- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Juniper Green Energy IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Juniper Green Energy IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Juniper Green Energy Limited

Juniper Green Energy is a leading independent renewable energy power producer in India, focusing on the development, construction, and operation of solar, wind, and hybrid power projects. Committed to sustainable energy solutions, the company supports India’s transition to a greener future by generating power from non-fossil fuel sources. It manages the complete lifecycle of renewable energy projects, covering bidding, site prospecting, land acquisition, grid permits, engineering, procurement, project financing, construction, and operations. Juniper Green Energy has signed long-term power purchase agreements with government entities such as SECI, SJVN, NHPC, and NTPC, as well as private clients like Tata Power. As of 31 May 2025, the company’s total portfolio capacity stands at 7,898.45 MW, with a strong presence across Gujarat, Rajasthan, Maharashtra, and Madhya Pradesh.

Juniper Green Energy Limited IPO Overview

Juniper Green Energy Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on June 27, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is a book-built issue aimed at raising ₹3,000.00 crores entirely through a fresh issue of shares, with no offer-for-sale component. The company’s equity shares are proposed to be listed on both NSE and BSE. ICICI Securities Ltd. will act as the book running lead manager, while Kfin Technologies Ltd. will serve as the registrar. Key details, including IPO dates, price band, and lot size, are yet to be announced. The promoters include Arvind Tiku, Hemant Tikoo, Niharika Tiku, At Holdings Pte. Ltd., and Juniper Renewable Holdings Pte. Ltd. Pre-IPO, the promoters hold 100% of the shares.

Juniper Green Energy Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹3000 crore |

| Fresh Issue | ₹3000 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 48,89,89,292 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Juniper Green Energy Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Juniper Green Energy Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹1.90 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 2.31% |

| Net Asset Value (NAV) | ₹81.93 |

| Return on Equity (RoE) | 2.31% |

| Return on Capital Employed (RoCE) | 5.59% |

| EBITDA Margin | 87.37% |

| PAT Margin | 10.23% |

| Debt to Equity Ratio | 1.00 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/pre-payment, in full or part of certain borrowings availed by our Company | 10,922.71 |

| Investment in our Material Subsidiaries namely Juniper Green Gamma One Private Limited, Juniper Green Three Private Limited, Juniper Green Field Private Limited, Juniper Green Beam Private Limited, and our Subsidiaries namely Juniper Green Kite Private Limited and Juniper Green Ray Two Private Limited for repayment/ pre-payment, in full or in part, of all or a portion of certain of their outstanding borrowings | 11,577.29 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

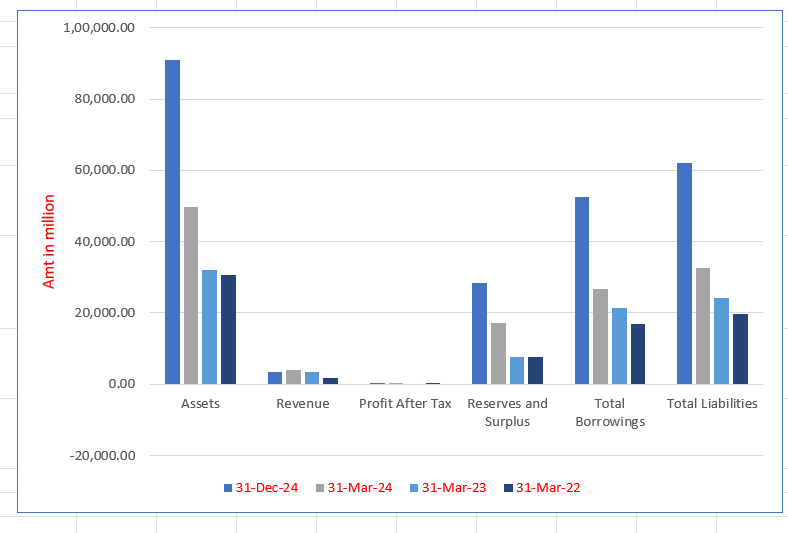

Juniper Green Energy Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 90,909.30 | 49,864.44 | 32,120.14 | 30,708.37 |

| Revenue | 3,515.94 | 3,915.50 | 3,313.07 | 1,705.30 |

| Profit After Tax | 78.19 | 400.64 | (120.58) | 272.28 |

| Reserves and Surplus | 28,355.39 | 17,057.71 | 7,691.66 | 7,781.30 |

| Total Borrowings | 52,548.81 | 26,717.01 | 21,333.79 | 17,005.86 |

| Total Liabilities | 62,148.86 | 32,547.67 | 24,290.40 | 19,788.99 |

Financial Status of Juniper Green Energy Limited

SWOT Analysis of Juniper Green Energy IPO

Strength and Opportunities

- Backed by AT Capital and Vitol, enhancing financial stability.

- Strong presence in solar, wind, and hybrid power projects.

- Plans to raise INR 3,000 crore through an IPO, indicating growth aspirations.

- Adequate land bank and technological know-how for rapid expansion.

- Alignment with India's renewable energy goals, positioning the company to benefit from policy support.

- Efficient technology and quality standards in developing, operating, and managing renewable energy assets.

- Healthy project pipeline with a diversified asset base.

- Strong governance and regulatory information, enhancing investor confidence.

- Strategic focus on scaling up renewable energy businesses in India.

Risks and Threats

- Reliance on government policies and renewable energy tariffs.

- Exposure to risks inherent in renewable power projects.

- Limited track record of operations.

- Increased execution and funding risks due to large, complex projects in the developmental phase.

- Cash flow sensitivity to plant load factor (PLF), which depends on solar irradiance and weather patterns.

- Exposure to counterparty risks inherent in renewable energy assets.

- Potential underperformance due to teething issues related to operations and maintenance (O&M) of the plant.

- Heavy reliance on external funding for large upfront capital expenditures.

- Sensitivity of debt metrics to energy generation by the company and its subsidiaries.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Juniper Green Energy Limited

Juniper Green Energy Limited IPO Strengths

Market Leadership and Diverse Project Portfolio

Juniper Green Energy Limited is a leading renewable energy independent power producer in India, ranking among the top 10 as of December 31, 2024. The company’s portfolio has significantly expanded to 7,898.45 MW (10,069.58 MWp) across 48 projects, focusing on complex and technologically diverse projects like wind-solar hybrid (WSH) and firm, dispatchable renewable energy (FDRE) projects.

Strategic Land and Grid Connectivity

Juniper Green Energy Limited has a proven ability to secure land and grid connection approvals well in advance, holding surplus connectivity of 1,588 MW for future projects as of May 31, 2025. This strategy addresses a major industry challenge and is supported by a substantial land bank of over 9,000 acres and more than 300 WTG locations in key renewable energy zones.

Stable and Long-Term Agreements

The company operates on a “Build-Own-Operate” model, with 97.64% of its total capacity secured through long-term power purchase agreements (PPAs) with central and state government off-takers that have strong credit ratings. These agreements feature fixed tariffs, ensuring stable and predictable long-term cash flows and enabling the company to secure competitive financing.

Proven Project Execution Capabilities

Juniper Green Energy Limited has a track record of commissioning most of its operational projects ahead of schedule, with a weighted average of 136 days since starting operations. Its end-to-end in-house capabilities, from bidding to project development, procurement, and operations and maintenance, are the key to this efficiency and timely project delivery.

De-risked and Strategic Supply Chain

The company mitigates supply chain risks by directly sourcing critical components from market leaders and securing long-term agreements. Its strategic procurement approach includes a 1 GW agreement with First Solar, which provides modules exempt from future regulatory changes, ensuring cost-effectiveness and timely delivery for its under-construction projects.

Strong Financial and Leadership Support

Juniper Green Energy Limited benefits from committed promoters and financial partners who have infused significant capital and provided guarantees totaling over ₹32,824 million in equity as of May 31, 2025. This strong financial backing and a dynamic, experienced leadership team have enabled the company to scale operations while maintaining financial discipline.

More About Juniper Green Energy Limited

Juniper Green Energy Limited is ranked among the top 10 largest renewable independent power producers (IPPs) in India in terms of total capacity as of December 31, 2024, encompassing operational, under-construction contracted, and awarded projects (CRISIL Report). The company develops, builds, operates, and maintains utility-scale renewable energy projects through its in-house EPC and O&M teams. Revenue is primarily generated through the sale of electricity to various off-takers, including central and state government-backed entities.

Since commissioning its first solar project of 100 MW (144.97 MWp) in March 2020, Juniper Green Energy has expanded its portfolio to a total capacity of 7,898.45 MW (10,069.58 MWp) as of May 31, 2025. Its portfolio includes solar, wind, and complex renewable energy projects such as WSH and FDRE projects integrated with BESS. The company ranked second in total capacity won in WSH and FDRE tenders concluded between April 1, 2021, and December 31, 2024, achieving a 100% conversion rate for these tenders (CRISIL Report).

Project Portfolio

Operational Projects:

- 179 projects with 954.30 MW AC / 1,320.17 MWp

- Includes both solar and wind projects; some capacity sold on a merchant basis

Under Construction Contracted Projects:

- 183 projects with 3,153.35 MW AC / 3,892.11 MWp

- Includes solar, wind, WSH, FDRE, and battery storage projects

Under Construction Awarded Projects:

- 133 projects with 3,790.80 MW AC / 4,857.30 MWp

The company has recently received partial commissioning certificates, raising operational capacity to 1,047.20 MW (1,450.94 MWp) in June 2025. Geographically, Gujarat, Rajasthan, Maharashtra, and Madhya Pradesh account for the majority of its capacity.

Integrated Execution and Operations

Juniper Green Energy manages the full project lifecycle, including bidding, site acquisition, engineering, procurement, financing, construction, and O&M. Its in-house EPC and O&M integration improves cost control, timelines, and project quality. Projects are typically commissioned ahead of schedule, with a weighted average of 136 days early.

Off-Takers and Financial Strength

As of May 31, 2025, 97.64% of total capacity is backed by long-term PPAs with creditworthy counterparties, ensuring stable cash flows. Strategic partnerships with suppliers such as Envision, Suzlon, First Solar, Waaree, Goldi, Sungrow, and TBEA strengthen supply chain resilience.

Leadership and Growth

Promoters Arvind Tiku, Hemant Tikoo, AT Holdings, and Juniper Renewable have been associated since 2018, providing experience, equity support, and financial backing. Senior Management, supported by over 500 employees, drives operational excellence. Revenue, EBITDA, and profit after tax grew at CAGRs of 51.53%, 49.92%, and 21.30% respectively from FY2022 to FY2024. Credit ratings of CRISIL A+/Ind Ra A+ and ICRA A+ reflect the company’s robust financial health.

Industry Outlook

Market Growth and Projections

India’s renewable energy sector is poised for significant expansion:

- Installed Capacity: Projected to reach 237.17 GW by 2025, growing to 500.23 GW by 2030, at a CAGR of 16.10%.

- Solar Energy: Anticipated to grow from 92 GW in 2024 to 284.14 GW by 2033, reflecting a CAGR of 13.35%.

- Wind Energy: Expected to increase from 58 GW in 2025 to 150 GW by 2030, with a CAGR of 20.93%.

Growth Drivers

Key factors fueling this growth include:

- Government Policies: Supportive initiatives like Production Linked Incentive (PLI) schemes and incentives for solar parks and hybrid energy projects.

- Private Investment: Attraction of substantial foreign and domestic investments into renewable energy projects.

- Technological Advancements: Innovations in energy storage solutions and grid integration enhancing efficiency and reliability.

Challenges

Despite positive trends, the sector faces challenges:

- Skill Shortages: A significant gap in trained professionals, affecting project timelines and costs.

- Infrastructure Constraints: Grid integration issues and storage limitations hindering optimal utilization of renewable energy.

How Will Juniper Green Energy Limited Benefit

- Strong growth in India’s renewable energy sector provides opportunities to expand operational and under-construction capacities.

- Rising solar and wind installations align with the company’s diversified portfolio, enhancing revenue potential.

- Government incentives and supportive policies reduce project costs and improve financial viability.

- Strategic partnerships with leading equipment and technology suppliers strengthen supply chain resilience and ensure timely project execution.

- In-house EPC and O&M capabilities allow better control over costs, timelines, and quality, boosting profitability.

- Access to long-term PPAs with creditworthy off-takers provides stable and predictable cash flows.

- Geographical diversification across high-potential states mitigates regional risks and optimizes resource utilisation.

- Advanced technology adoption, including hybrid and battery-integrated projects, positions the company at the forefront of innovation.

- Experienced leadership and strong promoter support enhance operational efficiency and access to project financing.

Peer Group Comparison

| Name of the Company | Revenue (₹ million) | Face Value (₹) | P/E (x) | EPS (₹) | RoNW (%) | NAV (₹) |

| Juniper | 3,915.50 | 10 | NA# | 1.90 | 2.31 | 81.93 |

| Peer Groups | ||||||

| Acme Solar Holdings Limited | 13,192.50 | 2 | 19.73 | 12.55 | 26.95 | 46.59 |

| NTPC Green Energy Limited | 19,626.00 | 10 | 153.14 | 0.72 | 5.50 | 13.17 |

| Adani Green Energy Limited | 92,200.00 | 10 | 152.85 | 6.21 | 11.19 | 62.01 |

| Renew Global Energy PLC | 83,399.00 | 0 | 567.32 | 14.05 | 9.92 | 287.18 |

Key Strategies for Juniper Green Energy Limited

Capitalize on the Growing Renewable Energy Sector in India

Juniper Green Energy Limited aims to leverage India’s expanding renewable energy sector by aligning with national capacity targets, utilising its technical expertise, and pursuing large-scale solar, wind, and hybrid projects. This approach addresses rising power demand, policy support, and grid integration opportunities efficiently.

Expand and Diversify Project Portfolio to Gain Market Share

The company focuses on expanding and diversifying its renewable energy portfolio, including solar, wind, WSH, FDRE, and cross-border power trading. By securing land, grid connectivity, and permits in advance, it reduces execution risks while entering new market segments like energy storage and green hydrogen.

Invest in Supply Chain and Procure Critical Components Efficiently

Juniper Green Energy Limited strengthens project execution through strategic procurement of solar modules, WTGs, inverters, and transformers. Maintaining strong supplier relationships, advance orders, and quality control measures ensures timely delivery, cost efficiency, and resilience against price volatility and supply chain disruptions.

Integrate Advanced Digital Technologies into Operations

The company employs AI/ML, IIoT, and cloud computing to optimise renewable energy operations. Real-time monitoring, predictive maintenance, and generation forecasting enhance efficiency, revenue management, and system reliability while supporting intelligent scheduling of energy storage and maximizing clean energy output.

Diversify Funding Sources and Optimise Cost of Capital

Juniper Green Energy Limited pursues a balanced mix of equity and long-term debt, aligning financing with project lifecycles. Refinancing, working capital lines, and bank guarantees enhance execution flexibility, reduce borrowing costs, and support new projects while maintaining an optimised capital structure for sustained growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Juniper Green Energy

How can I apply for Juniper Green Energy Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the IPO open and list?

The IPO dates and listing schedule are yet to be announced by the company.

What is the size of the IPO?

Juniper Green Energy IPO is ₹3,000.00 crore consisting entirely of a fresh issue of shares.

Will the IPO include an offer for sale (OFS)?

No, the IPO is solely a fresh issue; there is no offer for sale component.

What is the face value of the shares?

Each equity share has a face value of ₹10, with issue price band to be announced.

How will the IPO proceeds be used?

Proceeds will fund repayment of borrowings, subsidiaries’ debt, and general corporate purposes.