- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

LG Electronics India IPO

₹14,040/13 shares

Minimum Investment

IPO Details

07 Oct 25

09 Oct 25

₹14,040

13

₹1,080 to ₹1,140

NSE, BSE

₹11,607.01 Cr

14 Oct 25

LG Electronics India IPO Timeline

Bidding Start

07 Oct 25

Bidding Ends

09 Oct 25

Allotment Finalisation

10 Oct 25

Refund Initiation

13 Oct 25

Demat Transfer

13 Oct 25

Listing

14 Oct 25

About LG Electronics India Ltd. IPO

LG Electronics India IPO Live Updates

LG Electronics India IPO Subscription Status Day 2 (as of 03:21 p.m., Oct 8, 2025)

As of 3:21 p.m. on October 8, 2025, the LG Electronics India IPO witnessed strong buying interest across all investor categories, with overall bids reaching 2.82 times the total offer size on Day 2.

Subscription Status (as of 3:21 p.m., Oct 8, 2025)

| Category | Shares Offered | Shares Bid For | Subscription (x) |

|---|---|---|---|

| Qualified Institutional Buyers (QIBs) | 2,03,21,026 | 3,43,78,968 | 1.69 |

| Non-Institutional Investors (NIIs) | 1,52,40,770 | 10,26,04,866 | 6.73 |

| Retail Individual Investors (RIIs) | 3,55,61,796 | 6,31,32,589 | 1.78 |

| Employees | 2,10,728 | 7,93,052 | 3.76 |

| Total | 7,13,34,320 | 20,09,09,475 | 2.82 |

LG Electronics India IPO Subscription Status Day

As of 5:00 p.m. on October 7, 2025, the LG Electronics India IPO achieved full subscription on Day 1, with overall bids reaching 1.04 times the total offer size across both exchanges.

- Non-Institutional Investors (NIIs) remained the key drivers, subscribing their portion 2.31x, led by the ₹2–10 lakh category, which surged to 2.83x.

- Retail Individual Investors (RIIs) subscribed 81% of their quota, while the employee category witnessed strong interest at 1.89x.

- Qualified Institutional Buyers (QIBs) maintained moderate participation at 0.49x, largely supported by Foreign Institutional Investors (FIIs), who accounted for over 93 lakh shares of bids.

In total, the IPO received bids for 7.45 crore shares against 7.13 crore shares available, reflecting robust investor demand across categories as Day 1 closed with full booking.

Incorporated in 1997, LG Electronics India Limited is a leading manufacturer and distributor of home appliances and consumer electronics, excluding mobile phones. It caters to both B2C and B2B markets in India and overseas, while also providing installation, repair, and maintenance services. The company operates through segments such as Home Appliances, Air Solutions, and Home Entertainment, supported by advanced manufacturing facilities in Noida and Pune, 25 warehouses, 51 branches, over 30,000 sub-dealers, 1,006 service centres, and a workforce of 3,796 employees. Its brand philosophy is “Life’s Good When We Do Good.”

LG Electronics IPO Overview

LG Electronics India Ltd. IPO is a book-built issue worth ₹11,607.01 crores, entirely comprising an offer for sale of 10.18 crore shares. The subscription window will open on 7 October 2025 and close on 9 October 2025, with the allotment expected to be finalised on 10 October 2025. The company’s shares are proposed to list on both BSE and NSE, with the tentative listing date set for 14 October 2025. The IPO price band is fixed between ₹1,080 and ₹1,140 per share, and the minimum application lot size is 13 shares. For retail investors, this translates to an entry investment of ₹14,820 based on the upper price band. For small non-institutional investors (sNII), the minimum bid is 14 lots or 182 shares, requiring an investment of ₹2,07,480, while for big non-institutional investors (bNII), the minimum application is 68 lots or 884 shares, amounting to ₹10,07,760. Morgan Stanley India Co. Pvt. Ltd. is the book-running lead manager for the issue, while Kfin Technologies Ltd. is serving as the registrar.

LG Electronics India Ltd. IPO Details

| Particulars | Details |

| IPO Date | 7 October 2025 to 9 October 2025 |

| Listing Date | 14 October 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹1,080 to ₹1,140 per share |

| Lot Size | 13 Shares |

| Total Issue Size | 10,18,15,859 shares (aggregating up to ₹11,607.01 Cr) |

| Fresh Issue | NA |

| Offer for Sale | 10,18,15,859 shares (aggregating up to ₹11,607.01 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 67,87,72,392 shares |

| Share Holding Post Issue | 67,87,72,392 shares |

| Market Maker Portion | NA |

LG Electronics India Ltd. IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Offer |

| Retail | Not less than 35% of the Offer |

| NII (HNI) | Not less than 15% of the Offer |

Investor Category Reservations

| Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

| Only RII | Up to ₹2 Lakhs | Yes |

| Only sNII | ₹2 Lakhs to ₹10 Lakhs | No |

| Only bNII | > ₹10 Lakhs | No |

| Only Employee | Up to ₹5 Lakhs | Yes |

| Employee + RII/NII | Employee limit: Up to ₹5 Lakhs; RII: Up to ₹2 Lakhs; sNII: ₹2–10 Lakhs | Yes |

LG Electronics IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 13 | ₹14,820 |

| Retail (Max) | 13 | 169 | ₹1,92,660 |

| S-HNI (Min) | 14 | 182 | ₹2,07,480 |

| S-HNI (Max) | 67 | 871 | ₹9,92,940 |

| B-HNI (Min) | 68 | 884 | ₹10,07,760 |

LG Electronics IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100% |

| Post-Issue | 85% |

LG Electronics India Ltd. IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 32.46 (Pre IPO), 30.25 (Post IPO) |

| Price/Earnings (P/E) Ratio | 35.12 (Pre IPO), 37.69 (Post IPO) |

| Return on Net Worth (RoNW) | 37.13% |

| Net Asset Value (NAV) | ₹87.42 per share |

| Return on Equity | 37.13% |

| Return on Capital Employed (ROCE) | 42.91% |

| EBITDA Margin | 12.76% |

| PAT Margin | 8.95% |

| Debt to Equity Ratio | 0.00 |

Objectives of the Proceeds

- Entire IPO is an Offer for Sale; proceeds go to existing shareholders.

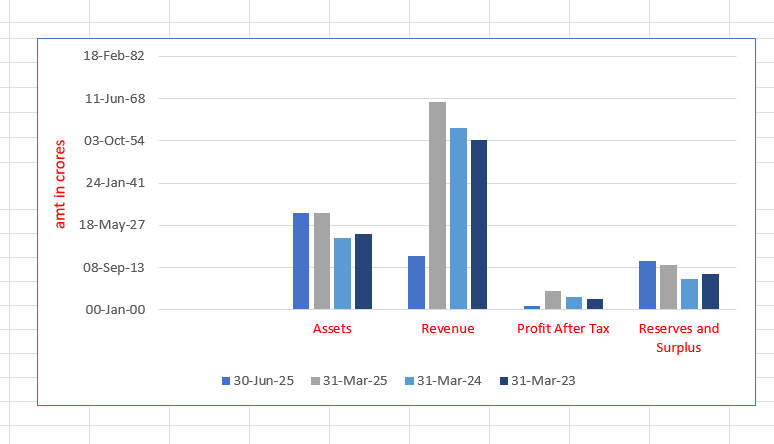

Key LG Electronics India Financials (in ₹ Crore)

| Particulars | 30 June 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 11,516.44 | 11,517.15 | 8,498.44 | 8,992.12 |

| Revenue | 6337.36 | 24,630.63 | 21,557.12 | 20,108.58 |

| Profit After Tax | 513.26 | 2,203.35 | 1,511.07 | 1,344.93 |

| Reserves and Surplus | 5805.50 | 5,291.40 | 3,659.12 | 4,243.12 |

| Total Borrowings | 0.00 | 0.00 | 0.00 | 0.00 |

SWOT Analysis of LG Electronics India IPO

Strength and Opportunities

- Strong market share across key home appliance categories

- Wide pan-India distribution and service network

- Advanced manufacturing units with efficient supply chain

- Innovative products tailored for Indian consumers

- Capital-efficient operations with high growth potential

Risks and Threats

- Heavy dependence on parent company LG Electronics Inc.

- Intense competition from other consumer electronics brands

- Limited presence in mobile and personal electronics segments

- Vulnerable to raw material price fluctuations

- Economic downturns may impact discretionary spending

LG Electronics IPO Live News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About LG Electronics India Limited IPO

LG Electronics India IPO Strengths

- Leading market share in India’s home appliances and consumer electronics industry.

- Strong brand backing of global parent LG Electronics Inc.

- Advanced manufacturing facilities in Noida and Pune ensuring efficiency.

- Wide pan-India distribution and after-sales service network.

- Innovative product portfolio customised for Indian consumers.

- Debt-free balance sheet and capital-efficient operations.

Peer Comparison (as of March 31, 2025)

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| LG Electronics | 32.46 | 32.46 | 87.42 | 37.69 | 37.13 | – |

| Peer Group | ||||||

| Havells | 23.49 | 23.48 | 133.05 | 64.14 | 17.63 | 11.32 |

| Voltas | 25.43 | 25.43 | 197.66 | 52.68 | 12.76 | 6.80 |

| Whirlpool | 28.30 | 28.30 | 314.52 | 43.53 | 9.09 | 3.92 |

| Blue Star | 28.76 | 28.76 | 149.19 | 65.59 | 19.27 | 12.66 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On LG Electronics India Ltd

What is the IPO size of LG Electronics India Ltd?

The IPO size is 101.8 million shares, representing 15% of the company’s total equity. This offering will be entirely an Offer-for-Sale (OFS) with no proceeds for LG Electronics.

When will the IPO open and close?

The exact opening and closing dates for the IPO are to be announced (TBA). Updates will be shared once the company receives approval from SEBI for the IPO.

What is the price range for the IPO?

The price range for LG Electronics India Ltd’s IPO is currently to be updated. Investors can expect the price details once the final pricing is determined by the company and SEBI.

What is the lot size for the IPO?

The lot size for LG Electronics India Ltd’s IPO is to be announced (TBA). The number of shares per lot will be specified once the company releases further details.

Where will the shares be listed?

The shares of LG Electronics India Ltd will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) after the successful completion of the IPO process.

Who will benefit from the funds raised in the IPO?

Since the IPO is an Offer-for-Sale (OFS), LG Electronics India will not receive any funds. The entire amount raised will go to the selling shareholder, not the company.

When will the IPO allotment be finalised?

The IPO allotment finalisation date is to be announced (TBA). After bidding ends, the company will notify the investors regarding the allocation of shares in the IPO.

When is the IPO listing date?

The IPO listing date for LG Electronics India Ltd is to be announced (TBA). The listing will occur after all the IPO procedures, including allotment and demat transfer, are completed.