- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Lamtuf IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Lamtuf Limited

Incorporated in 1978, Lamtuf Limited is engaged in manufacturing and selling industrial laminates, shuttering films, and composite materials. Operating under its current name since 2022 after several restructurings, the company runs a facility at Pashamylaram, Hyderabad, spread across 190,124 square feet with an annual capacity of 7,200 metric tons as of March 31, 2025. Supported by in-house R&D and quality control, Lamtuf serves over 23 customers in 15 countries, including the US, UK, Germany, and Australia. Key clients include Atlas Fibre LLC, Spaulding Composites Inc., and Norplex Micarta.

Lamtuf Limited IPO Overview

Lamtuf Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 14, 2025, proposing to raise funds through an Initial Public Offer (IPO). The IPO is structured as a Book Building Issue of 1.20 crore equity shares, comprising a fresh issue of up to 1.00 crore shares and an offer for sale (OFS) of up to 0.20 crore shares. The equity shares are proposed to be listed on both NSE and BSE. While Kfin Technologies Ltd. has been appointed as the registrar, the book running lead manager is yet to be announced. Details such as IPO dates, price band, and lot size remain undisclosed, and investors may refer to the DRHP for complete information.

Lamtuf Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.20 crore equity shares |

| Fresh Issue | 1.00 crore equity shares |

| Offer for Sale (OFS) | 0.20 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,18,36,672 shares |

| Shareholding post-issue | 4,18,36,672 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Lamtuf Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Lamtuf Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹6.86 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 16.08% |

| Net Asset Value (NAV) | ₹42.39 |

| Return on Equity (RoE) | 16.07% |

| Return on Capital Employed (RoCE) | 22.34% |

| EBITDA Margin | 17.36% |

| PAT Margin | 12% |

| Debt to Equity Ratio | 0.11 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure for Proposed Expansion | 604.3 |

| Funding working capital requirements of our Company | 340 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

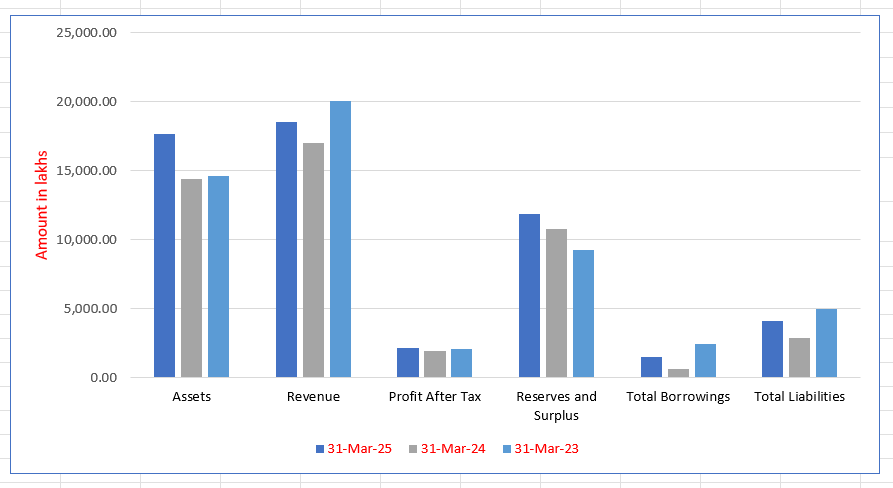

Lamtuf Limited Financials (in lakhs)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 17,640.91 | 14,428.97 | 14,615.73 |

| Revenue | 18,554.51 | 17,027.73 | 20,073.97 |

| Profit After Tax | 2,182.68 | 1,980.01 | 2,082.19 |

| Reserves and Surplus | 11,903.71 | 10,759.24 | 9,257.04 |

| Total Borrowings | 1,479.92 | 639.59 | 2,470.85 |

| Total Liabilities | 4,145.36 | 2,873.81 | 4,979.68 |

Financial Status of Lamtuf Limited

SWOT Analysis of Lamtuf IPO

Strength and Opportunities

- Leading manufacturer of epoxy glass, polyester composites, and densified wood laminates

- Fully integrated plant covering resin making, impregnation, pressing, and finishing

- In-house capabilities enhance quality control and cost efficiency

- Longstanding foundation since 1976 indicates deep industry experience

- Hyderabad location provides access to skilled workforce and industrial ecosystem

- Ability to serve international standards broadens market opportunities

- Scope to diversify into related composite or laminate segments

Risks and Threats

- Operates in a market with intense competition from larger firms

- Early-stage company status may limit access to larger financing options

- Small funding amount suggests limited financial cushioning

- Market rank of mid-tier among competitors reduces brand positioning

- Global customer expectations demand continuous innovation, challenging for small firms

- Lack of fresh funding in recent years may hinder expansion

- Global economic slowdown may reduce industrial demand

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Lamtuf Limited

Lamtuf Limited IPO Strengths

Fully Integrated Manufacturing Facility

Lamtuf Limited’s fully integrated facility in Hyderabad enables end-to-end control over the entire production process, from resin synthesis to final finishing. This vertical integration allows the company to maintain strict quality control, enhance cost efficiency, and shorten turnaround times. By retaining key processes in-house, they ensure product consistency and supply chain resilience.

Diverse and Technically Advanced Product Portfolio

Lamtuf Limited offers a technically advanced portfolio of industrial laminates and composite materials, catering to performance-critical applications across various industries like railways, power, and civil construction. The company’s products are engineered to meet stringent requirements for thermal resistance, dielectric strength, and durability. This diversified product range helps reduce sectoral concentration risk and ensures revenue stability.

Established Track Record and Industry Experience

With over 47 years of experience since 1978, Lamtuf Limited has established a strong legacy as a trusted manufacturer. This long-standing presence has provided deep domain knowledge and specialized technical capabilities. The company has developed enduring relationships with a diverse customer base, solidifying its reputation for quality, reliable delivery, and adherence to industry standards and certifications.

Diversified and Globally Dispersed Customer Base

Lamtuf Limited serves a diversified customer base of over 512 clients in India and more than 23 clients across 15+ countries. This broad geographic and sectoral distribution reduces reliance on any single market or customer, enhancing revenue stability and insulating the business from economic fluctuations. The company’s ability to meet global standards has facilitated its expansion into international markets.

Strong Research and Development Capabilities

Lamtuf Limited’s dedicated in-house R&D division focuses on advancing material science and developing next-generation composite solutions. The lab is equipped with precision testing and prototyping equipment, enabling proactive responses to changing customer requirements and opening new high-margin application segments. This R&D-led approach sustains long-term value creation through continuous innovation.

Consistent Quality and Compliance Standards

Lamtuf Limited emphasizes quality assurance and regulatory compliance through a dedicated in-house quality control lab. The company adheres to stringent international standards like ISO 9001 and ISO 14001, along with REACH and RoHS compliance. This commitment ensures traceability, batch consistency, and reliable service for critical applications, strengthening customer trust and repeat business.

More About Lamtuf Limited

Lamtuf Limited is a vertically integrated manufacturer engaged in the production and sale of industrial laminates, shuttering films, and composite materials. Established in 1978 and reorganised through several corporate restructurings, the company has operated under its present name since 2022. Its operations span resin synthesis, impregnation, pressing, compression moulding, and finishing.

The company’s diverse product portfolio includes:

- Paper phenolic laminates

- Cotton phenolic laminates

- Densified wood laminates

- Epoxy glass laminates

- Glass polyester composites

- Phenolic and epoxy rods and tubes

These products are widely used as insulation materials in power transformers, railways, automobiles, electrical switchgears, oil and gas, civil construction, steel rolling, and defence industries.

Manufacturing and R&D

Lamtuf Limited operates a single manufacturing facility near the Industrial Park, Pashamylaram, Hyderabad, Telangana, with a built-up area of 190,124 square feet and an annual installed capacity of 7,200 metric tons as of March 31, 2025.

The facility is supported by:

- An in-house quality control laboratory

- A dedicated R&D division focused on product innovation, efficiency, and international quality compliance

R&D efforts have led to specialised laminates such as densified wood, glass epoxy, and glass polyester laminates, serving performance-critical applications including semiconductor wafer equipment.

Domestic Operations

In India, the company markets its products primarily through a direct sales model, complemented by participation in public tenders. Customers include public sector undertakings, multinational corporations, and OEMs. Notable domestic clients are High Volt Electricals, Sabar Industries, Technical Associates, Auto CNC, and Bharat Bijlee. Operations remain compliant with local regulatory requirements, including those set by the State Pollution Control Board.

International Presence

Lamtuf Limited exports to more than 23 customers across 15+ countries, including the US, UK, Germany, Czech Republic, Australia, South Africa, and the Middle East. Prominent clients include Atlas Fibre LLC, Spaulding Composites Inc., Norplex Micarta, and Attwater & Sons Limited. Exports accounted for 45.83% of revenue in FY 2025, underlining the company’s strong global footprint.

Key Performance Indicators

- Installed capacity: 7,200 MT (FY 2023–2025)

- Revenue per MT: ₹2.79 lakh in FY 2025

- Raw material cost per MT: ₹1.57 lakh in FY 2025

- Export revenue contribution: 45.83% in FY 2025

Industry Outlook

The Indian composites and laminates industry is on a strong growth trajectory, supported by rising demand across infrastructure, automotive, energy, electronics, and defence sectors. The composites market was valued at around USD 8.8 billion in 2022 and is expected to reach USD 17.8 billion by 2030, growing at a CAGR of nearly 9.2 percent. This growth reflects the increasing need for lightweight, durable, and high-performance materials.

Growth Prospects and Drivers

Demand for advanced materials is driven by several factors:

- Expansion of the power and electrical sectors, creating higher requirements for insulation materials.

- Increased use of laminates and composites in railways, defence, and aerospace for safety and performance.

- Rapid urbanisation and infrastructure development boosting construction and real estate applications.

- Growing automotive production, where composites are preferred for reducing weight and improving fuel efficiency.

Epoxy Resins

The epoxy resin market in India was valued at about USD 443 million in 2022 and is projected to reach nearly USD 767 million by 2030, recording a CAGR of over 7 percent. Epoxy composites alone are expected to expand at close to 9 percent CAGR through 2028. The laminates segment, including both decorative and industrial uses, stood at USD 2.2 billion in 2024 and is forecast to touch USD 3.1 billion by 2033, with steady growth at about 3.8 percent CAGR.

How Will Lamtuf Limited Benefit

- Rising demand in infrastructure, defence, and transport sectors will create sustained opportunities for its laminates and composites.

- Strong presence in epoxy glass laminates and phenolic products aligns with high-growth industrial applications.

- Expansion of the electrical and power sectors will boost need for insulation materials, directly supporting its product portfolio.

- Increasing adoption of lightweight, high-strength composites in automotive and aerospace enhances market scope.

- Urbanisation and housing growth will lift demand for decorative laminates and engineered materials.

- Export potential strengthens as global markets seek reliable suppliers of industrial laminates.

- Product diversification into densified wood and polyester composites reduces dependency on a single category.

- Technological know-how and focus on quality position it competitively against domestic and global players.

- Long-term industry growth ensures recurring opportunities for scaling operations and strengthening revenues.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Lamtuf Limited

Capacity Expansion and Operational Excellence

Lamtuf Limited plans to expand its densified wood and epoxy glass production to meet rising domestic and international demand. This strategy involves strategic investments in advanced automation and process optimization to ensure consistent product quality, cost efficiency, and delivery reliability, supporting scalable growth.

Strengthening Position in High-Performance and Niche Applications

Lamtuf Limited aims to reinforce its market position by focusing on high-performance sectors like semiconductors and aerospace. The company is scaling production for high-value applications, conducting focused R&D for advanced material systems, and offering customized products to improve customer retention and reinforce its role as a strategic supplier.

Broadening Domestic Customer Base

Lamtuf Limited seeks to strengthen its position in the Indian market by expanding into new industrial verticals and underserved regions. The strategy involves targeting emerging application segments, enhancing geographic coverage with regional teams, and offering tailored material solutions to secure a broader domestic customer base.

Accelerating Innovation Through R&D

Lamtuf Limited is committed to sustained investment in research and development to diversify its product portfolio. The company’s strategy includes developing high-performance laminates, expanding into new material categories like carbon composites, and engaging in rapid prototyping to meet evolving industrial and electronic application needs.

Pursuing Strategic Partnerships and Alliances

Lamtuf Limited intends to explore strategic partnerships and alliances to strengthen its technological capabilities and expand its market reach. Collaborations may include technology partnerships for co-development, distribution alliances to increase its international footprint, and joint ventures to access proprietary technologies and new product platforms.

Sustaining Focus on Quality, Compliance, and ESG Integration

Lamtuf Limited is committed to upholding high standards of product quality, regulatory compliance, and environmental stewardship. The company is strengthening its quality assurance systems, maintaining compliance with global standards, enhancing sustainability through energy-efficient practices, and institutionalizing ESG governance to reinforce its reputation as a trusted partner.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Lamtuf Limited IPO

How can I apply for Lamtuf Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the Lamtuf IPO?

The IPO comprises 1.20 crore shares, including 1 crore fresh issue and 0.20 crore offer for sale.

Where will Lamtuf Limited shares be listed?

The equity shares are proposed to be listed on both the NSE and BSE stock exchanges.

What is the purpose of Lamtuf IPO proceeds?

Proceeds will fund capital expenditure for expansion, working capital needs, and general corporate purposes.

Who are the promoters of Lamtuf Limited?

The promoters include Surender Kumar Mehta, Prateek Mehta, Rachna Mehta, Kamlesh Mehta, and Predict Technologies India Pvt Ltd.

What were Lamtuf’s revenue and profit in FY March 2025?

The company reported ₹186.21 crore in revenue and ₹21.83 crore in profit after tax for FY March 2025.