The company’s equity shares are proposed to be listed on both the NSE and BSE.

What is the primary objective of the Indo-MIM IPO?

The proceeds will be used mainly for debt repayment and general corporate purposes to strengthen financial stability.

Who are the promoters of Indo-MIM Limited?

The promoters include Green Meadows Investments Ltd., Krishna Chivukula, Krishna Chivukula Jr., Raj Chivukula, and Jagadamba Chandrasekhar.

Who is managing the Indo-MIM IPO?

HDFC Bank Ltd. is the book running lead manager, while MUFG Intime India Pvt. Ltd. is the registrar for the issue.