- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

K. V. Toys India IPO

₹1,36,200/600 shares

Minimum Investment

IPO Details

08 Dec 25

10 Dec 25

₹1,36,200

600

₹227 to ₹239

BSE

₹40.15 Cr

15 Dec 25

K. V. Toys India IPO Timeline

Bidding Start

08 Dec 25

Bidding Ends

10 Dec 25

Allotment Finalisation

11 Dec 25

Refund Initiation

12 Dec 25

Demat Transfer

12 Dec 25

Listing

15 Dec 25

K. V. Toys India Limited

Incorporated in 2009, K. V. Toys India Limited manufactures and sells plastic and metal-based toys for children. Its portfolio spans educational and recreational toys, including dolls, die-cast vehicles, battery-operated toys, and soft bullet guns. The company markets proprietary brands like Alia & Olivia, Yes Motors, Funny Bubbles, and Thunder Strike. Operating on a contract manufacturing model with 11 OEM facilities across India, it ensures quality compliance and timely delivery while maintaining competitive pricing for domestic and export markets.

K. V. Toys India Limited IPO Overview

K. V. Toys India IPO opens on 8 December 2025 and closes on 10 December 2025, with a total issue size of ₹40.15 crore entirely through a fresh issue. The price band is set at ₹227–₹239 per share, with a lot size of 1,200 shares for retail investors. The allotment will be finalised on 11 December 2025, refunds on 12 December, and shares credited to demat accounts the same day. The IPO will list on BSE SME on 15 December 2025. GYR Capital Advisors Pvt. Limited is the lead manager, Purva Sharegistry the registrar, and Giriraj Stock Broking Pvt. Limited the market maker.

K. V. Toys India Limited IPO Details

| Particulars | Details |

| IPO Date | 8 December 2025 to 10 December 2025 |

| Listing Date | 15 December 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹227 to ₹239 per share |

| Lot Size | 1,200 Shares |

| Total Issue Size | 16,80,000 shares (aggregating ₹40.15 Cr) |

| Fresh Issue | 16,80,000 shares (₹40.15 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE SME |

| Share Holding Pre Issue | 46,00,000 shares |

| Share Holding Post Issue | 62,80,000 shares |

| Market Maker Portion | 1,00,800 shares |

K. V. Toys India IPO Reservation

| Investor Category | Shares Offered |

| Market Maker | 1,00,800 (6%) |

| QIB | 7,80,600 (46.46%) |

| NII (HNI) | 2,39,400 (14.25%) |

| Retail | 5,59,200 (33.29%) |

| Total | 16,80,000 (100%) |

K. V. Toys India IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 2 | 1,200 | ₹2,86,800 |

| Retail (Max) | 2 | 1,200 | ₹2,86,800 |

| HNI (Min) | 3 | 1,800 | ₹4,30,200 |

| HNI (Max) | 6 | 3,600 | ₹8,60,400 |

K. V. Toys India IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 79.65% |

| Post-Issue | 58.35% |

K. V. Toys India IPO Valuation Overview

| KPI | Value |

| EPS | Pre IPO: ₹9.98; Post IPO: ₹12.91 |

| Price/Earnings (P/E) Ratio | Pre IPO: 23.94x; Post IPO: 18.51x |

| Return on Net Worth (RoNW) | 22.22% |

| Net Asset Value (NAV) | 19.75 |

| Return on Equity | 22.22% |

| Return on Capital Employed (ROCE) | 30.83% |

| EBITDA Margin | 26.67% |

| PAT Margin | 13.33% |

| Debt to Equity Ratio | 0.33 |

Objectives of the Proceeds

- Funding working capital requirements – ₹20.92 crore

- Repayment/prepayment of borrowings – ₹11.70 crore

- General corporate purposes

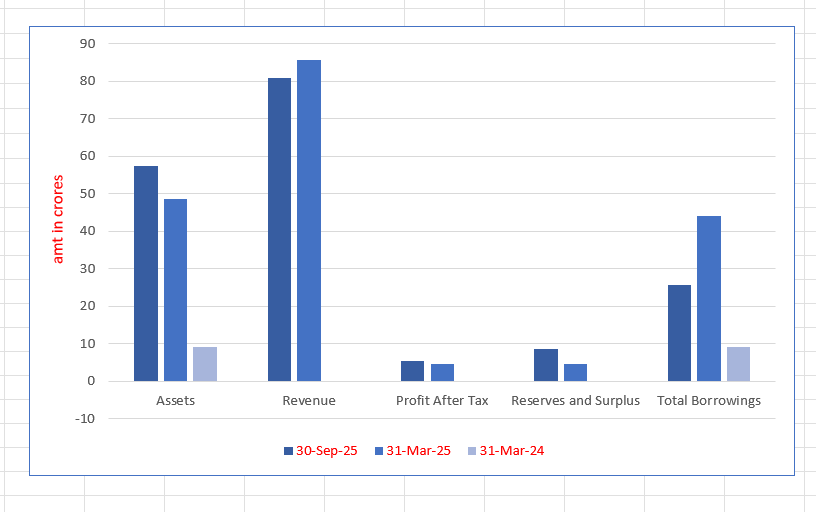

Key Financials (in ₹ crore)

| Particulars | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 |

| Assets | 57.46 | 48.53 | 9.17 |

| Revenue | 80.80 | 85.60 | – |

| Profit After Tax | 5.43 | 4.59 | -0.14 |

| Reserves and Surplus | 8.54 | 4.49 | -0.11 |

| Total Borrowings | 25.57 | 44.03 | 9.17 |

SWOT Analysis of K. V. Toys India IPO

Strength and Opportunities

- Experienced promoters with technical expertise

- Well-diversified toy product portfolio

- Strong domestic and export market presence

- Proprietary brands with loyal customer base

- Asset-light model with integrated supply chain

Risks and Threats

- Dependence on OEM partners for manufacturing

- Vulnerable to fluctuations in raw material prices

- Intense competition from local and global brands

- Seasonal demand affecting revenue consistency

- Regulatory changes may impact operations

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About K. V. Toys India Limited

K. V. Toys India IPO Strengths

- Product range serves varied age groups with engaging, diverse toy categories.

- Local OEM manufacturing ensures consistent production quality across facilities.

- In-house teams deliver strong design expertise and efficient packaging solutions.

- Asset-light model supports streamlined operations with controlled supply chains.

- High-quality toys offered consistently at affordable, competitive market prices.

Peer Group Comparison

- As per the DRHP, there are no comparable listed peer of the company and therefore information related to peer is not provided

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On K. V. Toys India IPO

How can I apply for K. V. Toys India IPO?

You can apply via HDFC Sky using UPI-based ASBA application process.

What is the minimum investment for retail investors?

Retail investors need to invest ₹2,86,800 for 1,200 shares in this IPO.

What is the tentative listing date of the IPO?

The K. V. Toys India IPO is expected to list on BSE SME on 15 December 2025.

Who is the lead manager for the IPO?

GYR Capital Advisors Pvt. Limited is appointed as the book running lead manager.