- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Jinkushal Industries IPO

₹13,800/120 shares

Minimum Investment

IPO Details

25 Sep 25

29 Sep 25

₹13,800

120

₹115 to ₹121

NSE, BSE

₹116.11 Cr

03 Oct 25

Jinkushal Industries IPO Timeline

Bidding Start

25 Sep 25

Bidding Ends

29 Sep 25

Allotment Finalisation

30 Sep 25

Refund Initiation

01 Oct 25

Demat Transfer

01 Oct 25

Listing

03 Oct 25

Jinkushal Industries Limited

JKIPL stands as a leading exporter of non-OEM construction machinery and a reliable provider of mining and logistics solutions. Recognised as a Three-Star Export House by the DGFT, Government of India, the company offers customised, accessorised construction machines tailored to global client specifications. JKIPL has also introduced its own brand, ‘HexL’, to meet international standards. With over 50 years of industry expertise, JKIPL operates across three verticals—machinery exports, mining services, and logistics—delivering sustainable, efficient, and affordable solutions across global markets.

Jinkushal Industries Limited IPO Overview

Jinkushal Industries IPO is a book build issue worth ₹116.11 crores. The issue comprises a fresh issue of 0.86 crore shares aggregating to ₹104.49 crores and an offer for sale of 0.10 crore shares amounting to ₹11.61 crores. The IPO will open for subscription on September 25, 2025, and close on September 29, 2025. The basis of allotment is expected to be finalised on September 30, 2025, and the shares are proposed to list on both BSE and NSE, with the tentative listing date set for October 3, 2025. The price band for the IPO has been fixed between ₹115.00 and ₹121.00 per share, with a lot size of 120 shares. For retail investors, the minimum investment required is ₹14,520 (based on the upper price band). For sNII, the lot size is 14 lots (1,680 shares) amounting to ₹2,03,280, while for bNII, it is 69 lots (8,280 shares) amounting to ₹10,01,880. GYR Capital Advisors Pvt. Ltd. is acting as the book running lead manager for the issue, while Bigshare Services Pvt. Ltd. is the registrar.The IPO filing was made with SEBI on April 30, 2025. The promoters of Jinkushal Industries include Anil Kumar Jain, Abhinav Jain, Sandhya Jain, Tithi Jain, and Yashasvi Jain, who currently hold 100% of the pre-issue equity. The post-issue shareholding details will reflect changes based on equity dilution, which can be calculated by the difference between pre-issue and post-issue holdings.

Jinkushal Industries Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 0.97 crore equity shares

Offer for Sale (OFS): NA |

| IPO Dates | 25 September to 29 September 2025 |

| Price Bands | ₹115 to ₹121 per share |

| Lot Size | 120 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,97,46,000 shares |

| Shareholding post -issue | 3,83,96,000 shares |

Jinkushal Industries IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 120 | ₹14,520 |

| Retail (Max) | 13 | 1,560 | ₹1,88,760 |

| S-HNI (Min) | 14 | 1,680 | ₹2,03,280 |

| S-HNI (Max) | 68 | 8,160 | ₹9,87,360 |

| B-HNI (Min) | 69 | 8,280 | ₹10,01,880 |

Jinkushal Industries Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Jinkushal Industries Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 6.27 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 43.29% |

| Net Asset Value (NAV) | 14.48 |

| Return on Equity | 55.19% |

| Return on Capital Employed (ROCE) | 29.44% |

| EBITDA Margin | 11.56% |

| PAT Margin | 7.81% |

| Debt to Equity Ratio | 1.06 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding the working capital requirements of the Company | 7267.50 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

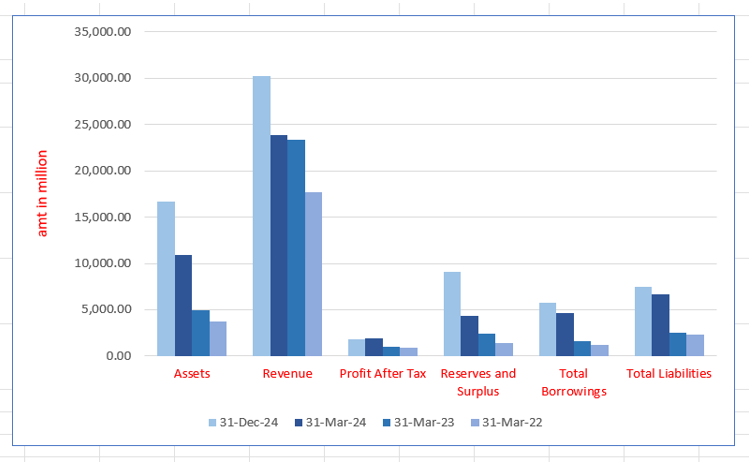

Jinkushal Industries Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 16,685.70 | 10,943.81 | 4939.20 | 3774.20 |

| Revenue | 30,251.12 | 23,859.18 | 23,345.05 | 17,696.28 |

| Profit After Tax | 1812.34 | 1864.45 | 1011.74 | 857.39 |

| Reserves and Surplus | 9047.11 | 4293.05 | 2436.22 | 1430.96 |

| Total Borrowings | 5719.04 | 4604.37 | 1629.52 | 1174.92 |

| Total Liabilities | 7472.24 | 6622.74 | 2489.08 | 2328.53 |

Financial Status of Jinkushal Industries Limited

SWOT Analysis of Jinkushal Industries IPO

Strength and Opportunities

- Recognized as a Three-Star Export House by DGFT, Government of India.

- Largest exporter of Non-OEM construction machinery in India.

- Diversified operations across machinery exports, mining services, and logistics solutions.

- Over 50 years of industry experience since 1972.

- Launched own brand 'HexL' for construction machines, catering to global markets.

- Export presence in over 30 countries, expanding global footprint.

- Recognized among the “Top SME Businesses of 2024” by Great Companies.

- Strong financial performance with a CAGR of 56.7% in revenue.

- Commitment to sustainability through refurbishment and recycling practices.

Risks and Threats

- Revenues are directly linked to construction activity levels, making operations vulnerable to economic cycles.

- Faces stiff competition from both domestic and international players, constraining pricing flexibility.

- Moderate working capital management with increased debtor days due to changes in payment policy.

- Dependence on export markets may expose the company to international market risks.

- Cyclical nature of the construction and mining industries can impact demand.

- Changes in international trade policies and tariffs could affect export operations.

- Fluctuations in foreign exchange rates may impact profitability.

- Regulatory changes in environmental and safety standards may require operational adjustments.

- Potential challenges in scaling operations while maintaining quality standards.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Jinkushal Industries Limited

Jinkushal Industries Limited IPO Strengths

One of the Largest Players in Export Trade of Construction Machines with Presence in UAE and USA through Subsidiaries

Jinkushal Industries Limited (JKIPL), recognised as a Three-Star Export House by DGFT, holds a 6.3% market share as India’s largest Non-OEM exporter of construction machines. With exports to over 30 countries and strategic subsidiaries in the UAE and USA, JKIPL leverages favourable trade policies and logistics to scale operations, maintain supply chains, and deliver quality machinery globally.

Refurbishment, Reuse, and Contribution to Circular Economy with Environmental Responsibility

Jinkushal Industries Limited extends the lifecycle of construction machines through systematic refurbishment, restoring used equipment to reliable condition. This process reduces the need for new manufacturing, conserves raw materials, lowers emissions, and promotes sustainability. By offering cost-effective, high-quality refurbished machines, JKIPL supports resource efficiency, environmental responsibility, and a circular economy while helping clients optimise capital investments.

Diversified Market Presence and Optimized Machine Solutions

Jinkushal Industries Limited offers a broad range of customized, refurbished, and new construction machines, including excavators, backhoe loaders, and cranes, catering to diverse global markets. This diversified portfolio reduces reliance on any single product or region, enhancing resilience and growth. With a focus on quality and sustainability, JKIPL delivers cost-effective, efficient solutions that meet evolving customer needs and optimise resource utilisation.

Supply Chain Efficiency

Jinkushal Industries Limited has developed a robust supply chain with 228 suppliers, including contractors, traders, and manufacturers, supporting its export trading of construction machines. The company collaborates with refurbishment centres across India and the UAE and partners with logistics providers for smooth distribution. Strategic outsourcing to Chinese manufacturers further enhances cost efficiency and ensures a reliable supply of high-quality machines globally.

Launch and Expansion of HexL Brand Machines

Jinkushal Industries Limited’s launch of the HexL brand marks a shift to a product-driven, customer-centric approach. Through contract manufacturing, HexL machines are produced to precise specifications and quality standards, with regular quality checks. This enables flexible production, strengthens market presence, and enhances customer relationships. To date, 36 HexL backhoe loaders have been supplied, expanding the company’s global footprint.

Established Relationships with Customers and Wide Customer Base

Jinkushal Industries Limited specializes in supplying construction machines with strong resale demand, offering ready-to-use refurbished and customized machines that reduce lead times. The company serves a broad customer base, with many clients maintaining associations for over three years. Consistent focus on client needs and timely delivery drives repeat business, contributing significantly to stable revenue from long-term customers across domestic and international markets.

Consistent Financial Performance Strengthening Balance Sheet

Jinkushal Industries Limited has demonstrated strong financial growth with a 56.7% CAGR in revenue and a 42.18% Return on Equity, reflecting effective capital utilization. From Fiscal 2022 to 2024, revenue, EBITDA, and profit after tax steadily increased, supported by cost rationalization and productivity improvements. Efficient resource management has enabled expansion through internal accruals and working capital debt, positioning the company for future growth.

More About Jinkushal Industries Limited

Jinkushal Industries Limited (JKIPL) operates a 30,000 sq. ft. in-house Refurbishment Facility in Raipur, Chhattisgarh. This centre is instrumental in reconditioning used construction machines, aiming to enhance their operational lifespan and efficiency.

- Equipped with advanced machinery: hydraulic mobile cranes, plasma cutting systems, MIG welding machines, lathe and turning machines, sand blasting units, and painting devices.

- Supported by a skilled workforce of 48 employees dedicated to refurbishment and machine customisation.

- The facility adheres to strict industry standards to ensure consistent quality.

Third-Party Support

In addition to its internal operations, JKIPL engages third-party non-exclusive refurbishment centres. These partners refurbish machines as per JKIPL’s SOPs, instructions, and technical guidelines.

HexL – Proprietary Construction Machinery Brand

JKIPL has recently introduced its own brand, HexL, through contract manufacturing partnerships in China.

- Initial focus: backhoe loaders, with 36 units sold to date.

- Future plans: to expand into other categories of construction and electric machinery under the HexL brand.

This outsourcing model allows the company to manage costs, optimise resources, and ensure a timely supply of high-quality machinery.

Export Growth and Global Presence

Since 2017, JKIPL has transitioned into export trading of both new and refurbished machines, having supplied over 1,500 construction units globally.

- 900+ new machines (customised or accessorised).

- 600+ used/refurbished machines.

- Significant customer retention: 85%, 84%, and 84% revenue from repeat clients in FY 2024, 2023, and 2022, respectively.

Subsidiary Network

To enhance global operations:

- Hexco Global FZCO was incorporated in JAFZA, UAE, in 2023 (80% stake).

- Acquired Hexco Global USA LLC in 2024 (90% membership), becoming a step-down subsidiary.

Industry Experience and Leadership

Incorporated in 2007, JKIPL came under current promoters in 2009, led by Mr. Anil Kumar Jain. With over eight years of operational experience in export trading, refurbishment, and customisation, JKIPL has become India’s largest non-OEM exporter of construction machines.

- Strong leadership: Promoter Directors Anil Kumar Jain and Abhinav Jain bring over 45 years of industry expertise.

- The management’s vision and business acumen have driven sustained growth and customer trust.

Industry Outlook

India’s construction equipment industry is poised for robust growth, driven by substantial infrastructure investments, urbanization, and technological advancements. Companies like Jinkushal Industries Limited (JKIPL), engaged in refurbishment and manufacturing of construction machinery, are well-positioned to capitalize on these trends.

Industry Overview

- Market Size & Growth: The Indian construction equipment market was valued at approximately USD 14.3 billion in 2024 and is projected to reach USD 29.5 billion by 2033, growing at a CAGR of 7.6% during 2025–2033.

- Segment Insights: Earthmoving machinery, including backhoe loaders and excavators, dominates the market with over 70% revenue share in 2022 and is expected to maintain the highest CAGR through 2032.

Growth Drivers

- Infrastructure Development: Government initiatives like the National Infrastructure Pipeline (NIP), Smart Cities Mission, and PM Gati Shakti are fueling demand for construction equipment. For instance, the NIP envisages an investment of Rs. 100 lakh crores by 2025.

- Urbanization: India’s urban population increased from 34% in 2018 to 36% in 2022, necessitating enhanced transportation, housing, and sanitation infrastructure, thereby boosting equipment demand.

- Technological Advancements: Integration of GPS, telematics, and IoT in construction machinery is improving efficiency and reducing downtime. Additionally, the shift towards electric and hybrid equipment aligns with sustainability goals.

Backhoe Loaders Market

- Market Size & Growth: The backhoe loaders market in India reached USD 561.30 million in 2024 and is expected to grow at a CAGR of 5.95% to USD 944.45 million by 2033.

- Demand Factors: Their versatility in excavation, trenching, and material handling makes them indispensable for infrastructure projects, especially in rural and urban development schemes.

Refurbished Equipment Market

- Market Dynamics: The high cost of new machinery and the rise of rental services are propelling the refurbished equipment market. Companies like JKIPL, with in-house refurbishment facilities and third-party collaborations, cater to this growing segment.

- Export Potential: India’s construction equipment exports stood at around $500 million, with expectations to reach $3 billion by 2030, indicating significant opportunities for refurbished equipment in international markets

How Will Jinkushal Industries Limited Benefit

- JKIPL’s in-house 30,000 sq. ft. refurbishment facility enables cost-effective reconditioning, extending machinery life and improving efficiency.

- Advanced tools and a skilled workforce ensure high-quality refurbishment aligned with industry standards.

- Collaborations with third-party centres expand refurbishment capacity while maintaining consistent quality through SOPs.

- Rising demand for refurbished equipment due to high costs of new machinery positions JKIPL to capture a growing market share.

- With over 1,500 global shipments, JKIPL leverages export potential as India’s refurbished equipment exports rise.

- Introduction of HexL backhoe loaders taps into a segment holding over 70% market share, with plans to expand the product line.

- Contract manufacturing in China ensures cost control and steady product supply for HexL.

- High client retention rates signal strong brand trust and recurring business.

- Subsidiaries in UAE and USA strengthen global presence and operational reach.

- Experienced leadership and market foresight support JKIPL’s sustained growth in a booming industry.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Jinkushal Industries Limited

Further Integration and Diversification

Jinkushal Industries Limited aims to expand its vendor network for procurement, refurbishment, customization, and contract manufacturing. This diversification enhances supply chain resilience, improves inventory management, and strengthens quality control. The company focuses on branded products and contract manufacturing to ensure compliance and tailor solutions for diverse markets.

Sales Volume Growth

The company plans to boost sales by expanding its global distribution and customer base. By targeting wholesalers, dealers, and distributors, Jinkushal Industries Limited aims to increase market penetration in new, refurbished, and customized construction machines, fostering strategic partnerships and optimising revenue across multiple regions.

Efficiency Enhancement and Cost Optimization

Jinkushal Industries Limited seeks to improve operational efficiency by refining procurement, refurbishment, and logistics. Investment in automation and technology will reduce turnaround times, improve inventory accuracy, and optimise resource use. This focus will enhance cost control while maintaining high product quality and long-term profitability.

Expansion of Product Portfolio

The company intends to broaden its product range beyond traditional construction machines by introducing electric models. This expansion responds to market demand for sustainable solutions, environmental regulations, and diverse customer needs, positioning Jinkushal Industries Limited as an innovative leader in the global construction equipment sector.

Create and Strengthen Brand Recognition

Jinkushal Industries Limited will invest in digital marketing, distributor engagement, and international exhibitions to boost brand visibility and customer loyalty. Supporting dealers with training and marketing resources ensures quality after-sales service. Targeted campaigns will deepen market presence and expand global reach effectively.

Working Capital Optimisation

To improve margins and financial sustainability, the company plans to shorten its working capital cycle by enhancing inventory turnover and negotiating better payment terms. This will improve cash flow and liquidity, supporting scalable growth and global expansion, while aligning financial strategy with operational efficiency.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Jinkushal Industries Limited IPO

How can I apply for Jinkushal Industries Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the Jinkushal Industries IPO open?

The IPO open date for the issue is 25 September 2025 and closing date 29 September 2025

What is the total issue size of the IPO?

The IPO comprises 0.97 crore equity shares, including fresh issuance and offer for sale.

On which stock exchanges will Jinkushal Industries IPO be listed?

The IPO shares will be listed on both the BSE and NSE after allotment.

Who is managing the Jinkushal Industries IPO?

GYR Capital Advisors Private Limited is the book-running lead manager for the IPO.

What is the face value of Jinkushal Industries shares in the IPO?

The face value of each equity share offered in the IPO is ₹10.