- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

iValue Infosolutions IPO

₹14,200/50 shares

Minimum Investment

IPO Details

18 Sep 25

22 Sep 25

₹14,200

50

₹284 to ₹299

NSE, BSE

₹560.29 Cr

25 Sep 25

iValue Infosolutions IPO Timeline

Bidding Start

18 Sep 25

Bidding Ends

22 Sep 25

Allotment Finalisation

23 Sep 25

Refund Initiation

24 Sep 25

Demat Transfer

24 Sep 25

Listing

25 Sep 25

iValue Infosolutions Limited

Founded in 2008, iValue Infosolutions Limited is a technology services and solutions provider focused on enterprise digital transformation. Headquartered in Bangalore, with eight offices across India and international presence in Singapore, Bangladesh, Sri Lanka, UAE, Cambodia, and Kenya, it caters to diverse markets. The company delivers customised solutions for securing and managing digital applications and data, working closely with System Integrators and OEMs. Its business spans cybersecurity, information lifecycle management, data centre and application lifecycle infrastructure, cloud services, and other OEM-supported, customer-specific solutions.

iValue Infosolutions Limited IPO Overview

iValue Infosolutions IPO is a book-built issue worth ₹560.29 crore, consisting entirely of an offer for sale of 1.87 crore shares. The IPO will open for subscription on 18 September 2025 and close on 22 September 2025, with allotment expected on 23 September 2025. The shares are proposed to list on both BSE and NSE, with a tentative listing date of 25 September 2025. The price band is set at ₹284 to ₹299 per share, with a lot size of 50 shares. Retail investors can apply with a minimum investment of ₹14,950, while the sNII and bNII categories require investments of ₹2,09,300 and ₹10,01,650 respectively. IIFL Capital Services Ltd. is acting as the book-running lead manager, and Kfin Technologies Ltd. is the registrar for the issue.

iValue Infosolutions Limited IPO Details

| Particulars | Details |

| IPO Date | 18 September 2025 to 22 September 2025 |

| Listing Date | 25 September 2025 |

| Face Value | ₹2 per share |

| Issue Price Band | ₹284 to ₹299 per share |

| Lot Size | 50 Shares |

| Total Issue Size | 1,87,38,958 shares (aggregating up to ₹560.29 Cr) |

| Fresh Issue | NA (Entirely OFS) |

| Offer for Sale | 1,87,38,958 shares (aggregating up to ₹560.29 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 5,35,39,880 shares |

| Share Holding Post Issue | 5,35,39,880 shares |

IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Offer |

| Retail | Not less than 35% of the Offer |

| NII (HNI) | Not less than 15% of the Offer |

IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 50 | ₹14,950 |

| Retail (Max) | 13 | 650 | ₹1,94,350 |

| S-HNI (Min) | 14 | 700 | ₹2,09,300 |

| S-HNI (Max) | 66 | 3,300 | ₹9,86,700 |

| B-HNI (Min) | 67 | 3,350 | ₹10,01,650 |

IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 39.92% |

| Post-Issue | 32.73% |

iValue Infosolutions Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹15.93 |

| Price/Earnings (P/E) Ratio | 18.77x |

| Return on Net Worth (RoNW) | 22.02% |

| Net Asset Value (NAV) | ₹75.77 |

| Return on Equity | 21.13% |

| Return on Capital Employed (ROCE) | 28.98% |

| EBITDA Margin | — |

| PAT Margin | 8.87% |

| Debt to Equity Ratio | — |

Objectives of the Proceeds

- Entire issue is an Offer for Sale; company will not receive proceeds.

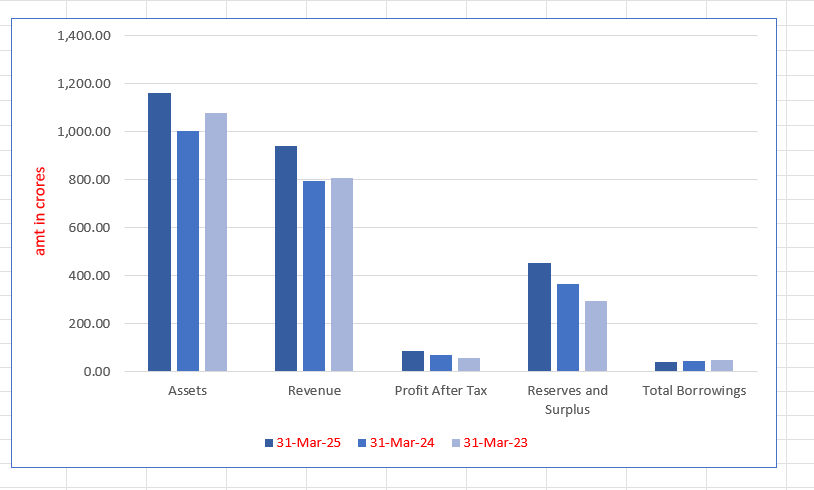

Key Financials (in ₹ Crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,162.67 | 1,004.25 | 1,080.19 |

| Revenue | 942.35 | 795.18 | 805.79 |

| Profit After Tax | 85.30 | 70.57 | 59.92 |

| Reserves and Surplus | 452.36 | 364.77 | 294.24 |

| Total Borrowings | 42.45 | 45.19 | 50.48 |

SWOT Analysis of iValue Infosolutions IPO

Strength and Opportunities

- Strong presence in India and international technology services markets.

- Multi-OEM solutions portfolio supports enterprise digital transformation

- Expanding System Integrator network with high client retention

- Experienced leadership and skilled workforce with domain expertise

Risks and Threats

- High reliance on OEM partnerships may impact business independence.

- Intense competition in cybersecurity and cloud services sector

- Rapid technological changes may reduce relevance of offerings

- Geopolitical risks may affect overseas operations and growth plans

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About iValue Infosolutions Limited

iValue Infosolutions IPO Strengths

- Positioned uniquely in the fast-growing technology and digital transformation services sector across multiple regions.

- Offers comprehensive multi-OEM portfolio, making it a preferred enterprise technology advisor.

- Trusted partner for OEMs in India, with growing and strong relationships.

- Broad System Integrator network, generating repeat business and long-term collaborations.

- Experienced leadership team with a well-trained, skilled workforce and effective talent programs.

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) |

| iValue Infosolutions Limited | 13.27 | 13.27 | 60.26 | TBD | 22.02 |

| Peer Group | |||||

| Exclusive Netwroks SA | 43.9 | 43.9 | 979.19 | 4.5 | 2.21 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On iValue Infosolutions Limited IPO

How can I apply for iValue Infosolutions Limited IPO?

You can apply for the IPO online through HDFC SKY using UPI-based ASBA facility.

What is the minimum investment required in iValue Infosolutions IPO?

Retail investors must invest at least ₹14,950 for one lot of 50 shares.

When will the allotment for iValue Infosolutions IPO be finalised?

The allotment for the IPO is expected to be finalised on 23 September 2025.

On which exchanges will iValue Infosolutions IPO be listed?

The equity shares of iValue Infosolutions will be listed on both NSE and BSE.