- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Laser Power and Infra IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Laser Power and Infra IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Laser Power and Infra Limited

Laser Power & Infra Ltd. is an integrated manufacturer specialising in power cables, conductors, and other advanced components serving India’s power transmission and distribution industry. To strengthen its presence, the company expanded into the engineering, procurement, and construction (EPC) segment, focusing on rural electrification, power distribution infrastructure, and substation installation projects. It operates three manufacturing units in West Bengal, with a combined installed capacity of 73,100 MT as of March 31, 2025. The company’s operations are divided into two key segments—Manufacturing and EPC—offering a diverse range of products, including power and control cables, speciality products, and conductors.

Laser Power and Infra Limited IPO Overview

Laser Power & Infra Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 27, 2025, to raise funds through an Initial Public Offering (IPO). The proposed IPO is a Book-Build Issue amounting to ₹1,200.00 crores, which includes a fresh issue of shares worth ₹800.00 crores and an offer for sale (OFS) of ₹400.00 crores. The equity shares of the company are proposed to be listed on both the NSE and BSE. IIFL Capital Services Ltd. will act as the book-running lead manager, while MUFG Intime India Pvt. Ltd. has been appointed as the registrar of the issue.

Key details such as the IPO opening and closing dates, price band, and lot size are yet to be announced. As per the DRHP, the issue carries a face value of ₹5 per share and is structured as a Book-Building IPO combining fresh capital and an offer for sale. The total issue size will aggregate up to ₹1,200.00 crores, comprising a fresh issue of shares worth ₹800.00 crores and an OFS amounting to ₹400.00 crores. Post-issue, the shares will be listed on both the BSE and NSE. Prior to the issue, the company has 11,50,41,240 equity shares outstanding.

The DRHP was officially filed with SEBI on September 27, 2025. The promoters of Laser Power & Infra Ltd. are Deepak Goel, Devesh Goel, Akshat Goel, and Rakhi Goel, who currently hold 100% of the company’s shares prior to the issue. The promoter holding post-issue will be updated once the IPO details are finalised.

Laser Power and InfraLimited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1200 crore |

| Fresh Issue | ₹800 crore |

| Offer for Sale (OFS) | ₹400 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 11,50,41,240 shares |

| Shareholding post-issue | TBA |

Laser Power and Infra IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Laser Power and Infra Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Laser Power and Infra Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹9 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 18.02% |

| Net Asset Value (NAV) | ₹49.95 |

| Return on Equity (RoE) | 19.76% |

| Return on Capital Employed (RoCE) | 17.58% |

| EBITDA Margin | 9.74% |

| PAT Margin | 4.12% |

| Debt to Equity Ratio | 0.67 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Pre-payment or re-payment, in full or in part, of all or a portion of certain outstanding borrowings availed by the Company | |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

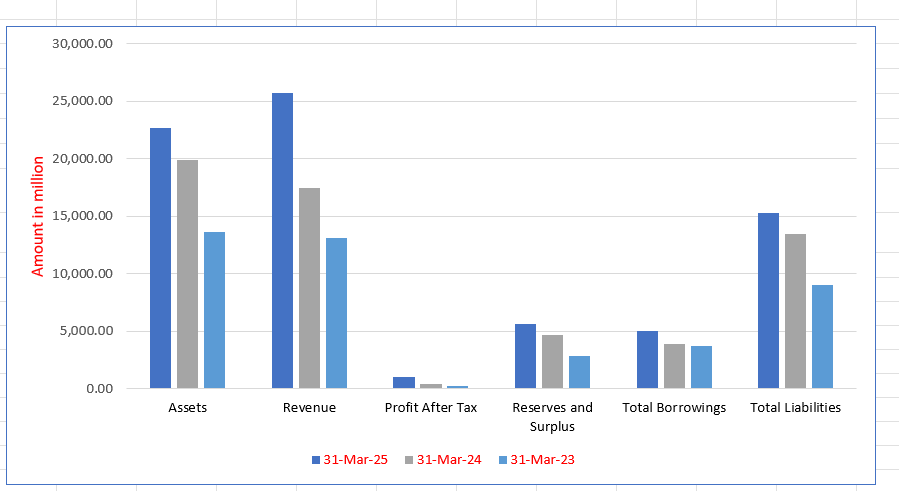

Laser Power and Infra Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 22,701.65 | 19,869.87 | 13,614.90 |

| Revenue | 25,703.97 | 17,475.78 | 13,144.57 |

| Profit After Tax | 1,046.52 | 404.09 | 231.97 |

| Reserves and Surplus | 5681.93 | 4670.46 | 2870.13 |

| Total Borrowings | 5029.49 | 3937.49 | 3758.77 |

| Total Liabilities | 15,255.77 | 13,466.28 | 9016.33 |

Financial Status of Laser Power and Infra Limited

SWOT Analysis of Laser Power and Infra IPO

Strength and Opportunities

- Strong track record in cables and conductors manufacturing in eastern India.

- Diversified business model: manufacturing plus EPC in the power distribution sector.

- Large installed manufacturing capacity (73,100 MT) providing scale.

- Robust orderbook providing mediumterm revenue visibility.

- Growth tailwinds from rural electrification, rail electrification, and T&D infrastructure.

- Strategic partnerships (e.g., advanced conductor technology) to move up the value chain.

- Established relationships with utilities and strong client base across government/private sectors.

- Capability to export products and tap international markets for growth.

- Opportunity to leverage ESG, sustainability, and electrification themes for new product lines.

Risks and Threats

- High working capital intensity with long receivable and inventory cycles.

- Heavy reliance on government contracts and schemes, creating dependency risk.

- Geographic concentration of manufacturing units in West Bengal increases regional risk exposure.

- Intense competition in cable and conductor industry limiting margin expansion.

- Raw material price volatility (copper, aluminium) could erode profitability.

- Exposure to execution risks in EPC projects (delay, cost overrun) undermines profits.

- Orderbook reduces relative to the previous year, indicating a possible slowdown in new orders.

- High gearing or debt levels could limit financial flexibility (though improving).

- Gigantic industry fragmentation means many small competitors could erode market share.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Laser Power and Infra Limited

Laser Power and Infra Limited IPO Strengths

Market Leadership in Power Cables and Conductors

Laser Power and Infra Limited is a rapidly growing manufacturer of power cables and conductors, excelling in revenue from operations growth. According to a CRISIL Report, the company is also one of the leading players in terms of manufacturing capacity, boasting 73,100 MT for power cables and conductors as of Fiscal 2025 among East India-based players. This strong capacity and swift growth rate underscore its influential position in the power transmission sector.

Integrated and Strategic Manufacturing Capabilities

The company maintains robust in-house manufacturing across three integrated units in West Bengal, India, with an aggregate installed capacity of approximately 73,100 MT. Its manufacturing process is backward-integrated, including in-house production of critical inputs like aluminum wire rods and XLPE/PVC compounds. This vertical integration enhances product consistency, operational flexibility, and crucial cost efficiency, utilizing a strategically advantageous location near major ports and raw material sources.

Proven Track Record in Complex EPC Projects

Laser Power and Infra Limited possesses strong execution capabilities demonstrated by its successful track record in handling complex Engineering, Procurement, and Construction (EPC) projects. With over three decades of experience, the company has completed numerous turnkey assignments, notably under government schemes like Saubhagya and RDSS. Its integrated model allows it to execute all EPC-related work in-house, reducing dependence on third parties and ensuring timely, cost-effective project delivery.

Established Marquee Customer Base and Approvals

The company serves a diversified and high-profile customer base that includes government utilities like the Indian Railways and various DISCOMs, private sector EPC players, and international clients in Africa, Bangladesh, and Nepal. Being a registered and approved vendor with key authorities, such as the RDSO, strengthens its market position. This broad and established clientele provides a stable foundation for repeat business and sustained growth.

Strategic Alliances for Advanced Technology

Laser Power and Infra Limited strategically enhances its technological edge through key international partnerships. Specifically, its agreement with TS Conductor Corp, a U.S.-based transmission technology company, qualifies it to manufacture conductors using composite core technologies. This collaboration allows the company to expand its portfolio to include advanced conductors like AECC and other High-Temperature, Low-Sag (HTLS) variants, positioning it at the forefront of innovation in energy-efficient power transmission.

Strong and Diversified Order Book

The company possesses a substantial and diversified Order Book, which reached ₹23,172.49 million as of March 31, 2025, demonstrating an impressive growth of 35.35% from Fiscal 2023. This strong order book, which is spread across its manufacturing and EPC businesses, government and private sectors, and various geographies, provides significant visibility into future revenue growth and highlights the market’s confidence in its execution and quality standards.

Experienced Leadership and Management Team

The company is guided by an experienced management team led by its Promoters, including Deepak Goel, who has over 36 years of industry experience. This leadership has driven the company’s growth from a single unit to a multi-facility operation through a focus on strategic asset acquisition and backward integration. The team’s deep industry knowledge and vision cultivate a culture of excellence and innovation, ensuring the company’s continued success.

More About Laser Power and Infra Limited

Laser Power and Infra Limited is an integrated manufacturer specializing in power cables, conductors, and other specialized products for the power transmission and distribution industry in India. With over three decades of operational history, the company has built a strong reputation for delivering high-quality products tailored to the evolving needs of its clients.

In 2015, the company expanded its business by entering the engineering, procurement, and construction (EPC) segment. This move was aimed at capitalizing on rural electrification projects, power distribution infrastructure development, and substation installations, among other turnkey solutions.

Manufacturing Capacity and Locations

Laser Power and Infra Limited operates three strategically located manufacturing units in West Bengal, India. These facilities have a combined installed capacity of 73,100 MT as of March 31, 2025, making it one of the leading players in East India.

- Manufacturing Unit I focuses on high tension (HT) power cables and RDSO signalling control cables.

- Manufacturing Unit II produces aluminium wire rods and HT covered conductors.

- Manufacturing Unit III specializes in low tension (LT) aerial bunched cables, LT power cables, and ACSR conductors.

The manufacturing units are certified for ISO 9001, ISO 14001, and ISO 45001 standards, ensuring quality and operational excellence. Additionally, the units adhere to stringent quality control measures, with raw material testing and in-process monitoring to meet international benchmarks.

EPC Segment and Market Presence

Laser Power and Infra also has a significant footprint in the EPC sector, offering turnkey solutions for rural and urban electrification, substation development, and power infrastructure. The company has completed over 36 projects and currently has 33 ongoing EPC projects across multiple states in India.

The company’s export footprint is expanding as it continues to serve international clients in Africa, Bangladesh, and Nepal, demonstrating its growing global presence.

Growth and Financial Outlook

With a strategic focus on both manufacturing and EPC, Laser Power and Infra is well-positioned to capitalize on the increasing demand for power infrastructure driven by government electrification initiatives and smart grid investments. The company’s growth trajectory, marked by a CAGR of 39.84% in revenue from operations (FY 2023–2025), highlights its strong performance and competitive edge in the power cable and conductor market.

Laser Power and Infra is well-poised for continued growth, leveraging its manufacturing capabilities, strategic partnerships, and an experienced management team led by founder Deepak Goel.

Industry Outlook

The Indian power cable and conductor industry is poised for significant growth, driven by expanding infrastructure development, government electrification initiatives, and increasing demand for energy-efficient solutions. The market is set to grow at a robust pace, with a projected CAGR of 11-13% from FY 2025 to FY 2030. By FY 2030, the total market size is expected to reach ₹3,350-₹3,550 billion, up from ₹1,951 billion in FY 2025.

Key Growth Drivers

- Electrification Initiatives: Rural electrification and the expansion of transmission lines are key drivers of growth. Government projects like the Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya) are accelerating electrification in remote areas.

- Railway Electrification: The Indian Railways’ electrification program and the shift towards electric trains are contributing to the demand for power cables and conductors, especially for high-tension cables and signalling control systems.

- Infrastructure Development: The growing infrastructure sector, including smart grids, construction activities, and urbanization, is leading to higher demand for power cables, especially in urban areas and under smart distribution networks.

Products in Focus

- Power and Control Cables: The demand for low voltage (LV), medium voltage (MV), and high voltage (HV) cables is increasing due to widespread infrastructure expansion.

- Conductors: Products like ACSR (Aluminium Conductor Steel Reinforced) and AAC (All Aluminium Conductor) are seeing growth in both domestic and international markets, particularly for long-distance power transmission.

- Speciality Cables: With industries focusing on efficiency and performance in extreme conditions, the demand for specialty cables such as elastomeric cables and rubber-insulated cables is increasing.

Market Dynamics and Opportunities

The rising focus on smart grid investments, coupled with increasing exports of cables and conductors, positions the Indian industry for continued growth, enhancing opportunities for companies like Laser Power and Infra to expand their footprint both domestically and internationally.

How Will Laser Power and Infra Limited Benefit

- The growth in rural electrification and government projects such as Saubhagya will expand demand for the company’s power cables and conductors, positioning it well to benefit from these initiatives.

- Railway electrification programs provide an opportunity for Laser Power and Infra to supply high-tension cables and signalling control cables, tapping into the growing infrastructure needs of Indian Railways.

- Infrastructure development and urbanization in India, along with smart grid investments, will fuel demand for the company’s power and control cables, especially in urban and commercial projects.

- As exports of cables and conductors rise, Laser Power and Infra can capitalize on increasing international demand, expanding its global footprint in markets like Africa, Bangladesh, and Nepal.

- The company’s established manufacturing capabilities and strategic partnerships enable it to meet growing market requirements while maintaining cost-efficiency and high-quality standards.

Peer Group Comparison

| Name of the Company | Face Value per Equity Share (₹) | P/E (Basic) | EPS (Diluted) | RoNW (%) | NAV (₹ per share) |

| Laser Power and Infra Limited | 5 | 9.00 | 9.00 | 18.02 | 49.95 |

| Peer Group | |||||

| Apar Industries Limited | 10 | 43.27 | 204.47 | 18.46 | 1,107.88 |

| Polycab India Limited | 10 | 56.42 | 134.34 | 20.55 | 653.31 |

| KEI Industries Limited | 2 | 55.59 | 75.65 | 12.04 | 605.21 |

| Dynamic Cables Limited | 10 | 15.66 | 27.31 | 17.34 | 154.31 |

| Universal Cables Limited | 10 | 31.11 | 25.76 | 5.04 | 510.72 |

Key Strategies for Laser Power and Infra Limited

Expand Product Portfolio in Power Distribution

The company plans to capitalize on robust growth in the power distribution sector by expanding its product portfolio. This includes introducing advanced, high-margin specialty conductors like ACSS and HTLS to cater to niche market segments. Leveraging its R&D, the strategy minimizes reliance on single products while positioning the firm for a Pan-India presence in transmission efficiency projects.

Diversify EPC Portfolio to Infrastructure Sectors

Building on its strong foundation in rural electrification, the company seeks to expand its EPC portfolio by leveraging existing capabilities. It aims to enter high-growth infrastructure sectors such as water distribution, solar EPC, and Battery Energy Storage Systems (BESS). This diversification strategy supports alignment with major government schemes and mitigates sector-specific risks, broadening the revenue base.

Advance Manufacturing Through Technology and Automation

The company is strategically focused on adopting advanced technology and automation to enhance its manufacturing capabilities. Key initiatives include implementing systems like MES and ERP for real-time visibility and cost optimization, while also utilizing a strategic partnership to manufacture advanced conductors like AECC. This focus on R&D and automation aims for higher efficiency and a sustainable competitive advantage.

Increase Domestic and Global Market Footprint

Laser Power and Infra Limited intends to expand its geographical presence both in India and internationally. Domestically, it will capitalize on its reputation in Eastern India while also broadening its reach across various states. Globally, the company aims to increase exports and expand its EPC business outside India to diversify its revenue base and hedge against regional market volatility

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Laser Power and Infra Limited IPO

How can I apply for Laser Power and Infra Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Laser Power & Infra Ltd. IPO?

The IPO is a ₹1,200 crores book build issue, consisting of a fresh issue of ₹800 crores and an offer for sale (OFS) of ₹400 crores.

When is the Laser Power & Infra Ltd. IPO expected to list?

The listing date has not been announced yet, as key details such as IPO dates and price bands are still awaited.

What is the face value of the shares in the Laser Power & Infra IPO?

The face value of each share is ₹5.

Who are the promoters of Laser Power & Infra Ltd.?

The promoters of the company are Deepak Goel, Devesh Goel, Akshat Goel, and Rakhi Goel.