- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Knowledge Realty Trust REIT IPO

₹14,250/150 shares

Minimum Investment

IPO Details

05 Aug 25

07 Aug 25

₹14,250

150

₹95 to ₹100

NSE, BSE

₹4 Cr

18 Aug 25

Knowledge Realty Trust REIT IPO Timeline

Bidding Start

05 Aug 25

Bidding Ends

07 Aug 25

Allotment Finalisation

12 Aug 25

Refund Initiation

13 Aug 25

Demat Transfer

13 Aug 25

Listing

14 Aug 25

Knowledge Realty Trust

Knowledge Realty Trust is the largest office REIT in India, with a Gross Asset Value (GAV) of ₹619,989 million as of March 31, 2025. It also ranks as the second-largest office REIT globally in terms of total leasable area, highlighting its significant presence both in the Indian and international real estate markets. REIT holds a global position in terms of leasable area, with a portfolio of 30 Grade A office assets spanning 46.3 million square feet. This includes 37.1 msf of completed space, 1.2 msf under construction, and 8.0 msf earmarked for future development. The assets are located across six major Indian cities—Hyderabad, Mumbai, Bengaluru, Chennai, Gurugram, and GIFT City, Ahmedabad. With a committed occupancy of 91.4%, the portfolio serves a diverse tenant base, including Fortune 500 companies, GCCs, and leading Indian corporates

Knowledge Realty Trust REIT IPO Overview

The Knowledge Realty Trust REIT is a book-built issue worth ₹4,800.00 crores, comprising entirely a fresh issuance of 48.00 crore shares. The public offering opens for subscription on August 5, 2025, and will close on August 7, 2025. The allotment is expected to be finalised by Tuesday, August 12, 2025. The REIT is proposed to be listed on both the BSE and NSE, with a tentative listing date set for Monday, August 18, 2025.

The price band for the issue is fixed between ₹95 and ₹100 per share. Investors can bid in a minimum lot size of 150 shares, requiring a retail investment of ₹14,250. However, the lot size and investment amount for sNII and bNII categories have not been defined yet.

Kotak Mahindra Capital Company Limited is acting as the book-running lead manager for the issue, while Kfin Technologies Limited is the designated registrar.

Knowledge Realty Trust REIT IPO Details

| Particulars | Details |

| IPO Date | 5 August 2025 to 7 August 2025 |

| Listing Date | 18 August 2025 |

| Face Value | ₹[TBD] per share |

| Issue Price Band | ₹95 to ₹100 per share |

| Lot Size | 150 Shares |

| Total Issue Size | 48,00,00,000 shares (₹4,800.00 Cr) |

| Fresh Issue | 48,00,00,000 shares (₹4,800.00 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding REIT |

| Listing At | BSE, NSE |

Knowledge Realty Trust REIT Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 75% of the Issue |

| NII (HNI) | Not less than 25% of the Issue |

Knowledge Realty Trust REIT Lot Size

| Application | Lots | Shares | Amount |

| All Investors | 1 | 150 | ₹15,000 |

Knowledge Realty Trust REIT Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100.00% |

| Post-Issue | [TBD]% |

Knowledge Realty Trust REIT Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | [TBD] |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 10.53% |

| Net Asset Value (NAV) | [TBD] |

| Return on Equity | 10.53% |

| ROCE | 6.72% |

| EBITDA Margin | 79.41% |

| PAT Margin | 5.40% |

| Debt to Equity Ratio | 9.53 |

Objectives of the Proceeds

- Partial repayment of borrowings of Asset SPVs – ₹4,640 crore

- For general corporate purposes – Amount not specified

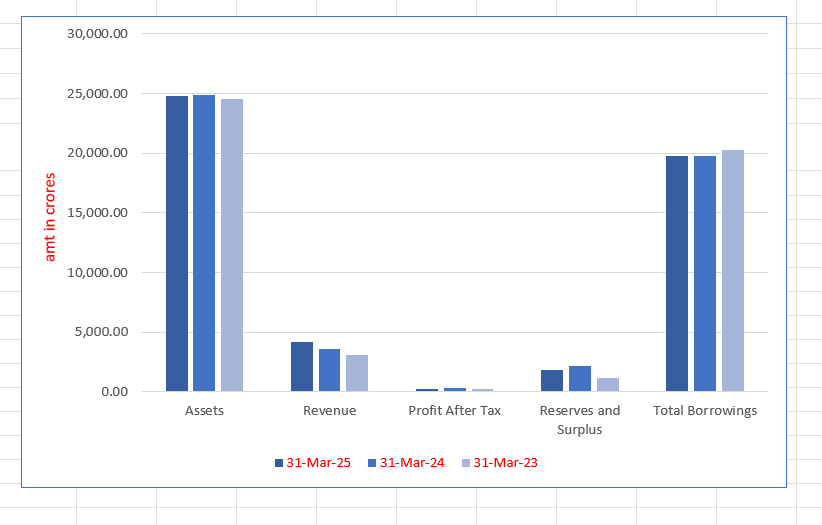

Key Financials (in ₹ crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 24,768.08 | 24,902.82 | 24,544.42 |

| Revenue | 4,146.86 | 3,588.48 | 3,115.97 |

| Profit After Tax | 222.52 | 339.66 | 219.24 |

| Reserves and Surplus | 1845.21 | 2179.83 | 1204.37 |

| Total Borrowings | 19,792.17 | 19,757.58 | 20,226.66 |

SWOT Analysis of Knowledge Realty Trust REIT IPO

Strength and Opportunities

- India’s largest office REIT by GAV and among top global players.

- Strategic assets located across top-performing Indian commercial cities.

- High-quality Grade A infrastructure with tenant-centric facilities.

- Stable occupancy with 91.4% committed lease rates and strong tenant mix.

- Backed by experienced sponsors like Blackstone and Sattva.

- Diversified and growing tenant base with Fortune 500 companies and GCCs.

Risks and Threats

- High dependence on continued demand for office leasing in Indian metros.

- Revenue and profit can be impacted by global economic slowdown.

- High borrowings, leading to interest burden.

- Regulatory changes in REIT tax structures may affect investor sentiment.

- Limited peer comparison may create challenges in benchmarking for retail investors.

- Earnings dropped 34% YoY despite revenue growth, indicating margin pressure.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Knowledge Realty Trust

Knowledge Realty Trust IPO Strengths

- Recognised as India’s leading office REIT by Gross Asset Value (GAV) and Net Operating Income (NOI), with a broad national footprint across key cities.

- Strategically positioned across India’s highest-performing commercial real estate markets.

- Comprises premium-grade properties offering strong infrastructure and a comprehensive suite of modern amenities.

- Features a well-diversified tenant portfolio, with a growing emphasis on top domestic firms and Global Capability Centers (GCCs).

- Maintains strong tenant loyalty through long-term relationships, contributing to high retention and consistent portfolio growth.

- Operates on a resilient business model that ensures stable cash flows and offers significant built-in growth potential.

- Backed by reputable sponsors—Blackstone and Sattva—bringing together global investment expertise and deep local market insights.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Knowledge Realty Trust REIT IPO

How can I apply for Knowledge Realty Trust REIT IPO?

You can apply through HDFC Sky using the UPI-based ASBA process.

What is the minimum investment required in this IPO?

The minimum investment is ₹14,250 for a single lot of 150 shares.

What is the IPO issue size and type of offering?

The total issue size is ₹4,800 crore and it’s a 100% fresh issue.

Where will the Knowledge Realty Trust REIT be listed?

It will be listed on both BSE and NSE.