- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Intraday vs Delivery Trading

By Ankur Chandra | Updated at: Jul 28, 2025 12:50 PM IST

Summary

Intraday vs Delivery Trading – Key Differences Explained | HDFC SKY Learn

- Definition & Timeframe:

- Intraday Trading: Buying and selling stocks on the same trading day.

- Delivery Trading: Buying stocks and holding them beyond the same day for short or long-term investment.

- Capital Requirements:

- Intraday: Lower capital is needed due to leverage/margin provided by brokers.

- Delivery: Requires full capital as shares are held in a Demat account.

- Risk Profile:

- Intraday: High risk due to market volatility and time-bound trades.

- Delivery: Lower short-term risk, suitable for long-term wealth creation.

- Ownership:

- Intraday: No share ownership; trades squared off within the day.

- Delivery: Shares are transferred to the investor’s Demat account.

- Brokerage & Charges:

- Intraday: Lower brokerage but higher transaction frequency.

- Delivery: Higher brokerage per trade but fewer transactions.

- Market Monitoring:

- Intraday: Requires continuous real-time monitoring and technical analysis.

- Delivery: Less intensive monitoring, driven more by fundamentals.

- Suitability:

- Intraday: Ideal for experienced traders seeking quick profits.

- Delivery: Best for long-term investors with a lower risk appetite.

- Taxation:

- Intraday: Profits taxed as business income.

- Delivery: Gains taxed as capital gains (short or long term).

Intraday and delivery trading are two of the most popular ways to trade in the stock market. You need to know that both have their share of pros and cons, and they work for different types of traders. The main difference between delivery and intraday trading depends on the duration for which you want to keep your stocks.

In intraday trading, buying and selling of the stocks is done on the same day. It’s a short-term strategy. In this case, you try to make quick profits by making the most of small price changes during the day.

In delivery trading, you buy stocks and hold them for a longer time. These stocks go into your Demat account, and you can keep them for days, months, or even years to make a more significant profit on your investment.

When you compare intraday vs delivery trading, intraday is like a quick game where speed matters, while delivery trading is more like planting a tree and waiting for it to grow. The choice between delivery vs intraday depends on whether you want fast returns or are happy to wait and watch your money grow!

What is Intraday Trading?

So, what is Intraday trading, and how does it work? Intraday trading, also known as day trading, is all about traders buying and selling stocks on the same day, which means trading during market hours. The goal of this type of trading is to profit from short-term price movements. Traders start by selecting a stock and setting a target price. If the stock reaches the target, they sell it for a profit. They sell it before the market closes to control the losses.

Is intraday trading risky? For this, you need to know that it’s a fast-paced strategy, and the risk factor depends on your careful planning and constant market monitoring.

How Intraday Trading Works?

- Stock Selection: First, they pick liquid stocks—the ones with high trading volume tons of buying and selling. Why? Because the more liquid a stock is, the easier (and faster) it is to jump in or out of a trade. Speed is key in intraday trading when you’re chasing those quick profits.

- Market Analysis: Here’s the trick: instead of worrying about a company’s performance (like in delivery trading), intraday traders focus on price charts and patterns. They use tools like moving averages, RSI, and other fancy indicators to guess which way the price will go. It’s all about trends and signals, not fundamentals.

- Execution: Last but not least, execution. Whatever stocks you are buying during the day must be sold before the market closes. You’re in and out fast.

Advantages of Intraday Trading

What are the advantages of intraday trading over delivery? Let’s have a look!

- Margin: Brokers let you use margin trading, which means they lend you extra money to buy more shares than your own cash allows. This boosts your potential profits since you’re trading with more money. But watch out it also increases the risk of losses if the trade goes south. It’s a double-edged sword!

- Daily Profit Potential: Stock prices move up and down throughout the day, and intraday traders can take advantage of these swings to make quick profits. You don’t need to wait weeks or months for returns like in delivery trading.

Disadvantages of Intraday Trading

While intraday trading has its advantages, you should also know about the risks and downsides. Let’s have a quick look.

- High Risk: Intraday trading is super unpredictable because stock prices can change fast within a single day. This high volatility means big risks.

- Stress: Intraday trading can get really stressful. Prices keep changing all day, so you have to be glued to your screen to act quickly.

What is Delivery Trading

Unlike intraday trading, delivery trading is all about buying stocks and holding them for a longer period. Once you buy the stocks, they’re moved to your demat account, and you can keep them for as long as you want days, months, or even years. You fully own these stocks until you decide to sell them.

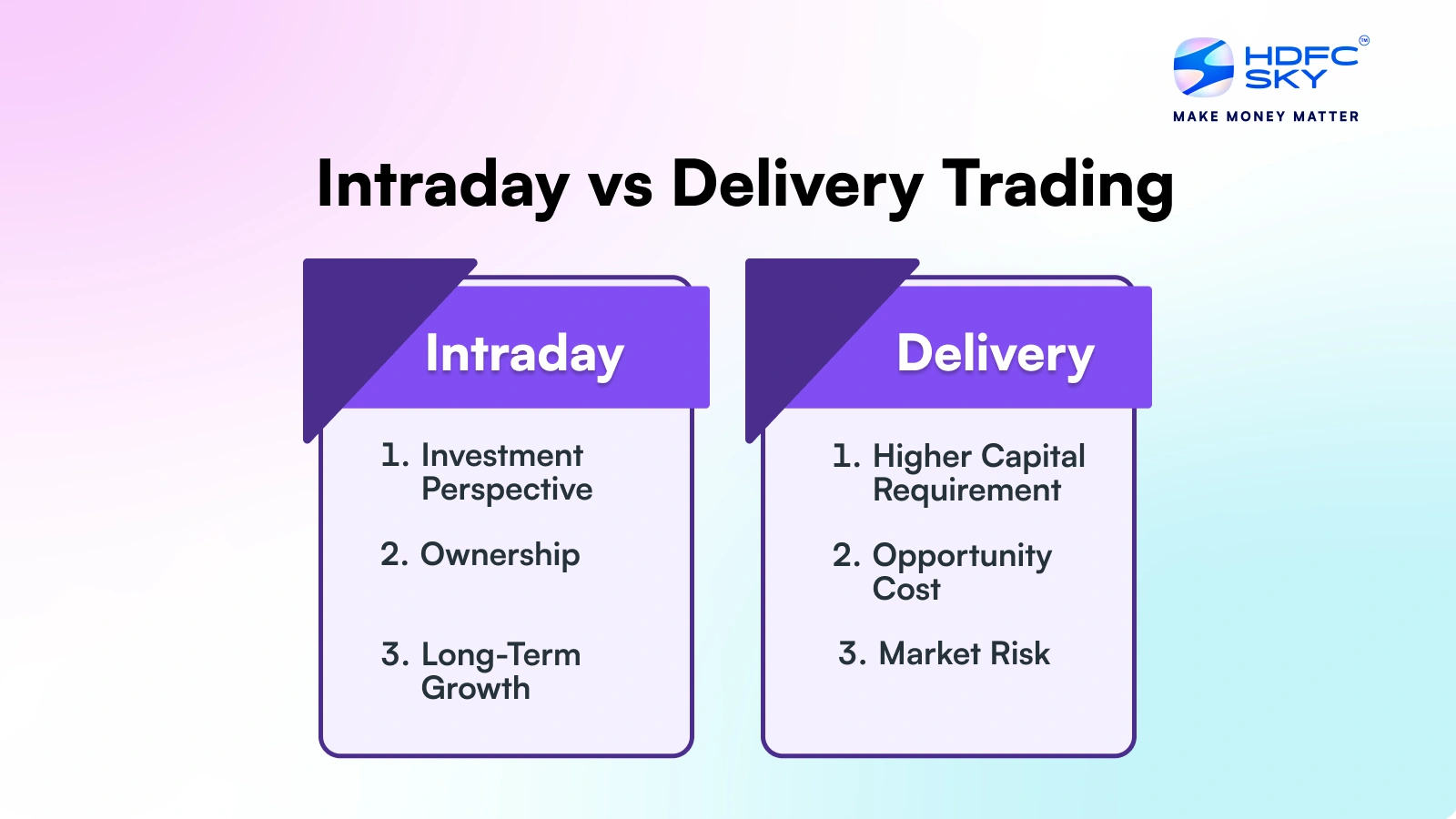

Advantages of Delivery Trading

- Investment Perspective: You hold the stocks for weeks, months, or years and make money as the company grows. This can give you profits through diverse ways. You can make money through the stock’s potential price increase or even regular payouts like dividends.

- Ownership: Once you buy the stocks, they’re stored in your demat account (an electronic record). You can sell them whenever you want or hold onto them as long as you like.

- Long-Term Growth: When you invest in stocks, you’re basically betting on companies that have the potential to grow.

- Here’s the bonus: many companies share their profits with investors in the form of dividends. So, even if the stock price doesn’t change much in the short term, you still earn regular payouts.

Disadvantages of Delivery Trading

Now that we know of the advantages of delivery trading, let’s also look at some of its downfalls.

- Higher Capital Requirement: In delivery trading, you need to pay for the full value of the shares upfront. This means you need more money to get started, which can be a lot compared to intraday trading, where you only need a smaller amount to trade.

- Opportunity Cost: When you lock money into delivery trading, you’re missing out on other potential investments.

- Market Risk: Even though delivery trading is a long-term strategy, you’re still exposed to market risks. Events like economic downturns, political instability, or company-specific issues can result in stock prices dropping.

- Portfolio Management: A delivery trading portfolio requires active portfolio management. In addition, a long-term strategy is needed where there is tracking of market trends, company performances, and global events.

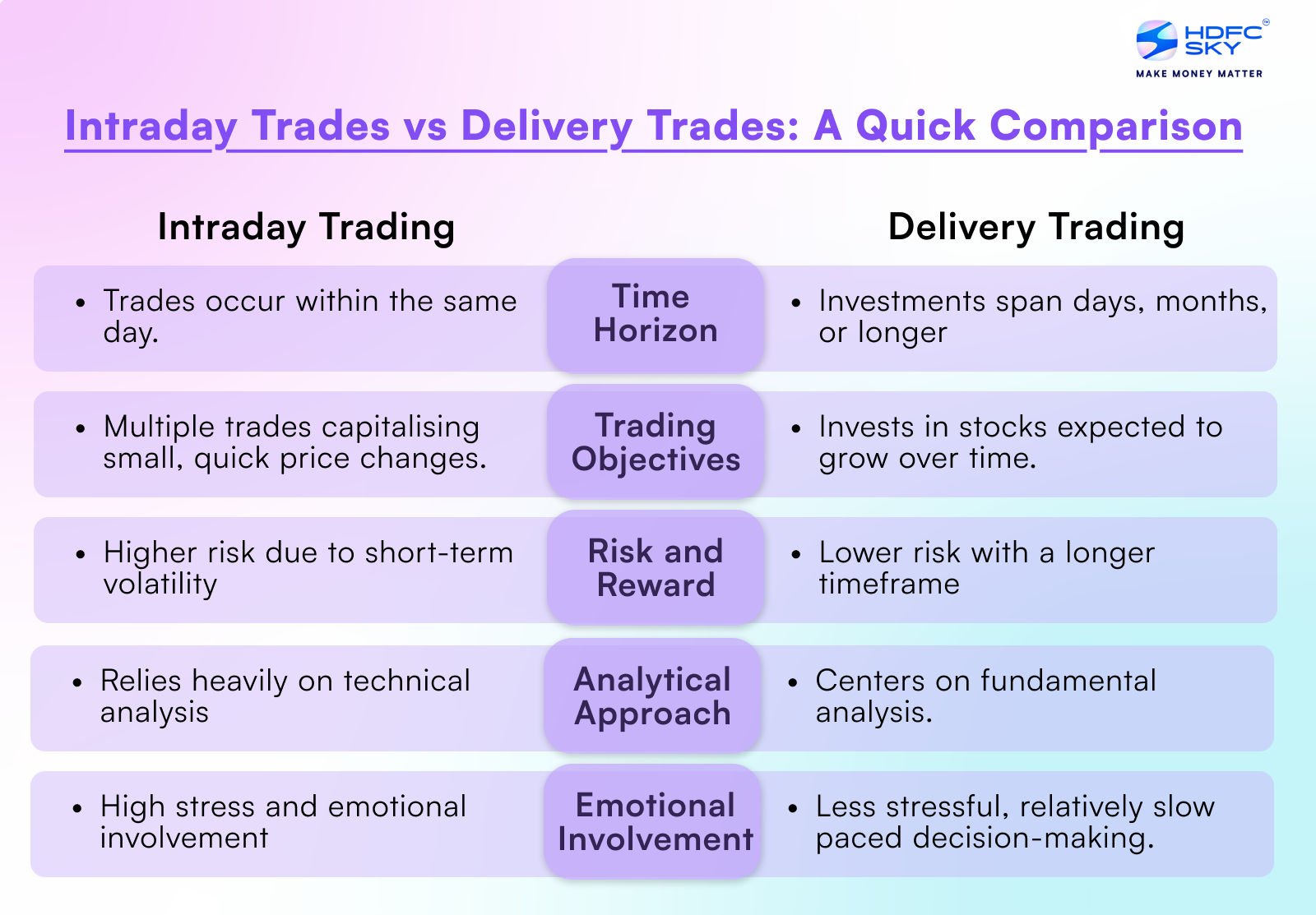

Intraday Trades vs Delivery Trades

Following are the difference between delivery and intraday trading

| Aspect | Intraday Trading | Delivery Trading |

| Time horizon | These trades happen on the same trading day. The trader intends to make a quick profit on a stock during short-term fluctuations and completes his deal by the end of that day. | Delivery trades are trades for extended periods, such as days or months, with the goal of fundamental value changes or long-term market trends. |

| Trading objectives | Traders aim for several trades on a particular date to profit quicker from small price fluctuations. | Its objective is to invest in stocks that are expected to appreciate value over long-term growth prospects and value investing strategies. |

| Risk and reward | This approaches a higher risk rate due to volatility within short periods. Quick profits may be prompted; however, the trader stands a higher chance of losing due to rapid price fluctuations. | Delivery trading is generally less risky, as one has more time to react to market changes. The reward is relatively slow but has extended potential, depending on the time horizon, such as long-term investment gains and dividend yield. |

| Analytical approach | Most intraday traders make their trades based on technical analysis, including price charts, indicators, and pattern analyses to predict the short-term movements in the stock. Therefore, the trader concentrates on short-term immediate market activities instead of fundamental analysis. | Investors focus on the fundamentals, examining a company’s financial health, industry position, and prospects. Some technical analysis might be involved, but only to understand the stock’s intrinsic value. |

| Emotional involvement | Intraday trades require more emotional involvement because quick reactions are imperative for the trader. High stress levels are generated as traders are constantly pressured to make speedy decisions. | Delivery trades are more straightforward regarding emotions. The investor has a more extended timeframe to decide about the trade and can ride out market movements, allowing for calmer and more strategic decisions. |

How Should your Approach Differ for Intraday and Delivery Trades?

To make the decision intraday vs delivery trading depends completely on your interests, comfort with risk, and market expertise.

Intraday Trading Strategy

Following are some of the best strategies to excel in intraday trading.

- Implement Stop-Loss Orders: Set a stop-loss order. In case the market does not go as planned, the stop-loss will automatically trade your stock at a pre-set price. This will protect your capital and ensure minimised losses.

- Make Use of Technical Indicators: Traders use tools like moving averages, RSI, and MACD. With these tools you can make quick, informed decisions without wasting time.

- Observation of the Market: Staying alert and monitoring the market is very important. Prices can change in seconds, so keep an eye on live data, news, and global events to catch trading opportunities.

- Quick Decisions: Intraday trading requires quick thinking. The quicker you can analyse and respond to signals, the better your chances of making a profit.

- Control Emotional Response: Emotions can mess with your trading. Price changes during the day can cause fear or excitement, but staying calm and sticking to your strategy is key to avoiding impulsive decisions and unnecessary losses.

Delivery Trading Strategy

If you are looking for smart strategies for delivery trading, then the following points are sure to come to your rescue.

- Look at the Basics

Before you invest, check how healthy a company is financially, who’s running it, and if it has good growth potential. Companies with strong fundamentals are more likely to give steady returns over time. - Diversify Your Investments

Don’t put all your money in one place. Spread it across different industries or sectors. This way, if one sector isn’t doing well, the others might make up for it. Diversification helps reduce risk. - Think Long-Term

Delivery trading isn’t about quick wins. You should focus on steady growth over a long period, like months or years. Don’t get caught up in short-term price changes. - Take Your Time

Before making any decisions, research the companies you’re interested in. Make sure they match your long-term goals. Don’t rush take your time to make thoughtful choices. - Be Patient

Patience is key. Don’t sell your stocks just because the market are down. gets crazy. Stick to your plan and wait for the right time to see your investment grow.

Conclusion

What is intraday trading and how does it work? Essentially, it involves taking advantage of short-term price movements. If done well, it can lead to profits, but the market can quickly turn, leading to fast losses if you’re not careful. On the other hand, delivery trading is more suited to those who prefer long-term growth and stability. You buy stocks and hold them for a longer period, benefiting from the company’s growth and dividends. How to make profits in intraday vs delivery trading depends on timing, strategy, and market analysis.

Related Articles

FAQs on Intraday vs Delivery Trading

What is better, intraday or delivery trading?

It depends on your goals and how much risk you’re comfortable with. Intraday trading can give quick profits but comes with higher risk because of market ups and downs. On the other hand, delivery trading is safer and focuses on long-term growth, making it a good choice if you’re aiming for stable returns over time.

Which indicator is suitable for intraday trading?

Popular intraday indicators include Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI). These tools help traders figure out price trends and predict market moves by analyzing past price data. They also provide clear buy or sell signals to make smarter trading decisions.

Are intraday charges less than delivery trading?

Yes, intraday trading charges are usually lower since stocks aren’t transferred to a demat account. However, if you trade frequently in intraday, those charges can add up. It’s smart to keep these costs in mind when planning your trades.

When to choose intraday over delivery trading?

Go for intraday trading if you’re good at technical analysis, can monitor the market closely, and want quick, short-term profits. It works well for active traders who like making decisions multiple times a day. Delivery trading is better if you prefer long-term, stable growth and a more relaxed approach.