- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

JSW Cement IPO

₹14,178/102 shares

Minimum Investment

IPO Details

07 Aug 25

11 Aug 25

₹14,178

102

₹139 to ₹147

TBA

₹3 Cr

14 Aug 25

JSW Cement IPO Timeline

Bidding Start

07 Aug 25

Bidding Ends

11 Aug 25

Allotment Finalisation

12 Aug 25

Refund Initiation

13 Aug 25

Demat Transfer

13 Aug 25

Listing

14 Aug 25

JSW Cement Limited

JSW Cement Limited, established in 2006, is a part of the JSW Group and a leading green cement manufacturer in India. Focused on sustainability and innovation, it operates seven strategically located plants, including integrated, clinker, and grinding units across Andhra Pradesh, Karnataka, Tamil Nadu, Maharashtra, West Bengal, and Odisha. As of March 31, 2025, the company had an installed grinding capacity of 20.60 MMTPA. Its diverse portfolio includes blended and ordinary cement, GGBS, clinker, RMC, screened slag, and construction chemicals, supported by a vast distribution network of 4,653 dealers and 158 warehouses.

JSW Cement Limited IPO Overview

The JSW Cement IPO is a book-built issue amounting to ₹3,600.00 crores, comprising a fresh issue of 10.88 crore equity shares aggregating to ₹1,600.00 crores and an offer for sale of 13.61 crore shares worth ₹2,000.00 crores. The subscription window for the IPO opens on August 7, 2025, and closes on August 11, 2025. The basis of allotment is expected to be finalised by Tuesday, August 12, 2025, with the shares likely to be listed on both the BSE and NSE on Thursday, August 14, 2025. The price band for the IPO is fixed between ₹139 and ₹147 per share. Investors can apply for a minimum lot of 102 shares, requiring an investment of ₹14,178 for retail individuals. For small non-institutional investors (sNII), the minimum application is 14 lots (1,428 shares) amounting to ₹2,09,916, while for big non-institutional investors (bNII), it is 67 lots (6,834 shares), which totals ₹10,04,598. JM Financial Limited is acting as the book-running lead manager, and Kfin Technologies Limited is serving as the registrar for the issue.

JSW Cement Limited IPO Details

| Particulars | Details |

| IPO Date | 7 August 2025 to 11 August 2025 |

| Listing Date | 14 August 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹139 to ₹147 per share |

| Lot Size | 102 Shares |

| Total Issue Size | 24,48,97,958 shares (₹3,600.00 Cr) |

| Fresh Issue | 10,88,43,537 shares (₹1,600.00 Cr) |

| Offer for Sale | 13,60,54,421 shares (₹2,000.00 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 1,25,45,21,399 shares |

| Share Holding Post Issue | 1,36,33,64,936 shares |

| Market Maker Portion | Not Applicable |

JSW Cement Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

JSW Cement Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 102 | ₹14,994 |

| Retail (Max) | 13 | 1,326 | ₹1,94,922 |

| HNI (Min) (S-NII) | 14 | 1,428 | ₹2,09,916 |

| HNI (Max) (S-NII) | 66 | 6,732 | ₹9,89,604 |

| HNI (Min) (B-NII) | 67 | 6,834 | ₹10,04,598 |

JSW Cement Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 78.62% |

| Post-Issue | [To be updated] |

JSW Cement Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | -1.31 (Pre IPO), -1.20 (Post IPO) |

| Price/Earnings (P/E) | -112.61 (Pre), -122.38 (Post) |

| Return on Net Worth (RoNW) | -4.85% |

| Net Asset Value (NAV) | ₹23.85 |

| Return on Equity (ROE) | -6.90% |

| Return on Capital Employed (ROCE) | 7.05% |

| EBITDA Margin | 13.78% |

| PAT Margin | -2.77% |

| Debt to Equity Ratio | 0.98 |

Objectives of the Proceeds

- Establish new integrated cement unit in Nagaur, Rajasthan – ₹800 Cr

- Repayment or prepayment of certain borrowings – ₹520 Cr

- General corporate purposes – Unspecified amount

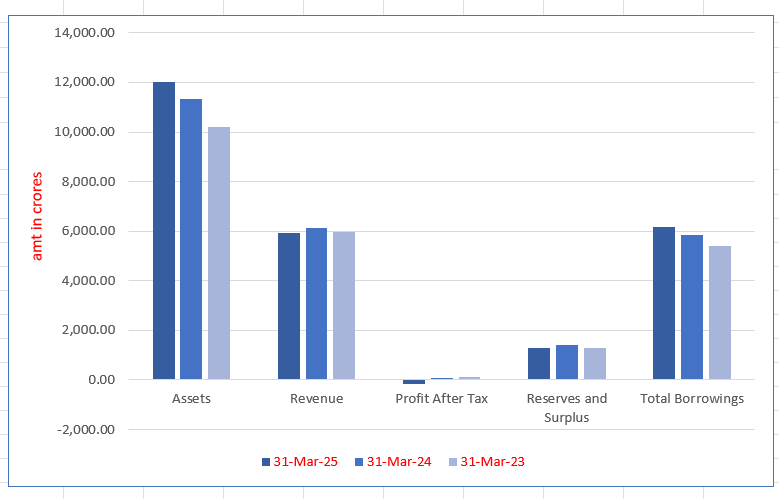

Key Financials (in ₹ crores)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 12,003.94 | 11,318.91 | 10,218.61 |

| Revenue | 5,914.67 | 6,114.60 | 5,982.21 |

| Profit After Tax | -163.77 | 62.01 | 104.04 |

| Reserves and Surplus | 1,287.31 | 1,399.06 | 1,296.66 |

| Total Borrowings | 6,166.55 | 5,835.76 | 5,421.54 |

SWOT Analysis of JSW Cement IPO

Strength and Opportunities

- Fastest-growing cement company in terms of grinding capacity and sales volume.

- India’s largest manufacturer of GGBS with proven scalability.

- Plants located near raw material sources and key markets.

- Lowest CO₂ emission intensity among peers and global leaders.

- Strong distribution network across India with 4,653 dealers and 158 warehouses.

- Backed by JSW Group’s brand and managed by a qualified leadership team.

Risks and Threats

- Recent financial performance shows a significant decline in net profit.

- Negative ROE and RoNW may concern conservative investors.

- Dependence on debt financing and capital expenditure-heavy expansion.

- Faces intense competition from well-established and larger cement players.

- Slower revenue growth and drop in EBITDA in the latest financial year.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About JSW Cement Limited

JSW Cement Limited IPO Strengths

- JSW Cement is among the fastest-growing cement producers in India, driven by expanding grinding capacity and rising sales volumes.

- It holds the distinction of being India’s leading GGBS manufacturer, backed by consistent business growth and operational excellence.

- Its manufacturing facilities are strategically positioned near raw material sources and major consumption hubs for logistical efficiency.

- The company records the lowest carbon emission intensity among Indian and top global cement manufacturers.

- A robust pan-India distribution network and strong brand presence support its market outreach.

- Backed by the JSW Group, the company draws strength from its experienced leadership and corporate backing.

Peer Group Comparison

| Company Name | EPS (Rs) | NAV (Rs) | P/E (x) | RoNW (%) | P/BV Ratio |

| JSW Cement Limited | -1.16 | 23.85 | NA | -4.85 | 6.16 |

| Peer Groups | |||||

| Ultratech Cement Limited | 205.30 | 2,403.71 | 59.56 | 8.54 | 5.08 |

| Ambuja Cements Limited | 17.00 | 218.00 | 35.97 | 7.80 | 2.80 |

| Shree Cement Limited | 311.18 | 5,969.32 | 97.77 | 5.21 | 5.10 |

| Dalmia Bharat Limited | 36.42 | 926.34 | 60.39 | 3.93 | 2.37 |

| JK Cement Limited | 111.44 | 788.03 | 58.39 | 14.14 | 8.26 |

| The Ramco Cements Limited | 11.53 | 314.82 | 103.50 | 3.66 | 3.80 |

| The India Cements Limited | 153.23 | 328.95 | 2.38 | -1.41 | 1.11 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On JSW Cement IPO

How can I apply for JSW Cement IPO?

You can apply via HDFC Sky using UPI-based ASBA for secure online bidding.

What is the minimum investment for JSW Cement IPO?

Retail investors can start with one lot comprising 102 shares, costing ₹14,994.

When will JSW Cement IPO be listed on exchanges?

The IPO is scheduled for listing on BSE and NSE on 14 August 2025.

What is the purpose of the funds raised via JSW Cement IPO?

Funds will be used for a new cement plant, debt repayment, and general corporate needs.