- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What is Interest Rate Futures? Impact of Interest Rate Futures on New-Age Investors

By HDFC SKY | Updated at: Jul 24, 2025 06:19 PM IST

Summary

- Interest Rate Futures (IRFs) are standardized exchange-traded derivatives that allow participants to hedge or speculate on interest rate movements, particularly chan

ges in government securities’ yields. - The underlying assets for IRFs in India are typically Government of India securities (G-Secs) like the 6-year, 10-year, or 13-year benchmark bonds.

- IRFs are traded on recognized exchanges such as NSE and BSE, ensuring transparent price discovery and lower counterparty risk.

- Investors can take long or short positions in IRFs based on their interest rate outlook—rising rates benefit short positions, while falling rates benefit long positions.

- IRFs help hedge portfolio risks for mutual funds, banks, and large institutions exposed to interest rate fluctuations.

- These contracts follow quarterly expiry cycles (March, June, September, December) and are cash-settled, not physically settled.

- The minimum lot size is one contract, typically representing a notional Rs. 2 lakh in G-Secs.

- IRFs are regulated by SEBI, and margin requirements ensure market discipline and stability.

Interest rate futures are future contracts that have a bond or other interest paying instrument as the underlying security. Usually the underlying security in interest rate futures is a government bond like US Treasury bonds. Interest rate futures can be settled through actual delivery or cash settled. Interest rate futures are often used for hedging interest rate risks.

What is Interest Rate Futures?

Interest rate futures (IRF) are standardised contracts of interest rate derivatives. These are traded on recognised stock exchanges. The NSE has standardised contracts for a tenure of 6-year, 10-year, and 13-year Government of India Security (NBF II). It also has Government of India Treasury Bills (91-DTB).

This trading facilitates buying and selling an interest bearing security or related interest-bearing instrument at a specific date in the future. The transactional price is decided and agreed upon when the contract is initially made. These futures include money market futures and are currently available on treasury bills, MIBOR (Mumbai Interbank Offered Rate), and securities of the Government of India.

You can even settle these futures with cash instead of actual delivery. Likewise, you can leverage hedges to offset the risks involved in interest rate futures trading. This means you have an upper edge in covering all your risks against fluctuations in interest risk futures.

Interest rate futures trading is based on anticipated future fluctuations in the interest rate trends in the market. Interest rate trading is both short-term and long-term. The short-term futures deal with investments maturing within a year, while the long-term futures deal with investments maturing beyond a year.

How does it Work?

There is an inverse relation between your interest rate and bond price. This means that when the interest rate rises, bond prices fall, and vice versa.

Let’s assume that you have a long-term position in a bond. You are anticipating selling it off at a higher selling price. However, the interest rates are rising gradually. This rise in the interest rate lowers the value of your bond. Hence, rising interest rates are signs of danger for your investment. You can enter into a selling position in an interest rate futures contract to hedge your interest rate risk.

To understand how interest rate futures work in financial markets, let us consider two examples:

Interest Rate Futures Example

Let’s assume you have a debt obligation of around 50 lakhs. You anticipate the interest rates to rise higher. You can enter a sell position in an interest rate futures contract. Any loss that you incur because of your long position in debt due to increase in interest rate can be fully or partially offset by the gains from your sell position in interest rate futures contract.

Interest Rate Hedging Example

Offsetting your interest rate risk by entering into an interest rate futures contract is an example of interest rate hedging.

How Do We Trade in Interest Rate Futures in India?

You need to have a trading and demat account with a broker in order to trade in interest rate futures in India. The accounts should be with brokers who offer derivative trading services. Brokers are members of stock exchanges. When you take a position in an interest rate futures, settlement is done on a daily basis on mark- to – market basis.

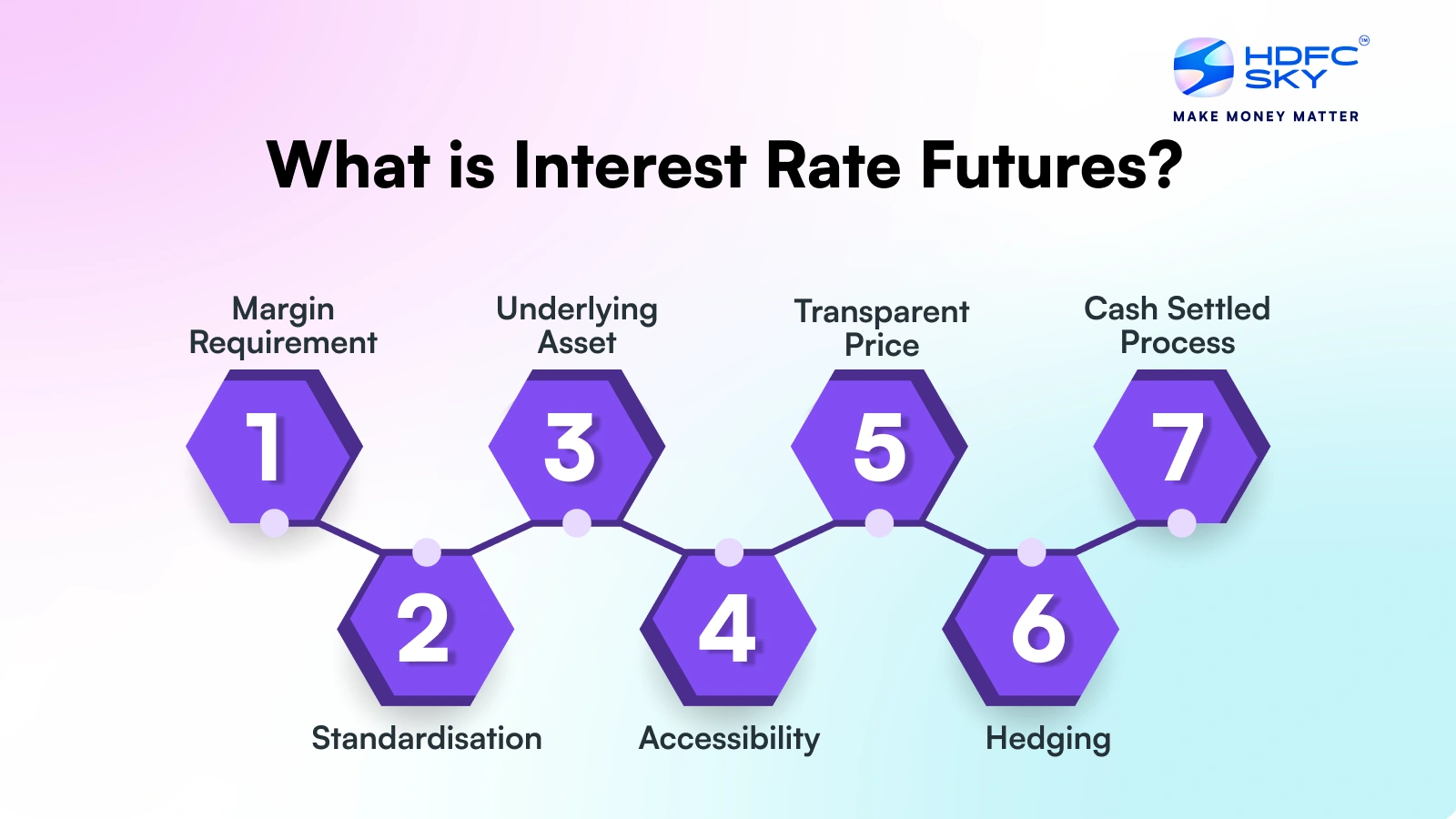

Features of Interest Rate Futures

The features of the interest rate futures include –

- Standardisation: These future contracts are standardised in the context of their expiration dates, sizes, and settlement process.

- Accessibility: Interest rate futures are easily accessible to independent investors, financial institutions, and small businesses.

- Hedging : You can use these futures to mitigate your risks from interest rate fluctuations.

- Transparent Price: As you trade interest rate futures on NSE and BSE, you can be assured of the clarity and transparency of their pricing and executions.

- Underlying Asset: T-bills or government bonds are the underlying assets of interest rate futures.

- Margin Requirement: You need an initial margin to enter the interest-rate futures contract.

- Cash Settled Process: All interest rate futures contracts are cash-settled on both NSE and BSE.

After features, let’s move on to the next aspect of the advantages of interest rate futures.

Advantages of Interest Rate Futures

Here are some of the key advantages of interest rate futures for investors contracts –

Hedging Mechanism is Suitable

Interest rate futures are acknowledged as suitable hedging mechanisms for mitigating interest rate risks. If you are a borrower in this process, you can hedge your risk with the fluctuating interest rate futures. You can opt for opposite positions across these interest rate futures.

Transparent Trading

Interest rate futures trading is quite transparent on NSE and BSE.

Apart from the above advantages, IRF contracts are cash-settled. Their low transaction cost makes them accessible to all investor types.

Types of Interest Rate Futures

Interest rate futures are contracts allowing buyers and sellers to lock their interest rates on the underlying asset. These are of two key types – 1. Based on their maturity period, and 2. Based on their mode of settlement

Based on Their Maturity Period

These are of two types –

1. Short-term interest rate futures

These interest rate futures have a maturity deadline within a year from the date of execution of the contract.

2. Long-term interest rate futures

Long-term interest rate futures have maturity deadlines going beyond the scope of one year.

Based on Their Mode of Settlement

These are of two types –

1. Cash Settled

Interest rate futures contracts that are settled in cash.

2. Physically Delivered

Interest rate futures contracts are settled with the physical delivery of your underlying assets.

Impact of Interest Rate Futures on New-Age Investors

Let us now explore the impact of interest rate futures on modern investors. These futures offer them flexibility in effectively managing and hedging against the risks associated with fluctuating interest rates across the market.

- Mitigating Risks: By acquiring an opposite position in the IRF segment, new-age investors can offset their potential losses on their existing bonds. It means the interest rate futures function like a protective hedge against rising volatility even if the interest rate increases.

- Gauging Market Sentiment: A thorough market analysis could offer useful insights into market expectations regarding the changes foreseen in future interest rates. This helps new-age investors make informed decisions.

- Profit Potential: If an investor accurately predicts the direction of movement of their interest rate futures, she can gain profits by entering into interest rate future contracts.

- Accessing Leverages : Interest rate futures contracts facilitate leverage in futures and options. This means that investors could execute a larger positional control with relatively smaller capital. It is one key source of amplifying their potential gains from their holdings.

Conclusion

This comprehensive guide deals with the features and types of interest rate futures. Interest rate futures are future contracts where the underlying asset is a bond or interest bearing security. Investors ideally use these to hedge against unplanned interest rate fluctuations. These are crucial instruments for mitigating risks associated with interest rates. In a nutshell, interest rate futures contracts are ideal for safeguarding investment portfolios from market dynamics.

Related Articles

FAQs on What is Interest Rate Futures?

When interest rates decline, what happens to the price of the bond?

When the interest rate declines, the price of the bond tends to increase.

How To Find The Interest Rate Futures?

Interest rate futures can be found on the NSE and BSE platforms for investors and traders in India.

What are short-term interest rate futures?

Short term interest rate futures are those where the underlying interest bearing asset has a short term maturity, like 3-month Treasury bills.

What are the risks of trading interest rate futures?

Interest rate futures can be quite risky to trade. Some common risks are –

- Risks associated with changing interest rate

- Unexplained market fluctuations

- Risks associated with liquidity

- Operational risks and price swings

- Declining asset prices