- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Jain Resource Recycling IPO

₹14,080/64 shares

Minimum Investment

IPO Details

24 Sep 25

26 Sep 25

₹14,080

64

₹220 to ₹232

NSE, BSE

₹231.66 Cr

01 Oct 25

Jain Resource Recycling IPO Timeline

Bidding Start

24 Sep 25

Bidding Ends

26 Sep 25

Allotment Finalisation

29 Sep 25

Refund Initiation

30 Sep 25

Demat Transfer

30 Sep 25

Listing

01 Oct 25

Jain Resource Recycling Limited

Jain Resource Recycling Limited, with a legacy of over seventy years, is a pioneer in India’s non-ferrous metal recycling and production sector. Recognised as the largest and fastest-growing business in this field for Fiscal 2022, 2023, and 2024 (CRISIL), the group’s success stems from its advanced infrastructure, multi-product recycling capabilities at a single location, and a vast global sourcing network. Established initially as Jain Metal Rolling Mills in 1953, it became a private limited company in 2022. Its product range includes lead, copper, and aluminium ingots, with its lead ingot brand registered by the London Metal Exchange, enhancing its global market reach.

Jain Resource Recycling Limited IPO Overview

Jain Resource Recycling IPO is a book-built issue worth ₹1,250.00 crores, comprising a fresh issue of 2.16 crore shares aggregating to ₹500.00 crores and an offer for sale of 3.23 crore shares aggregating to ₹750.00 crores. The IPO opens for subscription on September 24, 2025, and closes on September 26, 2025, with the allotment expected to be finalized by September 29, 2025. Jain Resource Recycling shares are set to list on BSE and NSE, with a tentative listing date of October 1, 2025.

The IPO price band is fixed between ₹220.00 and ₹232.00 per share, with a lot size of 64 shares. For retail investors, the minimum investment required is ₹14,848, based on the upper price band. For non-institutional investors, the lot size is 14 lots (896 shares), amounting to ₹2,07,872, while for qualified institutional buyers, it is 68 lots (4,352 shares), amounting to ₹10,09,664. Dam Capital Advisors Ltd. is acting as the book-running lead manager, and Kfin Technologies Ltd. is the registrar for the issue.

Jain Resource Recycling Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 2,15,51,724 shares (aggregating up to ₹500.00 Cr)

Offer for Sale (OFS): 3,23,27,586 shares of ₹2 (aggregating up to ₹750.00 Cr) |

| IPO Dates | 24 September 2025 to 26 September 2025 |

| Price Bands | ₹220 to ₹232 per share |

| Lot Size | 64 Shares |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 32,35,34,090 shares |

| Shareholding post -issue | 34,50,85,814 shares |

Jain Resource Recycling IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 64 | ₹14,848 |

| Retail (Max) | 13 | 832 | ₹1,93,024 |

| S-HNI (Min) | 14 | 896 | ₹2,07,872 |

| S-HNI (Max) | 67 | 4,288 | ₹9,94,816 |

| B-HNI (Min) | 68 | 4,352 | ₹10,09,664 |

Jain Resource Recycling Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Jain Resource Recycling Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 5.29 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 58.08% |

| Net Asset Value (NAV) | 11.35 |

| Return on Equity | 57.66% |

| Return on Capital Employed (ROCE) | 19.13% |

| EBITDA Margin | 5.13% |

| PAT Margin | 3.70% |

| Debt to Equity Ratio | 1.65 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Pre-payment or scheduled re-payment of a portion of certain outstanding borrowings availed by the company | 3750 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

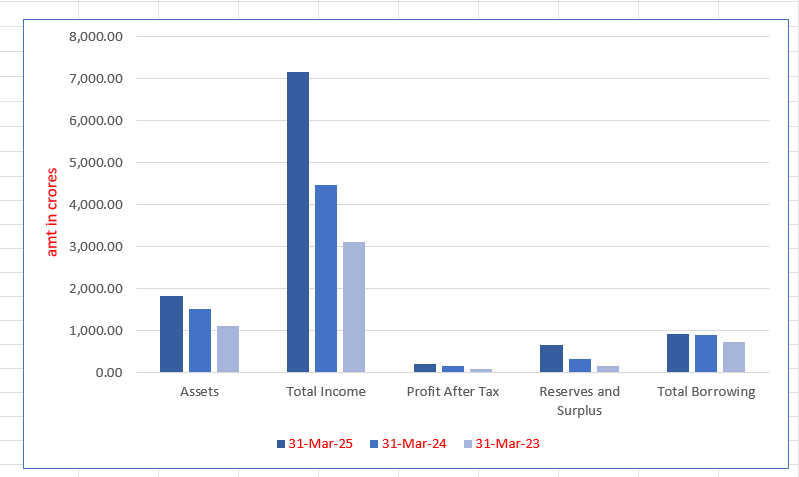

Jain Resource Recycling Limited Financials (in crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,836.24 | 1,528.76 | 1,115.96 |

| Total Income | 7,162.15 | 4,484.84 | 3,107.53 |

| Profit After Tax | 223.29 | 163.83 | 91.81 |

| Reserves and Surplus | 660.01 | 328.13 | 161.30 |

| Total Borrowing | 919.92 | 909.38 | 732.79 |

Financial Status of Jain Resource Recycling Limited

SWOT Analysis of Jain Resource Recycling IPO

Strength and Opportunities

- Over 70 years of experience in non-ferrous metal recycling, establishing a strong industry presence.

- Recognized as India's largest producer of recycled lead ingots, with an annual production exceeding 150,000 tons.

- Diversified product portfolio, including lead, copper, and aluminum alloys, catering to various industries.

- Investment in advanced technologies, such as automated scrap processing and clean recycling methods, enhancing efficiency and environmental compliance.

- Strong global sourcing network, procuring scrap from over 60 countries, ensuring consistent raw material supply.

- Products exported to over 20 countries, expanding market reach and brand recognition.

- Commitment to sustainability, achieving zero landfill impact through comprehensive recycling processes.

- ISO certifications across all plants, ensuring quality management and environmental standards.

- Recognition by the London Metal Exchange for its refined lead ingots, enhancing credibility and marketability.

Risks and Threats

- Operating in a highly fragmented and low-margin industry, with operating margins ranging between 2.5% and 5.6%.

- Exposure to intense competition and fluctuations in foreign exchange rates, affecting profitability.

- Dependence on international markets for a significant portion of revenue, making it susceptible to global market dynamics.

- Stringent environmental regulations and potential changes in government policies pose operational risks.

- Vulnerability to changes in import-export policies and international trade regulations.

- Potential challenges in scaling operations due to infrastructure constraints or regulatory approvals.

- Reliance on specific industries, such as battery manufacturing, may lead to demand fluctuations.

- High working capital requirements, with bank limit utilization averaging around 79%..

- Exposure to risks associated with environmental activism and public scrutiny.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Jain Resource Recycling Limited

Jain Resource Recycling Limited IPO Strengths

Track Record of Profitability and Consistent Financial Performance in an Industry with Significant Entry Barriers

Jain Resource Recycling Limited, part of the Jain Metal Group, has demonstrated a robust track record of profitability and financial consistency over seven decades. With strong revenue growth, efficient operations, conservative debt policy, and industry leadership, the Company thrives in a sector defined by high regulatory and operational entry barriers.

Strategically Located Recycling Facilities with Capabilities to Handle Multiple Product Lines

Jain Resource Recycling Limited operates three strategically located recycling facilities in Gummidipoondi, Chennai, spread across 26.94 acres of leased land. These integrated units enable cross-facility use of by-products, efficient logistics via proximity to key ports, and cost-effective operations across specialised metal product lines—lead, copper, and aluminium—backed by advanced technology, robust infrastructure, and global market reach.

Strong Customer Base with Global Footprint and Deep Sourcing Capabilities

Jain Resource Recycling Limited has a robust international presence, exporting to over 20 countries including Singapore, China, Japan, and South Korea. With 342 customers in FY24 and 85% revenue from repeat clients, the company maintains strong customer retention. Its global sourcing network spans 120+ countries, ensuring efficient procurement and operational sustainability.

Application of Hedging Mechanism for Commodity Price Risk Protection for Products

Jain Resource Recycling Limited actively mitigates commodity price risks by employing hedging strategies through futures contracts on the London Metal Exchange (LME). This metals-focused approach safeguards profitability against base metal price volatility, ensuring cost coverage, financial stability, and operational flexibility while enhancing global competitiveness and product marketability.

Experienced Leadership and Skilled Industry Professionals Driving Growth

Jain Resource Recycling Limited is guided by an experienced leadership team, including Kamlesh Jain, Mayank Pareek, and Hemant Shantilal Jain, supported by qualified professionals across key business functions. Their deep industry knowledge and strategic expertise strengthen operations, enabling sustainable growth and positioning the company for future market opportunities.

More About Jain Resource Recycling Limited

With a rich legacy spanning over seven decades, Jain Resource Recycling Limited, a part of the Jain Metal Group, stands as India’s largest and fastest-growing non-ferrous metal recycling company by revenue in Fiscals 2022, 2023, and 2024 (Source: CRISIL).

Company Evolution

- Established in 1953 as Jain Metal Rolling Mills, a partnership firm.

- Reconstituted in 1993 and converted into a private limited company on February 25, 2022.

- Began recycling operations in FY2013 under the erstwhile firm.

Core Operations

The company focuses on manufacturing non-ferrous metal products through recycling, with a robust portfolio comprising:

- Lead and lead alloy ingots

- Copper and copper ingots

- Aluminium and aluminium alloys

Jain Resource Recycling is one of only two Indian recyclers with lead ingots registered as a brand on the London Metal Exchange (LME), granting access to global markets with LME pricing advantages.

Global Expansion & Subsidiary

- Acquired 70% in Jain Ikon Global Ventures (FZC), UAE, in partnership with Ikon Square Limited.

- Commissioned a gold refining facility at Sharjah in August 2024.

Vertically Integrated Recycling Facilities

The company operates three facilities in Chennai and one gold refinery in Sharjah:

- Facility 1: Copper scrap recycling

- Facility 2: Lead and copper scrap recycling

- Facility 3 (via subsidiary JGTPL): Aluminium scrap recycling

- Sharjah Refining Facility: Gold refining

Combined recycling capacity as of January 31, 2025:

- 136,082 MTPA for recycling

- 0.458 MTPA for gold refining

Market Presence and Clientele

- Sourced raw materials from over 120 countries.

- Key customers include Vedanta Limited, Luminous Power, Yash Resources, Mitsubishi Corporation, and Nissan Trading.

- Export revenue share: Over 50% consistently in recent fiscals.

Revenue Overview

- Strong presence in both domestic and international markets

- Export revenues contributed between 50% to 72% of total revenues across recent fiscals

- Sales are spread across key geographies including Singapore, China, Japan, South Korea, and Taiwan

Industry Outlook

India’s non-ferrous metal recycling industry is experiencing significant growth, driven by sustainability initiatives, industrial expansion, and supportive government policies. Companies like Jain Resource Recycling Limited are well-positioned to capitalize on these trends.

Market Size & Growth Prospects

- Asia Pacific Market: The non-ferrous scrap recycling market in the Asia Pacific region generated a revenue of USD 307.5 billion in 2023 and is expected to grow at a CAGR of 4.8% from 2024 to 2030. India is projected to register the highest CAGR during this period.

- India’s Metal Recycling Equipment Market: Expected to reach USD 808.4 million by 2030, growing at a CAGR of 5.6% from 2025 to 2030.

Key Growth Drivers

- Urbanization & Infrastructure Development: Rapid urbanization and infrastructure projects are increasing the demand for recycled metals in construction.

- Automotive & Electronics Demand: The rise in electric vehicles and electronic devices boosts the need for recycled non-ferrous metals like copper and aluminum.

- Environmental Regulations: Government policies promoting recycling and sustainability are encouraging the use of recycled materials.

- Technological Advancements: Innovations in recycling processes, such as advanced sorting technologies, enhance efficiency and metal recovery rates.

Product-Specific Outlook

- Lead: Lead was the largest revenue-generating metal in the Asia Pacific non-ferrous scrap recycling market in 2023 and is projected to register the fastest growth during the forecast period.

- Copper: India’s per capita consumption of copper is anticipated to rise from 0.6 kg to 1.0 kg by 2025, driven by advancements in energy transition and adoption of electric vehicles.

- Aluminum: Recycling aluminum saves up to 95% of the energy required to produce primary aluminum, making it a cost-effective and environmentally friendly option.

How Will Jain Resource Recycling Limited Benefit

- Positioned to benefit from India’s rapidly expanding non-ferrous metal recycling market, projected to grow significantly by 2030.

- Strong alignment with rising demand in lead, copper, and aluminum—metals expected to see fastest growth in Asia Pacific.

- Its LME-registered lead ingots enable premium pricing and global market penetration.

- Export-focused model aligns with increasing global recycling demand, with over 50% revenue from exports.

- Technologically integrated facilities across Chennai and Sharjah boost operational efficiency and scalability.

- Presence in over 120 sourcing countries ensures supply security amid rising raw material demand.

- Rising copper consumption in India, especially for EVs and infrastructure, supports higher domestic sales.

- Gold refining expansion in UAE broadens revenue streams and capitalises on precious metals market.

- Strong client base including global players like Mitsubishi and Nissan Trading enhances credibility and demand stability.

- Backed by a 70-year legacy and continuous evolution, making it resilient in a competitive, regulation-driven market.

Peer Group Comparison

| Name of Company | Revenue (₹ million) | Face Value (₹) | EPS Basic (₹) | EPS Diluted (₹) | NAV (₹) | P/E Ratio | RoNW (%) |

| Jain Resource Recycling Limited | 44,284.18 | NA | 5.29 | 4.70 | 11.35 | NA | 58.08 |

| Peer Groups | |||||||

| Gravita India Limited | 31,607.50 | 2 | 34.88 | 34.88 | 114.07 | 49.40 | 35.51 |

| Pondy Oxides & Chemicals Limited | 15,405.97 | 5 | 13.61 | 13.57 | 133.26 | 41.44 | 10.62 |

Key Strategies for Jain Resource Recycling Limited

Global Expansion of Gold Refining Operations

Jain Resource Recycling Limited is scaling gold refining operations globally, including UAE and India, to strengthen its market presence. Leveraging ISL’s sourcing network and their own industry expertise, the company targets increased production capacity and customer reach through strategic partnerships and advanced refining infrastructure.

Strengthening Gold Refining Presence in India

To capitalise on India’s rising gold refining demand, Jain Resource Recycling Limited plans to enter the domestic market. By partnering with capable local refineries, the company aims to achieve operational efficiency, reduce import costs, and benefit from favourable duty structures and growing customer demand.

Diversification into Heavy Minerals Sector

Jain Resource Recycling Limited is diversifying into heavy minerals by establishing mining and processing units in Sri Lanka. Through strategic agreements and exploration licences, the company aims to extract and process Ilmenite, Garnet, Rutile, and Zircon, targeting high-demand global industries like construction, aerospace, and electronics.

Establishing Titanium Slag Plant in Sri Lanka

As part of its diversification strategy, Jain Resource Recycling Limited is setting up a Titanium Slag Plant in Sri Lanka. The project involves a heavy mineral separation unit with advanced equipment, enabling the company to tap into global titanium dioxide markets and meet specialised industrial requirements

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs on Jain Resource Recycling Limited IPO

How can I apply for Jain Resource Recycling Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of Jain Resource Recycling's IPO?

The IPO aims to raise ₹1250 crore, comprising a ₹500 crore fresh issue and ₹750 crore offer for sale.

Who are the main selling shareholders in the IPO?

Promoter Kamlesh Jain will sell shares worth ₹1,430 crore; Mayank Pareek will sell shares worth ₹70 crore.

How will the proceeds from the fresh issue be utilized?

Funds will be used to repay or prepay certain borrowings and for general corporate purposes.

On which stock exchanges will the shares be listed?

The equity shares are proposed to be listed on both BSE and NSE.

What is the face value of each equity share in the IPO?

Each equity share has a face value of ₹2.