- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Jajoo Rashmi Refractories IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Jajoo Rashmi Refractories IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Jajoo Rashmi Refractories Limited

Jajoo Rashmi Group, established in 1995, has grown into a prominent player in manufacturing, trading, and exporting Silica Ramming Mass (Quartz Powder), Ferro Alloys, and various Refractory Materials. Serving industries such as steel manufacturing, engineered stone, glass, and ceramics, the group operates three manufacturing units in Rajasthan, West Bengal, and Gujarat, with a combined production capacity of 78,000 MTPA.Over 90% of its revenue is derived from exports, with a market presence across the Middle East, Africa, South East Asia, South Asia, Western Europe, and East Asia. In FY24, the company achieved a 6% increase in net profit, reaching ₹24.3 crore, with revenue growing by 8.9% to ₹334 crore.

Jajoo Rashmi Refractories Limited IPO Overview

Jajoo Refractories IPO is a bookbuilding issue of ₹150.00 crores, comprising entirely a fresh issue. The IPO dates are yet to be announced, with the allotment expected to be finalized shortly. The price band details are also awaited. Unistone Capital Pvt Ltd is acting as the book-running lead manager, while Bigshare Services Pvt Ltd is the registrar for the issue. The IPO will have a face value of ₹10 per share, with the total and fresh issue aggregating up to ₹150.00 crores. It will be listed on BSE and NSE, with a pre-issue shareholding of 3,03,28,799 shares. Promoters of the company include Sunil Jaju, Saurabh Jaju, Komal Jaju, Sunil Jaju Karta HUF, and Himalaya Commedeal Private Limited, holding 98.74% pre-issue stake. Post-issue shareholding will reflect equity dilution.

Jajoo Rashmi Refractories Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹150 crore

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,03,28,799 shares |

| Shareholding post -issue | TBA |

Jajoo Rashmi Refractories Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Jajoo Rashmi Refractories Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Jajoo Rashmi Refractories Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 8.11 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 31.42% |

| Net Asset Value (NAV) | 25.80 |

| Return on Equity | 31.42% |

| Return on Capital Employed (ROCE) | 28.55% |

| EBITDA Margin | 9.81% |

| PAT Margin | 7.27% |

| Debt to Equity Ratio | 0.43 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Part finance the cost of establishing new manufacturing facilities to expand our production capabilities of ferro alloys in the Proposed Bokaro Project | 618.29 |

| Funding working capital requirement | 476.71 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

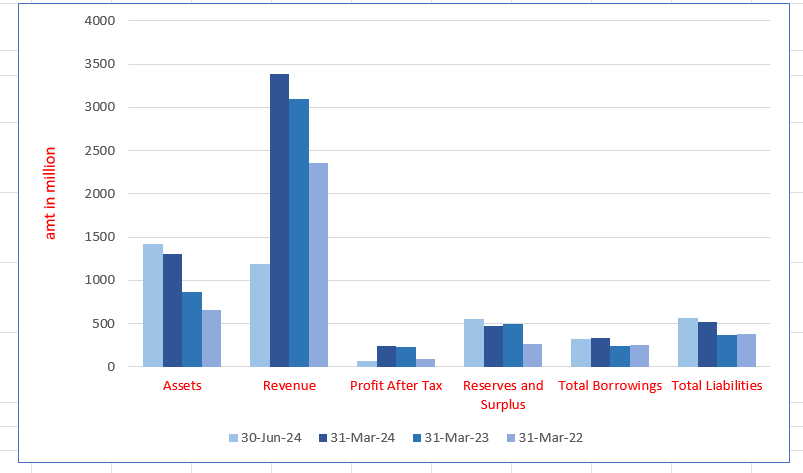

Jajoo Rashmi Refractories Limited Financials (in million)

| Particulars | 30 June 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 1420.04 | 1299.28 | 866.10 | 651.93 |

| Revenue | 1188.22 | 3385.79 | 3092.87 | 2354.04 |

| Profit After Tax | 63.92 | 242.80 | 229.21 | 87.71 |

| Reserves and Surplus | 552.09 | 472.74 | 492.60 | 262.80 |

| Total Borrowings | 318.08 | 336.02 | 236.48 | 257.12 |

| Total Liabilities | 561.69 | 522.07 | 366.99 | 382.62 |

Financial Status of Jajoo Rashmi Refractories Limited

SWOT Analysis of Jajoo Rashmi Refractories IPO

Strength and Opportunities

- Established in 1995, Jajoo Rashmi Refractories has decades of industry expertise, ensuring credibility and trust among customers and partners worldwide.

- Operates three advanced manufacturing units across India, boasting a combined installed production capacity of 78,000 Metric Tonnes Per Annum (MTPA) to meet diverse demands.

- Generates over 90% of its revenue from international exports, indicating a strong global footprint and diversified market reach.

- Serves diverse sectors, including steel, engineered stone, glass, and ceramics, reducing dependency on a single industry and spreading risk effectively.

- Focus on innovation and technological advancements ensures high-quality, efficient, and competitive products for customers in various global markets.

- Plans to raise ₹150 crore through an IPO, aimed at funding expansion and boosting working capital for sustainable growth.

- Recorded an 8.9% revenue growth to ₹334 crore in FY24, reflecting consistent financial performance and strong market demand for products.

- Led by an experienced promoter with over two decades of expertise in finance and manufacturing, providing strong leadership and strategic vision.

- Commitment to sustainable manufacturing processes reflects its focus on environmentally responsible operations and global standards, enhancing brand reputation and customer trust.

- Strong technical manufacturing expertise enables the development of innovative refractory materials and ferro alloys, catering to evolving customer requirements effectively.

- Expanding its presence in promising international markets, such as the Middle East, Southeast Asia, and Africa, broadening its revenue streams and growth potential.

Risks and Threats

- High dependence on export revenue exposes the company to global market fluctuations and uncertainties, potentially impacting financial stability and growth.

- Raw material price volatility poses significant risks to profit margins and overall cost efficiency, especially during times of market instability.

- Intense competition in the refractory materials industry, both domestically and internationally, challenges the company’s ability to maintain market share.

- Regulatory changes in export-import policies could disrupt operations, requiring quick adaptation and potential additional compliance expenses.

- Currency exchange rate fluctuations pose financial risks, especially for a company heavily reliant on international trade for its revenue.

- Environmental compliance costs may increase due to stricter regulations, impacting profitability and necessitating additional investments in green technologies.

- Dependency on the steel sector for a significant portion of revenue makes the company susceptible to downturns in that industry.

- Delays in planned expansion projects due to unforeseen circumstances could hinder future growth and competitive positioning in the market.

- Geopolitical tensions in key export markets can disrupt operations, affecting sales, logistics, and overall business continuity.

- Supply chain disruptions caused by natural disasters or logistical issues can lead to production delays and increased costs.

- Limited brand recognition in unexplored markets may slow down penetration efforts, requiring additional marketing and brand-building investments.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Jajoo Rashmi Refractories Limited IPO

More About Jajoo Rashmi Refractories Limited

Jajoo Rashmi Refractories Limited is a prominent manufacturer and exporter of ferro alloys and refractory products. Its products, used extensively in steel manufacturing, are designed to withstand high temperatures without deteriorating.

Export-Focused Revenue

Export operations constitute the core of the company’s revenue, contributing 90.97%, 91.47%, 92.32%, and 80.36% for the periods ending June 30, 2024, March 31, 2024, March 31, 2023, and March 31, 2022, respectively. The company exports to 29 countries across the Middle East, Africa, Southeast Asia, South Asia, Western Europe, and East Asia.

Manufacturing Capabilities

Jajoo Rashmi Refractories operates three facilities:

- Jaipur, Rajasthan: Installed capacity of 36,000 MTPA.

- Kalyaneshwari, West Bengal: Installed capacity of 36,000 MTPA.

- Kandla SEZ, Gujarat: Installed capacity of 6,000 MTPA (100% export unit).

The cumulative capacity across these units is 78,000 MTPA.

Expansion Plans

The company plans to establish a new facility in Bokaro, Jharkhand, with operations expected to commence by March 2026. ₹618.29 million has been allocated for this project.

Commitment to Quality

Manufacturing processes are supported by quality certifications like ISO 14001:2015 and ISO 9001:2015. All units undergo rigorous quality control, supported by in-house and third-party testing.

Sustainability Practices

The company operates zero-waste manufacturing units. By reutilising slag and quartz dust, it achieves eco-friendly production while commercialising waste materials for additional revenue.

Leadership and Expertise

Guided by Managing Director Sunil Jaju and Whole-Time Director Saurabh Jaju, the company thrives on its leadership’s two decades of expertise, making it a trusted supplier for domestic and international customers.

Industry Outlook

Global Ferro Alloy Industry Market Overview

Market Size and Growth

- CAGR: Projected at 5.9% (2023–2029).

- Key Drivers: Rising steel demand in automotive, aerospace, construction, and energy industries.

Regional Insights

- Asia-Pacific: Holds 74% market share, led by China and India.

- Europe and North America: Account for 14% and 6%, respectively.

- Emerging Markets: China, India, and Southeast Asia show rapid growth due to urbanization and infrastructure projects.

Impact of COVID-19

- Initial decline in steel demand during the pandemic.

- Recent recovery indicates sustained growth.

Industry Advancements

- Technological innovations enhancing ferroalloy properties like strength and corrosion resistance.

Future Outlook

- Increasing urbanisation, population growth, and steel applications to boost demand.

- Forecasted steady growth across all major regions.

India’s Ferro Alloys Production and Export Growth

- Production Growth:

- India’s ferro alloys production to grow at a CAGR of 6.8% (2023-2029).

- Driven by demand in construction, automotive, and infrastructure sectors.

- West Bengal: Largest producer, with strong mineral resources.

- Odisha: Focus on manganese ferroalloy production.

- Karnataka: Expanding production of silicon ferroalloys.

- Challenges:

- High raw material costs (manganese ore, chrome ore, coal).

- Environmental regulations and power supply issues.

- Competition from countries with lower production costs.

- Export Growth:

- Exports grew at a CAGR of 12% from 1,423K tonnes (2019) to 2,247K tonnes (2023).

- Expected export growth: CAGR of 7% (volume) and 8% (value) (2023-2029).

- Factors: Abundant raw materials, competitive costs, strong domestic demand, and government incentives.

Global Silica Ramming Mass Market Overview

- Composition and Purpose:

- Silica ramming mass is used to protect induction furnace linings.

- Composed of high-purity silica, alumina, and magnesia.

- Resists extreme temperatures, thermal shocks, and erosion.

- Market Growth:

- Market expected to grow at CAGR of 9.7% from USD 172 million (2023) to USD 299 million (2029).

- Growth driven by steel demand from construction, infrastructure, and manufacturing sectors.

- Regional Demand:

- Asia holds 86% of the global market share, driven by robust steel production.

- Demand expected to rise due to urbanization, infrastructure development, and population growth.

India – Silica Ramming Mass Top 5 Export Destinations

India is the largest exporter of silica ramming mass, with its top five export destinations being Saudi Arabia, the UAE, Uganda, Ghana, and Turkey. From 2019 to 2023, India’s export volume grew at a healthy CAGR of 14.8%, rising from 45,000 tonnes to 78,000 tonnes. This is projected to increase by 18.2% from 2023 to 2029. The value of these exports is expected to grow at a CAGR of 19.6% during the same period. The growth is driven by global steel demand, particularly in industries like automotive and infrastructure, which will require large quantities of silica ramming mass.

How Will Jajoo Rashmi Refractories Limited Benefit?

- Ferro Alloys and Silica Ramming Mass Market Growth

Jajoo Rashmi Refractories stands to benefit significantly from the forecasted growth in the ferro alloys and silica ramming mass markets. With the global market for ferro alloys projected to grow at a CAGR of 5.9% and silica ramming mass at 9.7%, Jajoo Rashmi’s export operations, particularly in steel-heavy industries like automotive, aerospace, and construction, will experience increased demand.

- India’s Ferro Alloys Production Growth

As India’s ferro alloys production grows at a CAGR of 6.8%, Jajoo Rashmi Refractories, which operates in key production states like West Bengal, Odisha, and Karnataka, will see enhanced opportunities. The company’s ability to produce high-quality alloys, including manganese and silicon ferroalloys, aligns with the rising demand from the construction, automotive, and infrastructure sectors.

- Silica Ramming Mass Export Growth

India’s strong position as the largest exporter of silica ramming mass will directly benefit Jajoo Rashmi. With the export volume of silica ramming mass growing at a CAGR of 14.8% and projected to continue increasing, Jajoo Rashmi will be well-positioned to meet global demand, especially in regions like the UAE, Saudi Arabia, and Turkey, where demand for steel in construction and infrastructure is high.

- Export-Driven Revenue Model

Given Jajoo Rashmi’s heavy reliance on exports, contributing over 90% of its revenue, the growth in India’s ferro alloys and silica ramming mass exports will further solidify its financial position. The company’s competitive pricing and strong domestic demand will drive export growth, especially as India’s ferro alloy exports are expected to grow at a CAGR of 7% in volume and 8% in value.

- Technological Advancements and Market Expansion

Technological innovations enhancing the properties of ferro alloys and silica ramming mass will provide Jajoo Rashmi an edge in global markets. As the company embraces these advancements, its products will become even more desirable for industries requiring high-strength, corrosion-resistant materials, leading to greater export opportunities.

- Sustainability and Regulatory Compliance

As environmental regulations become stricter, Jajoo Rashmi’s zero-waste manufacturing practices will position it as a sustainable supplier in the global market. The company’s eco-friendly production methods, including the reutilisation of slag and quartz dust, will make it a preferred choice for markets focused on reducing environmental impact while boosting production efficiency.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue

(₹ in Millions) |

Basic EPS (₹) | P/E | Return on Net Worth (%) | NAV (₹) |

| Jajoo Rashmi Limited | 10 | 340.34 | 8.11 | [●] | 31.42% | 25.80 |

| Peer Group | ||||||

| Raghav Productivity Enhancers Ltd | 10 | 1,327.66 | 5.66 | 126.35 | 16.42% | 34.46 |

| IFGL Refractories Ltd | 10 | 16,394.89 | 22.66 | 20.87 | 7.62% | 297.47 |

Key Insight

- Face Value: The face value of all companies—Jajoo Rashmi Limited, Raghav Productivity Enhancers Ltd, and IFGL Refractories Ltd—is ₹10. Since the face value is the same, it does not contribute significantly to differentiation between these companies. It serves as a standard nominal amount per share.

- Revenue: IFGL Refractories Ltd leads with the highest revenue, ₹16,394.89 million, signifying its dominant market position. Raghav Productivity Enhancers Ltd follows with ₹1,327.66 million, while Jajoo Rashmi Limited trails with ₹340.34 million, indicating its smaller operational scale compared to its peers.

- Basic EPS: Jajoo Rashmi Limited boasts a higher basic EPS of ₹8.11, indicating strong profitability relative to its size. In comparison, Raghav Productivity Enhancers Ltd has a lower EPS of ₹5.66. IFGL Refractories Ltd shows the highest EPS at ₹22.66, highlighting its robust earnings capacity.

- P/E: Jajoo Rashmi Limited has a P/E ratio of [●], which is yet to be calculated. Raghav Productivity Enhancers Ltd shows a high P/E ratio of 126.35, indicating market expectations for high future growth, whereas IFGL Refractories Ltd has a relatively more moderate P/E of 20.87.

- Return on Net Worth: Jajoo Rashmi Limited demonstrates a strong return on net worth at 31.42%, reflecting efficient use of equity capital. Raghav Productivity Enhancers Ltd follows with 16.42%, and IFGL Refractories Ltd lags with 7.62%, suggesting varied levels of financial efficiency among the companies.

- NAV: IFGL Refractories Ltd has a significantly higher NAV per equity share at ₹297.47, indicating strong asset base and value creation. Raghav Productivity Enhancers Ltd holds a moderate NAV at ₹34.46, while Jajoo Rashmi Limited is positioned similarly with a NAV of ₹25.80

Jajoo Rashmi Refractories Limited IPO Strengths

- Long-Standing Customer Relationships

Jajoo Rashmi Refractories Limited has built enduring relationships with both Indian and global clients over two decades. In Fiscal 2024 alone, the company served 97 customers, with a 94.21% customer retention rate. These long-term partnerships foster industry goodwill, offer revenue stability, and enable the company to meet evolving customer needs. Furthermore, these relationships help expand the product portfolio, boosting customer loyalty and increasing market visibility.

- Widespread International Presence

With operations in diverse regions like the Middle East, North Africa, and Southeast Asia, Jajoo Rashmi Refractories Limited has established a strong international presence. As of March 31, 2024, 91.47% of its revenue came from exports. The company serves 29 countries, with key markets such as Saudi Arabia, Egypt, and Kuwait contributing significantly to its growth. This global footprint enhances its competitiveness and ensures a diverse revenue stream.

- Diversified Product Portfolio

The company’s ability to adapt to customer needs and expand its product offerings is a key strength. Over the years, Jajoo Rashmi Refractories Limited has successfully supplied various products, including calcined petroleum coke, ferro chrome, and boric acid. By continuously responding to customer demands, the company has broadened its portfolio, helping it stay competitive and meet the ever-changing requirements of the steel industry, fostering sustained growth.

- Consistent Financial and Operational Performance

The company has achieved consistent revenue growth and profitability, with revenue increasing by 43.12% from Fiscal 2022 to Fiscal 2024, and profit after tax rising by 176.81%. Key financial metrics such as EBITDA margin expansion from 5.64% to 9.81% reflect operational efficiency. This success is driven by strategic cost management, improved productivity, and effective resource utilization, positioning the company for long-term growth.

- Experienced Promoters and Senior Management Team

The company benefits from a highly experienced management team, led by Promoter and Managing Director, Sunil Jaju, who brings over two decades of expertise in the refractory and ferro alloys industries. With the support of Whole-time Director Saurabh Jaju and experienced Independent Directors, the management team has demonstrated strong leadership, overseeing market expansion, ensuring regulatory compliance, and driving operational success, ultimately strengthening the company’s market position.

Key Insights from Financial Performance

- Assets: The company’s assets have steadily increased from ₹651.93 million in FY 2022 to ₹1420.04 million as of June 2024. This growth reflects improved asset management and the expansion of business operations, signaling a strong financial position over the period.

- Revenue: Revenue has experienced consistent growth, rising from ₹2354.04 million in FY 2022 to ₹3385.79 million in March 2024. However, the June 2024 revenue of ₹1188.22 million shows a sharp decrease compared to previous periods, possibly due to seasonality or market fluctuations.

- Profit After Tax (PAT): The company’s PAT has significantly increased, from ₹87.71 million in FY 2022 to ₹242.80 million in March 2024. In June 2024, PAT decreased to ₹63.92 million, possibly impacted by lower revenues or higher operational expenses, though still profitable.

- Reserves and Surplus: Reserves and surplus have grown from ₹262.80 million in FY 2022 to ₹552.09 million in June 2024, reflecting increased profitability and retained earnings. However, a slight dip in FY 2023 to ₹492.60 million could indicate temporary reinvestment or dividend distribution.

- Total Borrowings: Borrowings have fluctuated, reaching ₹318.08 million in June 2024, up from ₹257.12 million in FY 2022. This indicates the company’s reliance on debt has increased, potentially to fund expansion or working capital requirements, though borrowing levels remain manageable.

- Total Liabilities: The total liabilities have increased from ₹382.62 million in FY 2022 to ₹561.69 million in June 2024. The rise reflects both higher borrowings and potential growth in current liabilities, which may be linked to expanded operations and business activities.

Other Financial Details

- Cost of Materials Consumed: The cost of materials consumed dominates the total expenses, showing consistent growth across the years. From ₹1,974.52 crores in FY 2022 to ₹2,947.23 crores in FY 2024, the rise indicates increasing operational scale.

- Employee Benefits Expense: These expenses steadily increased, growing from ₹12.85 crores in FY 2022 to ₹35.49 crores in FY 2024. This trend implies investment in workforce development or recruitment to support expanding operations.

- Finance Costs: Finance costs remained stable, ranging between ₹9.80 crores in FY 2023 and ₹13.27 crores in FY 2024. This indicates controlled debt or interest management, maintaining a balance between borrowing and financial obligations.

- Depreciation and Amortisation Expense: These expenses peaked at ₹14.32 crores in FY 2022 but dropped to ₹11.24 crores in FY 2024. This reflects declining asset depreciation rates or limited additions to depreciable assets during the period.

- Other Expenses:Other expenses significantly contributed to the total, peaking at ₹351.35 crores in FY 2023. However, these declined to ₹315.86 crores in FY 2024, potentially due to cost-saving measures or reduced discretionary spending.

Key Strategies for Jajoo Rashmi Refractories Limited

- Greenfield Expansion at Bokaro, Jharkhand

Jajoo Rashmi Refractories Limited plans to establish a new manufacturing facility in Bokaro, Jharkhand, with a production capacity of 43,200 MTPA. This expansion aims to meet the rising global steel demand, improve profit margins, and reduce logistical costs. By serving local steel manufacturers, the company will strengthen its market competitiveness and shorten order execution times.

- Scaling Storage Capacity at Kandla SEZ

The company intends to expand its storage capacity near its Kandla SEZ unit, enhancing storage for raw materials. This move will support the growing export operations and contribute to global footprint expansion. Increased storage will facilitate better segregation and improve the operational efficiency of ferro silicon production, enhancing customer reach and supply chain management.

- Venturing into Manufacturing of Calcined Petroleum Coke

Jajoo Rashmi Refractories Limited is exploring the manufacturing of calcined petroleum coke, aiming to diversify its product portfolio. This expansion leverages existing customer relationships, addressing specific product demands. The company believes its operational efficiency and access to raw materials position it well to grow in this vertical, potentially increasing revenues and operational margins.

- Expansion in Global Markets

The company is expanding its global footprint by catering to customers across 29 countries. By setting up subsidiaries in Ghana and Dubai, Jajoo Rashmi Refractories aims to tap into the African and Middle Eastern markets. This strategy capitalises on the rising demand for steel and ferroalloys, boosting exports and diversifying revenue sources while enhancing profitability.

- Increase in Business from Existing Customers

Jajoo Rashmi Refractories Limited focuses on strengthening relationships with long-term customers to increase sales across multiple product lines. By providing quality products and services, the company seeks to expand its share of business within existing customer networks, leveraging established credibility, competitive pricing, and an expanding product portfolio to foster deeper engagement and loyalty.

- Increase Market Share and Acquire New Customers

The company is determined to increase its market share by approaching new customers across geographies, particularly in under-penetrated regions such as Asia and Europe. By leveraging existing relationships, product credibility, and long-term trust, Jajoo Rashmi Refractories plans to expand its customer base through referrals, pre-approvals, and targeted outreach in emerging markets.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs on Jajoo Rashmi IPO

What is the size of Jajoo Rashmi Refractories Limited IPO?

The IPO aims to raise approximately ₹150 crore through the issuance of fresh equity shares to fund business expansion and other corporate requirements.

What is the objective of the Jajoo Rashmi Refractories IPO?

The IPO proceeds will fund new manufacturing facilities, working capital needs, and general corporate purposes to support the company’s growth and operational expansion.

Who are the lead managers for the Jajoo Rashmi Refractories IPO?

The IPO is being managed by leading merchant bankers to ensure compliance, effective fundraising, and a smooth listing process.

What is the expected listing date for Jajoo Rashmi Refractories IPO?

The tentative listing date for the IPO will be announced post-subscription closure, subject to regulatory approvals and allotment finalisation.

How can investors apply for the Jajoo Rashmi Refractories IPO?

Investors can apply via their Demat account through ASBA (Application Supported by Blocked Amount) or UPI-based applications on participating platforms like banks or brokers.

What is the minimum investment amount for Jajoo Rashmi Refractories IPO?

The minimum investment depends on the IPO lot size, which will be disclosed in the official IPO prospectus.

What is the expected price band for Jajoo Rashmi Refractories IPO?

The IPO price band is yet to be announced and will be determined closer to the opening date based on valuations and market conditions.

Where will Jajoo Rashmi Refractories shares be listed post-IPO?

The shares will be listed on major stock exchanges like NSE and BSE to provide liquidity and trading opportunities for investors.