- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Intraday Trading Tips for Beginners: Know Intraday Trading Rules & Strategies

By HDFC SKY | Updated at: Oct 17, 2025 02:51 PM IST

Intraday trading also known as day trading involves buying and selling stocks within the same trading day. To succeed in this fast-paced market, traders need effective intraday trading tips that focus on timing, analysis and discipline. These strategies help minimise risks and maximise returns during short-term market movements.

What is Intraday Trading?

Intraday trading also known as day trading involves buying and selling stocks or other financial instruments within the same trading day. Unlike long-term investing where assets are held for weeks, months or even years intraday traders aim to profit from short-term price fluctuations.

Intraday trading is best suited for individuals who can monitor the market continuously and react quickly to price changes.

10 Intraday Trading Tips

Successful intraday trading requires quick decision-making, discipline and effective strategies. Here are 10 essential tips to help you trade smarter and minimise risks

1. Create a Rule Book/Trading Plan

Have a rule book to trade in a disciplined way. Set your capital allocation, risk-reward ratios and entry-exit strategies in stone. Your plan should have specific capital allocation per trade (e.g., risking no more than 1-2% of total capital), acceptable risk-reward ratios, criteria for stock selection and precise entry and exit points. Discipline in strictly following your rules is paramount for consistent profit in intraday trading. A well-defined plan promotes discipline and reduces impulsive, emotional decisions.

2. Choose the Right Stocks

Choosing stocks that are liquid (ones with high turnover) helps you comfortably enter and exit within the trading day. Identify stocks with favourable conditional sector performance. Consider stocks that correlate with major indices (like Nifty 50 or Sensex) or belong to sectors currently showing strong trends. Day trading in illiquid stocks like penny stocks is not advisable since they can be manipulated and have low volatility. You don’t want to get stuck with them. Researching how to make profit in intraday stock trading involves finding stocks using technical analysis and stay on top of news or events that could impact price movement.

3. Trade in Limited Stocks

There are hundreds of stocks in the stock market. Ignore most of them and identify a few stocks that meet your criteria. Day trading is one investment space where diversifying could be a bad idea. It can be challenging to keep track of numerous positions in the fast-paced world of intraday trading. Focus on mastering the intraday behaviour of just 1-3 liquid stocks at a time. This allows for better focus, quicker analysis and more effective trade management.

4. Frame a Limit on Your Investments

Avoid putting too much capital in one trade by setting a maximum investment limit. This way, you don’t make volatile decisions, like doubling down on losing trades or investing more than you can lose. Effective risk management is the cornerstone of how to make money in intraday trading. Capital preservation allows you to be ready for the next profitable opportunity. Sticking to a strict capital allocation rule (like the 1-2% guideline mentioned in step 1) helps preserve your trading capital.

5. Maintain Strict Stop Losses

Setting stop-loss orders for every day trade, which would prevent you from losing more than a set amount of money if the price drops, is important. These tools exit trades automatically when prices reach specific targets, limiting the loss of your capital in the event of a sudden downtrend. Stop losses are important because they enforce discipline and take away the emotional pressure of deciding when to cut losses.

6. Define a Profit Target

Just as important as limiting losses is knowing when to take profits. Set realistic profit targets for each trade using either technical analysis or using your risk-to-reward ratios. Getting out of trades once your profit target is met locks in gains and avoids the risk of losing profits if the market suddenly reverses. Sticking to a profit target helps lock in gains and prevents greed from turning a winning trade into a losing one. This discipline is vital if you want to make profit in intraday trading.

7. Go With the Trend

While contrarian strategies exist, beginners should focus on trading with the prevailing intraday trend. Trading with the market trend gives you a greater chance of gaining in intraday trading. Employ technical indicators such as moving averages or trendlines to detect bullish or bearish patterns. Generally counter trades are higher risk and have lower odds of success.

8. Returns vs Risk

Before taking any trade, evaluate its risk/reward ratio. Risk-reward ratios such as 1:2 or 1:3 (risking ₹1 to potentially make ₹2 or ₹3) should be used to assess every trade opportunity in terms of what is good and what is an acceptable level of risk to take. That allows for planned moves to be more profitable in the long run, without risking too much for a low reward.

9. Don’t Trade on Emotion

Fear and greed are a trader’s worst enemies. Emotional trading based on fear, greed or impatience usually results in poor decision-making and financial losses. Rely on analysis, not emotion while day trading. Maintaining emotional neutrality is crucial for learning how to earn maximum profit in intraday trading consistently.

10. Pick The Correct Trading Platform

A reputable trading platform improves efficiency by providing sophisticated tools such as charting software, technical indicators and rapid execution speeds. Good brokerage firms like HDFC Sky offer a user-friendly interface, solid security options and real-time data, which are essential for successful intraday trading strategies.

Intraday Trading Rules

Here are some essential rules traders should follow to manage risk and improve success in intraday trading:

- Trade with a Plan: Always define entry, exit and stop-loss before placing a trade.

- Set Stop Losses: Limit potential losses by placing stop-loss orders on every trade.

- Avoid Overtrading: Stick to limited trades rather than chasing the market.

- Use Risk Management: Never risk more than 1–2% of your capital on a single trade.

- Follow the Trend: Trade in the direction of the market trend for higher probability.

- Pick Liquid Stocks: Focus on high-volume stocks for easy entry and exit.

- Stay Informed: Be updated with market news and events that may impact prices.

- Avoid Holding Positions Overnight: Close all positions before the market closes.

Intraday Trading Strategies

Below are some effective strategies traders use to make quick profits within the same trading day:

- Momentum Trading: Focuses on stocks showing strong price movement with high volume.

- Breakout Trading: Involves entering trades when the price breaks above resistance or below support.

- Reversal Trading: Identifies potential reversal points using indicators like RSI or MACD.

- Scalping: Makes multiple small profits from minor price changes throughout the day.

- Gap and Go Strategy: Trades stocks that open with a price gap due to news or earnings.

- Moving Average Crossover: Uses crossover of short-term and long-term moving averages to spot entry/exit signals.

Each strategy requires proper risk management and real-time analysis.

Conclusion

Learning how to intraday trading is a marathon, not a sprint. It requires developing a sound strategy, mastering risk management, maintaining strict discipline, controlling emotions and continuously learning from both wins and losses. While the potential for quick profit in intraday exists, the risks are substantial and most beginners lose money.

By diligently following the steps to make money in intraday trading outlined above, particularly focusing on capital preservation and risk control, traders can improve their chances of achieving consistency in the dynamic Indian market. Remember to start small, perhaps practice with paper trading and only trade with capital you can genuinely afford to lose.

Related Articles

FAQs on Intraday Trading Tips

Which indicators are useful in intraday trading?

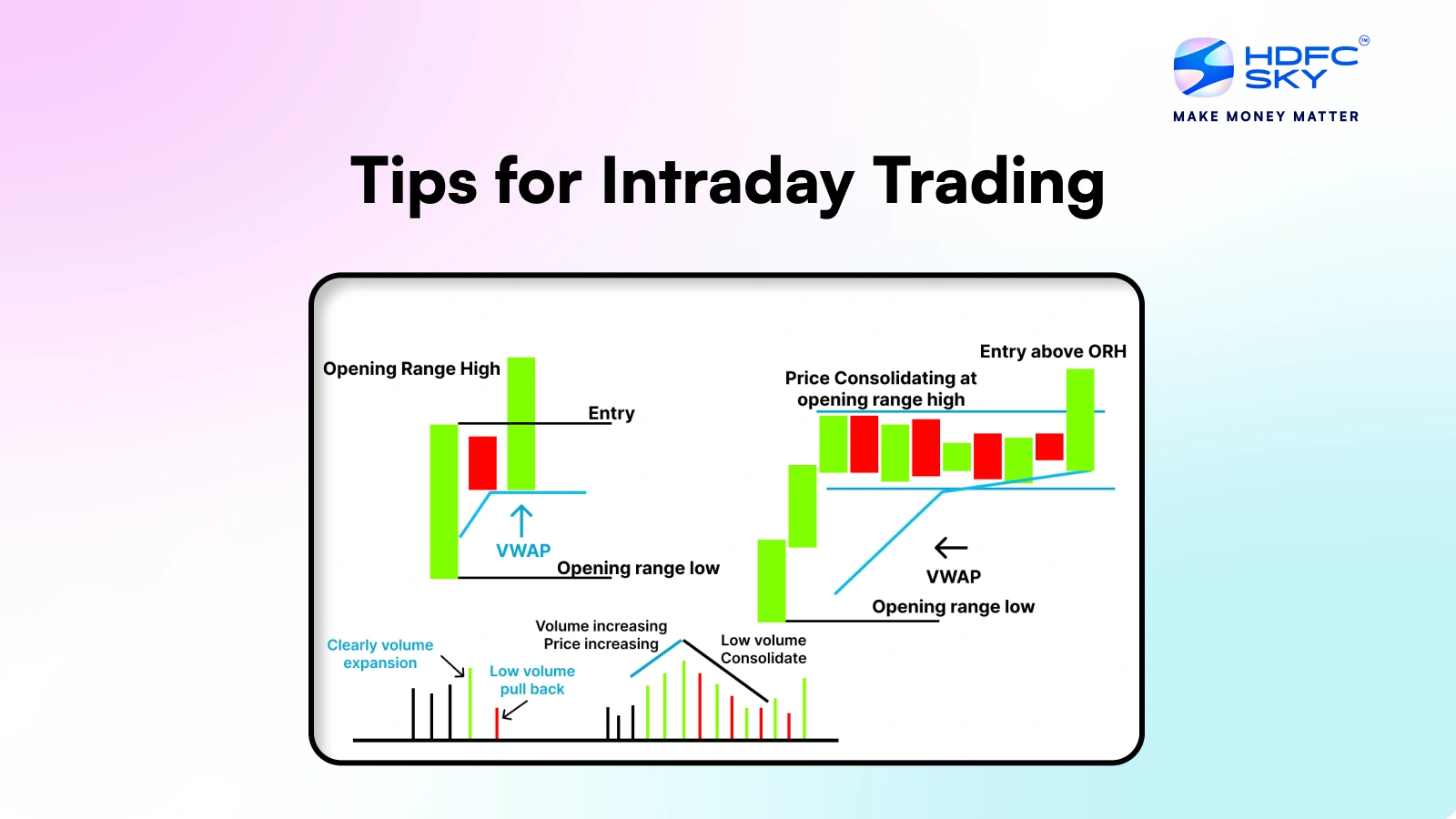

RSI, MACD, VWAP and Moving Averages are popular tools.

Can beginners do intraday trading?

Yes but it’s advised to start with paper trading or low capital while learning.

How do I make sure I’m choosing the right stocks for intraday trading?

When selecting the right stocks for intraday trading, liquidity, volatility, and trading volume should be your targets. Choose high-volume stocks to facilitate seamless entry and exit strategies. Use technical analysis to start recognising trends and patterns, then pay attention to news catalysts driving price-sensitive moves. Focus on stocks that have predictable behaviour concerning price.

Why should I be trading in limited stocks during intraday sessions?

Trading in limited stocks during intraday sessions allows you to stay focused and accurate in a fast-paced environment. A lesser number of stocks to track leads to better action in price, trends and entry-exit points. This decreases complexity, lowers the chances of mistakes and increases the chances of right decisions.

Which trading is suitable for beginners?

Trend-following trading is recommended for beginners as it requires someone to buy an asset when prices are increasing and sell when they are decreasing, based on the predictable trends of the markets. Another option is intraday trading where, with a momentum or breakout trading strategy, you could get profits from small price movements. If you are a beginner, start small and only buy liquid stocks.

Can I do intraday without margin?

Yes, you can do intraday trading without margin. Margin trading means that you are borrowing money from your broker to buy a larger position than you could otherwise afford.