- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Laxmi India Finance IPO

₹14,100/94 shares

Minimum Investment

IPO Details

29 Jul 25

31 Jul 25

₹14,100

94

₹150 to ₹158

NSE, BSE

₹254.26 Cr

05 Aug 25

Laxmi India Finance IPO Timeline

Bidding Start

29 Jul 25

Bidding Ends

31 Jul 25

Allotment Finalisation

01 Aug 25

Refund Initiation

04 Aug 25

Demat Transfer

04 Aug 25

Listing

05 Aug 25

Laxmi India Finance Limited

Laxmi India Finance Limited is a non-deposit-taking non-banking financial company dedicated to addressing the financial needs of underserved customers in India’s lending market. As of September 30, 2024, its operational network spans 139 branches across rural, semi-urban, and urban areas in Rajasthan, Gujarat, Madhya Pradesh, and Chhattisgarh. The company’s product portfolio includes MSME loans, vehicle loans, construction loans, and other lending products tailored to meet diverse customer needs. Its MSME lending supports economic growth and financial inclusion by empowering small businesses and entrepreneurs, with over 80% of MSME loans meeting Priority Sector Lending criteria as per RBI guidelines.

The company’s roots trace back to the early 1990s with Deepak Finance & Leasing Company (DFL), a proprietorship founded by the Promoter’s father. In 2010, the Promoter acquired the company, integrating DFL’s business and operations in 2011 to leverage combined expertise and strengthen operations.

Laxmi India Finance Limited IPO Overview

The Laxmi India Finance IPO is a book-built issue of ₹254.26 crore, comprising a fresh issue of 1.05 crore equity shares worth ₹165.17 crore and an offer for sale (OFS) of 0.56 crore shares totalling ₹89.09 crore. The IPO will open for public subscription on 29 July 2025 and close on 31 July 2025. The basis of allotment is expected to be finalised on 1 August 2025, with the stock scheduled to list on the BSE and NSE on 5 August 2025. The price band has been fixed at ₹150 to ₹158 per share, with a lot size of 94 shares. Retail investors need to invest a minimum of ₹14,100, while the investment for sNII is ₹2,07,928 (1,316 shares in 14 lots) and for bNII is ₹10,09,936 (6,392 shares in 68 lots). PL Capital Markets Private Limited is the book-running lead manager, and MUFG Intime India Private Limited is the registrar to the issue.

Laxmi India Finance Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹165.17 crores (aggregating to 1,04,53,575 shares)

Offer for Sale (OFS): ₹89.09 crores (aggregating to 56,38,620 shares) |

| IPO Dates | 29 July 2025 to 31 July 2025 |

| Price Bands | ₹150 to ₹158 per share |

| Lot Size | 94 Shares |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,18,14,300 shares |

| Shareholding post -issue | 5,22,67,875 shares |

Important Dates

| IPO Activity | Date |

| IPO Open Date | 29 July 2025 |

| IPO Close Date | 31 July 2025 |

| Basis of Allotment Date | 1 August 2025 |

| Refunds Initiation | 4 August 2025 |

| Credit of Shares to Demat | 4 August 2025 |

| IPO Listing Date | 5 August 2025 |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 94 | ₹14,852 |

| Retail (Max) | 13 | 1,222 | ₹1,93,076 |

| S-HNI (Min) | 14 | 1,316 | ₹2,07,928 |

| S-HNI (Max) | 67 | 6,298 | ₹9,95,084 |

| B-HNI (Min) | 68 | 6,392 | ₹10,09,936 |

Laxmi India Finance Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Laxmi India Finance Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) Pre-/Post- IPO | 8.61/6.89 |

| Price/Earnings (P/E) Ratio- Pre-/Post- IPO | 18.35/22.94 |

| Return on Net Worth (RoNW) | 13.95% |

| Net Asset Value (NAV) | 101.3 |

| Return on Equity | 13.95% |

| Return on Capital Employed (ROCE) | – |

| EBITDA Margin | 66.07% |

| PAT Margin | 14.48% |

| Debt to Equity Ratio | 4.42 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ crore) |

| Augmentation of capital base to meet future capital requirements towards onward lending | 143 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

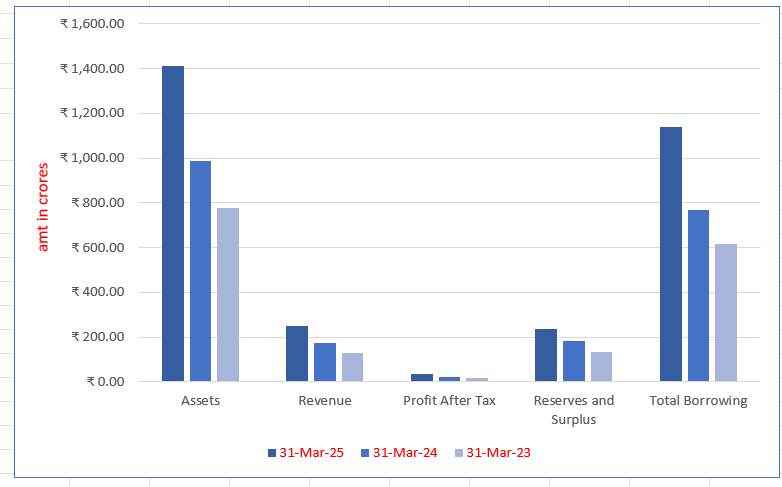

Laxmi India Finance Limited Financials (in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | ₹1,412.52 | ₹984.85 | ₹778.71 |

| Revenue | ₹248.04 | ₹175.02 | ₹130.67 |

| Profit After Tax | ₹36.01 | ₹22.47 | ₹15.97 |

| Reserves and Surplus | ₹236.99 | ₹181.87 | ₹134.23 |

| Total Borrowing | ₹1,137.06 | ₹766.68 | ₹615.49 |

Financial Status of Laxmi India Finance Limited

SWOT Analysis of Laxmi India Finance IPO

Strength and Opportunities

- Experienced promoters with over two decades in the financing sector, providing strong leadership.

- High operational scale with significant loan portfolio growth and a broad resource base.

- Real-time KYC verification enhances business efficiency and customer onboarding.

- Adoption of digitalization techniques improves operational efficiency and customer service.

- Expansion into new geographies like Gujarat and Madhya Pradesh opens growth avenues.

- Diverse product offerings, including MSME, vehicle, and construction loans, cater to varied customer needs.

- Strong presence in sub-urban and rural areas supports financial inclusion and business growth.

- Upgraded credit ratings reflect financial stability and enhance credibility.

- Planned IPO to raise funds indicates growth ambitions and potential for increased capital.

- Implementation of internal audit departments strengthens governance and risk management.

- Launch of referral app 'Laxmi Mitra' leverages digital platforms for customer acquisition.

Risks and Threats

- Geographical concentration in operations, primarily in Rajasthan and Gujarat, limits market reach.

- Stiff competition from other NBFCs and banks poses challenges to market share.

- Moderately diversified loan portfolio may increase risk exposure in specific sectors.

- Dependence on external credit ratings; any downgrade could affect borrowing costs.

- Regulatory changes in the NBFC sector could impact operational flexibility.

- Economic downturns may increase default rates, affecting financial stability.

- High competition in rural financing could pressure profit margins.

- Operational risks associated with rapid expansion into new regions.

- Market volatility could affect the success and valuation of the IPO.

- Dependence on promoter equity infusion for capital needs may limit financial flexibility.

- Technological advancements require continuous investment to stay competitive.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Laxmi India Finance Limited

More About Laxmi India Finance Limited

Laxmi India Finance Limited is a non-deposit taking Non-Banking Financial Company (NBFC) dedicated to addressing the financial needs of underserved customers in India’s lending market. As of September 30, 2024, the company operates through 139 branches across Rajasthan, Gujarat, Madhya Pradesh, and Chhattisgarh. It has established the widest network in Rajasthan among its peers for FY24 (Source: CARE Report).

Business Model and Offerings

Diverse Product Portfolio

The company provides a range of lending products tailored to various customer needs, including:

- MSME Loans: Supporting small businesses and entrepreneurs, with 80% qualifying as Priority Sector Lending under RBI guidelines.

- Vehicle Loans: Financing used commercial vehicles, personal vehicles, tractors, two-wheelers, and electric vehicles.

- Construction Loans: Enabling property purchase, renovation, and construction.

- Other Loans: Small-ticket unsecured loans for business and personal needs.

Key Performance Metrics

- Assets Under Management (AUM): ₹10,355.35 million as of June 30, 2024, reflecting a CAGR of 34.49% since March 31, 2022.

- MSME Loans: 75.49% of AUM, growing at a CAGR of 30.73%.

- Vehicle Loans: 17.46% of AUM, with a CAGR of 78.55%.

- Customer Base: 26,065 customers, including 15,732 active MSME clients and 6,146 vehicle loan clients.

Technological Advancements

Digital Integration

Laxmi India Finance leverages advanced technology across all operations:

- Loan origination and disbursal through Loan Origination Software (LOS) and Loan Management System (LMS).

- A mobile app for seamless customer onboarding.

- CRM tools for enhanced customer engagement and retention.

Efficiency Improvements

- Real-time tracking of collections with a dedicated team of 255 personnel.

- Reduced borrowing costs from 12.46% in FY22 to 11.49% by June 30, 2024, attributed to credit rating upgrades and expanded partnerships.

Market Position and Growth

Branch Network Expansion

- Branches increased from 93 in FY22 to 135 by June 30, 2024.

- Focused on deepening market penetration and exploring new geographies.

Improving Metrics

- Collection efficiency stood at 96.06% for the quarter ending June 30, 2024.

- Credit rating improved to ‘A- with a stable outlook’ (Acuite Ratings).

Leadership and Vision

Laxmi India Finance is led by Deepak Baid, a financial services veteran with over 20 years of experience. Supported by a dedicated management team, the company continues to bridge the financial inclusion gap and cater to underserved markets with a focus on technology-driven efficiency and customer-centric solutions.

Industry Outlook

Overview of NBFC Growth Trends (2019–2027)

India’s Non-Banking Financial Companies (NBFCs) have witnessed transformative growth between FY19 and FY24, with promising projections through FY27. Regulatory harmonisation in 2019 merged categories such as AFCs, LCs, and ICs into NBFC-ICC, forming 11 activity-based classifications.

Key Growth Highlights:

- Systemic credit expanded from ₹134.53 trillion (FY19) to ₹217.47 trillion (FY24E).

- Projected to hit ₹300 trillion by FY27, growing at ~11.8% CAGR.

- NBFCs’ credit share rose from 17% (FY19) to an expected 20% by FY26.

- Retail credit share increased from 21.6% (FY19) to 30.7% (FY24E).

- NBFC housing credit rose 53% YoY in FY24.

MSME Credit Trends (2019–2023):

- MSME credit grew 11% CAGR (Sep 2019–Sep 2023); 13% CAGR post-COVID.

- NBFCs achieved 31.2% CAGR in MSME lending (FY21–FY23).

- Borrowers rose from 5.2M to 8M, with credit outstanding at ₹28.2 trillion.

Auto Financing Outlook:

- Retail auto loans rose 22.2% YoY (Sep 2023); commercial vehicle financing up 30%.

- NBFCs play a key role in rural lending, especially in used vehicle financing.

How Will Laxmi India Finance Limited Benefit?

- Expanding branch network strengthens reach across semi-urban and rural underserved markets.

- MSME lending focus aligns with rising demand and 11% sector growth.

- Vehicle loan segment surges with 78.55% CAGR, driving financing opportunities.

- Technology adoption streamlines processes, reduces costs, and boosts operational efficiency.

- Improved asset quality and credit rating enables access to cheaper capital.

- Geographic expansion from 93 to 135 branches unlocks new growth areas.

- Retail and MSME product focus taps into strong multi-sector lending demand.

- Government infrastructure push increases demand for construction and property finance products.

Peer Group Comparison

| Name of the Company | Face Value (₹) | EPS (Basic)

(₹) |

NAV (₹) | P/E | RoNW (%) |

| Laxmi India Finance | 5 | 6.11 | 101.30 | [●] | 12.80 |

| MAS Financial Services | 10 | 15.11 | 107.87 | 18.35 | 16.09 |

| Five Star Business Finance | 12 | 28.64 | 177.68 | 22.40 | 17.50 |

| SBFC Finance | 10 | 2.35 | 25.87 | 37.87 | 10.43 |

| Ugro Capital | 10 | 13.39 | 154.95 | 18.41 | 9.40 |

| CSL Finance | 10 | 28.60 | 208.42 | 11.68 | 15.15 |

| AKME Fintrade (India) Limited | 10 | 5.85 | 52.31 | 16.04 | 8.66 |

| Moneyboxx Finance Ltd | 10 | 3.45 | 55.38 | 68.34 | 7.31 |

Laxmi India Finance Limited IPO Strengths

- Commitment to MSME Financing

Laxmi India Finance Limited focuses primarily on financing MSMEs, contributing over 75% of revenues in recent fiscals. The company addresses the credit needs of small businesses with loans ranging from ₹0.05 to ₹2.5 million, secured by tangible assets. With a growing customer base and strong loan-to-value (LTV) ratios, Laxmi India leverages the significant unmet demand in this sector to promote financial inclusion and economic growth.

- Diversified Funding Sources

The company secures cost-effective capital from varied sources, including banks, NBFCs, and market instruments like NCDs. It has established strong lender relationships, achieving competitive borrowing costs and repeat funding. Laxmi India’s capital adequacy ratio and asset-liability management (ALM) practices ensure liquidity and operational stability. This strategic approach enhances financial flexibility and sustains growth while maintaining resilience during economic challenges.

- Robust Risk Management Framework

Laxmi India employs a comprehensive credit assessment and risk management system tailored to underserved segments. With stringent quality checks and collateral-backed lending, the company balances customer profiles and ensures operational efficiency. Its policies address credit, market, and liquidity risks. A significant proportion of customers have high credit scores, demonstrating its focus on maintaining asset quality while serving emerging borrowers across diverse markets.

- Extensive Geographic Presence

The company caters to a wide demographic, including rural, semi-urban, and urban customers. With a strong presence across multiple locations, Laxmi India tailors its financial products to diverse needs. This extensive reach, coupled with its focus on financial inclusion, allows the company to effectively support underserved populations, fostering regional development and community growth through accessible financial services.

- Technology-Driven Operations

Laxmi India integrates advanced technology in its operations, including data-driven credit assessment and digital loan processing. These innovations streamline workflows, reduce turnaround times, and enhance customer experience. By leveraging technology for risk evaluation and loan management, the company not only ensures efficiency but also strengthens its ability to serve customers in an increasingly digital economy.

- Strong Promoter Commitment

The promoters of Laxmi India Finance Limited demonstrate unwavering support through regular capital infusions, holding over 87% equity. Their commitment underpins the company’s stability and growth trajectory. This strong backing, coupled with improved credit ratings and prudent financial management, enables the company to negotiate favourable terms with lenders and expand its business sustainably.

Key Strategies for Laxmi India Finance Limited

- Expansion of Geographical Footprint

Laxmi India Finance Limited continues expanding its geographical footprint, aiming to reach underserved markets with lower penetration. The company opened 4 new branches in Q3 2024 and focuses on long-term customer relationships, selective location expansion, and strategic acquisitions. It also plans to increase district-level penetration and enhance market presence, guided by comprehensive market studies, to foster business growth in new and existing regions.

- Leveraging Branch and Customer Network

The company capitalizes on cross-selling opportunities within its existing customer base to increase revenues and customer retention. By targeting current customers, Laxmi India Finance aims to diversify product offerings and expand its loan portfolio. It uses data analytics and relationship-based selling to improve operational efficiency, manage risks, and drive higher profitability through increased loan sizes and customer acquisition.

- Enhancing Information Technology

Laxmi India Finance is committed to boosting operational efficiency and customer service by investing in advanced technology. The company integrates digital tools for underwriting, loan origination, and collection processes, aiming to reduce operational risks, enhance customer experience, and drive business growth. The focus on mobile and digital transactions will further improve cost efficiency, lower acquisition costs, and provide better data-driven insights to refine strategies.

- Diversifying Borrowing Profile

Laxmi India Finance aims to optimize its borrowing costs through a diversified funding strategy, reducing dependence on expensive loans. By leveraging its improved credit rating, the company secures favorable terms with lenders, decreasing borrowing costs. The company utilizes a mix of term loans, working capital, securitized loans, and NCDs to ensure cost-effective financing, maintaining financial stability and supporting sustainable business growth

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Laxmi India Finance Limited

What is the IPO size of Laxmi India Finance Limited?

Laxmi India Finance Limited’s IPO comprise₹254.26 crores, which includes fresh issue of ₹165.17 crores and ₹89.09 crores of offer for sale.

What are the objectives of the Laxmi India Finance Limited IPO proceeds?

The proceeds from the IPO will be used to augment the capital base for future lending requirements and for general corporate purposes, to be updated in the Prospectus before filing.

When will Laxmi India Finance Limited’s IPO be listed?

The listing date for Laxmi India Finance Limited’s IPO on the BSE and NSE tentatively scheduled for 5 August 2025

How can I apply for the Laxmi India Finance Limited IPO?

You can apply for the IPO through your Demat and trading accounts via online platforms, brokers, or IPO-specific applications once the bidding period is open and the details are announced.

What is the financial performance of Laxmi India Finance Limited?

As of June 30, 2024, Laxmi India Finance reported a revenue of ₹512.55 million and a profit after tax of ₹66.26 million, reflecting steady growth in its operations.

What is the listing venue for Laxmi India Finance Limited’s IPO?

Laxmi India Finance Limited’s shares will be listed on the BSE and NSE. Investors can track their shares post-listing through these stock exchanges.