- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

IPO Valuation Guide: How Companies Price Their IPOs

By Shishta Dutta | Updated at: May 26, 2025 01:54 AM IST

As an investor, investing in an IPO (Initial Public Offering) is a great opportunity to take part in the growth journey of a company. But before you put your money in a company, it is of utmost importance to understand how the price of the shares are determined when a company goes for an IPO. IPO valuation is one of the most critical decisions in the IPO process, as it is one of the prime factors influencing the prices of an IPO.

In this blog, we will discuss IPO valuation in detail, along with other important aspects like what are the factors that impact the IPO valuation and how it is calculated.

What is an IPO Valuation?

In the simplest terms, IPO valuation is a process that helps in determining the appropriate valuation of the company going public. The prices of the shares and the valuation of the company gives us the IPO valuation. The purpose of this is to determine the IPO price. One may think the price of an IPO is determined by the demand supply dynamics of the shares of the company going for the IPO. But in reality, it is much more than that.

As and when a company goes for IPO, it has to ensure that the stocks are valued reasonably as well as appropriately. The IPO valuation is a process that requires due diligence this is because if the IPO is underpriced, then the possibility of earning gains after the listing is high. On the other hand, if the IPO is overvalued, the possibility of post-listing gains remains limited.

Factors Impacting IPO Valuation

As discussed above, that IPO valuation is much more than simultaneous realisation of demand and supply of trade market. Let us understand in detail, which factors affect the valuation of a company and thus the price of its IPO –

- Number of Shares Offered (Supply) – IPO valuation is significantly impacted by the number of shares offered in an Initial Public Offering (IPO). Increase in the number of shares can lead to dilution of ownership and lower valuation and earnings per share. A smaller number, on the other hand, might cause high-demand and thus higher valuation.

- Demand for the Shares – High demand for a stock often drives its price higher, reflecting investors’ willingness to pay a higher price premium. However, relying solely on demand as a gauge for an IPO’s value can be misleading. It’s essential for investors to consider additional factors for a comprehensive assessment.

- Financial History – The financial records of a company plays an important role in the valuation. Several quantitative factors like assets, liabilities, revenue generating capacity, earnings per share (EPS), price-to-earning (PE) ratio, net asset value per share etc. are taken into consideration while calculating the company’s valuation.

- Industry Competition – The share price of the peers and the existing competition in the industry of the company going for IPO also affects the valuation of the company. An IPO issuing company evaluates the market prices and values of equities in the same sector. If the IPO valuation of a company diverge too much from its peers, investors often hesitant to invest in such a company.

- Potential Growth – A company with higher, better and clear growth prospect is most likely to attract more investors and thus will have a higher valuation.

- IPO Timing and Market Trend – Timing and market trends also have an impact on a company’s valuation. A greater valuation won’t draw investors if the market is in a downtrend.

- Products and Services – The company’s product offerings can also significantly influence its pricing. If the company provides products or services that enhance everyday life or are deemed essential, chances are high that the IPO will attract more investors or higher willingness to pay a premium.

- Values and Management of the Company – A company that has high values, maintains transparency in its operations, has a strong and experienced management indicates that the company is set for a healthy growth, and hence attracts a higher valuation.

Also Read: What is SME IPO? Meaning & Importance

IPO Valuation Process

As evident from the discussion, there are multiple factors that impact the valuation of a company and thus is a complex process. Thus, companies hire expert merchant bankers to help them through the valuation process. The skills and experience of merchant bankers enable them to comprehend and evaluate every element influencing the IPO valuation.

Typically, the merchant banker carries out the following process to arrive at the IPO value –

- Compile all important company records, like financials, performance data etc.

- Analyse the compiled data

- Run an audit of the data collected

- Chart and compare the competitive valuations

- Analyse factors impacting valuation

- Apply IPO valuation techniques

- Incorporate findings into the draft document

- Submit data to SEBI for scrutiny and approval

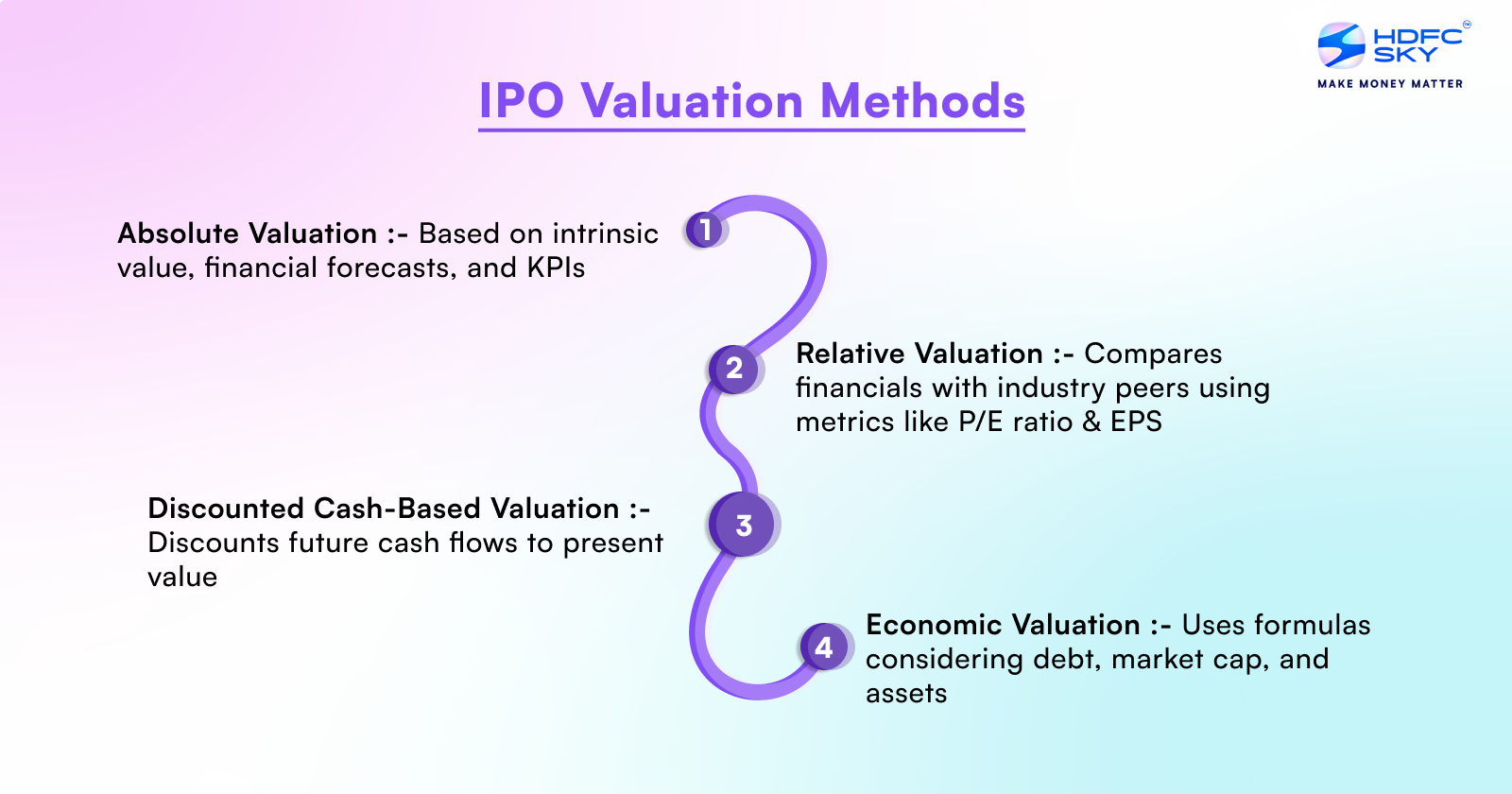

IPO Valuation Methods

There are several different types of IPO valuation method and a merchant banker can take into account the one that they deem fit for the quantitative calculation. Some of the commonly used IPO valuation methods are:

- Absolute Valuation – This approach determines the IPO value by evaluating the company’s intrinsic value, financial predictions and KPIs without peer comparison.

- Relative Valuation – This method assesses the IPO valuation by comparing the company’s financials, assets, and earnings with those of other peer companies in the industry. Some of the metrices that are used in this valuation are price to earning ratio, price to book value ratio, EPS and cash flows.

- Discounted Cash-Based Valuation – This approach estimates the IPO value by discounting future cash flows to their present value, considering the time value of money.

- Economic Valuation – This is a mathematical formula-based method that ascertain a company’s value, considering variables like its debt, market capitalization, income, assets, and other pertinent economic factors.

Valuation of IPO in India

Merchant bankers in India conduct IPO valuations by meticulously examining various aspects of the company, such as internal metrics, performance indicators, past finances, and market conditions. This thorough analysis aids them in determining the most suitable valuation method. The merchant banker ensures all relevant data is reviewed and disclosed in the IPO documents under “Basis for Offer Price/Issue Price.” SEBI evaluates this information and based on its analysis gives opinion or approval to implement the IPO.

Related Articles

FAQs

What are the criteria for the IPO?

A company planning to launch an IPO, has to meet the eligibility criteria as per the ICDR and Listing Regulations laid down by SEBI. Furthermore, the company also has to adhere to the rules laid down under the Companies Act 2013, the Securities Contract (Regulation) Act 1956 and the Securities Contract (Regulation) Rules 1957.

Are IPOs always profitable?

The profitability of an IPO depends on a multitude of micro and macro factors. The aggregate impact of these factors determines whether an IPO will be profitable or not.

How is IPO valuation calculated?

The IPO valuation of a company can be calculated using different types of IPO valuation methods. Some of them are – absolute valuation, relative valuation, economic valuation etc.

What is the minimum valuation for IPO?

There is no minimum valuation requirement for an IPO. It depends on various factors such as – company performance, market conditions, investor expectation, and peers.