- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Kalpataru IPO

₹13/36 shares

Minimum Investment

IPO Details

24 Jun 25

26 Jun 25

₹13

36

₹387 to ₹414

NSE, BSE

₹1 Cr

01 Jul 25

Kalpataru IPO Timeline

Bidding Start

24 Jun 25

Bidding Ends

26 Jun 25

Allotment Finalisation

27 Jun 25

Refund Initiation

30 Jun 25

Demat Transfer

30 Jun 25

Listing

01 Jul 25

Kalpataru Limited IPO

Established in 1988, Kalpataru Limited is a Mumbai-based real estate developer engaged in residential, commercial, retail, and township projects. Operating across key cities like Mumbai, Pune, Thane, Panvel, Hyderabad, Bengaluru, Indore, and Jodhpur, the company is part of the Kalpataru Group, which also includes Kalpataru Projects International, Property Solutions (India) Private Limited, and Shree Shubham Logistics Limited, among others. As of March 31, 2024, Kalpataru Limited has 40 active developments and has successfully completed 70 real estate projects across India.

Kalpataru Limited IPO Overview

Kalpataru IPO is a book-built issue worth ₹1,590.00 crores, consisting entirely of a fresh issue of 3.84 crore equity shares. The IPO will open for subscription on June 24, 2025, and close on June 26, 2025. The basis of allotment is likely to be finalised on Friday, June 27, 2025, and the shares are expected to be listed on the BSE and NSE on Tuesday, July 1, 2025. The price band for the IPO is set between ₹387 and ₹414 per share. Retail investors must apply for a minimum of one lot, which comprises 36 shares, requiring an investment of ₹13,932.

However, to avoid rejection in case of oversubscription, bidding at the cutoff price, amounting to ₹14,904, is recommended. For small non-institutional investors (sNII), the minimum application is 14 lots (504 shares), totalling ₹2,08,656, while for big non-institutional investors (bNII), it is 68 lots (2,448 shares), amounting to ₹10,13,472. The lead managers for the Kalpataru IPO are ICICI Securities Limited, JM Financial Limited, and Nomura Financial Advisory and Securities (India) Pvt Ltd. MUFG Intime India Private Limited (Link Intime) is appointed as the registrar for the issue

Kalpataru Limited IPO Details

| Particulars | Details |

| IPO Date | 24 June 2025 to 26 June 2025 |

| Listing Date | 1 July 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹387 to ₹414 per share |

| Lot Size | 36 Shares |

| Total Issue Size | 3,84,05,797 shares (aggregating up to ₹1,590.00 Cr) |

| Fresh Issue | 3,84,05,797 shares (aggregating up to ₹1,590.00 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | NSE, BSE |

| Share Holding Pre Issue | 16,74,89,537 shares |

| Share Holding Post Issue | 20,58,95,334 shares |

Kalpataru Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not less than 75% of the Net Issue |

| Retail | Not more than 10% of the Net Issue |

| NII (HNI) | Not more than 15% of the Net Issue |

Kalpataru Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 36 | ₹14,904 |

| Retail (Max) | 13 | 468 | ₹1,93,752 |

| S-HNI (Min) | 14 | 504 | ₹2,08,656 |

| S-HNI (Max) | 67 | 2,412 | ₹9,98,568 |

| B-HNI (Min) | 68 | 2,448 | ₹10,13,472 |

Kalpataru Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100.00% |

| Post-Issue |

Kalpataru Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (7.41) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (10.15%) |

| Net Asset Value (NAV) | 72.96 |

| Return on Equity | – |

| Return on Capital Employed (ROCE) | – |

| EBITDA Margin | (4.04) |

| PAT Margin | – |

| Debt to Equity Ratio | NA |

Objectives of the Proceeds

- Repayment/pre-payment, in full or in part, of certain borrowings availed by the Company and its Subsidiaries: ₹11,925 million

- General corporate purposes

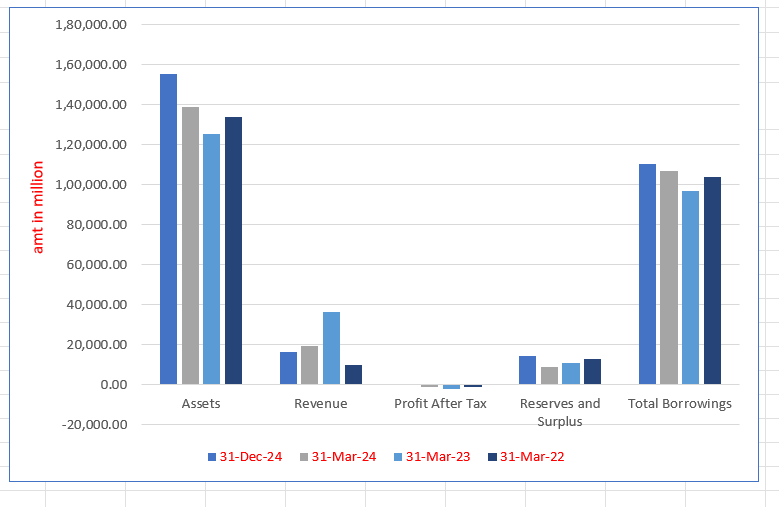

Key Financials (in ₹ million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 155,623.49 | 138,700.67 | 125,341.14 | 134,065.57 |

| Revenue | 16,247.36 | 19,299.84 | 36,331.82 | 10,006.73 |

| Profit After Tax | 55.11 | (1165.07) | (2294.33) | (1253.62) |

| Reserves and Surplus | 14,398.86 | 8792.14 | 10,755.82 | 12,853.46 |

| Total Borrowings | 110,563.95 | 106,883.09 | 96,796.43 | 103,659.65 |

SWOT Analysis of Kalpataru IPO

Strength and Opportunities

- Strong brand reputation in luxury residential sector.

- Diversified portfolio across top Indian cities.

- Focus on sustainable, green buildings aligned with demand.

- Growing demand for integrated townships in India.

Risks and Threats

- High project execution risk due to regulatory delays.

- Land acquisition challenges in prime micro-markets.

- Market cyclicality affecting real estate sentiment.

- Rising interest rates could impact buyer affordability.

News on Kalpataru IPO

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Kalpataru Limited IPO

Kalpataru IPO Strengths

- Leading real estate developer with diversified projects across key micro-markets and price segments in Maharashtra.

- Strong brand legacy enables premium pricing, faster sales, and partnerships with landowners and developers.

- Large portfolio of ongoing, forthcoming, and planned projects ensures steady revenue and cash flow visibility.

- In-house teams manage entire development lifecycle, ensuring quality, efficiency, and timely project completion.

- Focus on green building practices enhances efficiency, reduces environmental impact, and increases project marketability.

- Group affiliation offers access to industry experience, procurement efficiencies, and multi-sector construction expertise.

- Skilled management with strong employee development culture drives innovation, retention, and consistent project performance.

Peer Group Comparison

| Name of the Company | Revenue (in ₹ million) | Face value (₹) | P/E | EPS – Basic | RoNW (%) | NAV (₹) |

| Kalpataru Limited | 16,247.36 | 10 | – | (7.41) | – | 113.11 |

| Peer Groups | ||||||

| Oberoi Realty Limited | 44,957.90 | 10 | 35.91 | 52.99 | 13.92 | 380.76 |

| Macrotech Developers Limited | 1,03,161.00 | 10 | 90.84 | 16.03 | 8.87 | 175.66 |

| Godrej Properties Limited | 30,356.20 | 5 | 92.10 | 26.09 | 7.26 | 359.39 |

| Sunteck Realty Limited | 5,648.47 | 1 | 89.64 | 4.99 | 2.27 | 213.28 |

| Mahindra Lifespace Developers Limited | 2,120.90 | 10 | 56.71 | 6.34 | 5.25 | 120.82 |

| Keystone Realtors Limited | 22,222.50 | 10 | 56.97 | 9.85 | 6.24 | 157.85 |

| Prestige Estates Projects Limited | 78,771.00 | 10 | 48.31 | 34.28 | 12.17 | 281.59 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Kalpataru Limited IPO

How can I apply for Kalpataru Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the Kalpataru Limited IPO open and close for subscription?

The IPO opens on 24 June 2025 and closes on 26 June 2025 for public bidding.

What is the price band and minimum investment for the Kalpataru IPO?

The price band is ₹387–₹414 per share, with a minimum investment of ₹14,904 for one lot.

What is the size and structure of the Kalpataru IPO?

The IPO is ₹1,590 crore, comprising a fresh issue of 3.84 crore equity shares only.

When will Kalpataru Limited shares be listed on stock exchanges?

The shares are scheduled to be listed on BSE and NSE on 1 July 2025.