- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Karamtara Engineering IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Karamtara Engineering IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Karamtara Engineering Limited

Karamtara Engineering Limited is one of the largest integrated players globally, offering a comprehensive solution in the Renewable and Transmission segments of the power sector. Established in 1996 and commencing operations in 1998, the company has become a leader in Renewable Energy and Transmission. It provides a diverse range of products, including module mounting structures, tracker piles, stamped components, torque tubes, tubular and lattice towers, fasteners for solar and wind applications, and OHTL hardware fittings. Over nearly three decades, Karamtara has expanded from a single manufacturing unit to eight advanced facilities in India and Italy.

Karamtara Engineering Limited IPO Overview

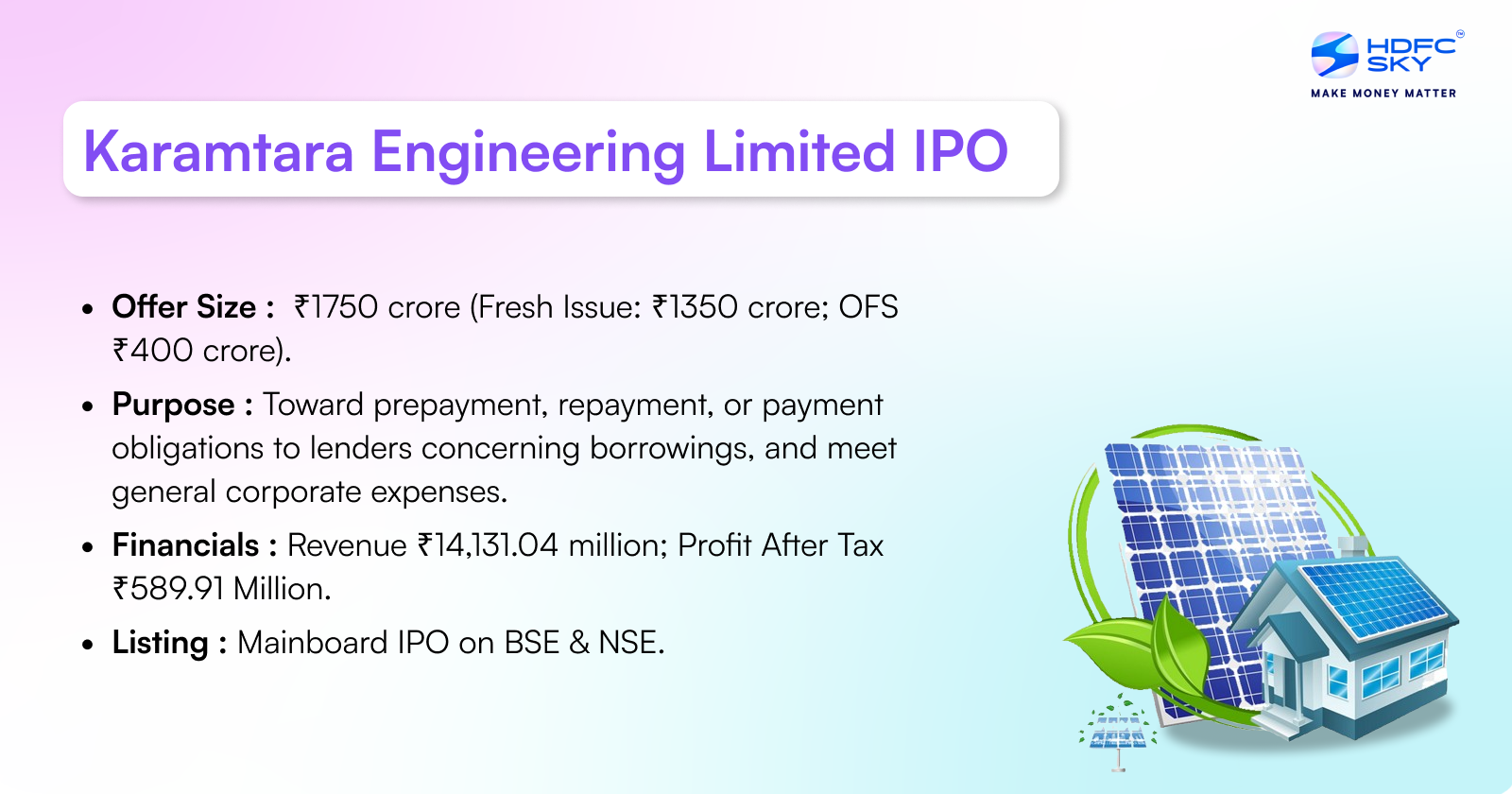

Karamtara Engineering IPO is a book-building issue of ₹1,750.00 crores, comprising a fresh issue of ₹1,350.00 crores and an offer for sale of ₹400.00 crores. The IPO dates and price band are yet to be announced, and the allotment is expected to be finalised soon. JM Financial Limited, ICICI Securities Limited, and IIFL Securities Ltd are the book-running lead managers, while Link Intime India Private Ltd is the registrar for the issue. The IPO will be listed on BSE and NSE, with a face value of ₹10 per share. The pre-issue shareholding stands at 29,22,95,240 shares. Investors can refer to the Karamtara Engineering IPO Draft Red Herring Prospectus (DRHP) for detailed information. The DRHP was filed with SEBI on January 27, 2025. The promoters of the company are Tanveer Singh, Rajiv Singh, Inderjeet Singh, Inderjeet Tanveer Singh Trust, and Inderjeet Rajiv Singh Trust, holding a 94.79% stake before the issue.

Karamtara Engineering Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹1,350 crore

Offer for Sale (OFS): ₹400 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 29,22,95,240 shares |

| Shareholding post -issue | 29,22,95,240 shares |

Karamtara Engineering Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Karamtara Engineering Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Karamtara Engineering Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 3.64 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 20.47% |

| Net Asset Value (NAV) | 19.60 |

| Return on Equity | 20.45% |

| Return on Capital Employed (ROCE) | 24.15% |

| EBITDA Margin | 10.84% |

| PAT Margin | 4.23% |

| Debt to Equity Ratio | 0.84 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding prepayment, repayment and/ or payment obligations to lenders towards borrowings and Acceptances, in part or full | 10,500 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

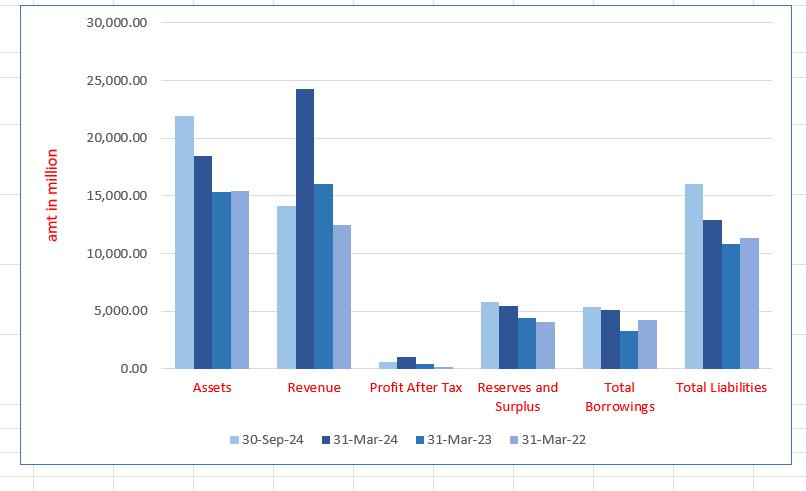

Karamtara Engineering Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 21,914.41 | 18,445.62 | 15,369.00 | 15,440.50 |

| Revenue | 14,131.04 | 24,251.50 | 16,003.07 | 12,448.09 |

| Profit After Tax | 589.91 | 1026.50 | 423.60 | 126.46 |

| Reserves and Surplus | 5834.40 | 5479.05 | 4451.81 | 4038.31 |

| Total Borrowings | 5385.30 | 5085.14 | 3273.56 | 4275.80 |

| Total Liabilities | 16,024.68 | 12,911.24 | 10,861.86 | 11,346.86 |

Financial Status of Karamtara Engineering Limited

SWOT Analysis of Karamtara Engineering IPO

Strength and Opportunities

- Controls production processes for solar piers and transmission towers.

- Among the largest structural galvanizing capacities in India.

- Supplies to EPC players and renewable power developers in multiple regions.

- One of the largest manufacturers and suppliers in its segment.

- Indian plants hold ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 certifications.

- Products are used in over 50 countries.

- Growing demand for renewable energy supports business expansion.

- Government policies favouring infrastructure and renewable energy development.

- Expansion into new global markets strengthens presence.

- Increasing investments in smart grids and telecom boost product demand.

Risks and Threats

- Dependence on steel and zinc prices can impact margins.

- High capital requirements for large-scale projects affect cash flow.

- Faces stiff competition from domestic and global players.

- Changes in environmental and trade policies may affect operations.

- Currency fluctuations impact international trade and profitability.

- Logistics and supply chain disruptions can affect delivery schedules.

- Fluctuating demand in transmission and telecom sectors affects revenue stability.

- Dependence on government tenders for infrastructure projects.

- Rising labour and operational costs impact profitability.

- Geopolitical tensions and trade restrictions affect global supply chains.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Karamtara Engineering Limited IPO

More About Karamtara Engineering Limited

Karamtara Engineering Limited is a backward-integrated manufacturer specializing in products for the renewable energy and transmission line sectors. As of Fiscal 2024, the company is the largest manufacturer of solar mounting structures and tracker components in India based on installed capacity (Source: F&S Report).

Manufacturing Capabilities

- Installed Capacity:

- Aggregate installed capacity: 567,000 MTPA (including 374,700 MTPA for solar products, equivalent to approximately 13.20 GW).

- Overhead transmission line (OHTL) hardware fittings and accessories: 480,000 pieces (excluding galvanizing capacity).

Market Presence and Global Footprint

- Among the largest exporters of solar products from India to North America in Fiscal 2024

- Expanding into wind energy by setting up a manufacturing facility for tubular towers, expected to commence operations in Fiscal 2026.

- Strong global delivery model, exporting to over 50 countries across North America, Europe, Asia, Africa, Australia, and Latin America.

- Serves six of the top 15 EPC companies in the United States (in terms of installed capacity).

Revenue Growth:

- Export revenue grew at a CAGR of 35.10% from ₹7,647.96 million (Fiscal 2022) to ₹13,958.32 million (Fiscal 2024).

- Exports contributed 61.44% and 57.56% of total revenue in Fiscal 2022 and 2024, respectively.

Recognized as a Four Star Export House by the Directorate General of Foreign Trade, Government of India.

Diverse Product Offerings

- Solar Energy Sector:

- Solar module mounting structures (Solar MMS).

- Solar tracker piles and piers.

- Solar torque tubes.

- Transmission Sector:

- Lattice towers for transmission lines.

- Additional Products:

- Fasteners (bolts, nuts, studs, washers).

- OHTL hardware fittings and accessories (insulator string fittings, jumper tubes, suspension clamps, vibration dampers).

Manufacturing Facilities

- Operates eight manufacturing facilities:

- Seven in Maharashtra, India.

- One in Italy.

- Largest in-house galvanizing facility in the solar sector in India, with a capacity of 258,000 MTPA.

- Two in-house rolling mill furnaces for manufacturing structural steel components.

Customer Base and Market Strategy

- Supplies to OEMs, EPCs, and IPPs.

- Approved supplier and critical partner for leading solar energy companies worldwide.

- Long-Term Customer Relationships:

- Top ten solar energy customers have been associated for an average of three years.

- Top ten transmission customers have an average association of more than four years.

- Repeat business from major domestic and international customers

- Average revenue per solar energy customer grew at a CAGR of 12.52% between Fiscal 2022 and 2024.

Commitment to Sustainability and Innovation

- Emphasizes energy-efficient manufacturing and technology innovations.

- Implements stringent procedures for data collection and carbon footprint reduction.

Industry Outlook

Renewable Energy: A Global Shift

The energy sector is undergoing a profound transformation, driven by environmental concerns, economic shifts, and rapid technological advancements. Renewable energy is at the forefront of this change, with global capacity growing at a CAGR of 10.4% (2018-2023). This growth is set to accelerate further, reaching an estimated CAGR of 13.6% (2023-2028), fueled by rising clean energy demand, government support, and innovations in green technology.

India’s Transition to Renewable Energy

India is making significant strides toward a cleaner energy future, shifting from coal to renewables. Key projections include:

- Total power generation capacity: 751 GW by Fiscal 2030 (estimated)

- Renewable energy target: 500 GW by 2030, with 280 GW from solar power

Harnessing India’s Solar Potential

- Receives approximately 5,000 trillion kWh of solar energy annually

- Solar radiation: 4-7 kWh per square meter per day

- Initiatives include:

- Subsidies for rooftop solar installations

- Competitive bidding for large-scale solar projects

Commitment to Sustainability

India’s focus on solar and wind energy aligns with its net-zero goals, reinforcing its commitment to reducing carbon emissions and combating climate change.

How Will Karamtara Engineering Limited Benefit

- Increased Demand for Solar Products: With India targeting 500 GW of renewable energy by 2030, including 280 GW from solar, Karamtara Engineering Limited stands to benefit from rising demand for solar mounting structures, tracker components, and other solar-related products, reinforcing its market leadership.

- Expansion into Wind Energy: Karamtara’s upcoming tubular tower manufacturing facility (Fiscal 2026) aligns with India’s shift to wind and solar power, expanding its footprint in renewable infrastructure and tapping into new opportunities in the growing wind energy sector.

- Export Market Growth: With a 35.10% CAGR in export revenue (Fiscal 2022-2024) and a strong presence in North America, Europe, and Asia, Karamtara is positioned to benefit from increasing global demand for solar and transmission products.

- Advanced Manufacturing Capabilities: Operating eight manufacturing facilities, including India’s largest in-house galvanizing plant, gives Karamtara a competitive edge in producing high-quality solar and transmission components while ensuring cost efficiency.

- Strategic Partnerships and Repeat Business: With long-term associations with leading solar and transmission companies, Karamtara ensures consistent revenue streams, trusted supplier status, and repeat business, enhancing market stability and growth potential in renewable energy.

Peer Group Comparison

| Name of Company | Face Value (₹ Per Share) | Revenue (₹ Million) | EPS (₹) – Basic | NAV (₹) | P/E Ratio | RONW (%) |

| Karamtara Engineering | 10 | 24,251.50 | 3.64 | 19.60 | TBD | 20.47% |

| Listed Peers | ||||||

| Inox Wind Limited | 10 | 17,432.35 | (1.56) | 50.61 | N.A | N.A |

| KP Green Engineering Limited | 5 | 3,490.49 | 9.70 | 2,381.68 | 50.41 | 23.64% |

| Premier Energies Limited | 1 | 31,437.93 | 6.93 | 14.63 | 213.61 | 46.29% |

| Waaree Energies Limited | 10 | 1,13,976.09 | 48.05 | 154.95 | 55.36 | 43.20% |

| Suzlon Energy Ltd | 2 | 64,968.40 | 0.50 | (1.95) | 113.76 | N.A |

Key Insights

- Revenue: Waaree Energies leads in revenue with ₹1,13,976.09 million, reflecting strong demand. Suzlon follows with ₹64,968.40 million, showing stability. Premier Energies generates ₹31,437.93 million, while Karamtara Engineering records ₹24,251.50 million. Inox Wind reports ₹17,432.35 million, and KP Green achieves ₹3,490.49 million.

- Earnings Per Share (EPS): Waaree Energies has the highest EPS at 48.05, indicating strong profitability per share. KP Green and Premier Energies follow with 9.70 and 6.93, respectively. Karamtara Engineering records 3.64, suggesting steady earnings. Suzlon and Inox Wind have weak EPS, with 0.50 and negative -1.56, respectively.

- Net Asset Value (NAV): KP Green reports the highest NAV at ₹2,381.68, indicating strong asset backing. Waaree Energies follows at ₹154.95, reflecting robust financial health. Inox Wind and Karamtara Engineering have ₹50.61 and ₹19.60, respectively. Premier Energies posts ₹14.63, while Suzlon has a negative NAV of -1.95.

- Price-to-Earnings (P/E) Ratio: Waaree Energies has a high P/E of 55.36, indicating strong market confidence. Premier Energies follows with 213.61, suggesting high valuation. KP Green records 50.41, reflecting optimism. Karamtara’s P/E is yet to be determined. Inox Wind and Suzlon lack a meaningful P/E due to negative or low earnings.

- Return on Net Worth (RONW): Premier Energies leads with a high RONW of 46.29%, reflecting strong profitability. Waaree Energies follows with 43.20%, while KP Green records 23.64%. Karamtara Engineering shows a moderate 20.47%. Inox Wind and Suzlon lack RONW data, indicating weaker financial returns.

Karamtara Engineering Limited IPO Strengths

- Leading Solar Component Manufacturer

Karamtara Engineering Limited is India’s largest integrated manufacturer of solar mounting structures and tracker components by installed capacity in Fiscal 2024 (Source: F&S Report). With strong backward integration, in-house galvanizing, and diverse product offerings, the company ensures quality, cost efficiency, and faster delivery, dominating the renewable energy sector.

- A One-Stop Shop for Solar and Transmission Structures

Karamtara Engineering Limited is a leading manufacturer of solar and transmission structures, offering a diverse product portfolio, including fixed-tilt structures, tracker components, lattice towers, fasteners, and OHTL hardware fittings. With advanced manufacturing facilities and cross-selling advantages, the company ensures enhanced customer experience, revenue growth, and market competitiveness.

- Strong Global Presence with Expanding Export Network

Karamtara Engineering Limited has established a robust international footprint, exporting to over 50 countries across six continents. With advanced manufacturing, efficient logistics, and stringent quality control, the company ensures timely deliveries and high product standards. Recognized as a “Four Star Export House,” it continues to strengthen its global market share.

- Strong Customer Relationships and High Retention Rate

Karamtara Engineering Limited has built lasting relationships with global OEMs, EPCs, and IPPs, expanding its solar energy customer base from 24 in Fiscal 2022 to 51 by September 2024. With a 77.34% revenue retention rate, cross-selling strategies, and strict quality assurance, the company continues to drive strong repeat business and revenue growth.

- Strategic Network of Manufacturing Facilities with Advanced Capabilities

The company operates eight manufacturing facilities, including seven in India and one in Italy, with a total installed capacity of 567,000 MTPA. Equipped with automation, robotics, and IoT, these facilities ensure efficiency. Stringent quality controls, advanced software, and strategic locations enhance operations, exports, and sustainability efforts.

- Experienced Promoter Directors Supported by a Skilled Management Team

The company is led by Promoter Directors Tanveer Singh and Rajiv Singh, each with 28 years of experience. Supported by CEO Sunil Kumar Rustagi and Whole-time Director Shreyans Jitendra Shah, the management team ensures strategic growth, market adaptability, and strong business execution.

- Consistent Track Record of Financial Performance and Strong Financial Position

With sustained revenue and profitability growth, the company has expanded significantly, especially in green energy. Between Fiscal 2022 and 2024, revenue and EBITDA grew at a 39.58% and 42.32% CAGR, respectively. Strong financial stability supports production expansion, product diversification, and enhanced customer trust.

Key Strategies for Karamtara Engineering Limited

Expansion of Installed Capacity in India

The company plans to expand its production capabilities to meet rising customer demand. By increasing capacity, it aims to serve a larger customer base while minimizing risks related to limited production. These expansions are expected to enhance operational efficiency, optimize costs, and improve economies of scale.

Strengthening Backward Integration for Cost and Operational Efficiency

The organization intends to establish an integrated steel manufacturing facility for captive consumption. This initiative will enhance margins, ensure ESG and CBAM compliance, and improve raw material quality control. It seeks to reduce reliance on external suppliers, optimize costs, and strengthen customer confidence in its operations.

Expanding Market Position in Renewable Energy

The company aims to develop and launch new products in the renewable energy sector. Plans include manufacturing tubular towers for wind turbines and solar stamping parts. By broadening its product portfolio, it expects to increase revenue, enhance customer satisfaction, and establish a competitive edge in the market.

Increasing International Customer Base

Efforts are underway to expand international sales through increased production capacity, a new Saudi Arabian facility, and a diversified product portfolio. By conducting market research, tailoring export-specific products, and strengthening global branding, the company aims to establish new relationships and enhance its presence in high-growth markets.

Enhancing Operational Efficiency and Cost Reduction

The company is focused on optimizing design, manufacturing, and supply chain processes to control costs. By leveraging its scale, supplier relationships, and backward integration, it plans to improve procurement strategies and price stability while ensuring operational efficiency and long-term financial sustainability.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the issue size of Karamtara Engineering Limited IPO?

The IPO comprises ₹1,350 crore fresh issue and ₹400 crore offer-for-sale, totaling ₹1,750 crore.

How will Karamtara Engineering use the IPO proceeds?

The company plans to utilize ₹1,050 crore for debt repayment and the remaining funds for general corporate purposes.

Who are the book-running lead managers for Karamtara Engineering IPO?

The IPO is managed by JM Financial, ICICI Securities, and IIFL Capital as book-running lead managers.

What sectors does Karamtara Engineering serve?

The company specializes in manufacturing products for renewable energy and transmission line sectors with backward integration capabilities.

How can investors apply for Karamtara Engineering IPO?

Investors can apply through ASBA via net banking or UPI in stock exchange platforms.