- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Kusumgar IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Kusumgar IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Kusumgar Limited IPO

Incorporated in 1990, Kusumgar Limited is a leading manufacturer of woven, coated, and laminated synthetic engineered fabrics, primarily based on polyamide and polyester filaments using polyurethane chemistry. The company has developed over 1,000 unique fabric types (SKUs) and serves diverse, high-growth sectors including aerospace and defence, industrial and automotive, and outdoor and lifestyle. With a strong focus on innovation, Kusumgar Limited has vertically integrated manufacturing facilities in Gujarat and a fabrication unit in Uttar Pradesh, enabling end-to-end control over quality and production. The company is led by an experienced promoter family and a professional management team with deep expertise in technical textiles.

Kusumgar Limited IPO Overview

Kusumgar Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 27, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is structured as a Book Building Issue of ₹650.00 crore, consisting entirely of an Offer for Sale. The company plans to list its equity shares on both the NSE and BSE. Axis Capital Ltd. has been appointed as the book running lead manager, while Bigshare Services Pvt. Ltd. will act as the registrar of the issue. Key details such as IPO dates, price band, and lot size are yet to be announced. The shares have a face value of ₹1 each, with the total issue size aggregating up to ₹650.00 crore, and pre- and post-issue shareholding remaining at 10,14,90,000 shares. The promoters, Yogesh Kantilal Kusumgar, Siddharth Yogesh Kusumgar, Sapna Siddharth Kusumgar, and Siddharth Yogesh Kusumgar HUF, currently hold 90.48% of the company’s equity. For further details, refer to the Kusumgar IPO DRHP.

Kusumgar Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | [●] shares (aggregating up to ₹650.00 Cr) |

| Fresh Issue | ₹0 |

| Offer for Sale (OFS) | ₹650.00 Crores |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,14,90,000 shares |

| Shareholding post-issue | 10,14,90,000 shares |

Kusumgar IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Kusumgar Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

Kusumgar Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹11.03 (Basic) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 56.26% |

| Net Asset Value (NAV) | ₹25.40 |

| Return on Equity (RoE) | 56.26% |

| Return on Capital Employed (RoCE) | 42.89% |

| EBITDA Margin | 24.18% |

| PAT Margin | 14.17% |

| Debt to Equity Ratio | 0.44 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

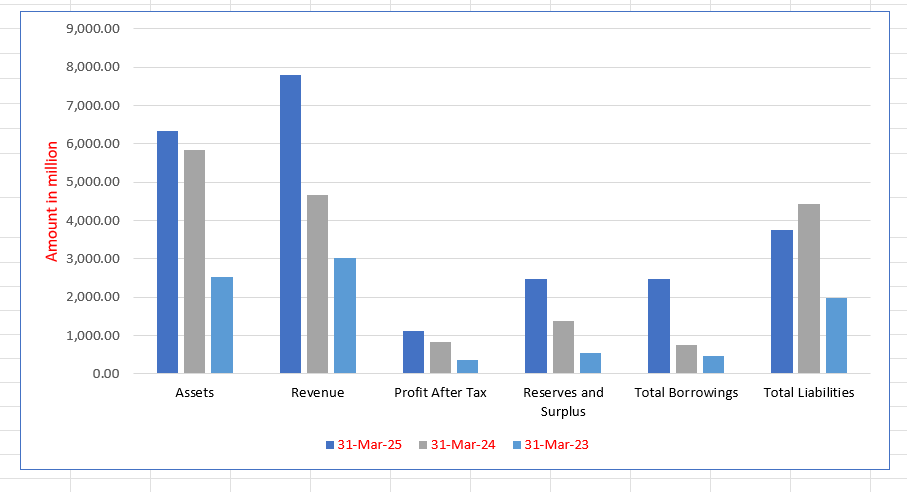

Kusumgar Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 6,323.98 | 5,847.41 | 2,538.70 |

| Revenue | 7,789.97 | 4,679.08 | 3,016.48 |

| Profit After Tax | 1,119.88 | 843.96 | 372.17 |

| Reserves and Surplus | 2,476.03 | 1,383.69 | 536.24 |

| Total Borrowings | 2,465.01 | 765.33 | 475.04 |

| Total Liabilities | 3,746.46 | 4,443.82 | 1,982.56 |

Financial Status of Kusumgar Limited

SWOT Analysis of Kusumgar IPO

Strength and Opportunities

- Operates in markets with very high entry barriers.

- Superior technical capabilities for unique solutions.

- Vertically integrated manufacturing value chain.

- Diversified presence across multiple high-growth end-use segments.

- Long-standing, trusted relationships with key customers.

- Strategic partnerships providing technology and market access.

- Experienced and visionary promoters and management.

- Strong culture of innovation and quality.

- Robust financial performance with high profitability.

- Beneficiary of 'China +1' strategy and 'Make in India' in defence.

Risks and Threats

- Dependence on a concentrated customer base.

- Exposure to international trade and tariff risks.

- Significant working capital requirements.

- Intense competition from global and domestic players.

- Potential for technological obsolescence.

- Regulatory changes in defence and textile sectors.

- Fluctuations in raw material prices.

- Risks associated with long product approval cycles.

- Execution risks in scaling up new solutions business.

- Currency exchange rate volatility impacting exports.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Kusumgar Limited

Kusumgar Limited IPO Strengths

High Entry Barrier Markets

Kusumgar Limited operates in engineered fabric markets characterized by significant entry barriers. These include the need for deep technical knowledge, lengthy product approval cycles that can span 2-10 years, and the requirement to deliver customized, life-preserving solutions that foster extreme customer loyalty. Furthermore, partnerships with leading brands and the need for substantial manufacturing infrastructure protect its business from easy replication by competitors.

Advanced Technical Capabilities

The company’s core strength lies in its advanced technical capabilities, which enable it to develop and supply unique, high-performance solutions. Its salient technical expertise includes manufacturing light fabrics from fine denier yarns, proficiently handling both Nylon 6 and Nylon 66, complex fabric engineering, and sophisticated coating and lamination processes. This allows Kusumgar Limited to create fabrics that meet the stringent demands of aerospace, defence, and industrial applications.

Diversified End-Use Segment Presence

Kusumgar Limited has strategically built a diversified presence across four primary market segments: Aerospace and Defence Fabrics, Aerospace and Defence Solutions, Industrial and Automotive Fabrics, and Outdoor and Lifestyle Fabrics. This diversification mitigates risk as each segment has independent growth drivers, ensuring that the company is not reliant on a single industry cycle and can capitalize on multiple high-growth opportunities simultaneously.

Long-Standing Customer Relationships

The company benefits from long-standing, trusted relationships with its key customers, which has allowed it to consistently increase its wallet share. In Fiscal 2025, its top six customers accounted for a significant portion of its revenue, with some relationships spanning over two decades. This loyalty is particularly strong in defence applications, where product failure is not an option, and customers are unlikely to switch suppliers once trust is established.

Strategic Partnership Ecosystem

Kusumgar Limited has built a valuable ecosystem of strategic partnerships that provide access to proprietary technologies and new markets. These include licensing agreements, co-development projects, and sales and marketing alliances with companies in the US, Europe, and Taiwan. These partnerships act as a business moat, embedding its products into partners’ designs and providing an early-alert system for new market requirements.

More About Kusumgar Limited

Business Overview and Segments

Kusumgar Limited is a prominent player in the engineered fabrics space, specializing in synthetic functional and performance textiles. Its business is segmented into four key verticals, each catering to distinct markets:

- Aerospace and Defence Fabrics: This segment involves creating high-performance fabrics for critical applications such as parachutes, tactical clothing, stealth systems, and rapid deployment systems. The company is a development and manufacturing partner for an Indian government customer and exports these fabrics globally.

- Aerospace and Defence Solutions: Leveraging its fabric expertise, the company has expanded into manufacturing finished products. This includes complete parachute systems, camouflage nets, and deployable shelters. It also undertakes maintenance and repair services for certain clients.

- Industrial and Automotive Fabrics: This segment supplies fabrics for various industrial uses, including automotive. The product lines include fabrics for tapes, custom applications, mechanical rubber goods (MRG), and inflatables.

- Outdoor and Lifestyle Fabrics: The company supplies performance fabrics to the global activewear and gear markets. Its products are used in athleisure, rainwear, winter wear, backpacks, luggage, tents, and sleeping bags, and it is an approved supplier for leading global brands like Decathlon.

Manufacturing and Operational Prowess

Kusumgar Limited’s operations are supported by a vertically integrated manufacturing setup, which includes six facilities in Gujarat and one fabrication unit in Uttar Pradesh. This integration covers preparatory, weaving, dyeing, printing, finishing, coating, lamination, and fabrication processes. This end-to-end control ensures consistency, reliability, traceability, and cost optimization, eliminating dependencies on external suppliers.

Leadership and Human Capital

The company is led by its promoters, Yogesh Kantilal Kusumgar, Siddharth Yogesh Kusumgar (Chairman & Managing Director), and Sapna Siddharth Kusumgar (Joint Managing Director), who bring decades of experience in technical textiles. They are supported by a professional management team that fosters a culture of continuous improvement, innovation, and quality. As of March 31, 2025, the company had a total workforce of 1,712 employees.

Financial Trajectory

Kusumgar Limited has exhibited exceptional financial growth:

- Revenue from operations grew from ₹3,016.48 million in FY 2023 to ₹7,789.97 million in FY 2025, a CAGR of 60.70%.

- Profit After Tax (PAT) surged from ₹372.17 million to ₹1,119.88 million in the same period, a CAGR of 73.47%.

- The company maintains strong profitability metrics, with an EBITDA Margin of 24.18% and a Return on Equity (RoE) of 56.26% in FY 2025.

Industry Outlook

Indian Technical Textiles and Engineered Fabrics

The technical textiles industry in India is on a high-growth trajectory, driven by government initiatives like the National Technical Textiles Mission and rising domestic demand. The engineered fabrics segment, in which Kusumgar Limited operates, is a critical and high-value part of this ecosystem.

Aerospace and Defence

This is a cornerstone segment for Kusumgar Limited. The Indian market for aerospace and defence-related engineered fabrics is projected to grow from ₹50.0 billion in Fiscal 2025 to ₹124.4 billion by Fiscal 2030, reflecting a strong CAGR of 20.0%. Key growth drivers include:

- ‘Make in India’ in Defence: Government policies mandating domestic procurement for defence equipment are a massive tailwind.

- Geopolitical Factors: Increased defence spending by India and other nations to bolster security.

- Supply Chain Diversification: The global “China +1” strategy is creating export opportunities for qualified Indian manufacturers.

Outdoor and Lifestyle

The global engineered fabric market for outdoor and lifestyle applications is projected to grow from US$20.0 billion in 2024 to US$36.0 billion by 2029, a CAGR of 12.5%. For India, specific drivers are:

- Supply Chain Shift: Global activewear and luggage brands are actively shifting their sourcing bases from China to India.

- Rising Domestic Demand: Growth in fitness consciousness and disposable income is boosting the athleisure market.

- Regional Hub Potential: India is well-positioned to supply engineered fabrics to garment manufacturers in Bangladesh, Vietnam, and Sri Lanka, which lack domestic capacity.

Industrial and Automotive

This segment offers stable, long-term growth driven by lengthy qualification cycles that ensure customer stickiness. Growth is fueled by:

- Automotive Production: Expansion of the automotive sector, both domestic and for exports.

- Industrialization: Demand for specialized fabrics for tapes, hoses, and other industrial applications continues to grow.

- Import Substitution: Opportunities to replace imports in niche areas like medical tapes and inflatables.

How Will Kusumgar Limited Benefit

- Benefit directly from the Indian government’s push for indigenisation in defence procurement, securing larger domestic orders for fabrics and solutions.

- Capture market share in the outdoor and lifestyle segment as global brands execute their “China +1” strategy, making Kusumgar Limited a preferred supplier.

- Leverage its existing partnerships and reputation to expand its export footprint in the aerospace and defence fabric market, especially in Europe and North America.

- Capitalize on the high-growth Indian market for military parachutes and related systems, where it is already a established player.

- Grow its Industrial and Automotive Fabrics business by increasing wallet share with existing customers and developing customized solutions for new, high-margin applications like medical tapes and inflatables.

- Utilize its technical expertise and integrated setup to maintain high EBITDA margins, ensuring profitable growth even as it scales operations.

- Exploit the high entry barriers in its core markets to maintain a competitive advantage and pricing power against new potential entrants.

Peer Group Comparison

| Name of the company | Revenue (in ₹ million) | Face value (₹) | P/E ratio | EPS (Basic) (₹) | RoNW (%) | NAV

(₹) |

| Kusumgar Limited | 7,789.97 | 1 | N.A. | 11.03 | 56.26% | 25.40 |

| Garware Technical Fibres Limited | 15,401.13 | 10 | 32.86 | 23.32 | 18.71% | 125.08 |

| Arvind Limited | 83,288.10 | 10 | 21.91 | 13.51 | 9.81% | 144.61 |

| SRF Limited | 146,930.70 | 10 | 68.42 | 42.20 | 10.38% | 425.95 |

Key Strategies for Kusumgar Limited

Build, Retain, Extend in Aerospace & Defence

Kusumgar Limited will continue to employ a “build, retain, extend” framework to grow its aerospace and defence business. This involves building customized solutions for specific defence customers, retaining these relationships through ongoing tailored offerings, and extending this proven expertise to develop similar products for a broader domestic and international customer base. This strategy is supported by strong market tailwinds from increased defence spending and supply chain diversification.

Deepening Ties with Global Outdoor Brands

The company plans to deepen its engagement with leading global outdoor and lifestyle brands to expand this business segment. By becoming an approved supplier and working directly with brands on pricing and design, Kusumgar Limited aims to increase its wallet share. It is well-positioned to benefit from the strategic shift of supply chains to India and the growing demand for performance fabrics in activewear and luggage across global markets.

Steady Growth in Industrial & Automotive Fabrics

Kusumgar Limited intends to achieve steady growth in its Industrial and Automotive Fabrics segment by leveraging the lengthy qualification cycles that create customer stickiness. The focus will be on increasing wallet share with existing customers and providing high-margin, customized solutions. The company will target niches with low cost-sensitivity, such as medical tapes and inflatables, where it can compete effectively with Western incumbents on cost and quality.

Focus on High-Margin, High-Barrier Products

A core strategic pillar is to continue focusing on manufacturing products and solutions that command high gross margins and are protected by high entry barriers. This includes aerospace and defence fabrics, custom industrial fabrics, and parachute solutions. By prioritizing profitability and leveraging its operational efficiency, the company aims to sustain and improve its industry-leading EBITDA margins while driving overall growth.

Investment in Capabilities and People

Kusumgar Limited will continue to invest in its manufacturing capabilities, technology, and human resources to support growth and innovation. This includes recruiting industry experts, promoting a culture of continuous improvement, updating machinery, and automating processes. The company will also focus on improving Overall Equipment Effectiveness (OEE) and availing government incentives to enhance efficiency and reduce costs.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Kusumgar Limited IPO

How can I apply for Kusumgar Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size and price band for the IPO?

The lot size and price band for the Kusumgar Limited IPO will be announced closer to the IPO opening date.

Is this a fresh issue or an Offer for Sale?

The Kusumgar Limited IPO is entirely an Offer for Sale (OFS) of ₹650 crores by the promoter selling shareholders.

Where will Kusumgar Limited shares be listed?

The equity shares of Kusumgar Limited will be listed on both the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

What is the company's core business?

Kusumgar Limited manufactures engineered synthetic fabrics and solutions for aerospace, defence, industrial, automotive, and outdoor lifestyle sectors.