- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Learnfluence Education IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Learnfluence Education IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Learnfluence Education Limited

Learnfluence Education Limited is a prominent institution focused on coaching for commerce and finance professional courses such as CA, ACCA, CMA, and CS. Operating under the trusted “Lakshya” brand since 2012, the company has a strong presence in South India, with 15 campuses across 8 cities. It boasts over 39,000 student enrolments and a robust digital footprint, including a proprietary Learning Management System (LMS) and a significant social media following. The company offers integrated degree programs alongside professional certifications, providing a comprehensive educational pathway for aspiring finance professionals.

Learnfluence Education Limited IPO Overview

Learnfluence Education Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is structured as a Book Building Issue, comprising a fresh issue of ₹246.00 crore and an Offer for Sale (OFS) of up to 0.40 crore equity shares. The company proposes to list its equity shares on both the NSE and BSE. Saffron Capital Advisors Pvt. Ltd. has been appointed as the book running lead manager, while Cameo Corporate Services Ltd. will act as the registrar of the issue. Key details such as the IPO dates, price band, and lot size are yet to be announced. The IPO will have a face value of ₹5 per share, and the issue is planned as a fresh capital-cum-offer-for-sale structure, with 5,46,00,000 shares held pre-issue. Orwel Lionel, the promoter of Learnfluence Education Ltd., currently holds 94.12% of the company’s equity, with post-issue holding to be determined based on equity dilution.

Learnfluence Education Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹ 246 crore |

| Offer for Sale (OFS) | 0.40 crore Equity Shares (Aggregating up to ₹ [●] million) |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

Learnfluence Education IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Learnfluence Education Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Learnfluence Education Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.54 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 33.42% |

| Net Asset Value (NAV) | ₹ 10.59 |

| Return on Equity (RoE) | 54.21% |

| Return on Capital Employed (RoCE) | To be updated |

| EBITDA Margin | 29.93% |

| PAT Margin | 14.95% |

| Debt to Equity Ratio | 0.40 |

Objectives of the IPO Proceeds

| Objects of the Issue | Expected Amount (₹ in million) |

| Capital expenditure towards setting up new physical campuses of the Company | 690 |

| Expenditure towards sales and marketing initiatives | 618.8 |

| Repayment and/or prepayment, in full or in part, of certain outstanding loans availed by the Company | 223.1 |

| Expenditure towards lease payments of existing identified long-term campuses operated by the Company | 213.3 |

| General Corporate Purposes | – |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

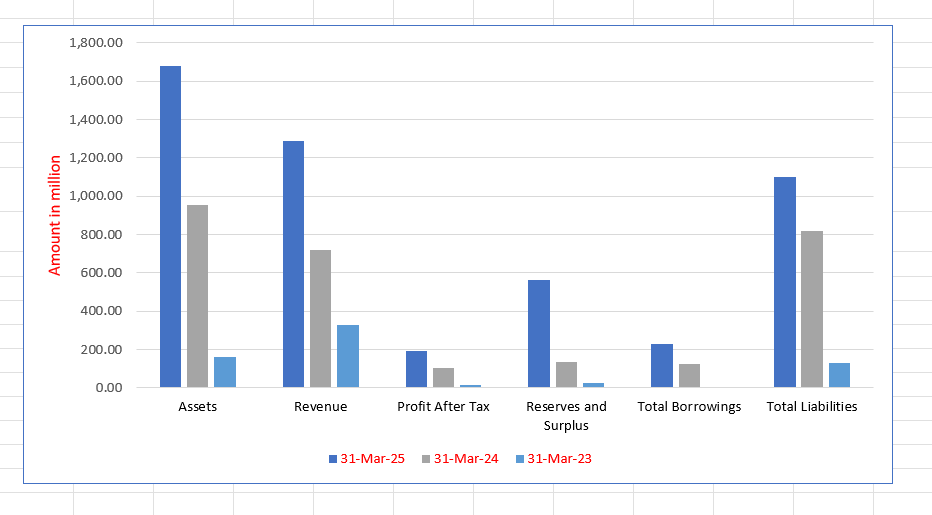

Learnfluence Education Limited Financials (in ₹ millions)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,679.11 | 952.49 | 160.33 |

| Revenue | 1,288.80 | 719.65 | 326.77 |

| Profit After Tax | 192.67 | 106.08 | 14.01 |

| Reserves and Surplus | 560.99 | 133.34 | 27.23 |

| Total Borrowings | 228.42 | 125.29 | 2.30 |

| Total Liabilities | 1,102.62 | 818.15 | 132.10 |

SWOT Analysis of Learnfluence Education IPO

Strength and Opportunities

- Established "Lakshya" brand with over a decade of trust and recognition.

- Specialized focus on high-demand commerce and finance professional courses.

- Vertically integrated academic ecosystem with UGC-recognized degree programs.

- Asset-light, scalable business model with low capital expenditure.

- Strong digital presence and proprietary Lakshya LMS App for online delivery.

- Experienced founder and a professional leadership team driving growth.

- Significant alumni network of over 100,000 facilitating referrals and lower acquisition costs.

- High EBITDA margin and PAT margin indicating operational efficiency and profitability.

- Growing demand for skilled finance professionals and global certifications in India.

- Favorable industry outlook with a high CAGR, driven by the need for professional qualifications.

Risks and Threats

- High dependence on the South Indian market, specifically Kerala, for a majority of revenue.

- Limited brand recognition in North and Central India compared to established national players.

- Operations reliant on leased premises, subject to rental market fluctuations and lease renewals.

- Intense competition from both organized national chains and unorganized local coaching centers.

- Regulatory changes in education policies or professional body syllabi could impact curriculum.

- Susceptibility to economic downturns affecting students' ability to pay for premium coaching.

- Execution risks associated with the rapid expansion plan into new geographies.

- Dependence on key personnel and faculty for academic quality and brand reputation.

- Potential for technological disruption from new EdTech entrants with innovative models.

- Risks associated with international expansion, including regulatory and geopolitical challenges.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Learnfluence Education Limited

Learnfluence Education Limited IPO Strengths

Comprehensive Portfolio of Globally Recognized Courses

The company maintains a diverse array of professional certification programs in commerce and accounting, including CA, ACCA, and CMA (USA/India). This broad portfolio serves students and professionals pursuing Indian or international qualifications, reducing reliance on any single course or market and thereby enhancing business resilience.

Established Brand in Commerce and Finance Education

Operating under the “Lakshya” brand since 2012, the firm has coached over 100,000 students across various professional courses. Recognition as an ACCA Platinum Approved Learning Partner and IMA Gold Approved Course Provider reinforces its brand trust, attracting high-potential students and supporting strategic expansion.

Multi-Modal Learning Delivery (Campus and Online Learning)

Learnfluence Education provides academic coaching through both classroom-based (campus) and online (live and recorded) modes. This multi-modal framework caters to diverse student preferences and geographic constraints, ensuring educational continuity and enabling efficient expansion without extensive physical infrastructure.

Specialized Faculty and Structured Learning Framework

The company emphasizes a team of 226 academic professionals, including qualified CAs and ACCA affiliates, who follow a structured curriculum. Their integrated framework, which includes centralized content, a Faculty Training Program (FTP), and technology-enabled delivery, strengthens academic quality and student performance.

Geographic Reach with Strategic Expansion

Its footprint includes physical campuses in key cities across Kerala, Karnataka, and Tamil Nadu, with an international presence in the UAE via online delivery. The technology-enabled platform allows the company to serve geographically dispersed learners across India and international markets, enhancing its scalability.

Integrated Degree Programs for Career Differentiation

Learnfluence offers UGC-recognized graduation and post-graduation programs integrated with professional coaching like ACCA and CMA (USA). This approach provides students with both academic degrees and professional certifications, improving time efficiency, cost-effectiveness, and overall employability.

Student-Centric Ecosystem with Career Support

The company provides a comprehensive support framework encompassing academic mentorship, skill development modules, and placement assistance. This includes resume guidance, mock interviews, and a network of hiring partners, which is intended to enhance student employability and career readiness upon completion of their programs.

Asset-Light, Technology-Driven, and Scalable Business Model

The business model minimizes fixed capital expenditure by using leased infrastructure and leveraging its centralized LMS and digital content repository. This asset-light approach, supported by academic collaborations, provides operating flexibility and facilitates rapid, scalable expansion across domestic and international markets.

Founder-Driven Organization with Professional Leadership

The company is led by its founder and promoter, who has over 13 years of experience, supported by a seasoned professional leadership team. This combination provides both entrepreneurial vision and a structured managerial approach, enabling agility in decision-making and effective business operations.

More About Learnfluence Education Limited

Learnfluence Education Limited is a corporate successor to the legacy of Lakshya CA Campus, a partnership firm established in 2012. The company was formally incorporated in 2021 and has since grown into a leading institution focused on coaching for prestigious commerce and finance qualifications.

Operational Scale and Reach

- As of August 31, 2025, the company had 39,218 student enrolments across all its courses.

- It operates through a network of 15 campuses spread across 8 cities, with a strong foothold in Kerala and a growing presence in Bengaluru and Coimbatore.

- The company boasts a vast alumni network of over 100,000 individuals.

Academic Delivery and Faculty

Learnfluence employs a total of 226 faculty members, including qualified professionals like CAs, CMAs, and ACCAs. The academic process is supported by a structured mentorship system where mentors provide academic and administrative support, monitor student progress, and help with doubt resolution.

Digital Prowess

- Lakshya LMS App: A proprietary Learning Management System that centralizes lecture recordings, study materials, practice tests, and performance analytics.

- Social Media: Over 208,000 subscribers on YouTube, 78,000 followers on Instagram, and 84,000 followers on Facebook, making it a highly engaged digital community.

Brand Endorsement

The company has reinforced its brand visibility by associating with renowned actor and Dadasaheb Phalke awardee, Shri. Mohanlal, as its brand ambassador.

Industry Outlook

The Indian coaching services industry for professional certifications in commerce and finance (including CA, ACCA, CMA, CPA, and CS) has been on a robust growth trajectory.

Market Growth and Drivers

- The industry has experienced a sharp CAGR of 14.8% between fiscals 2020 and 2025.

- This growth is primarily driven by the increasing demand for skilled professionals in accounting, finance, and commerce within the expanding Indian economy.

- The rise of Global Capability Centers (GCCs) and multinational firms in India is fueling the need for candidates with specialized global certifications like ACCA and CMA (USA), which are valued for their technical rigor and international recognition.

Key Trends

- Integration of Degrees and Certifications: A significant trend is the blending of academic degree programs with professional certification coaching, offering students a more comprehensive and time-efficient educational pathway.

- Digital Adoption: The proliferation of online and live-virtual coaching models has democratized access to quality education, allowing players to reach students in Tier 2 and Tier 3 cities.

- Focus on Global Credentials: There is a growing appetite for internationally recognized qualifications that offer global job mobility, with Indian coaching centers becoming a cost-effective source for such high-quality preparation.

The future outlook remains positive, with the sector expected to continue its growth, supported by the rising number of graduates seeking to enhance their employability and career prospects through professional certifications.

How Will Learnfluence Education Limited Benefit

- Capitalize on the high-growth industry CAGR of 14.8% to expand its student base and market share.

- Leverage the growing demand for global certifications like ACCA and CMA (USA) through its established coaching programs and online delivery platform.

- Utilize its integrated degree and certification model to attract students seeking efficient and comprehensive career pathways.

- Exploit the trend of digital adoption in education to scale its online offerings and penetrate untapped geographies beyond its physical campuses.

- Benefit from the increasing corporate demand for professionally certified talent by strengthening its placement assistance and corporate partnerships.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Learnfluence Education Limited

Aggressive Geographical Expansion

Learnfluence Education Limited plans to expand its footprint by establishing 26 new campuses over the next two years. This strategy involves data-driven identification of high-potential Tier 2 and Tier 3 markets across India, leveraging an asset-light leased model to ensure capital-efficient and rapid market penetration.

Enhancing Brand Awareness and Recall

The company will implement a multi-pronged promotion strategy involving targeted digital marketing, content-driven engagement, strategic partnerships with institutions, and leveraging its large alumni network. The association with brand ambassador Mohanlal will be utilized to strengthen national brand recall and trust.

Deepening Focus on Commerce and Finance Education

Learnfluence will continue its focused differentiation strategy by introducing new coaching programs in emerging specializations like international taxation and fintech. It aims to strengthen its vertical depth within commerce education, ensuring it remains the preferred institution for aspiring finance professionals.

Leveraging the Integrated Value Chain

The strategy involves promoting and scaling its unique integrated programs that combine UGC-recognized degrees with professional certifications. This aims to increase student retention cycles, create a differentiated offering, and capture a larger share of the student’s educational journey.

Maintaining Scalability with Centralized Control

The company will continue its hub-and-spoke operational model, centralizing academic control for quality and standardization while allowing localized delivery. This ensures consistent learning outcomes and brand experience across all new and existing campuses and online platforms.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Learnfluence Education Limited IPO

How can I apply for Learnfluence Education Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the face value of Learnfluence Education's shares?

The face value of Learnfluence Education Limited’s equity shares is ₹5 per share.

Where will Learnfluence Education Limited shares be listed?

The equity shares will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

What is the core business of Learnfluence Education Limited?

The company provides coaching for professional commerce and finance courses like CA, ACCA, CMA, and CS, both online and through physical campuses.