- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Integris Medtech IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Integris Medtech IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Integris Medtech Limited

Integris Medtech Limited is a diversified India-based global medical products and laboratory solutions company established in 2008. It develops, manufactures, and commercialises a broad portfolio spanning cardiovascular devices and scientific laboratory solutions. With manufacturing facilities in India, Germany, and the Netherlands, Integris supplies over 22,000 SKUs across 200+ brands to more than 65 international markets. Its customer base includes over 9,500 laboratories and 2,000 hospitals, supported by a team of 1,879 employees. The company is structured into two core divisions: Cardiovascular Devices and Laboratory Solutions, serving both public and private sectors globally.

Integris Medtech Limited IPO Overview

Integris Medtech Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on October 9, 2025, proposing to raise funds through an Initial Public Offer (IPO). The IPO is a book-built issue comprising a fresh issue worth ₹925 crores and an offer for sale (OFS) of up to 2.17 crore equity shares. The company’s equity shares are proposed to be listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). While the book-running lead manager has not yet been declared, Kfin Technologies Ltd. will act as the registrar to the issue. Key details such as the IPO opening and closing dates, price band, and lot size are yet to be announced. Interested investors can refer to the Integris Medtech IPO DRHP for further information.

According to the DRHP, the face value of each share is ₹1, and the issue will follow a book-building process. The IPO includes a fresh issue aggregating up to ₹925 crores and an offer for sale of 2,16,74,531 equity shares of ₹1 each. The company currently has a pre-issue shareholding of 10,83,38,049 shares, and the shares will be listed on both BSE and NSE once the process is complete.

Integris Medtech Ltd. filed its DRHP with SEBI on Thursday, October 9, 2025, marking an important milestone in its public listing journey. The company’s promoters include Evercure Holdings Pte. Ltd., Medicore Holdings Pte. Ltd., Gurmit Singh Chugh, and Punita Sharma. The promoter holding before the issue stands at 83.24%, while the post-issue shareholding will be updated upon completion of the IPO process.

Integris Medtech Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue of ₹925 Cr + OFS of 2,16,74,531 shares |

| Fresh Issue | ₹925 Crores |

| Offer for Sale (OFS) | Up to 2,16,74,531 shares (Aggregating up to ₹[●] Cr) |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,83,38,049 shares |

| Shareholding post-issue | TBA |

Integris Medtech Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Integris Medtech Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Integris Medtech Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.00 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 1.48% |

| Net Asset Value (NAV) | ₹414.12 |

| Return on Equity (RoE) | 5.35% |

| Return on Capital Employed (RoCE) | 14.51% |

| EBITDA Margin | 16.26% |

| PAT Margin | 3.72% |

| Debt to Equity Ratio | 1.31 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are proposed to be utilized as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment of certain outstanding borrowings of the Company and its subsidiaries | 6,963.90 |

| General corporate purposes* | [●] |

| Net Proceeds | [●] |

Note: The amount to be utilised for general corporate purposes shall not exceed 25% of the Gross Proceeds.

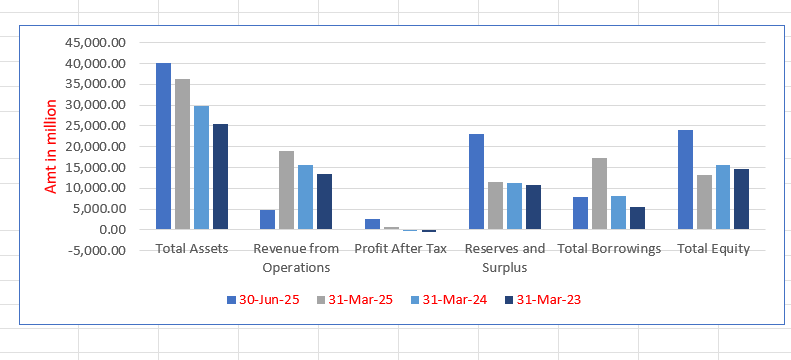

Integris Medtech Limited Financials (in million)

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Total Assets | 40,196.24 | 36,413.35 | 29,891.98 | 25,538.68 |

| Revenue from Operations | 4,852.54 | 19,024.66 | 15,533.82 | 13,481.04 |

| Profit After Tax | 2,675.67 | 706.84 | (48.84) | (405.41) |

| Reserves and Surplus | 22,998.35 | 11,507.37 | 11,357.12 | 10,731.18 |

| Total Borrowings | 7,934.18 | 17,294.58 | 8,131.03 | 5,565.35 |

| Total Equity | 23,997.79 | 13,213.24 | 15,721.38 | 14,609.97 |

Financial Status of Integris Medtech Limited

SWOT Analysis of Integris Medtech IPO

Strength and Opportunities

- Diversified global medical products and laboratory solutions portfolio.

- Largest scientific lab solutions company in Southeast Asia.

- End-to-end value chain capabilities in lab solutions from sourcing to after-sales.

- Strong, long-standing partnerships with over 200 global and regional suppliers.

- One of only two Indian companies manufacturing devices across all three risk classes.

- Comprehensive cardiovascular portfolio with "one-stop-shop" model for cath labs.

- Proven track record in scaling global cardiovascular technologies in emerging markets.

- Global manufacturing footprint with facilities in India, Germany, and the Netherlands.

- Strong, experienced leadership team with sectoral expertise.

- Significant growth opportunity in the underpenetrated Indian and Southeast Asian MedTech markets.

Risks and Threats

- History of inconsistent profitability with reported losses in previous years.

- High dependence on distributor-led sales model for cardiovascular devices.

- Significant levels of debt leading to substantial finance costs.

- Intense competition from large multinational corporations and local players.

- Complexity in managing a globally dispersed manufacturing and supply chain.

- Potential for adverse regulatory changes in key markets like the EU and India.

- Integration risks associated with past and future acquisitions.

- Pressure on pricing from healthcare cost containment measures globally.

- Dependence on key supplier relationships for laboratory solutions.

- Fluctuations in foreign currency exchange rates impacting international operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Integris Medtech Limited

Integris Medtech Limited IPO Strengths

Comprehensive Laboratory Solutions Platform with End-to-End Value Chain

Integris Medtech Limited operates the largest scientific lab solutions platform in Southeast Asia, managing the entire value chain from sourcing and regulatory compliance to logistics, installation, and after-sales support. This integrated approach creates high switching costs for customers, fosters long-term supplier relationships, and generates stable, recurring revenue streams through various service models, including reagent rentals, which convert customer capital expenditure into operational expenses.

Diversified and Innovative Cardiovascular Portfolio

The company offers one of the market’s most comprehensive cardiovascular portfolios, spanning the full spectrum of interventional cardiology, including drug-eluting stents, drug-coated balloons, lithotripsy, and imaging systems. Its “build-partner-operate” strategy, featuring exclusive partnerships with global innovators like Medinol and Shockwave, allows it to introduce cutting-edge technologies, such as the US-FDA approved EluNIR stent, establishing it as a credible competitor to multinational peers.

Global Manufacturing and R&D Capabilities

Integris Medtech Limited possesses a global manufacturing footprint with five facilities across India, Germany, and the Netherlands, producing medical devices across all three risk classes. Its manufacturing is closely integrated with in-house R&D, which has developed proprietary products like the VIVO ISAR polymer-free stent, backed by long-term clinical data. This capability ensures high-quality standards, supply chain resilience, and the agility to adapt to market needs.

Experienced and Seasoned Leadership Team

The company is led by a highly experienced management team and board with an average of over 20 years of industry expertise. The leadership, including professionals from renowned organizations like Terumo and B. Braun, brings multidisciplinary knowledge across R&D, regulatory affairs, manufacturing, and commercial operations, providing strategic direction and execution ability to capitalize on emerging opportunities in the dynamic MedTech sector.

More About Integris Medtech Limited

Integris Medtech Limited is a prominent, diversified global player in the medical technology and laboratory solutions space. Incorporated in 2008, the company has evolved into a significant force, supplying products to over 65 international markets.

Business Divisions

The company’s operations are strategically divided into two core segments:

- Cardiovascular Devices: This division encompasses a wide range of products for interventional cardiology, including drug-eluting stents, drug-coated balloons, complex coronary intervention products, lithotripsy systems, intravascular ultrasound, and vascular access solutions. It markets proprietary brands like Chrome and Protégé.

- Laboratory Solutions: This division provides a complete suite for clinical, research, and industrial laboratories. It offers equipment, reagents, consumables, and vital services such as installation, maintenance, and calibration under its BioCal™ brand, acting as a one-stop-shop for laboratory needs.

Global Footprint and Operations

Integris Medtech operates a network of manufacturing facilities in Dehradun (India), Hechingen (Germany), and Helmond (the Netherlands), in addition to a CE and ISO 13485 certified facility in Chennai for lab instruments. Its extensive customer base includes over 9,500 laboratories and 2,000 hospitals and cathlabs, supported by a vast portfolio of over 22,000 SKUs. The company employs 1,879 people as of June 30, 2025, including a strong force of sales, service, and application specialists.

Growth and Expansion Strategy

The company’s growth has been fueled by a combination of organic initiatives and strategic acquisitions, such as the purchases of Blue Medical Devices and Translumina GmbH, which expanded its cardiovascular capabilities in Europe. Its partnership-driven model, collaborating with global leaders like Medinol, Shockwave, and ACIST, enables rapid technology transfer and market access, solidifying its position as a key player in both developed and emerging markets.

Industry Outlook

The Indian medical devices and laboratory solutions industry is poised for robust growth, driven by rising healthcare expenditure, increasing accessibility, and a growing emphasis on quality healthcare infrastructure.

Market Growth and Drivers

- The Indian medical devices market is expected to grow at a significant CAGR, potentially reaching $50 billion by 2030, from approximately $11 billion in 2022.

- Key growth drivers include a growing and aging population, rising incidences of cardiovascular and lifestyle diseases, increasing health insurance penetration, and government initiatives like the Production-Linked Incentive (PLI) scheme for medical devices.

- The diagnostic and laboratory segment is also expanding rapidly, fueled by rising disposable incomes, a growing focus on preventive healthcare, and technological advancements.

Cardiovascular Devices Segment

- Cardiovascular diseases are a leading cause of mortality in India, creating a substantial and growing demand for interventional devices.

- The market is shifting towards advanced, minimally invasive technologies like drug-eluting stents, drug-coated balloons, and intravascular imaging and physiology devices.

- The “Make in India” initiative is providing a thrust to domestic manufacturing, reducing import dependency and creating opportunities for companies like Integris with local manufacturing capabilities.

Laboratory Solutions Segment

- The Indian in-vitro diagnostics (IVD) and laboratory equipment market is projected to witness a strong double-digit CAGR.

- Demand is being driven by the expansion of hospital chains, growth in standalone diagnostic centers, and increased outsourcing of diagnostic services.

- The post-pandemic era has underscored the need for a robust diagnostic infrastructure, leading to higher investments in laboratory automation, advanced analyzers, and reagents.

How Will Integris Medtech Limited Benefit

- Benefit from the strong underlying demand for medical devices and diagnostics in India and Southeast Asia, driven by demographic and economic trends.

- Capitalize on the government’s push for local manufacturing, leveraging its established domestic production facilities to gain a competitive edge and replace imports.

- Leverage its comprehensive “one-stop-shop” portfolio in both cardiovascular and lab solutions to cross-sell products and increase its share of wallet with hospital and laboratory customers.

- Utilize its strong track record and partnerships to introduce and scale next-generation technologies, such as structural heart devices and digital health solutions, in high-growth emerging markets.

- Exploit its position as the largest lab solutions player in Southeast Asia to consolidate the fragmented market and expand its reach through organic growth and targeted acquisitions.

- Use the IPO proceeds to significantly reduce its debt burden, leading to lower finance costs and an improved bottom line, thereby strengthening its financial profile for future investments.

Peer Group Comparison

| Particulars | Face Value (₹) | P/E | Revenue (₹ in million) | EPS (Basic) (₹) | EPS (Diluted) (₹) | RoNW (%) | NAV (₹) |

| Integris Medtech Limited | 1 | TBD | 19,024.66 | 5.82 | 5.73 | 1.84 | 316.09 |

| Peer Group | |||||||

| Poly Medicure Limited | 5 | 56.02 | 16,698.32 | 34.13 | 34.11 | 12.26 | 278.46 |

| Laxmi Dental Limited | 2 | 53.95 | 2,391.07 | 6.07 | 6.05 | 16.09 | 37.71 |

Key Strategies for Integris Medtech Limited

Platform Strategy: Expand Business Leadership through Innovation and Partnerships

Integris Medtech Limited intends to expand its product portfolio and business leadership by advancing innovation, making strategic investments, and forming high-impact partnerships. The company plans to address portfolio gaps through sustained R&D and collaborations with global technology firms. Its integrated platform-led approach, combining organic expansion with targeted acquisitions, supported by a robust financial position, is designed to capture emerging opportunities in the evolving MedTech landscape, including decentralized healthcare and digital health solutions.

Lab Solutions Strategy: Strengthen Market Reach and Localise Manufacturing

The company’s strategy for its lab solutions business focuses on broadening its product range through internal market research and partnerships with global suppliers. Integris Medtech Limited aims to identify portfolio white spaces and introduce innovative platforms. It is exploring opportunities to expand its local manufacturing footprint, such as the local assembly of analyzers, to enhance supply chain integration and domestic value addition. This will be complemented by digital transformation, e-commerce development, and regionally tailored solutions.

Cardiovascular Devices Strategy: Drive Clinical Impact and Global Expansion

Integris Medtech Limited’s cardiovascular strategy centres on delivering clinical impact and sustainable global expansion through constant portfolio innovation and integrated manufacturing. The company will focus on introducing new technologies, including structural heart devices, and broadening into new treatment areas. Growth will be driven by targeted acquisitions to enhance technological capabilities and rigorous regulatory and clinical assessment for international expansion, ensuring it remains agile and scalable in advancing cardiovascular innovation globally.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Integris Medtech Limited IPO

How can I apply for Integris Medtech Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size for the Integris Medtech IPO?

The lot size and the minimum investment amount for the IPO are yet to be announced (TBA).

What is the core business of Integris Medtech Limited?

It is a global medical products and laboratory solutions company developing and manufacturing cardiovascular devices and lab equipment.

How will the company use the IPO proceeds?

The net proceeds will primarily be used for repayment of borrowings and for general corporate purposes.

Is the Integris Medtech IPO a combination of fresh issue and OFS?

Yes, the IPO consists of a fresh issue of ₹925 crores and an offer for sale (OFS) of up to 2.17 crore shares.