- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

LCC Projects IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

LCC Projects IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

LCC Projects Limited

LCC Projects Limited is among India’s leading multidisciplinary Engineering, Procurement, and Construction (EPC) companies in the irrigation and water supply projects segment, based on market share as of the six-month period ending September 30, 2024. The company has successfully executed diverse construction projects, including dams, barrages, weirs, hydraulic structures, metro rail, industrial buildings, canals, pipe distribution networks, lift irrigation works, water supply schemes, roadworks, buildings, mining, and infrastructure development. With over a decade of experience, LCC Projects Limited continues to excel in EPC, demonstrating expertise across various sectors and striving for excellence.

LCC Projects Limited IPO Overview

LCC Projects IPO is a bookbuilding issue comprising a fresh issue of ₹320.00 crores and an offer for sale of 2.29 crore equity shares. The IPO dates, price band, lot size, and listing date are yet to be announced. The face value of each share is ₹5, and the issue will be listed on BSE and NSE. Motilal Oswal Investment Advisors Limited is the book-running lead manager, while Kfin Technologies Limited is the registrar. The IPO’s Draft Red Herring Prospectus (DRHP) was filed with SEBI on February 27, 2024, and again on February 27, 2025. The total pre-issue shareholding stands at 27.20 crore shares, fully held by promoters. The company is promoted by Arjan Suja Rabari, Laljibhai Arjanbhai Ahir, and Maya Arjan Rabari. Post-issue shareholding and allotment finalisation dates are yet to be disclosed. For complete details, refer to the LCC Projects IPO DRHP.

LCC Projects Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹320 crore

Offer for Sale (OFS): 2.29 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 27,20,00,000 shares |

| Shareholding post -issue | TBA |

LCC Projects Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

LCC Projects Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

LCC Projects Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.48 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 31.87% |

| Net Asset Value (NAV) | 14.07 |

| Return on Equity | 31.87% |

| Return on Capital Employed (ROCE) | 27.63% |

| EBITDA Margin | 9.90% |

| PAT Margin | 5.00% |

| Debt to Equity Ratio | 1.10 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Re-payment/ pre-payment, in full or in part, of certain outstanding borrowings availed by our Company | 2200 |

| Purchase of equipment | 149.12 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

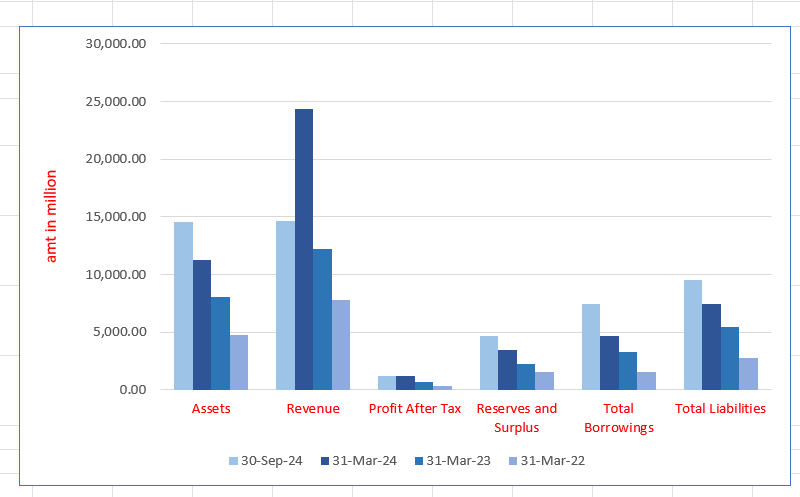

LCC Projects Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 14,539.43 | 11,299.87 | 8036.11 | 4732.89 |

| Revenue | 14,681.13 | 24,389.12 | 12,252.67 | 7808.96 |

| Profit After Tax | 1179.49 | 1219.97 | 682.17 | 353.34 |

| Reserves and Surplus | 4660.56 | 3488.25 | 2272.25 | 1591.07 |

| Total Borrowings | 7411.07 | 4690.59 | 3247.25 | 1558.57 |

| Total Liabilities | 9528.65 | 7466.25 | 5424.22 | 2801.83 |

Financial Status of LCC Projects Limited

SWOT Analysis of LCC Projects IPO

Strength and Opportunities

- Diverse portfolio encompassing dams, metro rail, industrial buildings, and more.

- Over 20 years of experience in infrastructure development.

- Strong leadership with extensive experience in civil engineering and project management.

- Established reputation as a leading construction company in Gujarat.

- Expertise in executing complex projects, including hydraulic structures and lift irrigation works.

- Commitment to quality and safety, ensuring high standards in project execution.

- Opportunities to expand into emerging sectors like mining, leveraging government initiatives.

- Potential for growth through diversification into sectors like water supply and metro rail projects.

- Ability to undertake large-scale government infrastructure projects, enhancing credibility.

Risks and Threats

- High operating costs compared to competitors.

- Dependence on existing supply chains, making the company vulnerable to global disruptions.

- High cash cycle compared to competitors, necessitating improvements in cash flow management.

- Potential challenges in aligning sales with marketing efforts.

- High dependence on star products, leading to insufficient focus on developing new offerings.

- Interest costs higher than competitors, impacting profitability.

- Employees limited understanding of company strategy, leading to potential misalignment.

- Competition from established project management firms and in-house teams.

- Economic downturns or recessions impacting construction activity.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About LCC Projects Limited IPO

LCC Projects Limited IPO Strengths

Leading EPC Company in Irrigation and Water Supply Projects

LCC Projects Limited is a prominent multidisciplinary EPC company in India, excelling in irrigation and water supply projects. With a proven track record of completing 71 projects, the company demonstrates expertise in project execution, timely delivery, and large-scale infrastructure development across diverse geographic conditions.

Strong Order Book and Diversified Project Portfolio

LCC Projects Limited has demonstrated consistent growth in its Order Book, reaching ₹73,474.24 million as of September 30, 2024. With a diversified portfolio across business verticals and government contracts, the company’s expertise in project execution, quality standards, and financial strength drive its sustained expansion.

In-House Project Design Capabilities with Robust Technical Expertise

LCC Projects Limited boasts a strong in-house design and engineering team, consisting of 496 qualified engineers and technical experts as of September 30, 2024. With expertise in construction management and design, the team ensures efficient project execution, cost control, and adherence to quality standards, leveraging cutting-edge technologies such as SCADA, GIS, and AutoCAD.

Strong Risk Management, Project Selection, and Dispute Resolution

LCC Projects Limited employs a comprehensive risk management system to identify, measure, and monitor potential risks across the project lifecycle. The company prioritizes projects with steady cash flows and mitigates credit risk through milestone-based payments and escalation clauses. Senior management conducts rigorous risk assessments at every stage, from pre-tendering to execution. Additionally, a structured dispute resolution approach ensures smooth project delivery by addressing contractual concerns proactively.

Efficient Business Model

LCC Projects Limited’s growth stems from strategic project selection, cost optimization, and precise pricing. Pre-bid assessments, high-quality execution, and efficient inventory management enhance profitability. A dedicated business development team ensures competitive pricing, stakeholder engagement, and resource efficiency, driving sustainable growth and financial stability.

Experienced Leadership and Skilled Management Team

LCC Projects Limited benefits from experienced leadership, with Promoters Arjan Suja Rabari and LalajibhaiArjanbhai Ahir bringing 27+ and 15+ years of expertise. A stable senior management team ensures strategic growth, market adaptability, and operational excellence, driving innovation and long-term success in multidisciplinary EPC projects.

More About LCC Projects Limited

LCC Projects Limited is among India’s leading multidisciplinary engineering, procurement, and construction (EPC) companies, particularly in the irrigation and water supply projects segment. As of the six-month period ending September 30, 2024, the company holds a significant market share in this sector (Source: ICRA Report). Additionally, it is one of Gujarat’s fastest-growing large corporate EPC companies in terms of turnover growth in Fiscal 2024. The company is expanding its infrastructure projects across 11 states in India (Source: ICRA Report).

Expertise and Experience

With over two decades of experience, including projects undertaken through a partnership firm before its conversion to a corporate entity, LCC Projects Limited has successfully executed diverse projects in the irrigation and water supply sector. These projects include:

- Construction of dams, barrages, and weirs

- Development of hydraulic structures and canals

- Implementation of pipe distribution networks

- Execution of lift irrigation works and water supply schemes

- Comprehensive EPC project management

The company has also ventured into infrastructure development beyond irrigation, recently completing a metro rail project involving the construction of stations, approaches, and viaducts. Additionally, it is currently engaged in a mining development and operations (MDO) project.

Project Portfolio

Current Order Book

As of September 30, 2024, LCC Projects Limited has an order book comprising 68 ongoing projects. The three largest projects by value include:

- Sondwa Lift Micro Irrigation Project – ₹13,954.11 million

- Sidhi Bansagar Multi-Village Scheme – ₹13,864.94 million

- Gandhi Sagar 1 Multi-Village Scheme – ₹10,490.00 million

Ongoing Projects

The top ten ongoing projects, as per contract value, include:

- Sondwa Lift Micro Irrigation Project (₹13,954.11 million) – Madhya Pradesh

- Sidhi Bansagar Multi-Village Scheme (₹13,864.94 million) – Madhya Pradesh

- Gandhi Sagar 1 Multi-Village Scheme (₹10,490.00 million) – Madhya Pradesh

- Luvkushnagar, Chhatarpur (Tarped) & Bijawar Multi-Village Drinking Water Supply Scheme (₹9,856.99 million) – Madhya Pradesh

- Bishrampur Mining Project (₹6,693.33 million) – Chhattisgarh

- Lift Irrigation Pipeline Project from Todiya Rock (Mahi River) (₹5,723.09 million) – Gujarat

- Bhandura Nala Diversion Scheme (Lift Scheme) (₹5,142.41 million) – Karnataka

- Irrigation Facilities to Nalkantha (₹3,776.56 million) – Gujarat

- Dudhi Dam Construction & Maintenance Project (₹3,548.00 million) – Madhya Pradesh

- Malthon Multi-Village Scheme (₹3,412.92 million) – Madhya Pradesh

Each of these projects is executed with a turnkey approach, covering engineering, procurement, construction, testing, commissioning, and long-term operation and maintenance.

Completed Projects

LCC Projects Limited has successfully delivered numerous high-value projects. The top ten completed projects (as of September 30, 2024) include:

- Dudhai Sub Branch Canal Project – Gujarat (₹3,201.68 million, completed in 2021)

- Sitanagar Project

Commitment to Infrastructure Development

LCC Projects Limited remains committed to executing large-scale EPC projects with precision and efficiency. By leveraging its extensive experience and technical expertise, the company continues to contribute to India’s infrastructure growth while maintaining its position as a market leader in the irrigation and water supply sectors.

Industry Outlook

Indian Infrastructure Industry Outlook

- Growth Projections

- Morgan Stanley forecasts a 15.3% compound annual growth rate (CAGR) in infrastructure investments over the next five years, amounting to a cumulative expenditure of $1.45 trillion.

- Government Initiatives

- The Union Budget has allocated ₹10 lakh crore (approximately $130.57 billion) to infrastructure development, with specific allocations including:

- National Highways Authority of India (NHAI): ₹134,015 crore ($17.24 billion)

- Ministry of Road Transport and Highways: ₹60,000 crore ($7.72 billion)

- Ministry of Housing and Urban Affairs: ₹76,549 crore ($9.85 billion)

- Department of Telecommunications: ₹84,587 crore ($10.87 billion)

- Indian Railways: ₹234,640 crore ($30.48 billion)

- The PM GatiShakti National Master Plan aims to accelerate project execution and reduce cost overruns.

Sector-Specific Outlook

- Irrigation and Water Supply

- Continued investments in irrigation projects are anticipated to enhance agricultural productivity and rural livelihoods.

- Transportation Infrastructure

- Roadways: Plans to expand the National Highways Network by 25,000 km in 2022–2023, with projects like the 1,380 km eight-lane Delhi–Mumbai expressway expected to boost connectivity.

- Railways: Introduction of 400 new Vande Bharat trains by 2025 under the “Make in India” initiative, with a focus on electrification and modernization.

- Airways: The UDAN program aims to enhance regional air connectivity, operationalizing 415 routes and 66 airports.

- Mining Development and Operations (MDO)

- The government’s focus on self-reliance in mineral production is expected to drive growth in the mining sector, offering opportunities for companies engaged in MDO projects.

Key Growth Drivers

- Government Policies

- Initiatives like PM GatiShakti and substantial budget allocations are set to drive infrastructure development.

- Urbanization

- Rapid urbanization necessitates the expansion of infrastructure, including water supply and transportation networks.

- Private Sector Participation

- Encouragement of private investments is expected to enhance efficiency and innovation in infrastructure projects.

How Will LCC Projects Limited Benefit

- Rising Infrastructure Investments: A projected $1.45 trillion infrastructure investment over five years provides LCC significant opportunities to secure large-scale EPC contracts and expand its nationwide presence.

- Government Budget Allocation: ₹10 lakh crore allocated for infrastructure development ensures financial support for LCC’s irrigation and water supply projects, boosting growth and project execution capabilities.

- Irrigation Sector Expansion: Increased government investments in irrigation projects enhance demand for LCC’s expertise in constructing dams, barrages, canals, and water distribution networks, strengthening its market position.

- Urbanization-Driven Growth: Rapid urban expansion fuels demand for water supply infrastructure, enabling LCC to capitalize on large-scale urban and rural development projects across multiple states.

- Transportation Infrastructure Development: Expanding roads, railways, and airways infrastructure creates diversification opportunities for LCC, allowing entry into new infrastructure sectors beyond irrigation and water supply.

- Mining Sector Growth: The government’s self-reliance push in mineral production increases mining project demand, benefiting LCC’s mining development and operations (MDO) business segment.

- PM GatiShakti Initiative: Streamlined project execution and reduced cost overruns under PM GatiShakti improve LCC’s efficiency, ensuring faster completion of EPC projects with optimized resources.

- Private Investment Opportunities: Rising private participation in infrastructure enhances project financing options, allowing LCC to undertake larger, more complex EPC projects with improved execution capabilities.

- Technological Advancements in EPC: Government-driven modernization in infrastructure encourages LCC to adopt advanced engineering and construction technologies, enhancing operational efficiency, cost-effectiveness, and competitive edge.

- Sustained Policy Support: Consistent government policies promoting infrastructure development create a stable business environment, ensuring LCC’s long-term growth and leadership in India’s EPC sector.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ in million) | Basic (₹) | P/E a | RONW (%) | NAV (₹) |

| LCC Projects Limited | 5.00 | 24,389.12 | 4.48 | – | 31.87% | 14.07 |

| Peer Groups | ||||||

| Vishnu Prakash R Punglia Limited | 10.00 | 14,738.65 | 10.95 | 15.72 | 16.95% | 57.85 |

| Enviro Infra Engineers Limited | 10.00 | 7,289.15 | 8.13 | 28.14 | 36.43% | 21.35 |

Key Insights

- Face Value: LCC Projects Limited has a face value of ₹5 per share, which is lower than its listed peers, Vishnu Prakash R Punglia Limited and Enviro Infra Engineers Limited, both having a face value of ₹10 per share. A lower face value does not affect market price but influences the number of shares issued.

- Revenue: LCC Projects Limited reports the highest revenue of ₹24,389.12 million, surpassing Vishnu Prakash R Punglia Limited at ₹14,738.65 million and Enviro Infra Engineers Limited at ₹7,289.15 million. This indicates LCC’s larger market presence and operational scale in the industry.

- Basic EPS:LCC Projects Limited has a Basic EPS of ₹4.48, which is significantly lower than Vishnu Prakash R Punglia Limited (₹10.95) and Enviro Infra Engineers Limited (₹8.13). A lower EPS suggests comparatively lower profitability per share, despite higher revenues.

- P/E Ratio: LCC Projects Limited’s P/E ratio is not available, while Vishnu Prakash R Punglia Limited and Enviro Infra Engineers Limited have P/E ratios of 15.72 and 28.14, respectively. The P/E ratio helps investors assess valuation, with a higher value indicating higher market expectations for future growth.

- Return on Net Worth: LCC Projects Limited has a strong RONW of 31.87%, outperforming Vishnu Prakash R Punglia Limited (16.95%) but lagging behind Enviro Infra Engineers Limited (36.43%). This suggests efficient capital utilization, leading to better shareholder returns.

- Net Asset Value: LCC Projects Limited has a NAV of ₹14.07, significantly lower than Vishnu Prakash R Punglia Limited (₹57.85) and Enviro Infra Engineers Limited (₹21.35). A lower NAV may indicate lesser asset backing per share compared to its peers.

Key Strategies for LCC Projects Limited

Expanding Geographical Presence in India

LCC Projects Limited aims to strengthen its presence in India by expanding operations beyond its existing 11-state footprint. The company seeks to capitalize on regional growth trends, mitigate risks associated with geographic concentration, and diversify revenue sources for sustained business expansion.

Diversifying and Optimizing Project Portfolio

LCC Projects Limited plans to broaden its project mix by undertaking complex, large-scale projects beyond water management. By venturing into renewable energy, mining, and infrastructure, the company intends to leverage industry demand, enhance expertise, and strengthen its position in multidisciplinary EPC segments.

Investing in Technology and Operational Efficiency

LCC Projects Limited continues investing in advanced technology to enhance project execution, engineering, and design capabilities. Through ERP systems, IoT, SCADA, and predictive analytics, the company aims to optimize cost efficiencies, improve operational effectiveness, and maintain a competitive edge in project management.

Focusing on Cost Management and Financial Strength

LCC Projects Limited prioritizes cost management by optimizing working capital and ensuring competitive pricing strategies. Strengthening financial capabilities enables the company to bid for larger projects, secure bank financing, and improve profitability while maintaining high-quality execution standards across its diverse project portfolio.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What does the LCC Projects Limited IPO consist of?

LCC Projects Limited IPO includes a fresh issue of ₹320 crore and an offer-for-sale of 2.29 crore shares.

Who are the selling shareholders in the LCC Projects Limited IPO?

Promoters Arjan Suja Rabari and LaljibhaiArjanbhai Ahir are selling up to 1.14 crore shares each in the offer-for-sale.

Who are the lead managers and registrars for the LCC Projects Limited IPO?

Motilal Oswal Investment Advisors Limited is the book-running lead manager, while KFin Technologies Limited is the registrar.

How will LCC Projects Limited use the IPO proceeds?

The IPO proceeds will be used for purchasing equipment, repaying certain borrowings, and general corporate purposes.

When is the LCC Projects Limited IPO opening?

The IPO dates are yet to be announced, and investors should follow official sources for updates.