- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Lohia Corp Limited IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Lohia Corp Limited IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Lohia Corp Limited

Lohia Corp is a global leader in manufacturing machinery for technical textiles, specializing in polypropylene (PP) and high-density polyethylene (HDPE) woven fabric and sacks (Raffia). As of March 31, 2025, it boasts an installed capacity of 240 tapelines, 13,800 circular looms, and 108,000 tape winders annually. The company offers a wide range of products, including tape extrusion lines, circular looms, and recycling machines, serving both packaging and non-packaging industries. With over 2,300 tape extrusion lines sold and numerous patents, Lohia Corp has a strong global presence with offices in India, Brazil, Russia, Thailand, UAE, and the USA.

Lohia Corp Limited IPO Overview

Lohia Corp Ltd. submitted its Draft Red Herring Prospectus (DRHP) to SEBI on August 12, 2025, to raise funds through an Initial Public Offer (IPO). The IPO will be a Book Build Issue, consisting solely of an offer for sale of up to 4.23 crore shares. The equity shares are proposed to be listed on the NSE and BSE. Equirus Capital Pvt. Ltd. will be the book-running lead manager, and MUFG Intime India Pvt. Ltd. will serve as the registrar for the issue. Key details such as the IPO dates, price bands, and lot sizes are yet to be disclosed. For more information, refer to the Lohia Corp IPO DRHP.

Lohia Corp Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 4.23 crore equity shares |

| Fresh Issue | NA |

| Offer for Sale (OFS) | 4.23 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Lohia Corp Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Lohia Corp Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹13.70 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 106.11% |

| Net Asset Value (NAV) | ₹34.83 |

| Return on Equity (RoE) | 31.71% |

| Return on Capital Employed (RoCE) | 30.45% |

| EBITDA Margin | 16.49% |

| PAT Margin | 8.50% |

| Debt to Equity Ratio | 0.47 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

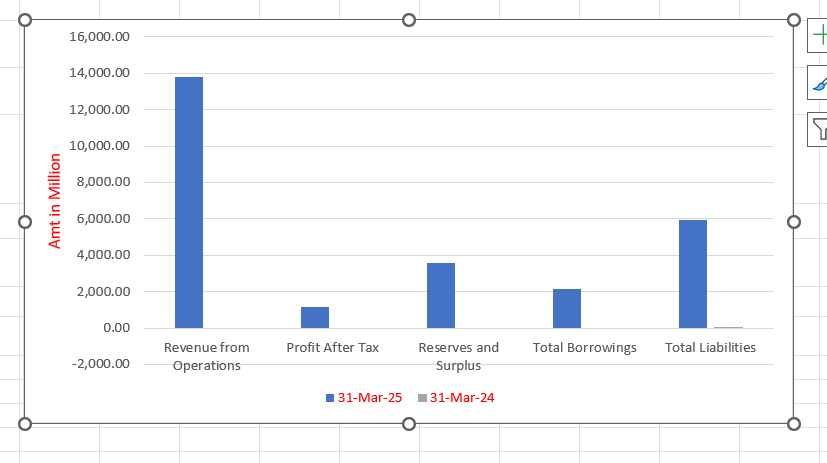

Lohia Corp Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 |

| Assets | ||

| Revenue from Operations | 13,768.72 | – |

| Profit After Tax | 1,178.41 | (0.09) |

| Reserves and Surplus | 3,574.10 | (0.09) |

| Total Borrowings | 2,121.63 | – |

| Total Liabilities | 5,960.15 | 0.01 |

Financial Status of Lohia Corp Limited

SWOT Analysis of Lohia Corp Limited IPO

Strength and Opportunities

- Strong global presence with sales offices in 5 countries.

- Extensive portfolio of machinery for technical textiles.

- Over 2,300 tape extrusion lines sold worldwide.

- Strong intellectual property with patents and trademarks.

- Proven track record of delivering high-quality machines.

- Large installed base of circular looms and tape winders.

- Focus on innovation with 56 patents outside India.

- Established relationships with key clients in multiple industries.

- Leading position in polypropylene (PP) and HDPE woven fabric production.

Risks and Threats

- High dependency on specific industries like packaging.

- Vulnerability to fluctuations in raw material costs.

- Significant competition from local and global players.

- Exposure to risks associated with global trade policies.

- Financial instability in certain international markets.

- Vulnerability to supply chain disruptions.

- Increasing operational costs due to global inflation.

- Regulatory challenges in different international markets.

- Challenges in expanding customer base in non-packaging sectors.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Lohia Corp Limited

Lohia Corp Limited IPO Strengths

Global Market Leadership

Lohia Corp Limited is a market leader in the woven raffia machinery industry in India and a significant global player. In 2024, the company held a 15.4% share of the global market by value, ranking among the top manufacturers. In its domestic market, it holds a dominant 40.7% market share by value.

Extensive Global Reach and Diversified Customer Base

The company has a broad global footprint, having supplied products to around 100 countries in recent years. Its sales and service network is supported by five international offices, multiple warehouses, and 17 exclusive sales agents. This extensive network and diverse customer base ensure the company is not dependent on any single market.

Advanced Manufacturing and R&D Capabilities

Lohia Corp has a highly advanced manufacturing infrastructure with four facilities in India and two international ones. The company’s operations are backed by comprehensive backward integration, which reduces reliance on external suppliers. A dedicated R&D center, the Hargovind Bajaj R&D Centre, drives innovation, with 234 on-roll employees engaged in R&D activities.

Comprehensive End-to-End Solutions

The company offers a diverse product portfolio that provides end-to-end solutions for the entire woven fabric ecosystem, from “concept to commissioning.” This includes a wide range of machinery and equipment for the raffia industry, such as extrusion lines, circular looms, and recycling machines, catering to various end-user industries.

Strong Management and Skilled Workforce

Lohia Corp Limited is led by a qualified and experienced senior management team with extensive industry expertise. This leadership is supported by a dedicated and skilled workforce. The company’s focus on in-house training and development, including the MTTC training center, ensures a continuous supply of skilled labor and maintains a low attrition rate, fostering a stable and committed team.

Technology-Driven Operations and Innovation

The company’s operations are driven by a strong commitment to technology and innovation, with a significant focus on research and development. With 53 trademarks and 116 patents, the company protects its innovations. Its advanced R&D and digital innovation centers enable the development of new products and the integration of modern technologies like IoT and AI, ensuring its offerings meet evolving market demands.

More About Lohia Corp Limited

Lohia Corp Limited is one of the leading global manufacturers of machinery and equipment for technical textiles, especially for polypropylene (PP) and high-density polyethylene (HDPE) woven fabric and sacks. In 2024, the company ranked among the top global players by revenue, holding a 15.4% share of the global woven Raffia machinery market by value. In India, it leads the domestic woven Raffia machines market with a 40.7% market share.

Manufacturing Capabilities

As of March 31, 2025, Lohia Corp operates with a robust manufacturing capacity, producing 240 tape lines, 13,800 circular looms, and 108,000 tape winders annually. The company offers a diverse range of machinery, including tape extrusion lines, circular looms, coating and lamination lines, printing machines, multifilament yarn machines, and recycling machines, catering to both packaging and non-packaging applications. Lohia Corp’s machines are extensively used across industries like cement, fertilizer, chemicals, food grains, and minerals, with applications in tarpaulins, ropes, and geotextiles.

Global Reach and Manufacturing Facilities

Lohia Corp operates six manufacturing facilities, including four in India, one in the USA, and one in Italy. These facilities enable the company to produce and supply machinery globally, supported by sales offices in multiple regions including Brazil, Russia, Thailand, UAE, and the USA. As of March 31, 2025, 68% of its total extrusion capacity was sold domestically, while 32% was exported globally.

Innovation and Research

Lohia Corp is committed to innovation, holding 60 patents in India and 56 patents internationally. The company has also invested heavily in R&D, operating research and development centers in Kanpur, Uttar Pradesh, and owns a training center for semi-skilled manpower. Their continuous focus on technology allows them to remain competitive in a rapidly evolving market.

Acquisitions and Growth Strategy

The company has expanded its product offerings through strategic acquisitions, including the purchase of Leesona Corp in 2019 and J.J. Jenkins Inc. in 2024, which helped strengthen its portfolio in high-performance fibers and specialty yarns. Through these acquisitions and joint ventures, Lohia Corp has consolidated its market position and diversified its range of products.

Experienced Leadership and Workforce

Lohia Corp’s experienced management team, led by Chairman Raj Kumar Lohia with over 43 years in the industry, has played a critical role in the company’s success. With a dedicated workforce of 1,736 permanent employees as of May 31, 2025, Lohia Corp continues to drive innovation and maintain its leadership position both in India and internationally.

Industry Outlook

The technical textiles industry in India is poised for robust growth, driven by increasing demand across diverse sectors such as packaging, agriculture, construction, and automotive. The industry is expected to witness a compound annual growth rate (CAGR) of 8-10% from 2024 to 2029. This growth is propelled by rising demand for functional fabrics and sustainable solutions in packaging and construction.

Growth Drivers:

- Rising demand for polypropylene (PP) and high-density polyethylene (HDPE): These materials are widely used in manufacturing woven fabrics and sacks, essential for sectors like cement, fertilizer, and food grains.

- Infrastructure and industrial expansion: Increasing construction and infrastructure projects are driving the demand for geotextiles, tarpaulins, and other industrial textiles.

- Sustainability trends: The growing focus on recycling, coupled with the need for eco-friendly solutions in packaging and construction, is propelling the demand for technical textiles and related machinery.

- Global market expansion: Rising exports and increasing international demand for technical textiles machinery, particularly for woven Raffia, is helping manufacturers expand their global reach.

Key Figures:

- The Indian technical textiles market is projected to grow to ₹2,03,000 crore by 2027.

- Key segments like woven fabric machinery, including tape extrusion lines and circular looms, are experiencing growth, reflecting strong demand in the packaging and construction sectors.

Market Segments:

- Packaging applications: The demand for woven fabric machines in cement, food grains, and fertilizer packaging remains strong.

- Non-packaging applications: There is increasing adoption of woven fabric machines in industries such as geotextiles, ropes, and automotive components, offering long-term growth prospects

How Will Lohia Corp Limited Benefit

- Lohia Corp’s strong market share in the woven Raffia machinery market will enable it to capture increased demand in packaging and construction sectors.

- Rising demand for polypropylene (PP) and high-density polyethylene (HDPE) woven fabrics will boost the sales of Lohia Corp’s machinery, particularly in cement, fertilizer, and food grain packaging.

- The company’s expanding presence in non-packaging sectors like geotextiles and automotive components will open new growth opportunities.

- With a robust global reach, Lohia Corp will benefit from increasing international demand for technical textiles machinery.

- The growing focus on sustainability will position Lohia Corp’s eco-friendly solutions to meet the rising demand for recycled and sustainable packaging and construction materials.

- Lohia Corp’s continuous innovation and investment in R&D will allow it to stay competitive in an evolving market.

Peer Group Comparison

| Name of the Companies | Face Value (₹) | Revenue (₹ in million) | EPS (₹) | P/E Ratio (times) | RoNW (%) | NAV (₹) |

| Lohia Corp Limited | 1.00 | 13,768.72 | 13.70 | [ ]** | 106.11 | 34.83 |

| Peer Group | ||||||

| Rajoo Engineers Limited | 1.00 | 2,536.55 | 2.32 | 54.91 | 23.35 | 9.95 |

| LMW Limited | 10.00 | 30,120.10 | 96.05 | 165.66 | 3.70 | 2,599.85 |

| Mamata Machinery Limited | 10.00 | 2,545.78 | 16.56 | 29.32 | 23.81 | 69.55 |

| Jyoti CNC Automation Limited | 2.00 | 18,177.00 | 13.90 | 74.13 | 18.74 | 74.14 |

| Windsor Machines Limited | 2.00 | 3,687.21 | (0.47) | NM | (0.44) | 86.90 |

Key Strategies for Lohia Corp Limited

Global Market Expansion

Lohia Corp Limited aims to increase its global market share by expanding its international footprint. The company plans to enter new geographies and introduce new products, such as Block Bottom Conversion machines, to strengthen its presence and capitalize on growing global demand.

Strengthening Conversion and Processing Capabilities

Lohia Corp Limited intends to bolster its position in the conversion and processing machines segment. The company will leverage its manufacturing infrastructure and extensive network to penetrate this growing market, solidifying its standing as a top manufacturer of machinery for technical textiles.

Advancing in High-Performance Fibers

Lohia Corp Limited plans to reinforce its presence in the high-performance fibers and monofilament sector. Through strategic acquisitions and continued innovation, the company will capitalize on the high-performance applications of these materials in various demanding industries, from defense to medical.

Focus on Recycling Machinery

Lohia Corp Limited is committed to sustainability by focusing on recycling machinery. The company will develop new equipment to address post-consumer plastic waste, aligning with global environmental goals and expanding into a relatively untapped, high-growth market for plastics recycling.

Improving Operational Efficiency

Lohia Corp Limited is dedicated to enhancing its operational efficiencies. The company will continue to implement technology and automation tools, such as the Zero Error Excellence Programme (ZEEP), to improve its production processes, optimize resource utilization, and embed a culture of precision throughout its operations.

Strategic Acquisitions and Alliances

Lohia Corp Limited aims to augment its scale through strategic mergers, acquisitions, and alliances. The company will selectively evaluate targets with high growth potential, leveraging these inorganic expansion strategies to strengthen its product portfolio, customer base, and market position as a one-stop-shop manufacturer.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Lohia Corp Limited IPO

How can I apply for Lohia Corp Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the offer size for Lohia Corp Limited's IPO?

The IPO consists entirely of an offer for sale of up to 4.23 crore shares.

What is the purpose of the Lohia Corp IPO?

The IPO proceeds will primarily go to the selling shareholders, and the company will not utilize any funds from the offer.

When will the Lohia Corp IPO be listed?

The listing date for the IPO is yet to be announced, and it will be listed on BSE and NSE.

How many shares will be offered in the Lohia Corp IPO?

The total issue size is 4,22,59,970 shares, aggregating up to ₹[.] crore.

Who are the promoters of Lohia Corp Limited?

The promoters of Lohia Corp are Raj Kumar Lohia, Gaurav Lohia, and Amit Kumar Lohia, holding a 93% stake pre-issue.