- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

LENSKART LIMITED IPO

₹14,134/37 shares

Minimum Investment

IPO Details

31 Oct 25

04 Nov 25

₹14,134

37

₹382 to ₹402

NSE, BSE

₹7,278.02 Cr

10 Nov 25

LENSKART LIMITED IPO Timeline

Bidding Start

31 Oct 25

Bidding Ends

04 Nov 25

Allotment Finalisation

06 Nov 25

Refund Initiation

07 Nov 25

Demat Transfer

07 Nov 25

Listing

10 Nov 25

Lenskart Limited IPO

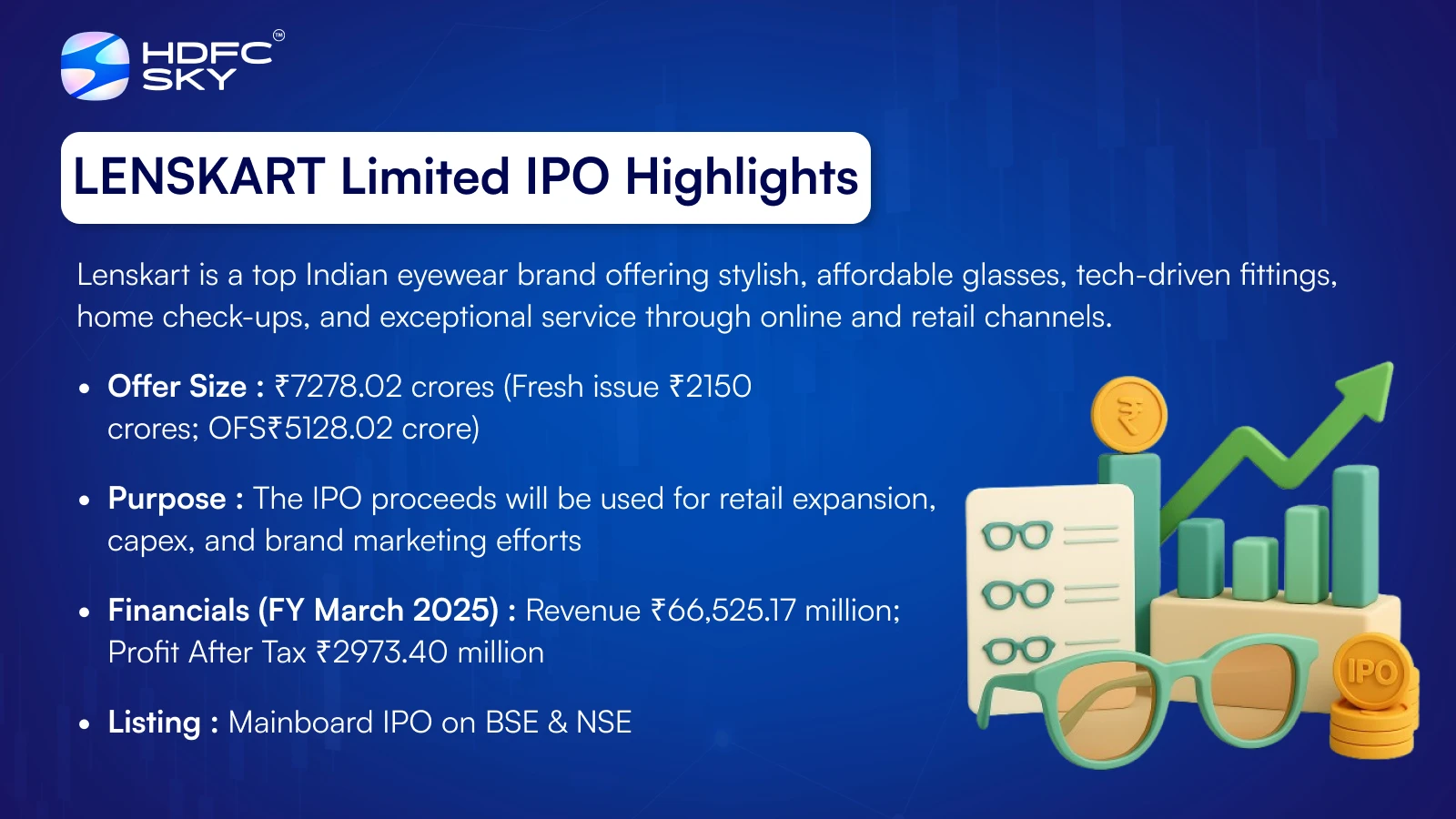

Lenskart is a leading Indian eyewear brand known for its wide range of stylish and affordable eyeglasses, sunglasses, and contact lenses. With a strong online presence and expanding retail network, it offers convenient home eye check-ups and try-at-home services. Lenskart uses advanced technology for precision in lens crafting and personalised fittings. The brand caters to diverse customer needs, blending fashion with function. Its innovative approach, quality products, and excellent customer service make Lenskart a trusted choice for vision care across India.

LENSKART Limited IPO Overview

Lenskart Solutions Ltd. IPO is a book-built issue with a total size of ₹7,278.02 crores. The issue consists of a fresh issue of 5.35 crore equity shares aggregating to ₹2,150.00 crores and an offer for sale (OFS) of 12.76 crore equity shares amounting to ₹5,128.02 crores. The IPO will open for subscription on October 31, 2025, and close on November 4, 2025. The basis of allotment is expected to be finalised on November 6, 2025, while the shares are likely to be listed on the BSE and NSE with a tentative listing date of November 10, 2025.

The price band for the Lenskart Solutions IPO has been set between ₹382.00 and ₹402.00 per share. The lot size for an application is 37 shares, requiring a minimum retail investment of ₹14,874 based on the upper price band. For small non-institutional investors (sNII), the minimum application is 14 lots (518 shares) worth ₹2,08,236, while for big non-institutional investors (bNII), the minimum application is 68 lots (2,516 shares) valued at ₹10,11,432.

The book running lead manager for the issue has not yet been declared, while MUFG Intime India Pvt. Ltd. will serve as the registrar of the IPO.

LENSKART Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 18,10,45,160 shares(aggregating up to ₹7,278.02 Cr)

Fresh Issue: 5,34,82,587 shares (aggregating up to ₹2,150.00 Cr) Offer for Sale (OFS): 12,75,62,573 shares of ₹2 (aggregating up to ₹5,128.02 Cr) |

| IPO Dates | 31 October 2025 to 4 November 2025 |

| Price Bands | ₹382 to ₹402 per share |

| Lot Size | 37 Shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,68,10,15,590 shares |

Lenskart Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 37 | ₹ 14,874 |

| Retail (Max) | 13 | 481 | ₹ 1,93,362 |

| S-HNI (Min) | 14 | 518 | ₹ 2,08,236 |

| S-HNI (Max) | 67 | 2,479 | ₹ 9,96,558 |

| B-HNI (Min) | 68 | 2,516 | ₹ 10,11,432 |

LENSKART Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

LENSKART Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 1.77 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 4.84% |

| Net Asset Value (NAV) | 36.43 |

| Return on Equity | 4.84% |

| Return on Capital Employed (ROCE) | 4.53% |

| EBITDA Margin | 19.01% |

| PAT Margin | 4.24% |

| Debt to Equity Ratio | 0.41 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Capital expenditure towards set-up of new CoCo stores in India | 2726.22 |

| Expenditure for lease/rent/license agreements related payments for our CoCo stores operated by the company | 5914.40 |

| Investing in technology and cloud infrastructure | 2133.75 |

| Brand marketing and business promotion expenses for enhancing brand awareness | 3200.63 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

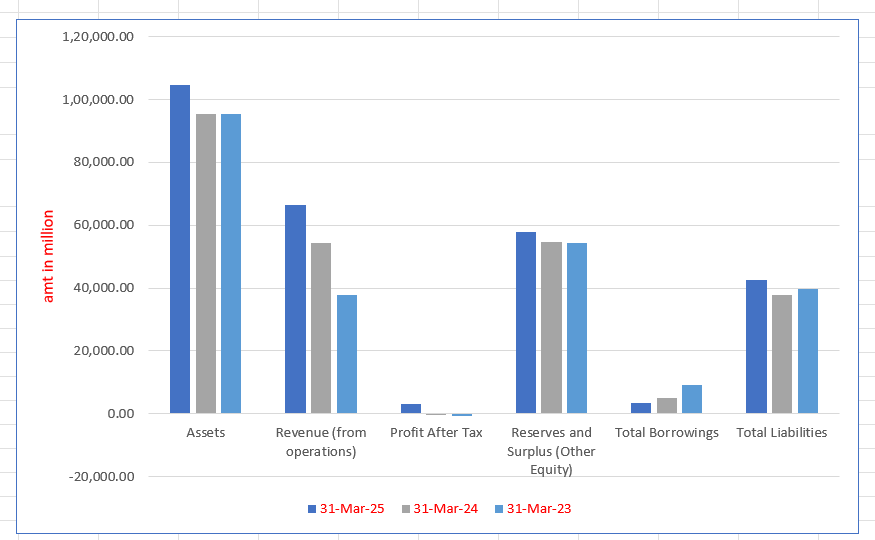

LENSKART Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,04,710.19 | 95,310.21 | 95,282.80 |

| Revenue (from operations) | 66,525.17 | 54,277.03 | 37,880.28 |

| Profit After Tax | 2,973.40 | (101.54) | (637.57) |

| Reserves and Surplus (Other Equity) | 57,773.00 | 54,669.10 | 54,412.84 |

| Total Borrowings | 3,459.39 | 4,971.08 | 9,172.07 |

| Total Liabilities | 42,648.49 | 37,750.71 | 39,584.94 |

Financial Status of LENSKART Limited

SWOT Analysis of LENSKART LIMITED IPO

Strength and Opportunities

- Integrated supplychain model with inhouse design and manufacturing.

- Hybrid onlineoffline retail strategy offering convenience and instant product access.

- Advanced tech tools like AR/3D virtual tryon and AIdriven personalization.

- Diverse product portfolio—eyeglasses, sunglasses, contact lenses.

- Home eyecheck and home trial services enhancing customer trust and outreach.

- Expanding eyewear market in India and abroad.

- Technological innovation and expansion into new segments (smart eyewear, subscriptions).

- Scope for geographic expansion into Tier 2/3 Indian cities and overseas markets.

- Partnerships, premium collaborations, or wellness brand extensions.

- Subscription/contactlens renewal models & teleoptometry services.

Risks and Threats

- High operational costs from running both online and offline stores.

- Heavy reliance on promotional discounts, affecting margins.

- Strong competition intensifies pressure on pricing and differentiation.

- Perception of lower quality due to aggressive pricing.

- Managing large inventory is complex, risking overstock or stockouts.

- Limited global scale; revenue still heavily dependent on the Indian market.

- Operational complexity across multiple formats and geographies.

- Potential regulatory, economic and supplychain disruptions.

- Growing threat of counterfeit products eroding brand trust.

- Consumers conditioned to discounts reduce fullprice purchasing behavior.

Live Lenskart IPO News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Lenskart Limited IPO

LENSKART Limited IPO Strengths

Centralied Supply Chain and Manufacturing Processes

Lenskart’s centralized supply chain and manufacturing enable efficient operations, addressing demand for each store location. This core proposition provides affordable, quality eyewear with fast delivery, leveraging in-house production. It minimizes inefficiencies and ensures consistent quality, lower costs, and quick delivery, offering “fast fashion” eyewear to customers across India.

Direct-to-Consumer Model

Lenskart’s direct-to-consumer model eliminates intermediaries, ensuring affordable prices and efficient delivery. This approach enhances quality control, reduces lead times, and boosts cost efficiency compared to traditional retailers. In FY25, Lenskart manufactured the third-largest volume of prescription eyeglasses globally among organized retailers, highlighting its market dominance.

Customer-Focused Product Design Capabilities

Lenskart focuses on customer-centric design and manufacturing, with in-house capabilities including structural configurations and mould designs. This allows for frequent new collections, with 105 new in-house designed products launched in FY25. The 105-member design and merchandising team ensures products meet customer requirements and drive purchasing frequency.

Lenskart Brand and Portfolio of Owned Sub-brands

Lenskart aims to cater to diverse customer needs with its “Do More” and “Be More” philosophy. Recognized as “India’s Most Trusted Eyewear Brand of 2025” by TRA Research, it boasts 29.52 million customer entries in FY25. Sub-brands like Lenskart and OwnDays, along with 22 curated brands, target specific customer segments based on preferences like comfort, quality, value, and fashion-forwardness.

Technology First Approach to Customer Experience and Operational Efficiency

Technology is crucial to Lenskart’s operations, enhancing customer engagement and supply chain management. The in-house POS system provides an integrated customer experience via tablets, ensuring transparency and informed choices. Mobile applications offer virtual try-ons and size measurements, with 38.59 million virtual try-ons in FY25, reducing customer wait times and improving store operations.

Culture and Values

Lenskart operates with a purpose-driven culture, dedicated to enhancing eyewear access and affordability through innovative solutions. This approach permeates all operations, from customer experience to manufacturing, supported by cross-functional teams. Technology is integral, driving operational efficiency and cohesion. Lenskart’s global identity is fostered by embracing local cultures, with a workforce from 13 international geographies and over 25 nationalities, reflecting its inclusive and global footprint.

Category Leadership, Scale, and Track Record of Revenue and EBITDA Growth

According to the Redseer Report, Lenskart is India’s largest and Asia’s second-largest organized prescription eyewear retailer by B2C sales volumes in FY25, within a USD 28.2 billion market. In FY25, Lenskart sold 27.20 million units and expanded to 2,067 Indian and 656 international stores. The company demonstrated strong financial growth, with revenue growing at a 32.52% CAGR (FY23-FY25) and improved EBITDA margins driven by efficiency gains.

Fast Fulfillment Capabilities

Lenskart’s centralized warehouse management system, NexS, efficiently handles eyewear supply and manufacturing. Just-in-time manufacturing ensures customized prescription eyeglasses are dispatched rapidly. As of March 31, 2025, single-vision eyeglasses were delivered within 24 hours to customers in over 40 Indian cities and within 72 hours to customers in 69 countries.

Retail Store Operations

Lenskart leverages AI-enabled Computer Vision tools to optimize retail store operations, enhancing customer flow, increasing conversion rates, and improving shopping experiences. AI helps identify popular products and optimize store layouts, contributing to volume-based same-store growth globally. AI tools also assist in store expansion, forecasting revenue potential and estimating payback periods.

Remote and Self Eye-Testing

Lenskart has digitized eye testing processes, expanding access to eye-testing services through remote optometry solutions. As of March 31, 2025, 136 optometrists conducted remote eye tests from 168 stores in India, and 274 stores globally provide remote optometry services. Self-eye test facilities are deployed in 129 global stores, allowing customers to chat with optometrists and view vision charts.

Omnichannel Retail Network

Lenskart operates an omnichannel retail network, integrating mobile applications, websites, and physical stores. This allows customers to browse online, transact at stores, and access products and services with consistent pricing. Customers can review purchase history, past eye test results, and prescription details, ensuring a seamless experience across all channels.

More About LENSKART Limited

LENSKART Limited is a prominent eyewear company based in Gurugram, India. Established in 2010, it has emerged as one of the largest optical retail chains in the country, operating on a hybrid model that combines both online and offline retail strategies. With a mission to provide high-quality yet affordable eyewear, LENSKART has revolutionised the Indian optical industry through its technology-first approach, in-house manufacturing, and direct-to-consumer model.

Product Portfolio

LENSKART offers a wide range of products catering to various customer needs:

- Prescription Eyeglasses – Including single vision, bifocals, and progressive lenses

- Sunglasses – With UV protection and polarised lenses, designed for style and function

- Contact Lenses – Monthly, daily, and coloured lenses under brands like Aqualens

- Computer Glasses – Blue-light blocking lenses for screen-heavy lifestyles

- Eyewear Accessories – Cleaning kits, cases, lens sprays, and chains

The company emphasises style, comfort, and quality in all its offerings. It uses lightweight, flexible materials such as Ultem and TR90 to enhance durability and wearer comfort.

In-house and Partner Brands

LENSKART’s growing brand ecosystem includes:

- Vincent Chase – Trend-driven, affordable frames

- John Jacobs – Premium fashion eyewear

- Lenskart Air – Ultra-lightweight and rimless frames

- Hustlr – Active lifestyle frames

- Aqualens – Daily and monthly contact lenses

- Lenskart Studio – Youth-focused and expressive styles

- Lenskidz – Fun and safe eyewear for children

Manufacturing & Technology

- Operates Asia’s largest automated eyewear facility in Bhiwadi, Rajasthan

- Vertically integrated manufacturing for lenses and frames

- Uses robotics and AI for precision and scalability

- Offers 3D virtual try-on via app and website

- Home eye test and ‘Lenskart@Home’ trials for enhanced customer experience

Omnichannel Presence

- Over 2,000+ physical retail stores across India, UAE, Singapore, and other regions

- Mobile app and website handle a large share of orders

- Seamless integration between offline and online channels for appointment booking, frame selection, and order tracking

Customer Segments

LENSKART caters to a wide audience:

- Students and young professionals seeking affordable style

- Working adults requiring screen-protective eyewear

- Seniors needing bifocal and progressive lenses

- Children with prescription or protective needs

Through its accessible pricing, in-house innovation, and wide reach, LENSKART continues to redefine how eyewear is bought and worn across demographics.

Industry Outlook

Market Size & Growth Projections

The Indian eyewear market was valued at approximately USD 10.4 billion in 2024 and is expected to reach USD 19.6 billion by 2033, growing at a CAGR of around 6.9% during 2025–2033.

Traditional eyewear, including spectacles and sunglasses, generated around USD 5.35 billion in 2023 and is projected to reach USD 12.02 billion by 2030, growing at a CAGR of 12.2%.

Segment-Specific Forecasts

- Spectacles (prescription glasses) dominated the market with USD 4.1 billion in 2024 and are expected to grow at a CAGR of approximately 11.4%, reaching around USD 7.6 billion by 2030.

- Luxury eyewear, including designer sunglasses and high-end frames, reached about USD 891 million in 2024 and is expected to surpass USD 1.72 billion by 2030, growing at an estimated CAGR of 11.7%.

Growth Drivers

- Rising incidence of refractive errors and increased screen time

- Higher disposable income in urban areas driving lifestyle-driven purchases

- Expansion of e-commerce and direct-to-consumer models

- Improved access to professional eye care and prescription eyewear services

- Growth of premium and designer eyewear demand

Key Figures & Outlook Summary

- Total market: USD 10.4 billion (2024) → USD 19.6 billion (2033) @ ~6.9% CAGR

- Spectacles: USD 4.1 billion → USD 7.6 billion (2030) @ ~11.4% CAGR

- Luxury eyewear: USD 891 million → USD 1.72 billion (2030) @ ~11.7% CAGR

How Will LENSKART Limited Benefit

- Lenskart will gain from the rising demand for prescription eyewear driven by increased screen time and vision issues.

- Its omni-channel model positions it well to serve both online shoppers and in-store customers across urban and Tier 2/3 markets.

- With a vertically integrated supply chain, Lenskart can manage costs, ensure quality, and scale production efficiently.

- The surge in premium and designer eyewear demand aligns with Lenskart’s curated product lines and brand partnerships.

- Growth in contact lens usage and subscription models supports its expansion into recurring revenue streams.

- Increased health awareness and optometry access favour its eye-check services and home trial initiatives.

- Rising disposable income and fashion-conscious youth fuel demand for stylish, affordable eyewear—Lenskart’s key focus.

- Expansion of digital adoption enhances Lenskart’s tech tools like 3D try-on and personalised recommendations.

- Strong market forecasts support Lenskart’s planned IPO and future capital investments in innovation and retail footprint.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for LENSKART Limited

Market Penetration and Customer Access Enhancement

LENSKART Limited aims to increase market penetration and customer access by expanding into existing and new markets through new initiatives. This includes deepening and broadening its store network across various Indian cities, emphasizing a presence in metro, Tier 1, and Tier 2+ cities. The company further plans international expansion by opening new stores and strategically acquiring businesses in other international markets.

Fortifying Manufacturing and Supply Chain Capabilities

LENSKART Limited is committed to strengthening its manufacturing and supply chain capabilities. This involves establishing a new facility in Telangana to meet growing demand and reduce manufacturing-related risks, complementing the existing Bhiwadi facility. The company will invest in enhancing prescription eyeglass, frame, and lens manufacturing, alongside establishing international regional facilities to support local demands and strengthen its centralized supply chain.

Innovation and Product Portfolio Expansion

LENSKART Limited seeks to innovate and diversify its product portfolio to address evolving customer needs. The strategy includes targeting new customer categories and launching new brands, exemplified by the acquisition of Ownways. The company is also developing advanced eyewear like camera-enabled smart glasses and focusing on lens innovation for myopia control and other advanced optical technologies, while incorporating sustainable materials in its products.

Investing in New Technologies

LENSKART Limited is investing in technology to enhance its operations and customer value proposition. This involves integrating AI into its front-end platform for frame recommendations, developing AI-based eye testing solutions, and utilizing AI for merchandising. Furthermore, the company will enhance automation in manufacturing, integrate international order management, and leverage AI-based analytics for store identification and improved store productivity.

Enhancing Customer Experience

LENSKART Limited is dedicated to improving customer experience through various initiatives. This includes enhancing in-store and mobile application experiences, scaling remote optometry for easier access to eye testing, and improving eyewear products through lens-related R&D. The company also aims to further scale next-day delivery services, invest in data analytics for personalization, and drive customer loyalty through digital channels and loyalty programs.

Strengthening Brand Across Markets

LENSKART Limited endeavors to strengthen its brand across all markets by positioning eyewear as a lifestyle and fashion category. The company plans to invest in maintaining brand relevance for future generations, implement brand-building initiatives through marketing campaigns, endorsements, and social media. This also includes innovating store designs for an improved customer experience and reinforcing its brand as environmentally responsible through sustainable materials and processes.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On LENSKART Limited IPO

How can I apply for LENSKART Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total issue size of the Lenskart IPO?

The IPO includes a ₹2,150 crore fresh issue and an Offer-for-Sale of 13.2 crore equity shares.

Where will Lenskart Limited shares be listed post-IPO?

Lenskart shares will be listed on both major Indian stock exchanges—BSE and NSE.

What is the face value of each Lenskart IPO share?

Each equity share in the Lenskart IPO carries a face value of ₹10.

What will the IPO funds be used for?

The proceeds will be used for retail expansion, technology upgrades, and brand marketing efforts.

Who are the key selling shareholders in the Offer-for-Sale?

Major investors like SoftBank, Temasek, and Schroders are offering shares through the Offer-for-Sale.