- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Jerai Fitness IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Jerai Fitness IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Jerai Fitness Limited

Jerai Fitness Limited is a prominent Indian manufacturer of fitness equipment with a legacy spanning over three decades. The company offers a comprehensive product portfolio, including strength training equipment, cardiovascular machines, and fitness accessories. It caters to a diverse clientele, including commercial gyms, real estate developers, government bodies, defence units, and individual home users. With a fully automated manufacturing facility in Wada, Palghar, and a growing international presence in 26 countries, Jerai Fitness has established itself as a key player in the fitness industry, supported by a strong brand and a focus on quality and innovation.

Jerai Fitness Limited IPO Overview

Jerai Fitness Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is structured as a Book Building Issue, consisting entirely of an Offer for Sale of up to 0.44 crore equity shares. The company proposes to list its shares on both the NSE and BSE. Emkay Global Financial Services Ltd. has been appointed as the book running lead manager, while Bigshare Services Pvt. Ltd. will act as the registrar of the issue. Key details such as the IPO dates, price band, and lot size are yet to be announced. The shares carry a face value of ₹10 each, and the total issue size is 43,92,500 shares, with pre- and post-issue shareholding remaining at 1,74,99,600 shares. The promoters, Rajesh Ramsukh Rai and Rinku Rajesh Rai, currently hold 100% of the company’s equity

Jerai Fitness Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 4,392,500 shares (Aggregating up to ₹[.] Cr) |

| Fresh Issue | ₹ 0 |

| Offer for Sale (OFS) | ₹ 4,392,500 shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,74,99,600 shares |

| Shareholding post-issue | 1,74,99,600 shares |

Jerai Fitness IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Jerai Fitness Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Issue |

Jerai Fitness Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ 13.37 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 25.19% |

| Net Asset Value (NAV) | ₹ 59.75 |

| Return on Equity (RoE) | 25.19% |

| Return on Capital Employed (RoCE) | 33.97% |

| EBITDA Margin | 24.38% |

| PAT Margin | 18.28% |

| Debt to Equity Ratio | 0.01 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

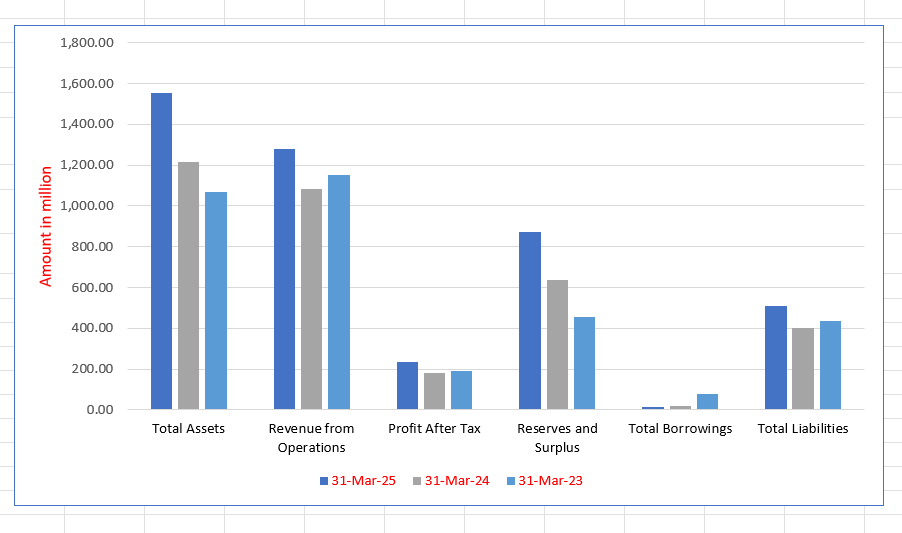

Jerai Fitness Limited Financials (in ₹ million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Total Assets | 1,556.25 | 1,214.44 | 1,069.46 |

| Revenue from Operations | 1,280.46 | 1,085.04 | 1,154.25 |

| Profit After Tax | 234.01 | 179.65 | 192.79 |

| Reserves and Surplus | 870.65 | 637.33 | 456.98 |

| Total Borrowings | 14.85 | 19.86 | 77.77 |

| Total Liabilities | 510.60 | 402.11 | 437.48 |

SWOT Analysis of Jerai Fitness IPO

Strength and Opportunities

- Established legacy and brand reputation of over three decades.

- Diversified and extensive product portfolio across fitness categories.

- Fully automated manufacturing facility with advanced machinery.

- Strong and diversified domestic customer base across multiple segments.

- Growing international presence with exports to 26 countries.

- Strong financial performance with high profitability and return ratios.

- Experienced management team with deep industry expertise.

- Significant opportunity from the expanding Indian fitness and wellness market.

- Potential for growth through in-house manufacturing of cardiovascular equipment.

- Favorable industry trends driven by rising health consciousness post-pandemic.

Risks and Threats

- Dependence on third-party international suppliers for cardiovascular equipment.

- Limited in-house manufacturing capacity for cardiovascular equipment currently.

- Relatively lower export contribution of 7.70% in FY25 compared to previous years.

- Intense competition from both organized international players and unorganized domestic manufacturers.

- Vulnerability to fluctuations in raw material prices, such as steel.

- Economic downturns can reduce discretionary spending on fitness equipment.

- Potential supply chain disruptions affecting sourcing and production.

- Currency exchange rate volatility impacting export profitability and import costs.

- Rapid technological changes requiring continuous investment in R&D.

- Regulatory changes in domestic and international markets.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Jerai Fitness Limited

Jerai Fitness Limited IPO Strengths

Established Legacy and Market Position

Jerai Fitness Limited has built a formidable reputation over three decades, evolving to meet changing customer needs and global standards. This long-standing presence has allowed the company to develop robust manufacturing processes, efficient inventory management, and strong customer relationships, providing a significant competitive advantage in the Indian fitness equipment industry.

Advanced and Automated Manufacturing Capabilities

The company operates a fully automated manufacturing facility equipped with state-of-the-art machinery, including laser cutting machines, robotic welding stations, and CNC/VMC machines imported from Japan, Turkey, and China. This technology-driven setup ensures precision, consistent product quality, scalable output, and manufacturing efficiency, enabling Jerai Fitness to meet international standards and cater to rising market demand effectively.

Diversified and Extensive Product Portfolio

Jerai Fitness offers a comprehensive range of fitness solutions, including strength training equipment, cardiovascular machines, and a wide array of accessories. Its tiered product series cater to various segments, from premium commercial gyms and HNIs to budget-conscious home users. This extensive portfolio allows the company to serve a broad customer base and act as a one-stop solution provider, enhancing market penetration and cross-selling opportunities.

Diverse and Resilient Customer Base

The company serves a wide spectrum of customers, including commercial gyms, corporate clients, real estate developers, government bodies, defence units, hotels, hospitals, and individual consumers. This diversification across industries reduces dependence on any single customer segment, mitigates sector-specific risks, and provides multiple stable revenue streams, contributing to business sustainability and resilience.

Growing Global Footprint

Jerai Fitness has established a meaningful international presence, exporting its products to 26 countries, including the UK, Japan, UAE, and Australia, through a network of international distributors. This global outreach diversifies its revenue sources, enhances brand visibility, and reduces reliance on the domestic market, positioning the company for sustained growth in the international fitness equipment landscape.

More About Jerai Fitness Limited

Jerai Fitness Limited is a leading name in the Indian fitness equipment manufacturing industry, with a history of over 30 years. The company has successfully carved a niche for itself by catering to the evolving demands of the fitness world.

Product Portfolio

Jerai Fitness boasts a wide and segmented product portfolio, which can be broadly categorized as follows:

- Strength Training Equipment: This is the company’s core strength, contributing to over 77% of its revenue. The range includes:

- Selectorized Machines: (Proton, X-Tend, Clubline Plus series) utilizing weight stacks and pulleys.

- Load-On Equipment: Plate-loaded machines for compound movements.

- Benches, Racks & Free Weights: Including power racks, squat racks, dumbbells, and Olympic bars.

- Multi-gym and Functional Training Stations: Modular systems for multi-user workouts.

- Cardiovascular Equipment: Currently sourced from third-party manufacturers in Taiwan, South Korea, and China, and sold under the “Jerai Fitness” brand. This includes treadmills, ellipticals, exercise bikes, and rowers.

- Fitness Accessories: A comprehensive range including dip stands, kettlebells, punching bags, battle ropes, and more.

Manufacturing Prowess

The company’s manufacturing facility in Wada, Palghar, Maharashtra, spans 145,530 sq. ft. and is dedicated to the production of strength training equipment. It features a fully automated production process with advanced machinery, including laser cutters, robotic welding, and CNC machines. The facility is certified with ISO 9001:2015, ISO 14001:2015, ISO 45001:2018, and complies with ASTM and European safety standards (EN). The current installed capacity for strength equipment is 21,000 units per annum.

Customer-Centric Approach and Distribution

Jerai Fitness serves a diverse clientele, from large commercial gyms and government bodies to individual home users. It has a pan-India presence with 14 exclusive showrooms and has also developed an e-commerce website, https://www.jeraifitness.com/, for direct-to-consumer sales. The company is supported by a strong team of 51 sales and marketing professionals and 64 customer support engineers, ensuring high service levels.

Financial Performance and Growth

The company has demonstrated robust financial health, with consistent revenue growth and high profitability. For Fiscal 2025, it reported a Revenue from Operations of ₹1,280.46 million and a Profit After Tax of ₹234.01 million. Key metrics like RoNW (25.19%) and ROCE (33.97%) reflect efficient capital utilization and strong operational performance.

Industry Outlook

The Indian fitness equipment industry is on a strong growth trajectory, fueled by a confluence of positive factors.

Market Growth and Projections

The industry is experiencing a significant shift, moving beyond traditional gyms to penetrate homes, corporations, and public spaces. According to industry reports, the cardiovascular training equipment segment currently holds the largest market share (55% in 2024), followed by strength training equipment (36%). By 2029, the market dynamics are expected to evolve, with strength training equipment’s share projected to increase to 40%, while cardiovascular equipment will adjust to 50%, indicating a more balanced market.

Key Growth Drivers

- Rising Health Consciousness: Post-pandemic, there is a sustained and increased focus on health and wellness among the Indian population.

- Growing Disposable Income: Expanding middle-class and upper-class segments have higher discretionary spending power for fitness products and services.

- Expansion of Commercial Gyms: The rapid growth of fitness chains and boutique studios across tier-1 and tier-2 cities is driving demand for commercial-grade equipment.

- Real Estate and Infrastructure Development: Integration of gyms in residential complexes, hotels, and corporate offices is becoming a standard feature, creating a steady B2B demand.

- Government Initiatives: Schemes like ‘Fit India Movement’ are encouraging physical activity, boosting demand in the public and institutional sectors.

- Export Potential: Indian manufacturers are increasingly becoming competitive on a global scale, offering quality products at attractive price points.

The overall outlook for the industry remains highly positive, with a promising future CAGR, driven by these structural and behavioral trends.

How Will Jerai Fitness Limited Benefit

- Benefit from the overall expansion of the Indian fitness market, leading to increased demand for both strength and cardiovascular equipment from all customer segments.

- Capitalize on the projected increase in the market share of strength training equipment, which is its core manufacturing competency and primary revenue driver.

- Leverage its established brand and distribution network to secure contracts from the growing number of commercial gyms, fitness chains, and boutique studios.

- Tap into the demand from real estate developers who are increasingly incorporating state-of-the-art gyms as an amenity in residential and commercial projects.

- Secure more business from government tenders for outdoor fitness equipment in public parks and for equipment in defence and other public sector units, supported by the ‘Fit India’ initiative.

- Expand its share in the home gym segment, which is growing as individuals invest in personal fitness solutions for convenience and safety.

- Enhance its export revenues by leveraging its existing international distributor network and competitive manufacturing capabilities to serve the global market.

- Increase its addressable market and margins by commencing in-house manufacturing of cardiovascular equipment, reducing reliance on third-party suppliers.

Peer Group Comparison

Here’s your data formatted into a clear table for easier comparison:

| Name of the Company | Face Value (₹) | P/E | Revenue (₹ million) | EPS (Basic) | EPS (Diluted) | RoNW (%) | NAV (₹) |

| Jerai Fitness Limited | 10 | [●] | 1,280.46 | 13.37 | 13.37 | 25.19% | 59.75 |

| Peer Group | |||||||

| Peloton Interactive Inc | 0.00 | NM | 2,11,913.57 | (25.52) | (25.52) | NM | NM |

| Johnson Health Tech Co Ltd | NA | NA | NA | NA | NA | NA | NA |

| Technogym S.p.A. | NA | NA | NA | NA | NA | NA | NA |

| Dyaco International Inc. | NA | NA | NA | NA | NA | NA | NA |

Key Strategies for Jerai Fitness Limited

Establishing a New Manufacturing Facility

Jerai Fitness Limited intends to set up a new Proposed Unit adjacent to its existing facility to increase production capacities. This facility will enable the in-house manufacturing of cardiovascular equipment, a segment it currently sources, thereby improving quality control and margins. It will also cater to the production of additional strength fitness and outdoor fitness equipment, supporting the company’s growth and diversification plans while enhancing its overall manufacturing capabilities.

Expansion of Product Portfolio

The company plans to strategically expand its product portfolio by launching new lines of outdoor fitness equipment for public spaces and residential complexes, and premium equipment series for HNIs and the luxury hospitality sector. This diversification aims to tap into new market segments, including B2G (Business-to-Government) tenders and the high-end home user market, thereby driving long-term revenue growth and strengthening its market position.

Enhancing Brand Visibility through Associations

Jerai Fitness Limited aims to strengthen its brand positioning by collaborating with celebrities, athletes, and fitness influencers. These partnerships are designed to enhance brand recall, build trust with target audiences, and support the launch of new product lines. The company believes consistent investment in such marketing is crucial for driving consumer awareness and solidifying its brand equity in a competitive market.

Global Market Expansion through Trade Shows

The company’s strategy involves actively participating in international trade shows and exhibitions to engage with a global audience and expand its export business. By showcasing its product range at events like the FIBO Global Expo and Dubai Muscle Show, Jerai Fitness aims to attract new international distributors and clients, enhance global brand visibility, and drive sustained growth in its export revenues.

Strengthening Domestic Retail Presence

Jerai Fitness Limited plans to establish high-tech showroom cum experience centres across key Indian cities. These centres will provide customers with an immersive, hands-on experience to explore the latest fitness equipment with expert guidance. This initiative is aimed at enhancing brand visibility, reinforcing customer engagement, and solidifying the company’s position in the competitive Indian fitness equipment market.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Jerai Fitness Limited IPO

How can I apply for Jerai Fitness Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size for the Jerai Fitness IPO?

The lot size and the minimum investment required will be announced closer to the IPO date (TBA).

Is the Jerai Fitness IPO a fresh issue?

No, the IPO is entirely an Offer for Sale (OFS) by the selling shareholders; the company will not receive any proceeds.

Where will Jerai Fitness shares be listed?

The equity shares will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

What is the face value of Jerai Fitness shares?

The face value of Jerai Fitness Limited’s equity shares is ₹10 per share.