- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Kent RO Systems IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

TBA

TBA

TBA

Kent RO Systems IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Kent RO Systems Limited

Kent RO Systems Limited is a leading name in India’s RO water purifier market, pioneering Reverse Osmosis (RO) technology (Source: Technopak Report). Established in 1999 in Noida, it has the highest number of SKUs in the category, including the premium segment. The company’s patented RO+UV+UF+TDS Controller ensures pure water with essential minerals, while Zero Water Waste Technology prevents wastage. Founded by Dr. Mahesh Gupta, an IIT Kanpur alumnus, Kent offers air purifiers, vegetable cleaners, and kitchen appliances, promoting healthier living.

SWOT Analysis of Kent RO Systems IPO

Strength and Opportunities

- Pioneered RO technology in India, establishing market leadership.

- Diverse product portfolio including air purifiers, vegetable cleaners, and kitchen appliances.

- Strong financial profile with low gearing and robust cash flows.

- Extensive pan-India distribution network with established dealers and service centers.

- Recognized for quality with ISO 9001:2008 certification.

- Opportunities to expand in rural markets due to low water purifier penetration.

- Growing awareness of health and hygiene boosts demand for purification products.

- Potential for technological advancements to enhance product offerings.

- Expansion into international markets can diversify revenue streams.

Risks and Threats

- Faces intense competition from both domestic and international brands.

- High dependence on the Indian market makes it vulnerable to regional economic fluctuations.

- Potential challenges in maintaining product innovation to stay ahead of competitors.

- Regulatory changes and compliance requirements could impact operations.

- Fluctuations in raw material prices may affect profit margins.

- Counterfeit products in the market could harm brand reputation.

- Economic downturns may reduce consumer spending on premium products.

- Rapid technological changes require continuous investment in R&D.

- Supply chain disruptions could impact product availability.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Kent RO Systems Limited IPO

Kent RO Systems Limited IPO Strengths

- A Leader in Water Purification

Kent RO Systems Limited pioneered RO technology in India, serving over 5.50 million consumers. With the largest SKUs in the premium segment, its certified water purifiers and softeners ensure safety and quality. The brand is recognized for innovation, industry awards, and advanced purification solutions.

- Commitment to Innovation

Kent RO Systems Limited is dedicated to innovation, addressing real-world challenges with practical, consumer-focused solutions. Its diverse portfolio includes advanced water purifiers, energy-efficient fans, and modern kitchen appliances. With a strong R&D team and multiple patents, Kent continuously enhances product design and performance to meet evolving consumer needs.

- Strategic Brand-Building Initiatives to Enhance Brand Equity

The company strengthens brand equity through television ads, cricket sponsorships, print, digital, and social media, e-commerce, and celebrity endorsements. Strategic marketing efforts ensure visibility across platforms, maximizing consumer engagement. Advertising spend as a percentage of revenue surpasses competitors, reinforcing brand presence and driving growth in a competitive market.

- Brand Expansion and Market Diversification

Kent RO Systems Limited has a strong track record in brand building, exemplified by the success of ‘Kent’ in RO water purifiers. Expanding into BLDC fans with ‘Kuhl’ in 2023, the company swiftly launched 120+ SKUs, leveraging expertise, infrastructure, and customer insights to drive growth in new categories.

- Expanding Product Portfolio for Greater Market Reach

Kent RO Systems Limited has diversified beyond water purifiers, leveraging brand strength to introduce water softeners, kitchen appliances, and BLDC fans. This strategic expansion broadens consumer reach, enhances revenue streams, and aligns with evolving household needs while maintaining the company’s commitment to quality and innovation.

- Expanding Product Portfolio for Greater Market Reach

Kent RO Systems Limited has diversified beyond water purifiers, leveraging brand strength to introduce water softeners, kitchen appliances, and BLDC fans. This strategic expansion broadens consumer reach, enhances revenue streams, and aligns with evolving household needs while maintaining the company’s commitment to quality and innovation.

- Sustaining Financial Strength with Robust Reserves

Kent RO Systems Limited leads its peers in EBITDA and PAT margins, reflecting financial resilience and profitability. Strong reserves, strategic investments in real estate, and prudent inventory management support innovation and stability. A debt-free approach and employee-focused housing initiatives further strengthen long-term growth and operational efficiency.

More About Kent RO Systems Limited

Brand Legacy and Market Leadership

- Kent RO Systems Limited is a well-established brand, recognized as a pioneer in introducing reverse osmosis (RO) technology in the water purifier market in India.

- The company’s Promoter, Chairman, and Managing Director, Mahesh Gupta, revolutionized the water purification industry in 1999 by introducing RO technology.

- Kent remains the first and only water purifier manufacturer in India to receive the NSF/ANSI 58 certification, a prestigious American standard for point-of-use RO systems.

- The brand name ‘Kent’ has become synonymous with RO water purifiers in India.

Diversified Product Portfolio

- Leveraging its recognition in water purification, Kent has expanded its offerings to include:

- Kitchen and home appliances

- Water softeners under the Kent brand

- Brushless Direct Current (BLDC) fans under the Kuhl brand

- These products are designed with the same commitment to quality and innovation that defines Kent’s water purifiers.

Commitment to Innovation and Sustainability

- Kent’s mission is to innovate for better living by creating solutions that promote health, sustainability, and comfort.

- The company focuses on practical, user-centric solutions, differentiating itself from competitors.

- Technological advancements include:

- Non-electric water purifiers

- IoT-enabled devices

- Zero-water-wastage technology

- Key innovations:

- 2005: Patented Mineral RO Technology to retain essential minerals while purifying water.

- 2010: India’s first patented water purifier with a removable storage tank for better hygiene.

- 2012: Patented zero-water-wastage technology, further enhanced in 2019.

- 2016: India’s first IoT-enabled water purifier, allowing remote monitoring via a mobile app. (Source: Technopak Report)

- The introduction of BLDC fans, which consume 24 to 38 watts compared to traditional 75-watt fans, offers approximately 65% cost savings. (Source: Technopak Report)

- Other home appliances include electric egg boilers, high-speed mixers, infrared cooktops, multicookers, and vegetable cleaners.

Research and Development (R&D)

- Kent’s dedicated R&D team focuses on enhancing product design and performance.

- As of September 30, 2024, the R&D team consists of 12 professionals from engineering, science, and technology backgrounds.

Intellectual Property and Global Presence

- The company holds extensive intellectual property rights, including:

- 15 registered patents in India

- 97 registered trademarks in India

- 69 registered designs in India

- 20 registered copyrights in India

- 27 registered trademarks internationally, spanning markets such as the USA, UK, UAE, and China.

- Pending registrations include:

- 8 patents

- 28 trademarks

- 9 designs across multiple countries.

Marketing and Brand Building

- Kent employs a multi-faceted marketing strategy, including:

- Television advertisements

- Cricket sponsorships (Punjab Kings, Sunrisers Hyderabad)

- Print and digital media campaigns

- Celebrity endorsements, notably with Hema Malini for over a decade.

- Advertisement and business promotion expenses as a percentage of revenue were:

- 20.23% in the first half of 2024

- 13.16% in Fiscal 2024

- 13.25% in Fiscal 2023

- 11.33% in Fiscal 2022

- Competitor Eureka Forbes had a lower marketing spend of 9.45% in Fiscal 2024. (Source: Technopak Report)

Manufacturing Capabilities

- Kent operates four manufacturing facilities:

- Roorkee, Uttarakhand: Water purifiers and water softeners

- Noida I: Water purifiers, kitchen, and home appliances

- Noida II: Fans

- Noida III: Mother-warehouse, fans, and water softeners

- Certifications:

- ISO 9001:2015 (Quality Management Systems)

- ISO 14001:2015 (Environmental Management Systems)

- ISO 45001:2018 (Occupational Health and Safety)

Sales and Distribution Network

- Kent’s multi-channel sales network includes:

- 1,898 channel partners

- 6 large-format retail chains

- 50 regional retail chains

- 34 CSD and 92 CPC stores

- 6 e-commerce websites

- 4 quick commerce platforms

- The company was India’s largest water purifier exporter in Fiscal 2024.

- Awarded ‘Star Performer for Exports’ in multiple years by the Engineering Export Promotion Council of India.

- Water purifiers are sold in over 30 countries, including Nepal, Bangladesh, Kuwait, and UAE.

- Export revenues for the six months ending September 30, 2024: ₹157.64 million.

- Export revenues for Fiscal 2024: ₹342.87 million.

Industry Outlook

Rising Consumption Trends in India

India is experiencing a significant increase in consumption, driven by rising affluence, urbanization, and an expanding middle class.

Growth of the Water Purifier Market

- The Indian water purifier market has shown consistent growth, with a CAGR of approximately 4.9%, increasing from ₹6,960 crore in Fiscal 2019 to ₹8,860 crore in Fiscal 2024.

- Further expansion is expected at a CAGR of 10.1% till Fiscal 2029, reaching ₹14,350 crore.

- Key drivers of this growth include:

- Rising population and disposable income

- Increasing water contamination and water-borne diseases

- Growing health awareness and electrification (Source: Technopak Report)

Expansion of the Kitchen Appliances Market

- The total kitchen appliances market expanded at a CAGR of 6.7%, growing from ₹15,635 crore in Fiscal 2019 to ₹21,630 crore in Fiscal 2024.

- Projections indicate further growth at a CAGR of 8.5%, reaching ₹32,590 crore by Fiscal 2029.

- Growth factors include:

- Increasing middle-class and dual-income households

- Urbanization and nuclear family trends

- Rising demand for smart kitchen appliances and quick commerce (Source: Technopak Report)

Surge in BLDC Fan Market

- The BLDC fan market witnessed a remarkable CAGR of approximately 62%, growing from ₹200 crore in Fiscal 2019 to ₹2,250 crore in Fiscal 2024.

- It is expected to expand at a CAGR of 37% till Fiscal 2029, reaching ₹10,765 crore.

- BLDC fans comprised 15% of the overall fan market in Fiscal 2024, with projections to capture 42% by Fiscal 2029.

- The demand is driven by:

- Energy efficiency and reduced noise

- Increasing consumer awareness of benefits

How Will Kent RO Systems Limited Benefit

- Increased Market Demand: Rising health awareness and water contamination issues will drive higher demand for water purifiers, positioning Kent RO Systems Limited for strong market growth.

- Revenue Expansion: With the Indian water purifier market projected to reach ₹14,350 crore by Fiscal 2029, Kent RO Systems Limited has significant opportunities for revenue expansion and profitability.

- Technological Advancements: Advancements in filtration technology and smart features will allow Kent RO to enhance its product offerings, attracting health-conscious consumers seeking premium purification solutions.

- Wider Consumer Base: Urbanization and rising disposable incomes will expand Kent RO’s consumer base, particularly among middle-class households investing in quality water purification systems.

- Brand Leadership: As a leading brand, Kent RO can strengthen its market dominance by leveraging its reputation, innovation, and customer trust to outperform competitors in the growing industry.

- Sustainable Growth: Growing electrification and demand for eco-friendly solutions will enable Kent RO to develop sustainable products, aligning with consumer preferences and regulatory standards.

- Enhanced Distribution Network: Expansion in e-commerce and retail channels will allow Kent RO to reach more customers, increasing accessibility and market penetration across urban and rural areas.

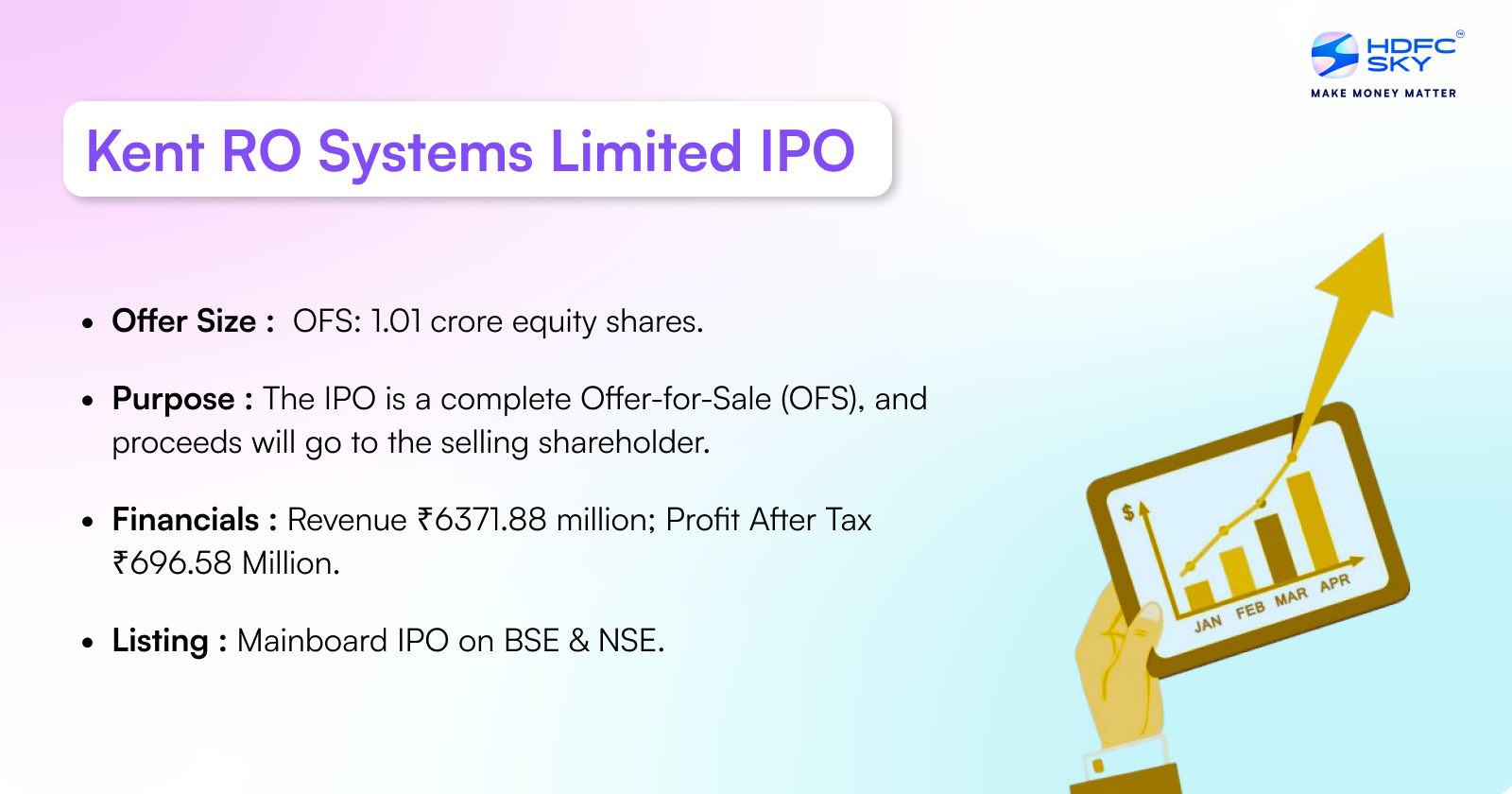

Kent RO Systems Limited IPO Overview

Kent RO Systems filed draft papers for its initial public offering (IPO) on January 22, 2025. In a strategic move, the company’s founders and promoters plan to offload a 10% stake, marking a major milestone in its stock market debut. The IPO will be entirely an Offer for Sale (OFS) by promoters Mahesh Gupta, Sunita Gupta, and Varun Gupta, who will sell a total of 10.1 million shares. This will reduce their collective holding from 99.77% to 89.77%, ensuring compliance with public listing norms.

Kent RO Systems Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): 1.01 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Kent RO Systems IPO Important Dates

| IPO Activity | Date |

| IPO Open Date | TBA |

| IPO Close Date | TBA |

| Basis of Allotment Date | TBA |

| Refunds Initiation | TBA |

| Credit of Shares to Demat | TBA |

| IPO Listing Date | TBA |

Kent RO Systems IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Kent RO Systems Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 15.68 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 9.93% |

| Net Asset Value (NAV) | 157.90 |

| Return on Equity | 9.95% |

| Return on Capital Employed (ROCE) | 13.02% |

| EBITDA Margin | 15.45 |

| PAT Margin | 13.25% |

| Debt to Equity Ratio | 0.17 |

Peer Group Comparison

| Name of the Company | Face Value per Equity Share (₹) | P/E | EPS (Basic) (₹) | RoNW (%) | NAV (₹) |

| Kent RO Systems Limited | 1 | [●] | 15.67 | 9.93 | 157.90 |

| Peer Group | |||||

| Havells India Limited | 1 | 80.38 | 20.28 | 17.08 | 118.69 |

| Eureka Forbes Limited | 10 | 119.70 | 4.94 | 2.27 | 217.03 |

| Whirlpool India Limited | 10 | 99.48 | 17.11 | 6.14 | 278.69 |

| V-Guard Industries Limited | 1 | 70.30 | 5.89 | 14.36 | 40.92 |

| Bajaj Electricals Limited | 2 | 67.51 | 11.39 | 9.02 | 126.06 |

Key Insights

- Face Value per Equity Share: The face value represents the nominal worth of a company’s share. Kent RO Systems, Havells, and V-Guard have a face value of ₹1, while Bajaj Electricals has ₹2. Whirlpool and Eureka Forbes have a higher face value of ₹10 each, indicating different share structures across peers.

- Price-to-Earnings (P/E): The P/E ratio reflects investor expectations and valuation. Eureka Forbes has the highest P/E at 119.70, followed by Whirlpool at 99.48, suggesting premium pricing. Havells (80.38) and V-Guard (70.30) also trade at high multiples, whereas Bajaj Electricals (67.51) has a moderate valuation. Kent RO’s P/E is yet to be determined.

- Earnings Per Share (EPS): EPS indicates profitability per share. Whirlpool leads with ₹17.11, followed by Havells at ₹20.28. Kent RO stands at ₹15.67, reflecting strong earnings. Bajaj Electricals (₹11.39) and V-Guard (₹5.89) have moderate EPS, while Eureka Forbes has the lowest at ₹4.94.

- Return on Net Worth (RoNW): RoNW measures profitability relative to shareholder equity. Havells leads at 17.08%, followed by V-Guard (14.36%) and Kent RO (9.93%). Bajaj Electricals (9.02%) and Whirlpool (6.14%) show stable returns, while Eureka Forbes lags at 2.27%, indicating lower profitability.

- Net Asset Value (NAV): NAV per share represents a company’s book value. Whirlpool (₹278.69) and Eureka Forbes (₹217.03) have the highest NAV, signifying strong asset backing. Kent RO (₹157.90) follows, while Bajaj Electricals (₹126.06) and Havells (₹118.69) have moderate values. V-Guard has the lowest at ₹40.92.

Objectives of the IPO Proceeds

The Promoter Selling Shareholder will be entitled to the entire proceeds of the Offer after deducting his portion of the Offer expenses and relevant taxes thereon. The Company will not receive any proceeds from the Offer

Kent RO Systems Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 18,790.50 | 18,571.11 | 16,892.96 | 15,932.15 |

| Revenue | 6371.88 | 11,781.85 | 10,843.93 | 10,473.67 |

| Profit After Tax | 696.58 | 1665.45 | 971.58 | 1542.21 |

| Reserves and Surplus | 16,460.74 | 16,776.95 | 15,100.66 | 14,480.97 |

| Total Borrowings | 102.41 | 7.23 | 133.62 | 107.60 |

| Total Liabilities | 2319.52 | 1784.50 | 1782.64 | 1441.32 |

Key Strategies for Kent RO Systems Limited

- Expansion in the Water Purifier Segment

Kent RO Systems Limited aims to strengthen its presence in the water purifier category by leveraging its brand recognition, manufacturing capabilities, and extensive distribution network. With a growing market and low penetration rates, the company sees significant opportunities, particularly in Tier-2 cities, and plans to enhance accessibility through direct sales, e-commerce expansion, and regulatory advantages.

- Growth in the BLDC Fan Market

Kent RO Systems Limited is expanding in the energy-efficient BLDC fan segment under the “Kuhl” brand, capitalizing on the category’s rapid growth. By increasing distribution channels and promoting awareness of BLDC technology’s benefits, the company aims to establish a stronger foothold in this emerging market.

- Expansion in Kitchen and Home Appliances

Kent RO Systems Limited continues to develop its kitchen and home appliances category, benefiting from regulatory shifts, rising disposable incomes, and the trend of quick commerce. The company plans to broaden its product offerings and strengthen its presence on rapid delivery platforms to meet evolving consumer needs.

- Capitalizing on Export Market Growth

Kent RO Systems Limited is actively expanding its international market presence, exporting water purifiers to over 30 countries. With a focus on North America and other high-demand regions, the company aims to scale its global reach and enhance export-driven growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the structure of the Kent RO Systems IPO?

The IPO is entirely an offer for sale (OFS) of 1 crore equity shares by the company’s promoters.

Who are the promoters selling shares in the IPO?

Promoters Sunita Gupta, Mahesh Gupta, and Varun Gupta are offloading shares in the OFS.

Will Kent RO Systems receive any proceeds from the IPO?

No, since the IPO is an OFS, the company will not receive any financial proceeds from it.

What is the expected valuation of Kent RO Systems post-IPO?

The expected valuation will depend on the final issue price and market demand at listing.

Who are the lead managers for the Kent RO Systems IPO?

ICICI Securities and Kotak Mahindra Capital Company are the book-running lead managers for the IPO.