- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Jaro Institute of Technology Management and Research IPO

₹13,536/16 shares

Minimum Investment

IPO Details

23 Sep 25

25 Sep 25

₹13,536

16

₹846 to ₹890

NSE, BSE

₹450 Cr

30 Sep 25

Jaro Institute of Technology Management and Research IPO Timeline

Bidding Start

23 Sep 25

Bidding Ends

25 Sep 25

Allotment Finalisation

26 Sep 25

Refund Initiation

29 Sep 25

Demat Transfer

29 Sep 25

Listing

30 Sep 25

Jaro Institute of Technology Management and Research Limited

Founded in 2009 by Sanjay Namdeo Salunkhe, Jaro Institute of Technology is a prominent platform for online higher education and upskilling in India. Partnering with 34 esteemed institutions, it operates through 22 pan-India offices and 15 advanced tech studios in IIMs. With 239 offerings, Jaro’s courses include online MBA, PG/UG programs, data science, digital marketing, finance, banking, cybersecurity, and cloud computing. These programs reflect the institute’s commitment to quality education, fostering enduring collaborations, and delivering exceptional learning experiences.

Jaro Institute of Technology Management and Research Limited IPO Overview

Jaro Institute IPO is a book-built issue worth ₹450.00 crores, comprising a fresh issue of 0.19 crore shares valued at ₹170.00 crores and an offer for sale of 0.31 crore shares totalling ₹280.00 crores. The IPO opens for subscription on September 23, 2025, and closes on September 25, 2025, with allotment likely on September 26, 2025. Shares will list on the BSE and NSE, with a tentative listing date set for September 30, 2025. The price band is fixed between ₹846.00 and ₹890.00 per share, and the lot size is 16 shares. For retail investors, the minimum investment stands at ₹14,240 (16 shares at the upper band), while the sNII category requires 15 lots (240 shares) amounting to ₹2,13,600, and the bNII category requires 71 lots (1,136 shares) worth ₹10,11,040. Nuvama Wealth Management Ltd. is the lead manager, and Bigshare Services Pvt. Ltd. is the registrar.

Jaro Institute of Technology Management and Research LimitedUpcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 19,10,112 shares (aggregating up to ₹170.00 Cr) |

| Offer for Sale: 31,46,067 shares of ₹10 (aggregating up to ₹280.00 Cr) | |

| IPO Dates | 23 September 2025 to 25 September 2025 |

| Price Bands | ₹846 to ₹890 per share |

| Lot Size | 16 Shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,02,46,177 shares |

| Shareholding post -issue | 2,21,56,289 shares |

Jaro Institute of Technology Management and Research IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 16 | ₹14,240 |

| Retail (Max) | 14 | 224 | ₹1,99,360 |

| S-HNI (Min) | 15 | 240 | ₹2,13,600 |

| S-HNI (Max) | 70 | 1,120 | ₹9,96,800 |

| B-HNI (Min) | 71 | 1,136 | ₹10,11,040 |

Jaro Institute of Technology Management and Research Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Jaro Institute of Technology Management and Research Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 18.90 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 32.35% |

| Net Asset Value (NAV) | 18.19 |

| Return on Equity | 37.82% |

| Return on Capital Employed (ROCE) | 40.90% |

| EBITDA Margin | 31.93% |

| PAT Margin | 18.75% |

| Debt to Equity Ratio | 0.21 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Marketing, brand building and advertising activities | 810 |

| Prepayment or scheduled repayment of a portion of certain outstanding borrowings | 480 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

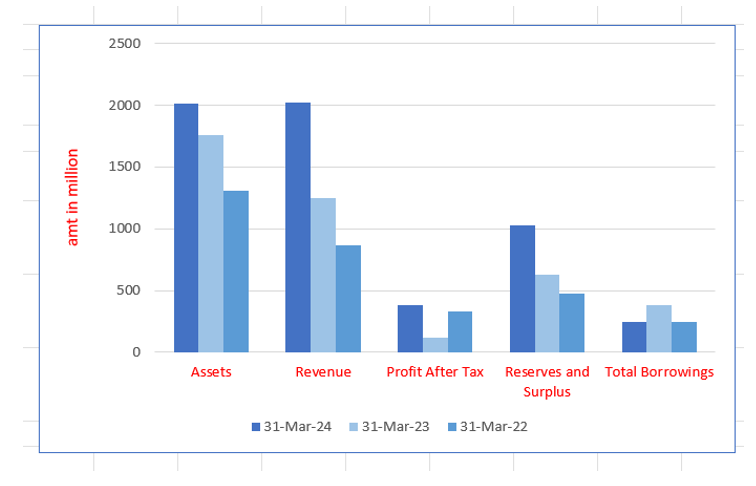

Jaro Institute of Technology Management and Research Limited Financials ( (in millions)

| Particulars | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2017.57 | 1757.51 | 1307.06 |

| Revenue | 2025.67 | 1245.85 | 868.80 |

| Profit After Tax | 380.10 | 114.22 | 331.80 |

| Reserves and Surplus | 1023.91 | 628.04 | 475.62 |

| Total Borrowings | 248.47 | 377.70 | 245.79 |

| Total Liabilities | 843.25 | 921.85 | 624.58 |

Financial Status of Jaro Institute of Technology Management and Research Limited

SWOT Analysis of Jaro Institute of Technology Management and Research IPO

Strength and Opportunities

- Leading online higher education platform in India, established in 2009 by Sanjay Namdeo Salunkhe.

- Partnerships with 34 esteemed institutions, enhancing program diversity and credibility.

- Presence in 22 pan-India offices and 15 advanced tech studios, ensuring widespread accessibility.

- Significant enrollment growth post-COVID-19 due to a shift towards online learning.

- Offers 239 diverse programs, including online MBA, data science, and cybersecurity, catering to various learner needs.

- Strong affiliations with top-tier institutions, enhancing brand reputation and trust.

- Utilises live classes and collaborative tools, providing interactive and engaging learning experiences.

- Customised programs at various academic levels, appealing to a broad audience.

- Capitalised on increased demand for upskilling in the digital era, aligning with market needs.

- Plans for IPO indicate growth ambitions and potential for increased investment.

- Commitment to quality education fosters strong, lasting collaborations and positive learner outcomes.

Risks and Threats

- Intense competition from other online education platforms and traditional institutions adapting to digital formats.

- Dependence on internet infrastructure, which can be unreliable in certain regions, affecting user experience.

- Rapid technological advancements require continuous platform updates, increasing operational costs.

- Potential regulatory changes in online education could impact operational procedures and compliance requirements.

- High marketing and acquisition costs to attract and retain students in a competitive market.

- Risk of data breaches and cybersecurity threats, necessitating robust protective measures.

- Variability in course quality due to partnerships may affect overall brand perception.

- Economic downturns could reduce individuals' disposable income for education, affecting enrollment rates.

- Potential faculty shortages or quality issues could impact course delivery and learner satisfaction.

- Overreliance on specific partner institutions may pose risks if partnerships are discontinued.

- Fluctuations in educational trends require constant adaptation to maintain relevance and competitiveness.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Jaro Institute of Technology Management and Research Limited IPO

Jaro Institute of Technology Management and Research Limited IPO Strengths

1. Market Leadership and Expansion

Founded in 2009, Jaro has become a market leader in online higher education and upskilling. With strong brand recognition, a pan-India presence, and strategic partnerships with top institutions like IIM Ahmedabad and IIT Madras, it offers flexible learning solutions. Jaro’s diverse course offerings and robust learning ecosystem have led to significant enrollment growth, establishing its leadership in India’s online education sector.

2. Comprehensive Solutions to Partner Institutions and Learners

Jaro offers a comprehensive solution for universities looking to provide online, hybrid, and in-person degree programs and certification courses. It supports Partner Institutions with business intelligence, program positioning, marketing, admissions, and learning delivery services. By providing real-time industry insights and a robust learning ecosystem, Jaro ensures that programs align with market demands, enhancing employability and expanding access to lifelong learning for a diverse range of learners.

3. High Revenue Predictability Backed by Long-Lasting Client Relationships

Jaro’s long-term partnerships with universities and institutions enhance global reach, cost-efficiency, and continuous innovation. With deep market insights and technology integration, Jaro boosts enrolment and program offerings for Partner Institutions. Their business model ensures revenue predictability, reflected in increasing program collaborations, renewals, and growing fee share. Strong relationships with Tier-1 universities demonstrate trust and satisfaction, solidifying Jaro’s position as a leader in online education and upskilling.

- Proven Track Record in Delivering High-Quality and Diversified Course Offerings

The company demonstrates a robust portfolio with a wide range of online degree and certification programs, including MBA, M.Com, Data Science, and more. Offering flexibility, it caters to learners seeking both short-term certificates and long-term degrees. With collaborations across 34 institutions, including Tier-1 universities like IITs and IIMs, the company is recognised for delivering high-quality, industry-relevant education meeting diverse learner needs across disciplines and time commitments.

- Leveraging Technology and Digitalisation for Enhancing Client Experience and Business Expansion

The company embraces digitalisation, revolutionising India’s education sector by offering accessible online platforms and blended learning models. With advanced tools like Generative AI, it enhances program offerings and anticipates market trends. Through AI-powered tools, learners receive personalised career insights, improving their learning journey. CRM software streamlines lead management, enabling data-driven decisions, while immersive tech studios and off-campus centres provide a dynamic, high-quality learning experience.

- Experienced Senior Management Team with Deep Industry Expertise and Proven Track Record

The company’s Board and Senior Management team bring over 15 years of experience in online higher education and upskilling. Led by founder and Chairman Sanjay Namdeo Salunkhe, with over 16 years of expertise, the team drives strategic vision and business growth. Supported by CEO Ranjita Raman and seasoned professionals, the team excels in product development and operational management. Their collective experience ensures high-quality offerings and a client-focused approach, with a strong track record of success.

More About Jaro Institute of Technology Management and Research Limited

Jaro Institute of Technology Management and Research Limited, established in 2009 by Sanjay Namdeo Salunkhe, has become one of India’s leading online higher education and upskilling platforms. Recognised for its operational efficiency, it holds significant positions in financial metrics like EBIDTA, PAT, and Return on Equity (ROE) as of March 31, 2023.

Strong Leadership and Experience

- Founded by Sanjay Namdeo Salunkhe, a first-generation entrepreneur with over 17 years of experience in education.

- Led by a proficient senior management team, including CEO Ranjita Raman, who drives Jaro’s operations and growth.

Strategic Partnerships and Presence

Jaro has formed long-term collaborations with top universities and global institutions, enhancing its market reach.

- 34 Partner Institutions: Includes prestigious institutions like IITs, IIMs, and Swiss School of Management.

- Pan-India Presence: Over 22 offices and 15 immersive tech studios across major cities and IIM campuses.

- Wide Range of Programs: Offers degree and certification programs in partnership with top universities.

Growth and Market Position

Post-COVID, Jaro capitalised on the surge in demand for online education by offering flexible learning options.

- Surge in Enrolments: Achieved a 16.79% CAGR in degree programs and 58.36% CAGR in certification courses from 2022 to 2024.

- Increased Brand Recognition: Focus on marketing, branding, and learner satisfaction leads to lower acquisition costs.

Revenue and Financial Sustainability

The company ensures a predictable revenue stream through well-established partnerships and flexible payment options.

- Revenue Model: Primarily derived from course fees, including application, tuition, study materials, and exam fees.

- Flexible Payment Options: Offers both full payment and instalment plans to students.

Future Outlook and Growth Prospects

Jaro’s growth trajectory remains positive with its strong emphasis on learner engagement and industry-relevant courses.

- High Demand for Online Education: Expected to continue capitalising on the online learning trend.

- Sustained Long-Term Partnerships: Continuing collaboration with top-tier institutions and global corporates ensures long-term growth.

Through its innovative offerings and strong partnership ecosystem, Jaro Institute is well-positioned to maintain its leadership in the online higher education sector.

Expanding Partner Institutions’ Reach

With a strong understanding of the online higher education and upskilling sector, the company aims to expand the outreach of its Partner Institutions, such as IITs and IIMs. Their primary role is to enhance these institutions’ offerings through an integrated online and offline experience. This includes:

- Engaging with prospective learners to gauge market demand.

- Promoting programs with trained professionals.

- Establishing high-tech immersive studios.

- Incorporating learner feedback for continuous improvement.

The Jaro has been recognised with several prestigious awards, including the Leading EdTech Company of the Year and the EdTech Leadership Award in recent years.

Industry Outlook

India’s Expanding Education Market

India’s education sector is on a rapid growth trajectory, projected to reach INR 25 trillion by FY 2028, up from INR 14.6 trillion in FY 2023. Government policies and digital innovations are driving this transformation.

Growth of Institutions

- Universities grew from 903 (FY 2018) to 1,216 (FY 2023).

- Colleges rose to 49,131 in the same period.

- School numbers consolidated for efficiency.

Government Initiatives

- PM SHRI Scheme: Upgrading 14,500 schools with modern facilities.

- NEP 2020: Focus on holistic, tech-integrated learning.

Student Enrolment & Budget Push

- Higher education enrolment touched 43 million in FY 2022.

- The Union Budget 2025allocatedINR 12.06 trillion, marking a 6.8% rise.

Digital & Higher Education Boom

- Online education market projected at INR 8.5 lakh Mn by FY 2028 (CAGR 23.1%).

- Key drivers: corporate upskilling, global collaborations, affordability, and tech adoption.

How Will Jaro Institute of Technology Management and Research Limited Benefit

- India’s education market projected at INR 25 trillion by 2028 offers Jaro strong growth opportunities.

- Online education market reaching INR 8.5 lakh Mn by 2028 aligns with Jaro’s diverse offerings.

- NEP 2020 and digital initiatives fuel demand for flexible online models, supporting Jaro’s expansion.

- Adaptive learning technologies enable Jaro to innovate, offering personalised and accessible online education experiences.

- Rising competition fosters collaborations, allowing Jaro to expand networks with universities and corporates globally.

- Growing corporate upskilling needs strengthen Jaro’s position through specialised programs and international institutional partnerships.

Peer Group Comparison

| Company | Courses & Programs Offered | Partner Institutions Globally | Revenue (INR Mn) (FY 2023) | EBITDA Margin (FY 2023) | PAT Margin (FY 2023) |

| Jaro | 239 | 341 | 1,221 | 20.9% | 9.4% |

| UpGrad | 208 | NA | 11,697 | -82.7% | -95.6% |

| Great Learning | 54 | 143 | 914 | -82.4% | -91% |

| Talent Edge | 86 | 30+ | 254 | -122.4% | -152.9% |

| Simplilearn | 52 | 126 | 840 | -29.4% | -34.9% |

| Imarticus | 43 | 151 | 653 | 3.8% | 2.1% |

| Eruditus | 42 | 75+ | 4,729 | -14.8% | -16.4% |

| TimesPro | 20 | 256 | 961 | 14.7% | 10.4% |

| Intellipaat | 94 | 151 | 602 | 25.2% | 17.6% |

| TalentSprint | 44 | 158 | 943 | 39.9% | -4.3% |

| UNext | 32 | 1,873 | -91.3% | -125.7% | – |

Key Strategies for Jaro Institute of Technology Management and Research Limited

1. Market Share Expansion through a Diverse Portfolio

The company aims to expand its market share by diversifying its offerings and building a wide network of partnerships. With the online higher education and upskilling market in India expected to grow significantly, the company plans to capitalise on this trend by forming collaborations with both domestic and global institutions, including prestigious universities like IITs and IIMs, to cater to a wider learner base.

2. High-Quality Institutional Partnerships

Building high-quality partnerships with esteemed institutions is key to the company’s growth. The company focuses on expanding its academic portfolio through collaborations with top-tier universities and international partners. Its existing successful partnerships, including with the Swiss School of Management and the University of Toronto, provide a strong foundation to offer advanced programs in specialised niches for a broader learner demographic.

3. Marketing and Brand Building for Growth

To drive growth, the company emphasises a strategic marketing approach, focusing on increasing brand awareness and generating leads through various digital channels. With campaigns like “Atke Mat Raho,” social media collaborations, and influencer partnerships, the company seeks to boost learner enrollments while optimising marketing costs. The goal is to reduce reliance on high marketing spending and achieve long-term scalability through sustained brand presence.

4. Geographical Expansion and Global Outreach

Expanding the company’s geographical footprint is integral to increasing its market reach. By setting up additional offices, learning centres, and immersive tech studios across India and enhancing partnerships with global institutions, the company aims to offer localised programs that meet specific regional needs. This strategy also includes leveraging international networks to expand learning and career opportunities for Indian learners abroad.

5. Enhanced Digital Capabilities for Operational Excellence

The company is focused on enhancing its digital platforms to provide a seamless user experience for learners and partner institutions. Through continuous investments in technology, including AI-powered tools like the “Upskilling Return on Investment Calculator” and immersive tech studios, the company seeks to optimise operational efficiency and improve client satisfaction. These innovations are designed to create a more interactive and engaging learning environment.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Jaro Institute's IPO

What is the purpose of Jaro Institute's IPO?

The IPO aims to raise funds for marketing, brand building, advertising, prepayment of borrowings, and general corporate purposes to support the company’s growth and expansion.

What is the size of the IPO?

Jaro Institute of Technology Management and Research Limited plans to raise ₹450 crore through the IPO, including a fresh issue of ₹170 crore and an offer for sale of ₹280 crore.

Who are the merchant bankers for the IPO?

The IPO is managed by Systematix Corporate Services Limited, Motilal Oswal Investment Advisors Limited, and Nuvama Wealth Management Limited, overseeing the issue’s structure and distribution process.

When will the Jaro Institute IPO be listed?

The IPO dates are , opening date 23 September 2025 and closing date 25 September 2025. The listing date is 30 September 2025

Can I apply for the Jaro Institute IPO using UPI?

Yes, UPI (Unified Payments Interface) is accepted as a payment option for applying to the Jaro Institute IPO. Ensure your UPI ID is linked to your bank account for easy payment processing.

What is the face value of the equity shares?

The equity shares of Jaro Institute of Technology Management and Research Limited have a face value of ₹10 each, which is the nominal value for each share issued.