- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Innovatiview India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Innovatiview India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Innovatiview India Limited

Innovatiview India Limited was founded in 2017 with a mission to tackle complex security challenges through innovative solutions, ensuring a safer society. The company leverages AI/ML-enabled technologies to uphold the integrity of critical exams, elections, and events. Its custom rental service, ‘Get It Rent,’ supports businesses by providing essential tools without heavy upfront costs. With operations spanning 700+ districts, Innovatiview has monitored 34.46 million candidates and executed over 45 million biometric verifications in FY24. Driven by research and adaptive strategies, it continues to refine security solutions for evolving challenges.

Innovatiview India Limited IPO Overview

Innovatiview India filed its Draft Red Herring Prospectus (DRHP) with SEBI on Monday, February 17, 2025 to raise ₹2,000 crores through an initial public offering (IPO). As per the Draft Red Herring Prospectus (DRHP) submitted on Thursday, the IPO will be an Offer-For-Sale (OFS), meaning the company itself will not receive any proceeds. The OFS includes ₹800 crore worth of shares each from Ashish Mittal and Ankit Agarwal, ₹320 crore from Vishal Mittal, and ₹80 crore from Abhishek Agarwal, with proceeds going to the selling shareholders. Prior to the IPO, the promoters collectively held 100% of the company’s shares. The post-issue shareholding will be known after the equity dilution, which is calculated as the difference between the pre-issue and post-issue holdings.

Innovatiview India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): ₹2000 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Innovatiview India IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Innovatiview India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Innovatiview India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 3.98 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 53.20% |

| Net Asset Value (NAV) | 7.51 |

| Return on Equity | 52.82% |

| Return on Capital Employed (ROCE) | 58.94% |

| EBITDA Margin | 48.90% |

| PAT Margin | 30.41% |

| Debt to Equity Ratio | 0.24 |

Objectives of the IPO Proceeds

- Being entirely an OFS issues, the IPO proceeds will entirely go to the selling shareholders and the company will not use the proceeds for corporate purpose

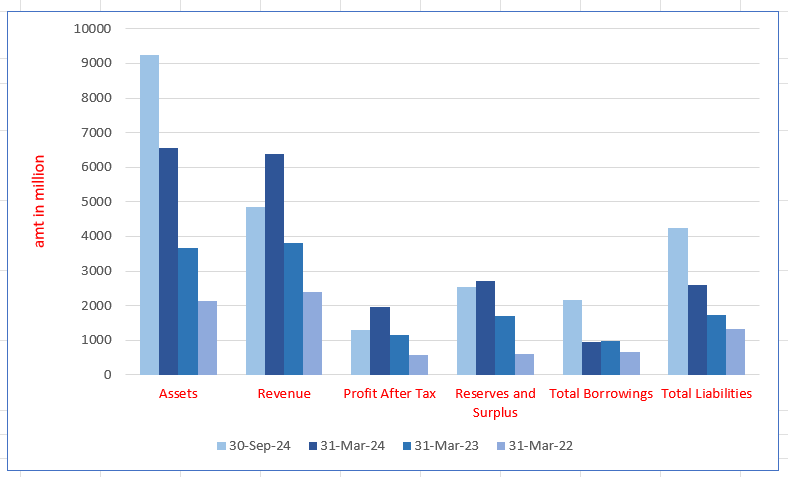

Innovatiview India Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 9252.77 | 6550.23 | 3672.86 | 2128.54 |

| Revenue | 4849.22 | 6380.52 | 3807.27 | 2382.08 |

| Profit After Tax | 1310.06 | 1967.19 | 1145.57 | 561.75 |

| Reserves and Surplus | 2552.90 | 2721.52 | 1700.31 | 600.41 |

| Total Borrowings | 2170.66 | 950.31 | 969.45 | 667.80 |

| Total Liabilities | 4238.11 | 2604.58 | 1722.96 | 1326.74 |

Financial Status of Innovatiview India Limited

SWOT Analysis of Innovatiview India IPO

Strength and Opportunities

- Strong market position with a 73.7% share in examination security solutions as of Fiscal 2024.

- Advanced AI/ML-enabled security solutions enhance credibility and fairness in critical processes.

- Comprehensive product portfolio addressing various security challenges, including biometric and surveillance solutions.

- Established presence across 28 states and 9 union territories, enabling extensive service coverage.

- Significant experience in securing over 1,500 examinations nationwide.

- Diversified services, including IT product rentals, providing additional revenue streams.

- Recognition as a 'Great Place to Work' in 2024 enhances employer branding and attracts top talent.

- Continuous innovation through dedicated R&D efforts ensures adaptability to emerging threats.

- Partnerships with prominent organizations like NTA, UPSC, and AIIMS bolster credibility and open avenues for growth.

Risks and Threats

- Dependence on the Indian market may limit growth opportunities and expose the company to regional economic fluctuations.

- Rapid technological advancements require continuous investment in R&D to stay ahead of competitors.

- Potential vulnerabilities in data security could impact client trust and company reputation.

- Regulatory changes in data protection and privacy laws may necessitate operational adjustments.

- High reliance on government contracts may pose risks related to policy shifts and budget allocations.

- Intense competition from emerging security solution providers could pressure market share and profitability.

- Economic downturns may affect clients' budgets for security solutions, impacting sales.

- Challenges in scaling operations while maintaining service quality could arise during rapid expansion.

- Dependence on key clients for a substantial portion of revenue may pose financial risks if contracts are lost.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Innovatiview India Limited IPO

Innovatiview India Limited IPO Strengths

- Largest Player in Terms of Revenue in Fiscal 2024

Innovatiview India Limited holds a 73.7% market share in examination security solutions in Fiscal 2024, growing 69.07% year-on-year. It has secured 1,972+ exams across 28 states, preventing malpractices with advanced surveillance, ensuring fair assessments, and maintaining its position as a preferred security provider.

- Extensive Portfolio of Integrated Security Offerings

Innovatiview India Limited has expanded from examination security to technology-driven surveillance solutions for elections and large public events. Its AI-powered offerings enhance security, reduce costs, and ensure transparency. With a diverse portfolio, it strengthens client relationships and maintains a competitive edge in the industry.

- Technology-Intensive, Client-Centric Processes

Innovatiview India Limited leverages AI, ML, and cloud-based solutions to enhance security and reduce costs. Its flagship offerings, including biometric authentication, GPS locks, and real-time surveillance, ensure seamless operations. With a strong R&D focus, it continuously evolves to meet client needs effectively.

- Experienced Leadership and Skilled Workforce

Innovatiview India Limited thrives under the leadership of founders Ashish Mittal and Ankit Agarwal, both engineering graduates from the University of Delhi. Their expertise, along with a strong management team, drives innovation and growth. With 554 employees and a commitment to training, the company has been recognized as a Great Place to Work (2024–2025).

- Strong Growth and Profitability

Innovatiview India Limited has achieved strong revenue growth, increasing from ₹2,382.08 million in Fiscal 2022 to ₹6,380.52 million in Fiscal 2024. Profit after tax grew at 87.13% CAGR. Efficient asset utilization through ISaaS and EraaS models enhances profitability and operational scalability.

More About Innovatiview India Limited

Innovatiview India Limited is a technology-driven company specializing in automated ancillary security and surveillance solutions for examinations, elections, and large-scale events across India. As of September 30, 2024, the company holds a dominant position in the examination integrated security solutions sector, capturing a 73.7% market share in terms of revenue for Fiscal 2024 (Source: F&S Report).

Comprehensive Examination Security Solutions

To prevent malpractices in examinations, Innovatiview integrates advanced security technologies, including:

- CCTV Surveillance: Real-time monitoring of examination centres

- Biometric Verification: AI-based, touchless authentication to prevent impersonation

- Physical Security Systems: Frisking and controlled access to prevent unauthorized entry

- GPS Tracking & VoIP Communication: Secure tracking of sensitive materials and personnel coordination

With over 72 clients served and 1,409 examinations secured in six months ending September 30, 2024, the company continues to enhance examination security nationwide.

Election Security and Large-Scale Event Surveillance

Innovatiview extends its expertise to elections and major public events, ensuring transparency and security through:

- Election Security Solutions: CCTV surveillance of polling booths, strong rooms, counting halls, and patrolling vehicles

- Event Surveillance: Deployment of security measures at large public gatherings, including Independence Day and Republic Day celebrations in New Delhi

In the 2024 General Elections, the company provided CCTV surveillance services across 16.38% of India’s districts, covering key states like Uttar Pradesh, Rajasthan, and Odisha.

Integrated Business Solutions

Innovatiview offers additional services that complement its core security operations:

- IT Equipment Rental (ERaaS): Leasing laptops, desktops, and surveillance equipment to businesses

- System Integration (SIaaS): End-to-end security infrastructure setup, including surveillance for public safety and immersive experiences like projection mapping and lighting solutions

Market Leadership and Clientele

The company’s extensive client base includes central and state government agencies such as the National Testing Agency, UPSC, and various state Public Service Commissions. With a network of over 5,100 vendors, Innovatiview efficiently delivers large-scale security solutions.

In May 2024, the company managed security for a single-shift examination involving 2.40 million candidates across 4,736 centres in 28 states and nine Union Territories—highlighting its capability to operate at an unmatched scale.

Industry Outlook

The Indian security and surveillance industry is experiencing robust growth, driven by increasing concerns over public safety, technological advancements, and government initiatives.

Market Overview

- Overall Security Market: Valued at USD 4.92 billion in 2024, the Indian security market is projected to reach USD 13.32 billion by 2033, growing at a compound annual growth rate (CAGR) of 11.7%.

- Electronic Security Segment: This segment, encompassing surveillance systems, access controls, and alarms, was valued at USD 2.07 billion in 2023 and is expected to escalate to USD 14.28 billion by 2031, with a CAGR of 23.57%.

Video Surveillance Systems

A critical component of electronic security, the video surveillance market in India is witnessing significant expansion:

- Market Size: Estimated at USD 4.40 billion in 2025, projected to reach USD 7.12 billion by 2030.

- Growth Drivers:

- Rising demand for safety in high-risk zones.

- Shift from analog to IP cameras.

- Integration of Internet of Things (IoT) technologies.

Growth Drivers

- Technological Advancements: Adoption of artificial intelligence (AI), IoT, and big data analytics enhances threat detection and response capabilities.

- Government Initiatives: Projects like smart cities and increased surveillance in public spaces bolster market demand.

- Urbanization: Rapid urban development necessitates advanced security solutions to ensure public safety.

Key Figures

- Data Center Security: Projected growth from USD 30.97 million in 2023 to USD 118.68 million by 2032, at a CAGR of 18.29%.

- Smart Security Cameras: Revenue expected to reach USD 677.8 million in 2025.

How Will Innovatiview India Limited Benefit

- Market Leadership in Examination Security: With a 73.7% market share, Innovatiview is positioned to capitalise on the growing demand for secure examination solutions.

- Expansion in Surveillance Solutions: The video surveillance market is projected to reach USD 7.12 billion by 2030, creating opportunities for Innovatiview’s CCTV solutions.

- Rising Demand for Election Security: Increasing electoral transparency needs will drive demand for AI-based surveillance and monitoring, benefiting Innovatiview’s election security services.

- Growth in Large-Scale Event Security: With India’s growing focus on public event safety, Innovatiview’s expertise in real-time surveillance will see greater adoption.

- Technological Integration Opportunities: Innovatiview’s AI, IoT, and biometric verification solutions align with the industry shift towards advanced security technologies.

- Boost from Smart City Projects: Government initiatives for smart city surveillance will increase demand for integrated security and monitoring systems.

- Increase in IT Equipment Rental Services: The rising need for security infrastructure will drive growth in Innovatiview’s IT equipment rental (ERaaS) business.

- Growing Need for System Integration Services: Public and private sector investments in security infrastructure will boost demand for Innovatiview’s SIaaS solutions.

- Strong Government and Institutional Clientele: Contracts with government agencies like NTA and UPSC ensure consistent revenue streams and expansion opportunities.

- Advantage from High Industry Entry Barriers: With established expertise and a vendor network of 5,100+, Innovatiview faces limited competition in its niche market.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Innovatiview India Limited

- Establishing Test Centres Across India for Long-Term Examination Solutions

Innovatiview India Limited aims to expand its test centre network by partnering with higher educational institutions and examination bodies. These centres, equipped with computer-based testing (CBT) infrastructure, will serve as controlled venues for various examinations and government-led training programs. The company has already set up a 4,700-node test centre in Noida and 1,090-node centres in Manipur. Plans include leasing government institutions, expanding to Bihar with 8,400-seat CBT centres, and integrating ancillary revenue streams such as food kiosks and advertising.

- Expanding Security and Surveillance Solutions for Elections and Events

With India’s elections and large-scale events demanding stringent security and surveillance, Innovatiview India Limited is capitalising on its expertise in CCTV surveillance, VoIP devices, and GPS tracking to prevent election malpractices. The company has extensive experience securing elections across central, state, and local levels. Additionally, it seeks opportunities in the Meetings, Incentives, Conferences, and Exhibitions (MICE) market, religious gatherings, and other high-attendance events, ensuring advanced security solutions for diverse sectors.

- Strengthening Presence Across India by Entering New States

Innovatiview India Limited has primarily focused on North, East, and West India but now plans to expand into South India. By targeting regional examination bodies and event organisers, the company aims to diversify its client base. It recently secured the central examination body of Karnataka as a client and intends to leverage its proven security and surveillance model to reach clients in remote and underpenetrated regions, ensuring a wider pan-India presence.

- Developing a Skilled Workforce Platform for Examinations

Innovatiview India Limited recognises the high manpower demand for large-scale examinations, including invigilators and technical support staff. To address challenges in personnel sourcing, the company plans to create a digital platform connecting examination organisers with verified manpower. This platform will offer background verification, training modules, and scheduling features, ensuring reliable and skilled personnel. It also presents a revenue opportunity by offering training and certification services, bridging the gap between demand and supply in the examination industry.

- Driving Growth Through Up-Selling and Cross-Selling Solutions

Innovatiview India Limited aims to enhance revenue by offering additional services to existing clients. The company has successfully up-sold fingerprint scanning alongside facial recognition in its TrustView offering and introduced AI/ML-enabled CCTV surveillance under CamView. Through cross-selling, it has provided VoIP services to clients using CCTV surveillance solutions. By leveraging client relationships, Innovatiview plans to bundle solutions, increasing client engagement and boosting overall business growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

How can I apply for Innovatiview India Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Innovatiview India IPO?

The IPO aims to raise ₹2,000 crores through an Offer for Sale (OFS) of equity shares.

When will the Innovatiview India IPO open and close?

The IPO is expected to open and close in the first week of June 2025; exact dates are pending.

What is the price band for the Innovatiview India IPO?

The price band will be announced after SEBI approves the Draft Red Herring Prospectus (DRHP).

How can investors apply for the Innovatiview India IPO?

Investors can apply online using UPI or ASBA through their bank’s net banking services or brokers.

When is the Innovatiview India IPO expected to be listed?

The listing is anticipated in the second week of June 2025 on BSE and NSE platforms.