- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Indogulf Cropsciences IPO

₹14,175/135 shares

Minimum Investment

IPO Details

26 Jun 25

30 Jun 25

₹14,175

135

₹105 to ₹111

NSE, BSE

₹200 Cr

03 Jul 25

Indogulf Cropsciences IPO Timeline

Bidding Start

26 Jun 25

Bidding Ends

30 Jun 25

Allotment Finalisation

01 Jul 25

Refund Initiation

02 Jul 25

Demat Transfer

02 Jul 25

Listing

03 Jul 25

Indogulf Cropsciences Limited

Indogulf Cropsciences Ltd is a prominent player in the manufacturing of crop protection products, plant nutrients, and biologicals in India. Established in 1993, Indogulf operates through three business verticals: crop protection, plant nutrients, and biologicals. The company serves retail and institutional customers, offering a diverse range of formulations such as water-dispersible granules (WDG), suspension concentrates (SC), capsule suspensions (CS), and more in various forms like powders, granules, and liquids. Its products aim to enhance crop yield while fostering sustainable agricultural practices and environmental care.

Indogulf Cropsciences Limited IPO Overview

The IndogulfCropsciences IPO is a book-built issue amounting to ₹200 crore. This offering includes a fresh issue of 1.44 crore equity shares aggregating to ₹160 crore, along with an offer for sale (OFS) of 0.36 crore shares totalling ₹40 crore.

The IPO opens for subscription on 26 June 2025 and will close on 30 June 2025. The basis of allotment is likely to be finalised on Tuesday, 1 July 2025, and the company is scheduled to be listed on both the BSE and NSE, with the tentative listing date set for Thursday, 3 July 2025.

The price band for the issue has been fixed between ₹105 and ₹111 per share. The minimum lot size for retail investors is 135 shares, requiring a minimum investment of ₹14,175. However, it is advisable for retail applicants to bid at the cut-off price, which amounts to ₹14,985, in order to avoid the risk of rejection in case of oversubscription.

For small non-institutional investors (sNIIs), the minimum application size is 14 lots (or 1,890 shares), which translates to an investment of ₹2,09,790. For big non-institutional investors (bNIIs), the minimum bid is 67 lots (9,045 shares), amounting to ₹10,03,995. Systematix Corporate Services Limited is acting as the book-running lead manager for the IPO, while Bigshare Services Pvt Ltd has been appointed as the registrar to the issue.

Indogulf Cropsciences Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Total Issue: 1,80,18,017 shares (aggregating up to ₹200.00 Cr), of which,

Fresh Issue: 1,44,14,414 shares (aggregating up to ₹160.00 Cr) |

| Offer for Sale: 36,03,603 shares of ₹10 (aggregating up to ₹40.00 Cr) | |

| IPO Dates | 26 June 2025 to 30 June 2025 |

| Price Bands | ₹105 to ₹111 |

| Lot Size | 135 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,87,87,456 shares |

| Shareholding post -issue | 6,32,01,870 shares |

Indogulf Cropsciences IPO Important Dates

| IPO Activity | Date |

| IPO Open Date | 26 June 2025 |

| IPO Close Date | 30 June 2025 |

| Basis of Allotment Date | 1 July 2025 |

| Refunds Initiation | 2 July 2025 |

| Credit of Shares to Demat | 2 July 2025 |

| IPO Listing Date | 3 July 2025 |

Indogulf Cropsciences IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 13 | ₹14,985 |

| Retail (Max) | 13 | 1755 | ₹1,94,805 |

| S-HNI (Min) | 14 | 1890 | ₹2,09,790 |

| S-HNI (Max) | 66 | 8910 | ₹9,89,010 |

| B-HNI (Min) | 67 | 9045 | ₹10,03,995 |

Indogulf Cropsciences Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 12 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 12.19% |

| Net Asset Value (NAV) | 97.98 |

| Return on Equity | 12.2% |

| Return on Capital Employed (ROCE) | 11.93% |

| EBITDA Margin | 10.09% |

| PAT Margin | 5.11% |

| Debt to Equity Ratio | 0.67 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Working capital requirements | 1,000 |

| Repayment/ Pre-payment, in part or full of certain borrowings | 400 |

| Capital expenditure for setting up a new sulphur plant | 140 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

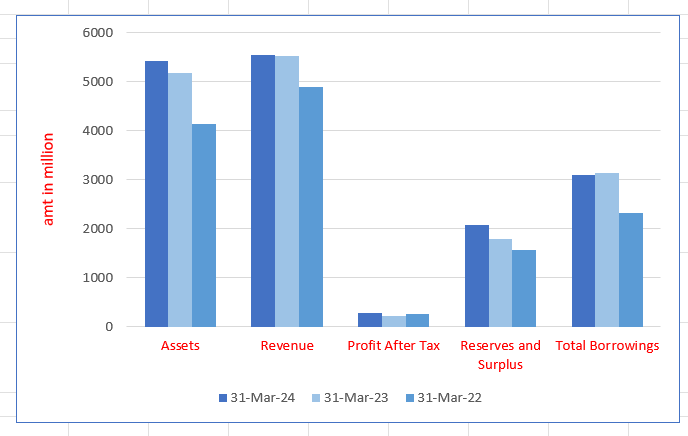

Indogulf Cropsciences Limited IPO Financials (in millions)

| Particulars | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 5422.49 | 5175.10 | 4135.91 |

| Revenue | 5557.87 | 5521.89 | 4902.30 |

| Profit After Tax | 282.33 | 224.23 | 263.63 |

| Reserves and Surplus | 2080.07 | 1796.04 | 1568.69 |

| Total Borrowings | 3105.98 | 3142.62 | 2330.78 |

| Total Liabilities | 1545.62 | 1892.18 | 1013.78 |

Financial Status of Indogulf Cropsciences Limited

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Indogulf Cropsciences Limited IPO

Indogulf Cropsciences Limited, established in 1993, has earned a prominent position in the agrochemical industry in India. The company primarily focuses on manufacturing crop protection products, plant nutrients, and biologicals, with a robust portfolio aimed at enhancing crop yields and promoting sustainable agricultural practices.

The company began producing Spiromesifen technical in 2019 with a purity of 96.5% and was one of the first indigenous manufacturers of Pyrazosulfuron Ethyl technical in 2018 with a purity of 97%. As a growing exporter, Indogulf Cropsciences exports its products to over 34 countries, earning recognition as a ‘Two Star Export House’ by the Government of India.

Business Verticals

- Crop Protection

- Crop protection is a core vertical, focusing on safeguarding crops from pests, diseases, and weeds, ensuring optimal growth and productivity.

- Key products include insecticides, fungicides, herbicides, and plant growth regulators.

- Notable formulations:

- Lambda Cyhalothrin 5% EC (brand: Farrate)

- Emamectin Benzoate 5% SG (brand: Dominator)

- Glyphosate 41% SL (brand: Bound Off)

- Biologicals

- Biologicals aim to provide sustainable crop management solutions. These products help combat pests, diseases, and environmental stresses, enhancing nutrient efficiency and soil health.

- Products include bio-simulants such as seaweed (brand: Breeza), humate (brand: Apache), and mycorrhiza (brand: Root-o-Max Gold).

- Plant Nutrients

- This vertical focuses on enhancing soil fertility, promoting root development, and boosting crop yields. The company manufactures a range of straight fertilisers and nutrient deficiency correctors.

- Notable products:

- Picaso Gold

- Zinc Super Gold

- Jagromin-99

Manufacturing and Operations

Indogulf Cropsciences operates four manufacturing facilities across India, located in Jammu and, Kashmir and Haryana. These ISO-certified facilities focus on producing high-quality products in various formulations, such as water-dispersible granules, suspension concentrates, and emulsions.

The company is committed to continuous research and development, having granted three patents since fiscal 2019, with more applications in the pipeline. Its R&D capabilities are supported by a NABL-certified laboratory in Haryana.

Market Presence

With a strong distribution network in India, Indogulf Cropsciences has a presence across 22 states and 3 Union Territories. The company also serves 34 international markets, building long-term relationships with key domestic and global brands.

Indogulf Cropsciences continues to grow by adapting to market demands, focusing on sustainable agricultural solutions, and expanding its presence both domestically and internationally.

Industry Outlook

Overview of the Indian Crop Protection, Plant Nutrients, and Biologicals Industry

The Indian agricultural industry is undergoing a transformation driven by the need for increased food production, sustainability, and innovation. In this context, Indogulf’s products, which include crop protection chemicals, plant nutrients, and biologicals, are benefiting from several key drivers of growth, as well as emerging trends that reflect the broader shifts in the Indian agriculture sector.

Overview of the Crop Protection, Plant Nutrients, and Biologicals Industry

The agricultural sector is pivotal to global food security, with crop protection products, plant nutrients, and biologicals playing essential roles in enhancing crop yields and promoting sustainable farming practices.

Crop Protection Products

- Market Size and Growth: India’s crop protection chemicals market was valued at approximately USD 2.48 billion in 2024 and is projected to reach USD 3.13 billion by 2029, growing at a CAGR of 4.72%.

- Trends: There’s a notable shift towards biological and bio-based solutions driven by environmental concerns and government initiatives promoting organic farming. These alternatives are gaining popularity due to their reduced toxicity and minimal environmental impact.

- Market Size and Growth: The global agricultural biologicals market was valued at USD 16.7 billion in 2024 and is expected to reach USD 31.8 billion by 2029, reflecting a CAGR of 13.8%.

- Trends: The industry is experiencing a shift towards sustainable and eco-friendly solutions, with increasing adoption of biologicals and bio-based products. This trend is influenced by the need to address challenges like pest resistance and environmental degradation.

Plant Nutrients

- Market Size and Growth: The Indian agrochemicals market, encompassing plant nutrients, was valued at USD 33.16 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030.

- Trends: Advancements in agricultural technology and the development of hybrid seeds are driving the demand for efficient and sustainable plant nutrients. These innovations aim to enhance soil fertility and optimise resource utilisation.

- Market Size and Growth: The global fertiliser industry, a key component of plant nutrients, was valued at USD 145 billion in 2023.

- Trends: The industry is witnessing a shift towards more sustainable and efficient fertilisers, with a focus on reducing environmental impact and improving nutrient use efficiency.

Biologicals

- Market Size and Growth: The Indian crop protection market, which includes biologicals, is expanding due to rising agricultural demand, increasing adoption of sustainable practices, and a growing focus on exports.

- Trends: There’s a growing preference for biological solutions as alternatives to traditional chemical pesticides and fertilisers, driven by environmental concerns and the need for sustainable agriculture.

- Market Size and Growth: The global agricultural biologicals market is projected to grow from USD 15.29 billion in 2024 to USD 44.70 billion by 2032, exhibiting a CAGR of 14.35%.

- Trends: The market is expanding rapidly, with increasing adoption of biologicals in crop protection and plant growth promotion, driven by the need for sustainable farming practices and environmental stewardship.

Crop Protection Products: Key Drivers and Trends

Key Drivers:

- Pest and Disease Threats: India’s vast agricultural base faces ongoing pest and disease risks, necessitating effective crop protection solutions to ensure food security.

- Food Security Demand: Growing population and food needs spur demand for reliable and efficient crop protection methods.

- Sustainable Farming: Increasing adoption of eco-friendly and low-residue pesticides aligns with both regulatory and farmer preferences for safer, sustainable solutions.

Trends:

- Shift Toward Biologicals: Growing preference for biopesticides driven by organic farming initiatives.

- Technological Advancements: Innovations like controlled-release pesticides enhance efficacy and reduce environmental impact.

- Regulatory Push: Government support for reducing harmful chemicals in agriculture boosts demand for bio-based products.

Plant Nutrients: Key Drivers and Trends

Key Drivers:

- Declining Soil Health: Increased demand for efficient fertilisers to address soil fertility issues and enhance crop productivity.

- Government Support: Fertiliser subsidies make plant nutrients more accessible to farmers.

- Balanced Nutrition: Farmers are focusing on tailored fertilisers to meet specific crop needs for optimal growth.

Trends:

- Efficiency and Sustainability: Growing demand for slow-release and water-soluble fertilisers to optimise nutrient use.

- Organic Fertilisers: Increased preference for microbial and organic fertilisers, driven by consumer demand for organic produce.

- Precision Agriculture: Fertilisers are being tailored to specific crop needs, improving productivity and reducing waste.

Biologicals: Key Drivers and Trends

Key Drivers:

- Sustainable Solutions: Rising demand for eco-friendly biological products as alternatives to chemical inputs.

- Organic Farming Shift: Growing adoption of organic practices boosts the need for non-toxic, biological products.

- Regulatory Support: Government initiatives promoting organic and reduced chemical use drive the biological products market.

Trends:

- Integration in IPM: Increasing use of biologicals in Integrated Pest Management (IPM) to minimise environmental impact.

- Growth Promoters: Demand for biological growth stimulants to improve crop yields and resistance.

- Organic Product Demand: Consumer preference for organic foods is pushing farmers to adopt biological solutions.

These drivers and trends reflect the evolution of India’s agriculture sector, emphasising sustainability, technological innovation, and regulatory alignment.

How Will Indogulf Cropsciences Limited Benefit?

- Crop Protection: Benefiting from Sustainable Solutions

The increasing shift towards biologicals and bio-based solutions, as highlighted in the industry outlook, directly benefits Indogulf. The company’s focus on sustainable, eco-friendly crop protection products aligns with the growing demand for low-toxicity, environmentally friendly options, positioning Indogulf to capitalise on this trend.

- Plant Nutrients: Addressing Soil Health Challenges

With soil health and declining fertility being key drivers in the industry, Indogulf’s plant nutrients play a crucial role. The company’s focus on efficient fertilisers, tailored to specific crop needs, responds to these concerns, aligning with the market’s demand for solutions that enhance productivity and sustainability.

- Biologicals: Responding to Demand for Eco-Friendly Products

Indogulf’s biological products cater to the growing preference for organic farming and sustainable alternatives to traditional pesticides and fertilisers. The rising regulatory support for organic farming and eco-friendly solutions in India strengthens the company’s positioning in this market, allowing it to meet demand effectively.

- Technological Innovation: Enhancing Product Efficiency

Indogulf’s adoption of technological advancements, such as controlled-release formulations for fertilisers and pesticides, is in line with industry trends aimed at improving product efficacy and reducing environmental impact. This innovation boosts the company’s competitiveness in the growing market for sustainable agricultural solutions.

- Global Reach: Leveraging Growing Export Potential

Indogulf’s export network capitalises on the global demand for sustainable agriculture products. As the biologicals market grows worldwide, the company’s established international presence helps it meet global needs, especially in regions increasingly adopting eco-friendly farming practices.

- Regulatory Alignment: Boosting Demand for Bio-Based Products

Indogulf’s

commitment to bio-based and sustainable products is further supported by government initiatives promoting reduced chemical use in agriculture. These policies encourage farmers to adopt safer and more sustainable solutions, creating a favourable environment for the company’s growth.

- Agricultural Technology: Adapting to Industry Trends

Indogulf’s focus on innovative plant nutrients and fertilisers aligns with trends like precision agriculture and organic farming. These technologies help farmers optimise resource utilisation, boost crop yields, and address soil health issues, positioning Indogulf as a key player in this evolving sector.

Peer Group Comparison

| Name of Company | Face Value (₹ per share) | Revenue

(in ₹ million) |

EPS (₹) | NAV

(₹ per share) |

P/E (times) | RoNW (%) |

| Indogulf Cropsciences Limited | 10 | 5,522.34 | 12.00 | 97.98 | TBA | 12.19 |

| Aries Agro Ltd | 10 | 5,164.58 | 14.94 | 200.20 | 17.47 | 7.07 |

| Basant Agro Tech India Ltd | 1 | 4,047.52 | 0.43 | 19.22 | 44.58 | 2.27 |

| Best Agrolife Ltd | 10 | 18,733.19 | 44.94 | 273.64 | 12.23 | 16.42 |

| Bhagiradha Chemicals & Industries Ltd | 1 | 4,076.48 | 17.50 | 397.59 | 101.81 | 4.40 |

| Heranba Industries Ltd | 10 | 12,570.70 | 8.72 | 213.19 | 35.34 | 4.04 |

| India Pesticides Ltd | 1 | 6,804.10 | 5.24 | 7.17 | 41.62 | 72.90 |

| Dharmaj Crop Guard Ltd | 10 | 6,541.03 | 13.13 | 106.33 | 18.02 | 12.35 |

Key Insight

- Revenue: Indogulf Cropsciences Limited reports revenue of ₹5,522.34 million, indicating moderate market activity. Best Agrolife Ltd leads the group with the highest revenue of ₹18,733.19 million, reflecting strong operations. Bhagiradha Chemicals and Basant Agro Tech lag behind with revenues of ₹4,076.48 million and ₹4,047.52 million, respectively.

- EPS: Best Agrolife Ltd stands out with a stellar EPS of ₹44.94, highlighting superior profitability. Indogulf follows with ₹12.00, showcasing steady earnings. Companies like Basant Agro Tech and India Pesticides Ltd report relatively lower EPS of ₹0.43 and ₹5.24, indicating weaker shareholder returns.

- NAV: Bhagiradha Chemicals leads with a NAV of ₹397.59 per share, reflecting robust asset strength. Best Agrolife Ltd is another frontrunner at ₹273.64. Comparatively, Indogulf’s ₹97.98 and Basant Agro Tech’s ₹19.22 signal moderate and weaker asset bases, respectively, in the competitive landscape.

- P/E: Best Agrolife Ltd has a P/E ratio of 12.23, suggesting undervaluation compared to high-performing peers like Bhagiradha Chemicals at 101.81. Indogulf’s P/E is not available, but companies like Aries Agro (17.47) show a balanced valuation, while India’s Pesticides is high at 41.62.

- RoNW: India Pesticides Ltd achieves an impressive RoNW of 72.90%, showcasing exceptional efficiency. Best Agrolife Ltd follows with 16.42%, reflecting strong profitability. In contrast, Indogulf’s 12.19% and Heranba Industries’ 4.04% indicate average and lower returns, respectively, compared to peers.

Indogulf Cropsciences Limited IPO Strengths

- Diversified Product Portfolio Across Vertical Segments

The company has built a diverse product portfolio over three decades, evolving into a multi-product manufacturer in crop protection, plant nutrients, and biologicals. By expanding from 198 products in Fiscal 2022 to 259 in Fiscal 2024, the organisation caters to diverse customer needs domestically and internationally. Innovative processes, patented packaging, and high-quality standards enhance product value, ensuring adaptability to changing market demands while maintaining a competitive edge.

- Extensive and Robust Distribution Network

Indogulf boasts a wide-reaching distribution network, covering 22 states and three Union Territories in India and over 34 countries globally. With 169 institutional partners, 5,772 domestic distributors, and advanced mobile applications, it ensures efficient product delivery. A dedicated marketing team supports customer relationships, analyses trends, and enhances market reach. Recognised as a Two Star Export House, it continues to expand its presence through strategic exports and partnerships.

- Backward Integrated Manufacturing Facilities

The company operates four manufacturing facilities equipped for formulating, technical-grade production, and packaging. These facilities offer flexibility to produce various product types while meeting strict quality and safety standards. Integration across operations ensures cost efficiency, regulatory compliance, and consistent supply chain management, empowering the company to address diverse customer needs while maintaining competitive manufacturing capabilities.

- Research-Driven Innovation and Development

Indogulf prioritises research and development, focusing on product innovation and compliance with stringent regulatory standards. With 152 products under registration and 19 under manufacturing, it remains at the forefront of industry advancements. High entry barriers, such as regulatory complexity and R&D costs, strengthen the company’s competitive position, ensuring long-term sustainability and growth within the agrochemical sector.

- Recognised Leadership and Brand Strength

Strong branding underpins the company’s market position, with 167 trademarks, seven copyrights, and six design registrations. Its leadership in key products fosters cost efficiency, economies of scale, and customer loyalty. Strategic participation in global trade events further enhances brand visibility, while a pipeline of innovative products and extensive regulatory compliance solidify its reputation as an industry leader.

Key Insights from Financial Performance

- Assets:IndogulfCropsciences Limited’s assets have shown consistent growth over three fiscal years, increasing from ₹4,135.91 million in 2022 to ₹5,422.49 million in 2024, indicating robust financial health and expansion of operations.

- Revenue: The company’s revenue has steadily risen, reflecting consistent business performance. From ₹4,902.30 million in 2022 to ₹5,557.87 million in 2024, this upward trend demonstrates effective market strategies and growing customer demand.

- Profit After Tax: Profitability fluctuated, peaking at ₹282.33 million in 2024 after a slight dip to ₹224.23 million in 2023. This recovery highlights improved operational efficiency and cost management over time.

- Reserves and Surplus: Reserves and surplus have steadily increased, from ₹1,568.69 million in 2022 to ₹2,080.07 million in 2024, signifying enhanced retained earnings and a strong foundation for future investments.

- Total Borrowings: Total borrowings have risen significantly, reaching ₹3,105.98 million in 2024 compared to ₹2,330.78 million in 2022, suggesting increased reliance on debt for business expansion or operational needs.

- Total Liabilities: Total liabilities experienced fluctuations, peaking at ₹1,892.18 million in 2023 before reducing to ₹1,545.62 million in 2024, indicating effective management of financial obligations.

Other Financial Details

- Cost of Raw Material and Components Consumed: In 2024, raw material costs were ₹4,026.65 million, down from ₹4,183.60 million in 2023 but significantly higher than ₹3,062.96 million in 2022, reflecting fluctuations in material demand and procurement strategies.

- Employee Benefits Expense: Employee expenses increased to ₹388.90 million in 2024 from ₹349.21 million in 2023 and ₹298.03 million in 2022, reflecting consistent investment in workforce retention, compensation, and benefits over the years.

- Finance Costs: Finance costs rose to ₹129.48 million in 2024 from ₹116.45 million in 2023 and ₹60.30 million in 2022, reflecting increased borrowing levels or higher interest rates impacting financial outflows.

- Depreciation and Amortisation Expense: Depreciation rose to ₹103.07 million in 2024, up from ₹96.14 million in 2023 and ₹86.01 million in 2022, reflecting additional investments in fixed assets or capital improvements.

- Other Expenses: Other operational expenses reached ₹592.62 million in 2024, slightly increasing from ₹580.47 million in 2023 and ₹496.67 million in 2022, reflecting steady overhead and administrative costs.

Key Strategies for Indogulf Cropsciences Limited

- Expand Existing Production Capacities

Indogulf Cropsciences Limited is focused on expanding its existing manufacturing capacities to enhance cost efficiency. With four facilities across Jammu and Kashmir, and Haryana, the company plans to expand its Barwasni, Haryana plant by adding a dry flowable plant. This expansion will optimise production processes, improve product quality, and increase operational efficiency to strengthen its market position.

- Grow Product Portfolio Across Three Verticals

Indogulf Cropsciences Limited aims to grow its product portfolio by launching new products to meet evolving consumer demands. With a focus on plant nutrients and biologicals, the company plans to diversify into high-growth areas. Its R&D efforts will continue to drive product innovation, enhancing market competitiveness and expanding its reach across both domestic and international markets.

- Strengthen R&D Capabilities

Indogulf Cropsciences Limited remains committed to strengthening its R&D capabilities to enhance its product offerings and reduce production costs. With an increased investment in R&D activities, the company focuses on developing innovative products, ensuring sustainability through quality certifications, and building strategic partnerships to maintain a competitive edge in the agrochemical market.

- Expand Sales & Distribution Network

Indogulf Cropsciences Limited seeks to expand its sales and distribution network by targeting underserved farmers and increasing global penetration. The company has established Abhiprakash Globus Private Limited as a subsidiary to enhance operational efficiency and diversify product offerings. The focus will be on appointing new distributors, increasing stock points, and expanding its geographical footprint to strengthen its market presence.

- Focus on Cost Optimisation

Indogulf Cropsciences Limited continues to prioritise cost optimisation to achieve operational efficiency. Through initiatives like implementing SAP systems, automating packaging, and reducing material costs, the company aims to enhance profitability. Expansion plans at the Barwasni facility and reduced reliance on imported raw materials will further contribute to cost reduction and better resource utilisation, improving overall financial performance.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Indogulf Cropsciences Limited IPO

What is the issue size of the Indogulf IPO?

The IPO includes a ₹200 crore fresh issue and an offer-for-sale of up to 38.54 lakh equity shares by existing shareholders.

When will the Indogulf IPO open and close?

The IPO opening date is 26 July 2025 and closing date is 30 July 2025.

What is the price range for the Indogulf IPO?

The price range for the IPO is around ₹105-111

Where will the Indogulf shares be listed?

The shares will be listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

How will the IPO allotment be reserved for investors?

The reservation is 50% for Qualified Institutional Buyers (QIBs), 15% for Non-Institutional Investors (NIIs), and 35% for retail investors.

What is the IPO process for Indogulf ?

The IPO will follow a book-building process, allowing price discovery based on investor demand within a specified range.

Is there a reservation for employees in the Indogulf IPO?

Yes, a portion of the IPO is reserved for eligible employees as part of the offer.

Is there a reservation for employees in the Indogulf IPO?

Yes, a portion of the IPO is reserved for eligible employees as part of the offer.