- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Leap India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Leap India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Leap India Limited

Incorporated in 2013, Leap India Ltd provides sustainable supply chain and asset-pooling solutions with services such as equipment pooling, returnable packaging, inventory management, transportation, and repair & maintenance. Its offerings include pallets, containers, and material handling equipment, catering to industries like FMCG, F&B, e-commerce, quick commerce, 3PL, automotive, and industrials. In 2023, global investment firm KKR acquired a majority stake in the company under its Asia infrastructure strategy. As of March 31, 2025, LEAP India employed 366 permanent staff, serving a diverse customer base.

Leap India Limited IPO Overview

LEAP India Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offer (IPO). The proposed IPO is a book-building issue of ₹2,400.00 crores, comprising a fresh issue of shares worth ₹400.00 crores and an offer for sale (OFS) of ₹2,000.00 crores. The equity shares are proposed to be listed on both NSE and BSE. JM Financial Ltd. is acting as the book-running lead manager, while MUFG Intime India Pvt. Ltd. is the registrar of the issue. Further details, including IPO dates, price band, and lot size, are yet to be announced. As per the DRHP, LEAP India has a face value of ₹1 per share, and the issue type is a book-building IPO. Pre-issue, the company has 12,07,30,296 shares outstanding, with promoters Sunu Mathew and Vertical Holdings II Pte. Ltd. holding 95.62% of the stake. The promoter holding is expected to dilute post-issue.

Leap India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹2400 crore |

| Fresh Issue | ₹400 crore |

| Offer for Sale (OFS) | ₹2000 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 12,07,30,296 shares |

| Shareholding post-issue | TBA |

Leap India IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Leap India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

OR

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Leap India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹1.00 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 4.09% |

| Net Asset Value (NAV) | ₹24.35 |

| Return on Equity (RoE) | 4.60% |

| Return on Capital Employed (RoCE) | 18.01% |

| EBITDA Margin | 56.45% |

| PAT Margin | 39.44% |

| Debt to Equity Ratio | 0.87 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment / prepayment, in full or in part, of certain borrowings availed by the Company | 3001.15 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

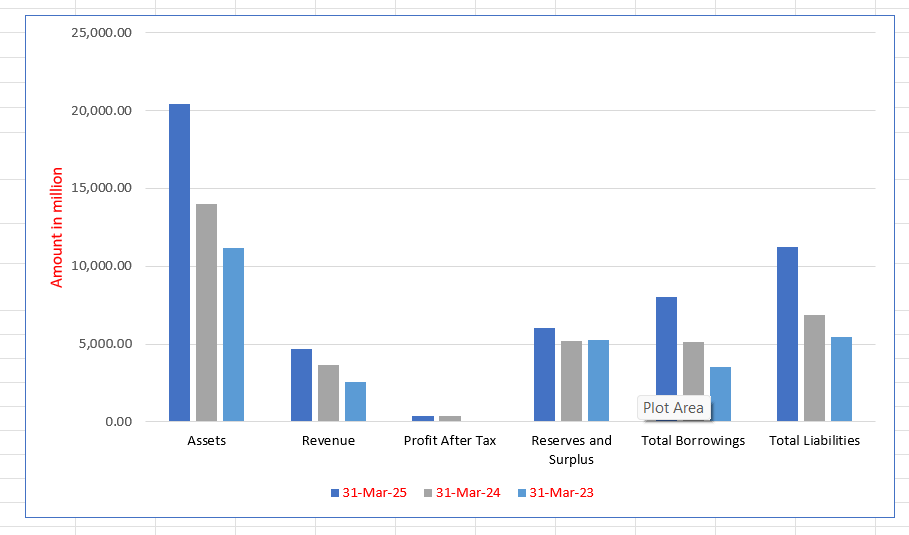

Leap India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 20,424.59 | 14,002.76 | 11,153.93 |

| Revenue | 4,664.72 | 3,649.71 | 2,533.67 |

| Profit After Tax | 375.58 | 371.74 | 90.11 |

| Reserves and Surplus | 6,060.86 | 5,218.40 | 5,258.25 |

| Total Borrowings | 8,016.58 | 5,130.73 | 3,545.41 |

| Total Liabilities | 11,251.11 | 6,860.98 | 5,459.87 |

Financial Status of Leap India Limited

SWOT Analysis of Leap India IPO

Strength and Opportunities

- Strong leadership in asset pooling with a vast network of assets, warehouses, touchpoints, and employees after merging with CHEP India

- ISO 27001:2022 certification underscores operational excellence and robust information security

- Recognized for sustainability and awarded as a sustainable business for eco-friendly solutions

- Extensive product and service portfolio including pallets, packaging, warehousing, transportation, and tracking

- Cost efficiencies and sustainability via returnable packaging and asset pooling help reduce client supply chain costs

- Broad national footprint across industries such as FMCG, e-commerce, automotive, and retail

- Merger with CHEP India enhances scale, capabilities, and customer-centric services

- Strong sustainability credentials including tree savings, resource optimisation, and carbon reduction

- Tech-forward trajectory with RFID tracking and web-enabled systems, aiming to be fully tech-centric by 2027

Risks and Threats

- Exposure to regional economic downturns, making revenue and profitability vulnerable during recessions

- Limited international reach; operations remain largely domestic

- Rising operational costs, particularly raw materials, may pressure margins

- Reliance on capital-intensive asset pooling model could strain cash flow during downturns

- Demand volatility in logistics services can destabilize revenue in economic slowdowns

- Regulatory changes in supply chain or environmental norms pose compliance risks

- Integration challenges post-merger may strain management bandwidth and operations

- Competitive pressure from other pooling and logistics providers could erode leadership

- Economic uncertainty and changing trade patterns may affect logistics demand unpredictably

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Leap India Limited

Leap India Limited IPO Strengths

Industry with a Multi-Decadal Growth Story

India’s palletization and pallet-pooling markets are in their nascent stages compared to developed economies, presenting a significant growth opportunity. The country’s logistics sector is moving away from manual, inefficient systems toward modern solutions. This shift, driven by rising consumption, expanding warehousing, and increasing supply chain automation, is boosting demand for standardized, reusable pallets and containers. Furthermore, growing environmental, social, and governance (ESG) commitments are accelerating the adoption of pallet-pooling as a sustainable practice.

Largest On-Demand Asset Pooling Company with High Barriers to Entry

Leap India Limited is the largest on-demand asset pooling provider in India’s supply chain sector, with over 13.57 million assets available and a vast network of over 7,747 customer touchpoints. The company’s leadership position is protected by significant barriers to entry, including its sheer scale, established customer relationships, a deep knowledge base, and strong network effects. Building a similar national-level fleet and network would require immense capital and time, making it difficult for new entrants to compete.

Trusted Supply Chain Partner Focused on Quality and Sustainability

The company is a trusted partner that helps customers transition to an asset-light business model, saving them from upfront capital and maintenance costs. Its standardized pallets and containers are rigorously tested and certified for quality and durability, ensuring they are compatible with automated systems. Leap India Limited also champions sustainability by using ethically sourced, long-lasting wood and pioneering the use of lithium-ion powered forklifts, aligning with its customers’ ESG goals.

Highly Resilient Business Model with a Blue-Chip Customer Base

Leap India Limited operates a highly resilient business model based on a diverse base of blue-chip customers across stable, high-growth sectors. Its customer list includes major brands like Hindustan Coca-Cola, Marico, and Daikin, demonstrating its ability to meet the needs of large, reputable companies. The business benefits from long-term contracts (1-5 years) with auto-renewal options and built-in provisions for cost recovery, which ensures predictable cash flows and protects its financial stability from market volatility.

Efficient Asset Management Led by Technology

The company’s operations are powered by advanced technology and a strong focus on customer service. Leap India Limited uses passive RFID tags on its containers and IoT-enabled forklifts for real-time tracking and efficient asset management. Its in-house platforms, like MyLEAP, provide customers with a user-friendly portal for inventory management and order tracking. The company’s data-driven approach, which includes AI-based demand forecasting, optimizes asset allocation and ensures timely service.

Strong Performance with an Attractive Financial Profile

Leap India Limited has a robust financial profile, marked by consistent and rapid revenue growth. The company has a long-standing track record of profitability, remaining PAT positive since 2020. This financial strength is driven by a business model that delivers attractive margins through operational leverage, economies of scale, and high asset utilization. A disciplined capital expenditure strategy and mechanisms for cost recovery further contribute to its strong unit economics and financial resilience.

More About Leap India Limited

Leap India Limited is recognised as India’s largest on-demand asset pooling company in the supply chain management sector, measured by the number of pooled assets. As of May 31, 2025, the company managed 13.57 million assets and operated a pan-India network of 7,747 customer touchpoints. Its circular “share and reuse” model helps reduce environmental impact while improving efficiency, safety, and cost-effectiveness for customers.

Range of Assets

Leap India Limited offers an extensive portfolio of assets designed to support supply chain operations:

- Pallets: These are flat carrier structures that improve cargo handling, storage, and transport efficiency.

- Containers: Used for safe transport and storage, containers reduce product damage and reliance on corrugated packaging.

- Material Handling Equipment (MHEs): This includes pallet trucks, forklifts, reach trucks, and stackers, enhancing warehouse productivity and safety.

Market Relevance and Growth

According to industry reports, pallets are critical to modern supply chains. Pallet pooling—where businesses use shared pallets instead of owning them—has become an effective solution globally. Leap India has consolidated its market presence by acquiring CHEP India in January 2025, expanding its asset base and strengthening its container business.

Customer Base and Dependence

As of March 31, 2025, the company had over 900 customers across FMCG, e-commerce, quick commerce, automotive, and industrial sectors. Its top 10 clients have partnered with Leap India for more than five years, reflecting customer loyalty and high retention.

Technology Integration

Leap India leverages advanced technology to enhance its services:

- MyLEAP platform provides real-time order tracking, reporting, and asset management.

- RFID and IoT solutions enable monitoring of assets and equipment across customer sites.

- SAP S/4HANA and Salesforce integrations facilitate seamless data exchange.

- Proprietary mobile and web applications manage asset audits, transport, and proof of delivery.

Commitment to Quality and Sustainability

The company uses FSC-certified materials and implements rigorous repair and maintenance standards to extend asset lifespan. Its ISO 27001 certification highlights strong data security practices.

Leadership and Backing

Promoted by Sunu Mathew, with over 26 years of experience, Leap India benefits from an experienced leadership team and the strategic support of investors including KKR.

Industry Outlook

Industry Outlook: India’s Pallet, Container & MHE Market

Pallet Market – Strong Growth & Structural Transition

- The India pallet market was valued at approximately 220 million units in 2024 and is projected to reach 373 million units by 2033, growing at a CAGR of 5.7%.

- In revenue terms, the market could grow from USD 4.8 billion in 2025 to USD 7.9 billion by 2031, at a CAGR of 8.7%.

- Demand is driven by industrialisation, e-commerce expansion, Make in India initiatives, and cold-chain development.

- Structural shifts favour composite and plastic pallets over traditional wood, supported by hygiene, recyclability, and export compliance.

Container & Returnable Packaging Segments

- The intermediate bulk container (IBC) market in India is expected to grow at a CAGR of 8%, with value rising from USD 630.8 million in 2021 to USD 1,258.9 million by 2030.

- The returnable transport packaging (RTP) market, which includes reusable pallets, crates, and containers, is forecast to grow from USD 0.88 billion in 2025 to USD 1.25 billion by 2030, at a CAGR of 7.4%.

Material Handling Equipment (MHE) – Automation Driving Demand

- The India MHE market generated USD 5.4 billion in 2023 and is estimated to reach USD 8.7 billion by 2030, at a CAGR of 7.2%.

- Growth is led by urbanisation and rising demand from auto, pharma, food & beverage, and e-commerce sectors for automated handling infrastructure.

Key Growth Drivers

- Rapid e-commerce expansion and warehousing demand across FMCG, pharma, and industrials.

- Sustainability regulations and export-friendly packaging standards.

- Technological adoption of RFID tracking, smart pallets, and IoT-enabled MHEs.

- Government initiatives like Make in India, infrastructure upgrades, and logistics digitisation.

How Will Leap India Limited Benefit

- Positioned strongly to capture demand from the expanding pallet market, with a large asset base and leadership in pooling services.

- Rising adoption of composite and plastic pallets aligns with Leap India’s sustainability-driven “share and reuse” model.

- Growth in returnable transport packaging (RTP) directly supports its container and crate offerings, reducing single-use packaging reliance.

- Increasing demand for intermediate bulk containers (IBCs) opens opportunities to expand its container business.

- Expansion of the material handling equipment (MHE) market complements its portfolio of pallet trucks, forklifts, and stackers.

- Strong demand from e-commerce, FMCG, pharma, and automotive sectors aligns with its existing customer base.

- Digital tracking, RFID, and IoT solutions strengthen its ability to deliver tech-enabled efficiency.

- Government policies promoting Make in India and logistics modernisation will drive adoption of pooled assets.

- Sustainability focus and FSC-certified products position Leap India as a partner of choice for ESG-conscious clients.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Leap India Limited

Expand within Existing and New Industries

Leap India Limited aims to grow by applying successful pallet-pooling solutions across its current customer base in sectors like FMCG and automotive. The company will also pursue new high-growth industries like textiles, solar energy, and pharmaceuticals by demonstrating the benefits of cost savings, efficiency, and sustainability.

Strategic Inorganic Growth and Expansion

The company plans to selectively pursue investments and acquisitions, like its recent merger with CHEP India, to consolidate its market leadership. By integrating these companies, Leap India Limited expects to achieve synergies and expand its customer base, while using its track record of successful integration to explore new value-accretive opportunities both within and outside India.

Penetrate across the Supply Value Chain

Leap India Limited’s strategy is to increase its value proposition by expanding its solutions across a customer’s entire supply chain, from manufacturers to distributors. This involves introducing complementary products beyond pallets and containers, such as material handling equipment (MHE) and racking, to streamline operations for customers and increase its share of their total spending.

Expand Product Offerings to Existing Customers

The company is committed to building a comprehensive product ecosystem, continually expanding its offerings to meet customer needs. By providing a diverse range of assets, including pallets, containers, and MHEs, Leap India Limited allows customers to consolidate their supply chain needs with a single provider, simplifying operations and reducing management complexity.

International Expansion

Leap India Limited is focused on expanding its global footprint by entering new international markets. The company plans to strategically target regions with advanced logistics infrastructure, such as the GCC (Gulf Cooperation Council), aiming to establish a subsidiary within the next 12-18 months. It will leverage its domestic operations to serve customers globally and capitalize on inter-country asset movement.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Leap India Limited IPO

How can I apply for Leap India Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the Leap India IPO?

The IPO is worth ₹2,400 crore, including ₹400 crore fresh issue and ₹2,000 crore offer for sale.

On which stock exchanges will Leap India shares be listed?

The equity shares are proposed to be listed on NSE and BSE.

What is the face value and issue type of the IPO?

The face value is ₹1 per share, and it is a book-building IPO.

How is the IPO quota divided among investors?

QIBs up to 50%, retail investors at least 35%, and NII at least 15% of the net offer.

Who are the IPO managers and registrar?

JM Financial Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.