- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Knack Packaging IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Knack Packaging IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Knack Packaging Limited

Knack Packaging Limited, founded in 2013, is a leading integrated packaging solutions provider emphasising innovation, sustainability, and exports. The company produces high-strength Printed and Laminated Woven Polypropylene (PLWPP) bags, including pinch bottom, gusset, block bottom, and retail shopping bags, used across food, pet food, agriculture, fertilizers, chemicals, cement, and other industries. Serving over 1,900 customers globally, including top Indian and international brands, Knack operates an in-house printing facility with end-to-end design and cylinder development, maintaining a 92,065 sq. ft. warehouse. In Fiscal 2025, it held a 10.1% share of India’s flexible bulk PLWPP market, with exports to 68 countries, primarily the US, Mexico, and South Africa.

Knack Packaging Limited IPO Overview

Knack Packaging Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 4, 2025, seeking to raise funds through an Initial Public Offer (IPO). The IPO is structured as a Book Build Issue, comprising a fresh issue of ₹475.00 crore and an offer for sale (OFS) of up to 0.70 crore equity shares. The company’s equity shares are proposed to be listed on NSE and BSE. While the book running lead manager is yet to be declared, MUFG Intime India Pvt. Ltd. will act as the registrar. Key details such as IPO dates, price bands, and lot size are yet to be announced. The company has a pre-issue shareholding of 10,00,00,000 shares, with promoters Alpesh Tulsibhai Patel, Pravinkumar Ambalal Patel, and Rashminbhai Tulsibhai Patel holding 89.6%. Post-issue promoter holding will depend on the equity dilution resulting from the IPO.

Knack Packaging Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹475 crore |

| Offer for Sale (OFS) | 0.70 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

Knack Packaging IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Knack Packaging Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Knack Packaging Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹7.38 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 41.54% |

| Net Asset Value (NAV) | ₹21.47 |

| Return on Equity (RoE) | 41.70% |

| Return on Capital Employed (RoCE) | 50.36% |

| EBITDA Margin | 19.31% |

| PAT Margin | 9.88% |

| Debt to Equity Ratio | 0.80 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Capital expenditure towards setting up of new manufacturing facility at Borisana situated at Kadi, Mehsana, Gujarat. | 4350 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

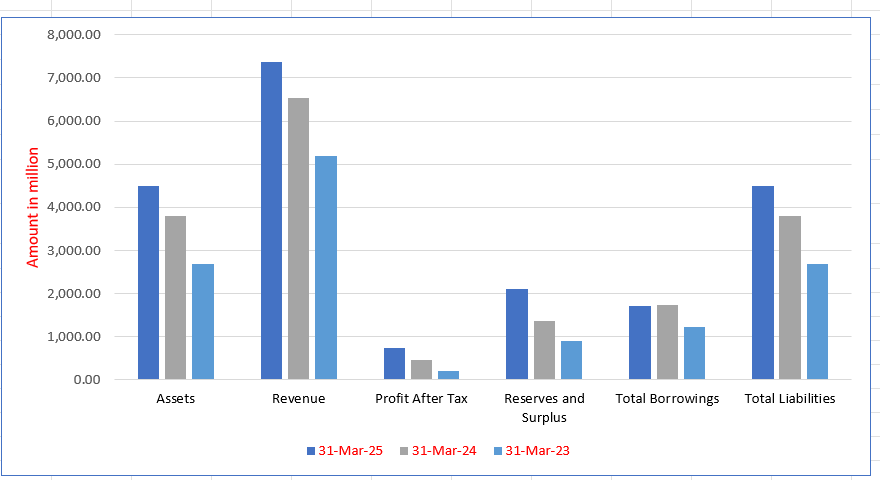

Knack Packaging Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 4,493.61 | 3,793.81 | 2,693.31 |

| Revenue | 7,364.90 | 6,545.59 | 5,184.42 |

| Profit After Tax | 738.10 | 459.77 | 198.70 |

| Reserves and Surplus | 2,097.09 | 1,356.22 | 903.43 |

| Total Borrowings | 1,720.60 | 1,730.93 | 1,226.64 |

| Total Liabilities | 4,493.61 | 3,793.81 | 2,693.31 |

Financial Status of Knack Packaging Limited

SWOT Analysis of Knack Packaging IPO

Strength and Opportunities

- Leading position in the Indian flexible bulk PLWPP bag market with a 10.1% share.

- Extensive export reach to over 68 countries, including the US, Mexico, and South Africa.

- Robust manufacturing capacity of 3,100 MT/month and 1.49 million bags/day.

- In-house printing facility with over 67,000 cylinders developed and 12,000+ SKUs handled.

- Strong client base across diverse industries, including food, agriculture, and chemicals.

- Significant investments in sustainability and anti-counterfeiting features in packaging.

- Established relationships with top Indian and global brands, ensuring repeat business.

- Continuous growth in revenue and profitability, indicating operational efficiency.

- Strategic plans for capacity expansion and technological advancements to meet growing demand.

Risks and Threats

- High debt levels with a debt/equity ratio of 0.80, indicating reliance on borrowings.

- Vulnerability to raw material price volatility, especially polypropylene linked to crude oil prices.

- Geographic concentration with significant export dependence on a few markets.

- Exposure to intense competition from global packaging giants and unorganized local players.

- Potential risks associated with foreign exchange fluctuations affecting international operations.

- Limited diversification in product offerings, focusing primarily on woven polypropylene bags.

- Regulatory changes in international markets could impact export operations.

- Dependence on a few key customers for a substantial portion of revenue.

- Potential challenges in scaling operations without compromising quality standards.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Knack Packaging Limited

Knack Packaging Limited IPO Strengths

Integrated and Digitized Operational Systems

Knack Packaging Limited prioritizes operational efficiency through integrated, digitized processes managed by their proprietary solution, Knack Galaxy. This system connects and tracks critical functions like procurement, production, and logistics in real-time. The company also utilizes integrated planning tools like SAP and Microsoft Dynamics, alongside continuous workforce training, ensuring high efficiency and cost control across the supply chain.

Technical Expertise in Complex Product Design

Knack Packaging Limited possesses the technical capability to execute complex product designs with high precision. This includes sophisticated bag construction, multi-layer lamination, and the incorporation of various add-on features like custom closures. Utilizing an in-house ink kitchen and a spectrophotometer, the firm guarantees accurate and consistent color matching, delivering custom packaging that meets demanding functional and visual specifications.

Comprehensive Customer-Centric Solutions

The company offers end-to-end customer-centric custom packaging solutions, starting from a basic product input (e.g., material to be packed) and weight requirement. Their in-house team handles design development, branding, cylinder printing coordination, and technical support. This comprehensive approach simplifies the packaging process for clients, supporting long-term relationships—as evidenced by healthy customer retention and long-standing key customer tenures.

Diversified Market Presence and Industry Reach

Knack Packaging Limited maintains a diversified market presence spanning domestic and global markets, supported by a subsidiary in South Africa, reducing reliance on any single geography. Its offerings cater to various B2C-driven industries including pulses, animal feed, and fertilizers. This diversification across geographies and sectors minimizes concentration risk, providing operational flexibility and supporting business stability.

Experienced Management and Board Leadership

Knack Packaging Limited benefits from an experienced Board of Directors and Promoters who bring over two decades of expertise in key areas like manufacturing, operations, and finance. This qualified leadership, holding various professional qualifications, guides the company’s strategic direction and long-term growth. The senior management further supports operations with over a decade of experience across various critical business functions

More About Knack Packaging Limited

Knack Packaging Limited is a leading, integrated, innovation-driven, and sustainable packaging solutions provider in India. The company specialises in Printed and Laminated Woven Polypropylene (PLWPP) bags and PLWPP Pinch Bottom bags, offering high-strength, customised solutions across a wide array of sectors, including food products and pet foods. Their solutions not only enhance brand visibility but also reduce counterfeiting risks and improve operational efficiency.

In Fiscal 2025, Knack Packaging held a 10.1% market share in the Indian flexible bulk PLWPP bag segment, including pinch bottom bags (Source: Technopak Report). As one of the early adopters of BOPP/PLWPP bag manufacturing, the company is also the first in India and Asia to introduce laser-cut and easy-open features in PLWPP pinch bottom bags.

Product Portfolio and Customisation

Knack Packaging offers a wide range of bulk packaging solutions, enriched with decades of technological expertise and industry experience. Add-on options include:

- Circular & back seam construction

- Half, full & register window

- Zig-zag cut, heat-cut & blade-cut

- Easy-open and zipper closures

These offerings make Knack Packaging a one-stop solution for domestic and international customers. The company serves top brands such as Baba Agro Food Limited, Drools Pet Food Private Limited, Ebro India Private Limited, KRBL Limited, and international clients in 68 countries, including Cargill and Cristo S.A.

Operational Excellence

The company operates vertically integrated manufacturing facilities in Gujarat, spanning over 1.1 million sq. ft. of land and 726,636 sq. ft. of constructed space, with a workforce of 1,300 employees. Facilities have a production capacity of 36,400 MTPA, supported by advanced machinery and in-house printing services managing over 12,000 SKUs and 67,000 cylinders.

Key Advantages of PLWPP Bags

- Enhanced strength & durability with leak-proof, heat-sealed laser-cut closures

- Six-sided branding for improved retail visibility

- Tamper-proof features like RFID, barcodes, QR codes, and NFC tagging

- Moisture & bacteria protection maintaining product hygiene

- User-friendly design for easy opening, resealing, and storage

- Space efficiency for storage, logistics, and exports

Certifications & Recognitions

Knack Packaging holds ISO 9001:2015, ISO 14001:2015, ISO 45001:2015 certifications, BRCGS packaging certification, and ECOVADIS Bronze Medal. Recognised as a Two Star Export House, the company has won multiple Export Excellence Awards for Woven Sacks/Bags/Fabric.

Through domestic and global reach, Knack Packaging continues to deliver innovative, sustainable, and high-quality packaging solutions to a diverse customer base.

Industry Outlook

Market Size and Growth Prospects

- The Indian flexible packaging market is projected to grow from USD 21.4 billion in 2023 to USD 33.3 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 6.5%.

- A more optimistic forecast estimates the market at USD 20.4 billion in 2025, with a CAGR of 11.46%, reaching USD 35.1 billion by 2030.

Growth Drivers

- E-commerce Expansion: The rapid growth of e-commerce has increased the demand for durable, lightweight, and space-efficient packaging solutions.

- Consumer Preferences: There is a rising demand for sustainable and convenient packaging options, influencing manufacturers to innovate and adopt eco-friendly materials.

- Regulatory Support: Government initiatives promoting green packaging solutions and recycling are encouraging the adoption of sustainable practices within the industry.

Market Segmentation

- Material Composition: Plastic remains the dominant material in flexible packaging, with bioplastics emerging as the fastest-growing segment due to their environmental benefits.

- Product Types: Pouches, bags, wraps, and other forms are prevalent, with pouches gaining significant traction due to their versatility and convenience.

- Printing Technologies: Advanced printing techniques, such as flexography, are widely used to meet the diverse needs of packaging across various industries.

Polypropylene Woven Bags Segment

- The global polypropylene woven bags and sacks market is projected to grow at a CAGR of 4.6% from 2020 to 2025, indicating a steady demand for these durable and cost-effective packaging solutions.

- In India, the industrial plastic bags market, which includes polypropylene bags, is estimated to grow at a CAGR of 5.9% by 2034, driven by continuous infrastructure development and increased demand for premium industrial plastic bags.

How Will Knack Packaging Limited Benefit

- Knack Packaging Limited is well-positioned to leverage the growing demand for flexible packaging in India, especially PLWPP and pinch bottom bags.

- Expansion of e-commerce provides increased opportunities for their lightweight, durable, and space-efficient packaging solutions.

- Rising consumer preference for sustainable and convenient packaging aligns with the company’s eco-friendly and innovative product offerings.

- The growing polypropylene woven bags segment supports consistent demand for their high-strength, customised bulk packaging solutions.

- Advanced printing and customisation capabilities allow the company to cater to brand-conscious clients seeking premium packaging.

- Regulatory support for green and recyclable packaging enhances the company’s market appeal and compliance advantages.

- The company’s vertically integrated operations and strong manufacturing capacity enable it to meet both domestic and export market growth efficiently

Peer Group Comparison

| Name of the Company | Face Value (₹) | P/E | EPS (Basic) | EPS (Diluted) | RoNW (%) | NAV (₹ per share) |

| Knack Packaging Limited* | 10 | [●] | 7.38 | 7.38 | 41.54% | 21.47 |

| Peer Group | ||||||

| Time Technoplast Limited | 126.71 | 456.80 | 17.10 | 17.10 | 14.49% | 127.45 |

| TCPL Packaging Limited | 102 | 1,293.34 | 157.16 | 157.16 | 24.52% | 707.43 |

| Mold-Tek Packaging Limited | 543.05 | 784.40 | 18.22 | 18.22 | 9.83% | 191.97 |

Key Strategies for Knack Packaging Limited

Enhance Production Capacity

Knack Packaging Limited plans to expand its manufacturing footprint by establishing new units, leveraging a portion of the Offer’s proceeds. This investment will increase the installed annual capacity, particularly for pinch bottom bags. The goal is to accommodate growing domestic and international demand, enhance operational flexibility, and strengthen the company’s position in the specialized packaging industry.

Focus on New Product Categories

The company aims to drive growth by expanding into Modern Trend Packaging and new-aged product segments. This includes introducing advanced formats like Zipper Pinch Bottom Bags and Easy Carry Handle Block Bottom Bags. By leveraging market expertise, the firm is committed to aligning product development with evolving customer needs and increasing its presence in high-growth sectors.

Capitalize on Sustainable Packaging Demand

The company’s strategy is to capitalize on the growing industry shift from paper woven bags to more durable and lightweight PP woven bags. Knack Packaging views its expertise as a manufacturer of PLWPP bags as a key opportunity. This transition is driven by the environmental advantages of PP bags, including lower life-cycle emissions and better recyclability.

Transition to Sustainable Practices

Knack Packaging is transitioning towards sustainable practices by adopting solar energy at its facilities, including the proposed new unit, to achieve cost savings and meet ESG objectives. Furthermore, the company is implementing waste-to-value strategies to convert production scrap into usable materials. This approach reflects a commitment to circular economy principles.

Increase Global Exports and Target New Industries

The firm intends to increase its export focus across regions like Europe, Australia, and Africa, aligning with the global ‘China Plus One’ strategy. By introducing PLWPP pinch bottom bags as an alternative to paper bags, it aims to penetrate new, high-growth end-user sectors, such as premixes, high-end fertilizers, and the global seed industry.

Advance Automation and AI/ML Capabilities

Knack Packaging is focused on advancing automation across its operations by integrating systems like MES, SCADA, and Industry 4.0 frameworks. This involves deploying AI and Machine Learning tools for predictive maintenance and production scheduling. The goal is to improve process control, enhance data-based decision-making, and increase consistency in its packaging solutions

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Knack Packaging Limited IPO

How can I apply for Knack Packaging Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the purpose of Knack Packaging Limited’s IPO?

The IPO aims to raise funds for a new manufacturing facility and general corporate purposes.

What is the structure of the IPO?

It is a Book Building Issue comprising a fresh issue of ₹475 crore and an Offer for Sale of 0.70 crore shares.

Where will Knack Packaging IPO shares be listed?

The equity shares are proposed to be listed on NSE and BSE for public trading.

Who are the promoters of Knack Packaging Limited?

Alpesh Tulsibhai Patel, Pravinkumar Ambalal Patel, and Rashminbhai Tulsibhai Patel are the company promoters.

What are the key dates and price details for the IPO?

IPO dates, price band, and lot size are yet to be announced in the DRHP.