- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Lalbaba Engineering IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Lalbaba Engineering IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Lalbaba Engineering Limited

Lalbaba Engineering is a leading engineering solutions company known for its high-performance seamless tubes, precision forgings, and integrated rail systems. Combining advanced metallurgy and precision manufacturing, it caters to industries like railways, automotive, energy, and infrastructure. As of August 31, 2025, it is India’s largest manufacturer of cold-finished seamless tubes and the second-largest for cold-finished steel tubes by installed capacity (CRISIL report). With three West Bengal plants and a total capacity of 85,000 MTPA, it also exports to 18+ countries, including the USA, Germany, France, and the UAE.

Lalbaba Engineering Limited IPO Overview

Lalbaba Engineering Ltd. filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on September 29, 2025, to raise funds through an Initial Public Offer (IPO). The proposed IPO is a Book-Build Issue amounting to ₹1,000 crore, comprising a fresh issue of shares worth ₹630 crore and an offer for sale (OFS) valued at ₹370 crore. The company plans to list its equity shares on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). IIFL Capital Services Ltd. has been appointed as the book-running lead manager, while MUFG Intime India Pvt. Ltd. will serve as the registrar of the issue. Key details such as the IPO opening and closing dates, price band, and lot size are yet to be disclosed. Interested investors can refer to the Lalbaba Engineering IPO DRHP for detailed information.

As per the preliminary details, the IPO will have a face value of ₹5 per share and will be issued through the book-building route. The total issue size will aggregate up to ₹1,000 crore, including a fresh issue component of ₹630 crore and an OFS component of ₹370 crore, consisting of ₹5 face value shares. The company’s shares will be listed on both BSE and NSE after the issue. Prior to the IPO, Lalbaba Engineering Ltd. has 10,23,84,540 equity shares in circulation.

The DRHP was filed with SEBI on Monday, September 29, 2025. The promoters of Lalbaba Engineering Ltd. include LBIC Engineering Pvt. Ltd., along with Kishan Dhanuka, Amit Dhanuka, Nikunj Dhanuka, and Nishit Dhanuka. The promoter holding stands at 100% before the IPO, which will dilute post-issue.

Lalbaba Engineering Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1000 crore |

| Fresh Issue | ₹630 crore |

| Offer for Sale (OFS) | ₹370 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,23,84,540 shares |

| Shareholding post-issue | TBA |

Lalbaba Engineering IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Lalbaba Engineering Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Lalbaba Engineering Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹4.35 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 25.32% |

| Net Asset Value (NAV) | ₹17.83 |

| Return on Equity (RoE) | 25.19% |

| Return on Capital Employed (RoCE) | 21.01% |

| EBITDA Margin | 12.63% |

| PAT Margin | 5.49 |

| Debt to Equity Ratio | 1.41 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirement for expansion of our Haldia Facility | 2712 |

| Repayment/ prepayment, in full or in part, of certain outstanding borrowings availed by our Company | 2090 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

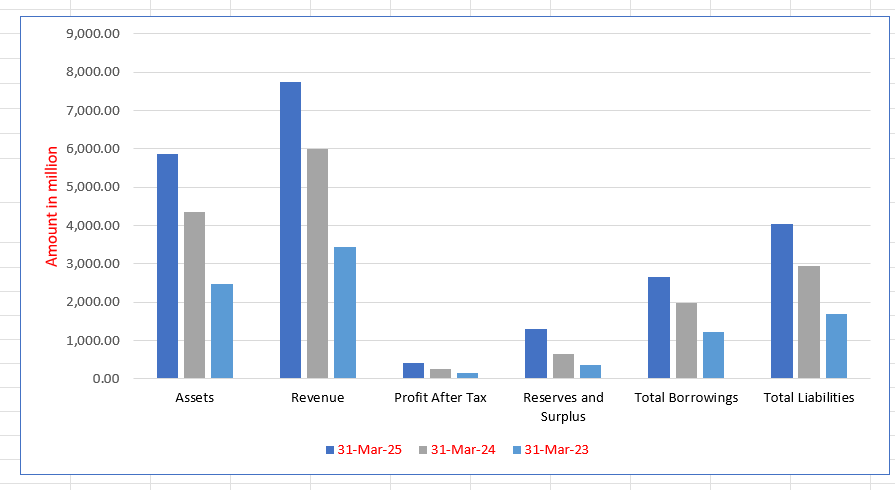

Lalbaba Engineering Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 5,869.61 | 4,356.62 | 2,484.21 |

| Revenue | 7,734.51 | 6,004.40 | 3,452.00 |

| Profit After Tax | 424.42 | 266.08 | 142.64 |

| Reserves and Surplus | 1,313.57 | 656.40 | 351.49 |

| Total Borrowings | 2,647.24 | 1,970.52 | 1,217.33 |

| Total Liabilities | 4,045.12 | 2,940.45 | 1,700.71 |

Financial Status of Lalbaba Engineering Limited

SWOT Analysis of Lalbaba Engineering IPO

Strength and Opportunities

- Strong manufacturing setup for cold-finished seamless tubes and forging

- Established presence in key sectors: railways, automotive, energy

- Large installed capacity enabling scale benefits (85,000 MTPA tubes, 8,400 MTPA forgings)

- Exports to over 18 countries, enabling global reach

- Ability to design end-to‐end solutions (manufacturing + rail systems)

- Growing railway infrastructure demand in India presents opportunity

- Innovation in metallurgy and precision manufacturing capability

- Potential for synergies between tube, forging and rail-system divisions

- Strong client base including automotive Tier-1s and public-sector undertakings

Risks and Threats

- High dependence on volatile raw-material (steel) prices

- Relatively limited diversification beyond core tube/forging businesses

- Capital-intensive operations with significant fixed costs

- Exposure to global demand fluctuations and currency risks

- Intense competition from larger players in steel and engineering space

- Regulatory and environmental compliance pressures in heavy industry

- Supply-chain disruptions or input availability issues can hamper growth

- High leverage or financial burden can restrict flexibility in downturns

- Threat of substitution or new technologies reducing demand for traditional tubes/forgings

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Lalbaba Engineering Limited

Lalbaba Engineering Limited IPO Strengths

Integrated Engineering Solution Provider

Lalbaba Engineering Limited excels as a comprehensive provider by operating three integrated business verticals: tubular, forging, and rail systems. This structure offers domain know-how and end-to-end execution, enabling the company to deliver mission-critical solutions. This allows them to serve diverse, high-specification needs across key sectors like railways, automotive, and energy, mitigating reliance on individual products or markets.

Long-Standing Customer Relationships

The company has fostered long-standing relationships with major, or marquee, customers through its commitment to quality and providing customized engineering solutions. With one key rail customer for over 17 years, the firm successfully cross-sells across all three verticals, evolving from a simple supplier to a strategic solutions partner. Repeat orders drive approximately 78% of operating revenue.

Largest Seamless Tube Manufacturer

Lalbaba Engineering Limited is the largest Cold Finished Seamless (CFS) tube manufacturer in India by installed capacity. This leadership position allows the company to leverage the versatility of CFS tubes, which are crucial for high-pressure applications across automotive, energy, and railway sectors. This diversified end-use profile and operational flexibility offer a natural hedge against cyclical swings.

Proprietary Process Innovation (Uniflow™)

The company drives efficiency and scalability through its engineered production solution, the Uniflow™ system. This unique “hot-to-finish” continuous flow process integrates the entire lifecycle of performance tubing, significantly reducing manufacturing time by 80% and lowering overall costs. This technological advantage expands their total addressable market and differentiates them from competitors.

Focus on Research and Development (R&D)

Lalbaba maintains a strong focus on R&D, evidenced by the Lalbaba Metals Innovation Centre. Staffed by 32 specialists, this facility drives innovation, including the Uniflow™ technology and key product development. Their work has contributed to transitioning railway components from cast steel to forged variants, ensuring enhanced mechanical reliability and supporting continuous technical evolution.

Strong Financial Track Record

The company has consistently demonstrated a strong track record of financial growth and robust return metrics. Revenue from operations increased at a compound annual growth rate (CAGR) of 49.92% between Fiscal 2023 and Fiscal 2025. This profitable growth is complemented by a sustained focus on capital efficiency, with Return on Capital Employed (ROCE) exceeding 20% in the last two fiscals.

More About Lalbaba Engineering Limited

Lalbaba Engineering Limited is a prominent engineering solutions company, specialising in the development and manufacture of high-performance seamless tubes, precision forgings and integrated rail systems. It operates at the intersection of advanced metallurgy, precision manufacturing and end-to-end solutions delivery, enabling it to serve critical applications across railways, automotive, energy and industrial infrastructure. According to a CRISIL report, as at 31 August 2025 the company is India’s largest manufacturer of cold-finished seamless tubes and the second-largest for cold-finished steel tubes by installed capacity.

Business Structure & Three Verticals

The company organises its business across three integrated verticals, each addressing distinct market needs yet reinforcing one another through shared capabilities and customer relationships:

- Tubular Solutions – This vertical forms the technological core. It designs and manufactures cold-finished seamless tubes in carbon, alloy and stainless-steel grades. These tubes serve automotive uses (steering columns, telescopic front forks), railway uses (air brake pipes, slack adjuster tubes), energy uses (boiler and heat-exchanger tubes, including rifled and U-bend types) and industrial infrastructure uses (hydraulic cylinder tube, bearing tube, drill rods, structural tubing). The offering is supported by the proprietary LALBABA PRIME™ product series and Uniflow™ technology, a continuous cold-drawing process for tighter tolerances and faster cycle times.

- Forging Solutions – This vertical produces precision-forged components for high-load, fatigue-resistant applications. While the majority of forging volumes currently come from the railway segment, the company is increasingly extending into defence and industrial applications. The capability supports customers who require durable, high-integrity components.

- Railway Systems – This vertical demonstrates the company’s full integration capability. It manufactures critical assemblies for bogies and brake systems and executes turnkey modernisation programmes under a Rail Solutions-as-a-Service (RSaaS) model, including coach conversions, life-extension retrofits and wagon rebuilds at multiple customer sites across India.

Key Insights & Capabilities

- The company operates three manufacturing plants in West Bengal (Haldia, Uluberia and Ghusuri). As of 31 August 2025, its cold-finished seamless tube manufacturing facility at Haldia has an installed capacity of 85,000 MTPA and the forging capacity is 8,400 MTPA.

- Its research and development initiative is anchored by the “Lalbaba Metals Innovation Centre”, a dedicated facility in Howrah that houses metallurgy, process-improvement and system-prototyping teams.

- The customer base includes leading wagon builders (such as Jupiter Wagons Limited and Texmaco Rail & Engineering Limited), automotive Tier-1 suppliers (such as Sona Comstar Limited) and major public-sector undertakings. From FY 2023 to FY 2025 the company has exported to over 18 countries, including the USA, Germany, France and UAE.

By combining deep engineering strength with manufacturing scale, Lalbaba Engineering Limited has established itself as a key player in performance-critical sectors, while its integrated structure and customer-centric orientation underpin its long-term growth potential.

Industry Outlook

The Indian steel tubes and pipes market, including seamless and cold-finished tubes, was valued at around USD 7.50 billion in 2024 and is projected to reach about USD 8.20 billion by 2033, reflecting a moderate CAGR of approximately 0.9% during 2025–2033. However, the seamless steel pipes segment shows stronger growth prospects with an estimated CAGR of about 5.2% for 2025–2031. The Indian forging industry, valued at USD 5.21 billion in 2024, is anticipated to grow to USD 10.17 billion by 2033 at a CAGR of nearly 7.7%.

Growth drivers include:

- Expanding infrastructure, rail, and urban development projects.

- Rising demand from automotive and EV manufacturing.

- Increased energy sector investments in boilers and pipelines.

- Government initiatives such as “Make in India” and import substitution policies.

Challenges remain in the form of fluctuating raw material prices and competition from alternative materials. Yet, cold-finished and value-added tubes are expected to grow at around 7–8% CAGR as industries prefer precision-engineered components over raw steel.

Industry Outlook for Rail Systems & Components

India’s freight wagon and rail systems market is expected to nearly double by 2031, growing at a CAGR of 10–12%. The Indian Railways’ planned investment of about Rs 16.7 lakh crore by 2031 aims to modernise infrastructure, electrify routes, and expand freight capacity.

How Will Lalbaba Engineering Limited Benefit

- Lalbaba Engineering Limited is strategically positioned to capitalise on the expanding demand for seamless tubes and precision forgings in automotive, energy and rail infrastructure sectors.

- The government’s “Make in India” and railway modernisation initiatives will directly boost demand for the company’s tubular and rail system products.

- Growing investments in EV manufacturing and green mobility will drive higher consumption of cold-finished tubes and forged components.

- The company’s technological edge, including Uniflow™ and LALBABA PRIME™ series, ensures competitiveness in global export markets.

- Increasing focus on import substitution creates opportunities for domestic suppliers of high-performance components.

- The surge in energy infrastructure, such as boilers and heat exchangers, supports steady order inflows for industrial-grade tubes.

- With three manufacturing plants and strong R&D capabilities, the company can scale efficiently to meet rising domestic and export demand.

- Diversified end-use sectors provide stability against cyclical slowdowns in individual markets.

Peer Group Comparison

| Name of Company | Face Value (₹ per share) | Revenue (₹ million) | EPS (₹) (Basic) | EPS (₹) (Diluted) | NAV (₹ per share) | P/E Ratio | RoNW (%) |

| Lalbaba Engineering Limited | 5.00 | 7,716.07 | 4.35 | 3.99 | 17.83 | N.A. | 25.32% |

| Peer Group | |||||||

| Titagarh Rail Systems Limited | 2.00 | 38,677.50 | 20.41 | 20.39 | 184.37 | 45.69x | 11.76% |

| Texmaco Rail & Engineering Limited | 1.00 | 51,065.72 | 6.24 | 6.21 | 69.35 | 23.66x | 9.35% |

| Jupiter Wagons Limited | 10.00 | 39,632.80 | 9.08 | 9.08 | 64.45 | 36.76x | 17.49% |

| Frontier Springs Limited | 10.00 | 2,313.37 | 89.79 | 89.79 | 314.75 | 52.95x | 32.51% |

| Venus Pipes & Tubes Limited | 10.00 | 9,585.26 | 45.65 | 45.45 | 256.55 | 31.93x | 26.74% |

| Tube Investments of India Limited | 1.00 | 1,94,646.50 | 34.83 | 34.80 | 286.09 | 96.42x | 12.66% |

| Goodluck India Limited | 2.00 | 39,358.91 | 50.66 | 50.66 | 394.43 | 21.73x | 13.56% |

Key Strategies for Lalbaba Engineering Limited

Expanding Product Portfolio in Key Sectors

The company plans to scale its rail solutions to include fleet modernization and coach manufacturing, backed by the intended majority acquisition of DTL and DIHL. It is also targeting high-integrity components, like multi-wall axles and telescopic forks, to enhance its presence and transition towards full sub-system manufacturing in the automotive sector.

Capacity and Product Mix Enhancement

Lalbaba Engineering is strategically expanding its Cold Finished Seamless (CFS) tube capacity to 235,000 MTPA by Fiscal 2027. This major expansion will introduce large-diameter tubes and value-added finishing capabilities, such as API upsetting and threading. The goal is to complete the full-range product basket and move up the value chain.

Global Manufacturing Footprint Expansion

The firm intends to expand its geographical presence globally and domestically by leveraging its modular Pandava Series™ manufacturing system. This flexible architecture allows for rapid, demand-led CFS tube deployment in high-growth regions like South East Asia, North America, and Europe, aligning capacity with confirmed customer offtake.

Deepening R&D and Innovation Focus

Lalbaba is expanding its Metals Innovation Centre to consolidate materials research, process development, and product validation. The strategy focuses on advancing proprietary materials like the LALBABA PRIME™ series and scaling the Uniflow™ process. This commitment shortens product time-to-market and supports import substitution for critical components.

Strategic Acquisitions and Joint Ventures

The company will continue to pursue selective acquisitions and joint ventures to accelerate entry into new markets and expand its product offerings. A recent example is the plan to achieve majority control in DTL and DIHL to strengthen its rail manufacturing capabilities, demonstrating a disciplined approach to supplementing organic growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Lalbaba Engineering Limited IPO

How can I apply for Lalbaba Engineering Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Lalbaba Engineering Limited’s IPO?

The total issue size is ₹1,000 crore, including a fresh issue of ₹630 crore and an OFS of ₹370 crore.

When was the DRHP for the IPO filed with SEBI?

The company filed its Draft Red Herring Prospectus (DRHP) with SEBI on 29 September 2025.

On which exchanges will the shares be listed?

The equity shares are proposed to be listed on both the NSE and BSE.

What will the company use the IPO proceeds for?

Funds will be used for Haldia facility expansion, debt repayment, and general corporate purposes.

Who are the lead manager and registrar for the IPO?

IIFL Capital Services Ltd. is the lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.